JobKeeper scheme lowers superannuation payments

The retirement pool is losing out on more than $200m every week due to JobKeeper payments not attracting super contributions.

Australia’s retirement pool is losing out on more than $200m every week due to millions of JobKeeper payments not attracting super guarantee contributions.

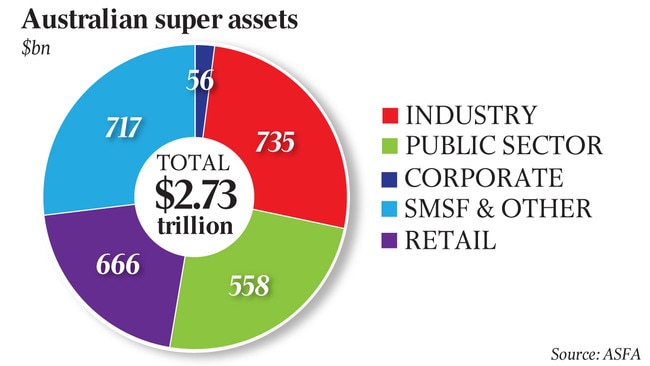

The 3.3 million workers receiving the $1500 fortnightly payment by the federal government are not receiving benefit contributions — stagnating inflows into the nation’s $3 trillion superannuation sector, which is already being hit by a multi-billion-dollar leakage caused by early super scheme withdrawals.

Based on the current minimum super guarantee rate of 9.5 per cent that an employer must pay, the JobKeeper subsidy is a $470m fortnightly loss to the sector in forgone contributions.

The federal government implemented the JobKeeper subsidy as a means to keep people employed during the economic downturn caused by the COVID-19 pandemic.

According to the Australian Taxation Office, JobKeeper payments are not required to pay super contributions, but any additional top-up by an employer must pay contributions to an employee’s respective fund.

Treasury estimates 3.5 million people will be placed on the scheme, with JobKeeper payments scheduled to expire at the end of September.

The reduced level of inflows is a double whammy to a savings system already being drained of more than $16bn through the federal government’s early release of super scheme.

Nearly two million requests have been lodged with the ATO for withdrawals of up to $10,000.

The Association of Superannuation Funds of Australia believes benefit contributions should be added to the temporary payment measure, so individual retirement balances can recoup some of the losses.

Speaking to The Weekend Australian, ASFA chief executive Martin Fahy said it was a necessity for the superannuation guarantee contribution to be increased to 12 per cent, so the industry could play catch-up from this “short and sharp” crisis.

“We need to recognise that going to 12 per cent is probably the most critical step in terms of catching up,” Dr Fahy said.

“For an individual who has had to access their super through early release, getting back into employment and receiving superannuation guarantee contributions at 12 per cent will be important to repairing their long-term return on outcomes.”

The federal government is increasing the country’s superannuation guarantee to 12 per cent and it is expected to be fully implemented by July 2025.

A 0.5 per cent increase is expected at the beginning of the 2022 financial year, bringing the contribution level to 10 per cent.

Dr Fahy noted investment returns in the short to medium term would be challenging in an environment riddled with low interest rates, affecting the growth potential of wealth portfolios.

“The long-term pressures which COVID-19 has placed on the fiscal purse make it imperative that as many retirees as possible are self-funded and a superannuation guarantee at 12 per cent makes this possible for 50 per cent of Australians by 2050,” Dr Fahy said.

Liberal senator Jane Hume told a Bloomberg forum on Thursday that an increase in the super guarantee had already been legislated, but that she would not be surprised if businesses pushed back against the scheduled rise.

“There is a limited amount of money out there to pay employees and when you increase the superannuation guarantee something has got to give,” Senator Hume said. “It might be hiring that extra employee or it might be a pay rise, so employees should understand that a rise in the superannuation guarantee does come with a trade-off.”

She noted criticisms of the federal government’s early release scheme had predominantly been from funds, claiming withdrawal requests would affect long-term investment capabilities.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout