2 million tap superannuation under early access scheme

More than 2 million people have now requested early super access under the government’s coronavirus relief scheme.

More than two million Australians have withdrawn nearly $15bn in superannuation under the federal government’s early access scheme, claiming financial hardship due to the coronavirus pandemic.

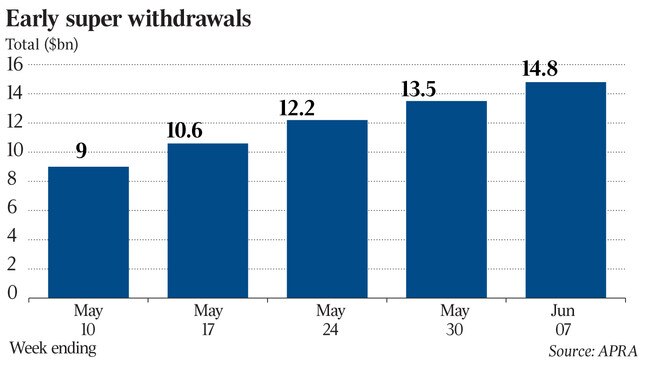

Weekly figures released by the Australian Prudential Regulation Authority showed $14.8bn has been withdrawn from the country’s near $3 trillion retirement pool, with 1.98 million account holders already being paid out by funds.

As at June 7, 2.12 million applications had been lodged with the Australian Taxation Office for early withdrawals of retirement balances.

Meanwhile, the Australian Council of Trade Unions said workers will be “consigned to poverty” as a result of the billions of dollars leached from the superannuation sector through early withdrawal requests.

In a submission to a Senate committee into the country’s COVID-19 response, the ACTU said the federal government’s early release of super scheme has induced “significant shocks” to the country’s near $3 trillion retirement pool.

The federal government implemented the early release of super scheme as a measure to assist people who have become unemployed or experienced a reduction in working hours due to the pandemic.

Superannuation account holders are able to request up to $10,000 this current financial year and another $10,000 in the 2021 financial year.

The ACTU said the scheme has disproportionately impacted workers who were already unemployed due to the pandemic, and undermines the architecture of Australia’s retirement income system.

“The government’s decision to allow and rely upon early access to superannuation to mitigate the impacts of the coronavirus crisis forces workers who are already suffering the most to do the heaviest lifting to support themselves,” the ACTU said in its submission.

“The preservation of benefits in superannuation is the only way to ensure that superannuation fulfils its purpose of being a vehicle for a better retirement.”

ACTU assistant secretary Scott Connolly has condemned the Morrison government’s key COVID-19 support measure, saying the scheme is riddled with fraudulent behaviour.

“Hundreds of people we know of have had their superannuation stolen due to inadequate government protections, and poor government identity checks,” Mr Connolly said.

Liberal Senator Jane Hume said early release is only one of the measures implemented to ease financial pressures put on Australians during the pandemic.

‘The early release of superannuation initiative has been widely welcomed and I am pleased that data released by APRA shows the scheme is progressing in line with government expectations,” Ms Hume said.

Under the scheme, the average payment request has been $7,475, APRA’s data revealed, with withdrawals processed in approximately 3.3 business days.

Ninety-five per cent of applications were being paid within five business days — the recommended turnaround period set by APRA.

Industry funds continue to make up the largest proportion of payments made to account holders, with five major funds representing about $7.04bn of total withdrawals.

Australia’s largest fund, AustralianSuper, continued to record the largest number of applications, with the fund already paying out $1.98bn to 264,404 account holders.

AustralianSuper members on average are requesting $7,485. According to APRA, 26,518 members are still waiting to receive payments.

Sunsuper has received 223,801 applications, dishing out $1.48bn to its membership base as at June 7.

Hostplus, which has a high proportion of members who work in the hospitality and events industry, has been sapped of $1.38bn. 216,783 Hostplus members have lodged claims with the ATO.

Retail industry workers fund Rest has paid out $1.35bn to 189,202 members, while Cbus has been hit by 101,195 applications totalling to $844.5m.

Australia’s superannuation sector is also taking a financial beating from the Morrison government’s JobKeeper payment scheme which is supplementing employer-paid wages.

The 3.3 million workers on the wage subsidy scheme are not receiving superannuation guarantee contributions, costing the sector more than $200m in forgone benefits.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout