12.5pc return tipped in big year for superannuation funds

Super fund returns have been exceptionally good this year thanks to a strong rise in shares, with double-digit returns predicted for median balanced funds.

Super fund returns have been exceptionally good this year thanks to a strong rise in shares.

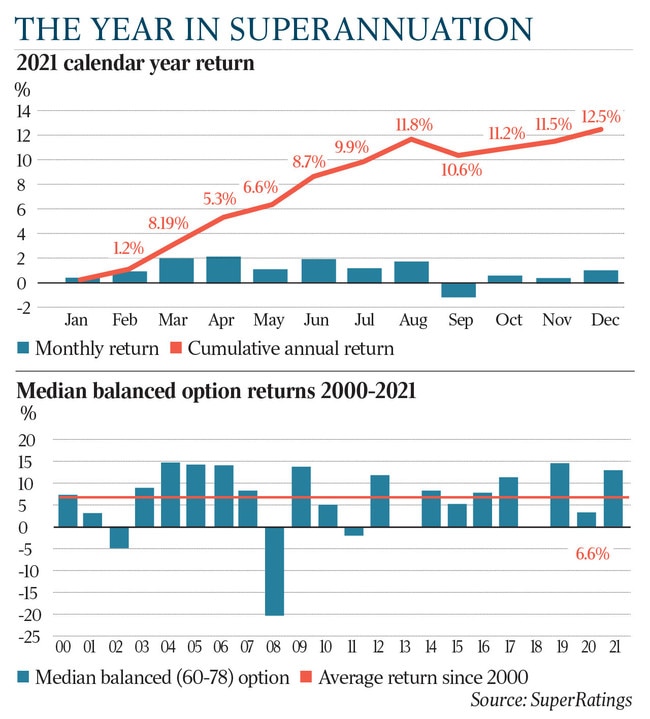

A double-digit return is tipped for the median balanced fund with a 70-30 per cent weighting to shares and bonds after positive returns were achieved for the standard investment option in 11 of the past 12 months, according to SuperRatings.

With a strong rise in share markets December baked in, the superannuation consultant has estimated a 12.5 per cent return for calendar year 2021, almost twice the average since 2000. This follows a 3.3 per cent return in 2020 and a 14.7 per cent gain in 2019.

The median balanced fund return was set to be the fourth best since a 19.7 per cent dive during the GFC. It follows a plunge in shares at the start of the Covid pandemic in early 2020.

Since 2000, there have only been three negative calendar year returns – 2002, 2008 and 2011.

The annualised return since 2000 sits at around 6.6 per annum and is slightly ahead of fund objectives of inflation plus 3 per cent over rolling 10-year periods. Over the past 22 calendar years, the estimated return for 2021 looks likely to be the seventh highest.

This year’s returns were again driven by international shares and Australian shares, while property has also supported growth in balances, according to SuperRatings.

Australia’s S&P/ASX 300 total return index has risen 18.4 per cent for the year to date. The MSCI All-Country World index has risen 17 per cent.

But despite the strength of the calendar year return for 2021, returns have been more muted in the past six months, with the median balanced fund returning 3.6 per cent since July 1.

While $100,000 invested in the median balanced super fund at the beginning of the coronavirus pandemic will have grown by about 20 per cent, the most rapid part of the rebound from the pandemic may be over.

“We anticipate volatility and lower expected returns going forward,” SuperRatings executive director Kirby Rappell said.

“The ability of the market to continue to sustain this pace of return has been a surprise, but for many younger members their account balances have been rebounding rapidly.”

However, the reality of the challenge of deriving income for many retirees has been clear.

The expected return from fixed income investments in the calendar year was negative and the projected return from cash options was a measly 0.13 per cent, according to Mr Rappell.

While returns remain healthy, the lower return environment still makes it very hard for retirees to live off the income generated by their investments, compared to a decade ago.

For the year ahead, Mr Rappell sees some key challenges and opportunities for super funds.

He sees greater exposure to equities and alternatives over time, and less to fixed interest.

This is expected to see greater volatility in return profiles as funds seek to maximise the probability of achieving their objectives. But merger and acquisition activity is expected to pick up in the industry, potentially generating fee savings for super fund members.

“With stapling, your fund will now follow you, so it’s time to make sure you are in a good one,” Mr Rappell said.

“If you are having some time out from work, it might be time to check your fund and insurance. Hopefully, we will see greater innovation in retirement products in the year ahead.”

Overall, it has been a big year for super funds. Looking at the long-term performance to date, super funds continue to perform well against objectives, but it is likely to be a rockier year ahead.

“For consumers, it remains important to set your strategy, stick to it for the long term and your future. will likely thank you,” Mr Rappell said. The returns come in a landmark year for the super industry, as the Your Future, Your Super legislative package was passed.

It aims to stop the proliferation of multiple super accounts for employees, while also requiring the prudential regulator to regularly test super fund performance.

The Australian Prudential Regulation Authority released the results of its first annual performance test in late August, showing that of 76 MySuper products assessed, 13 failed to meet its benchmarks.

All up, $56.2bn of 1.1 million workers’ retirement savings were found to be invested in the dud funds.

Within four months of the reforms, 7 per cent of all account holders in underperforming funds made the choice to switch, according to the Minister for Superannuation, Financial Services and the Digital Economy, Jane Hume.

“These (Your Future, Your Super) reforms have seen one of the biggest ever consumer behaviour change in a month in superannuation’s history,” she said.

“Clearly there is more work to do to engage those who remain; they are the hardest people to reach and the most likely to be disengaged.”