Trading Day: live markets coverage; War over a $100 Macquarie; plus analysis and opinion

The ASX seals a five-month closing high, while analysts ignite over cash-toting Macquarie’s $100 prospects.

And that’s the Trading Day blog for Monday, October 30.

Samantha Woodhill 4.23pm: ASX seals five-month high

The local share market closed the session at a five-month closing high but failed to completely realise strong leads from Wall Street and European markets.

The benchmark S&P/ASX200 was up 15.944 points, or 0.27 per cent, at 5919.102 points. The broader All Ordinaries index was up 14.420 points, or 14.42 per cent, to 5983.7 points at the close.

Despite the rise, CMC’s Michael McCarthy said the market has underperformed the futures lead which could suggest local investors continue to be nervous and are toning down on the buying at current high levels.

“Futures trading had us up by more than 30 points on Saturday morning and yet we haven’t achieved those heights locally,” he said.

“It’s pretty clear from that lift in volatility and that search for gold that not all investors are entirely confident at current levels.

“Interestingly enough, the volatility index has jumped. Often we see it drift when markets are mildly positive like this but instead it’s up, suggesting there are still some concerns out there and that’s echoed by the fact that gold stocks are generally doing well.”

In financials, NAB gained 0.61 per cent to $32.82. Commonwealth Bank edged 0.15 per cent lower to $78.12. Westpac ticked up 0.60 per cent to $33.28 and ANZ rose 0.64 per cent to $30.03.

Rio Tinto fell a modest 0.01 per cent to $69.98 and BHP edged up 0.15 per cent to $26.63.

Samantha Woodhill 4.04pm: Winter is coming for China steel

Iron ore prices have slumped as Chinese authorities attempt to improve pollution over winter by forcing steel mill closures and sentiment continues to weaken.

The spot price for Australia’s biggest was down 3.1 per cent to $US58.70 a tonne on Friday according to The Steel Index.

It’s the first time the price has dropped below $US60 a tonne in 2.5 weeks, when the spot price hit a 3.5 month low of $US57.40.

More to come.

3.43pm: War over a $100 Macquarie

It’s an exclusive club with a high entry fee, and it’s riling the analyst community to a feud over whether Macquarie can foot the performance required for a $100+ share price after the bank held true to form and over-delivered with its half-year results last week.

Shaw ($114.10, “buy”):

“We are big bulls and assume +14pc profit growth for MQG in FY18, as management are historically conservative when giving guidance.”

JPMorgan ($95.00, “hold”):

“We have upgraded our FY18- FY20 earnings estimates by an average of 3pc. Despite this, Macquarie continues to trade in line with fair value.”

Goldman Sachs ($94.92, “neutral”):

“Despite the earnings beat, DPS of 205cps was 7pc lower than our estimate as the 1H18 payout ratio fell to 56pc, which we suspect reflects the lumpiness of elevated performance fees in the half.”

Citi ($77.50, “sell”):

“Investors are capitalising too much in — as the share price marches toward $100, the increased risk of a snapback in earnings and consequently share price is building in our view.”

Bell Potter ($105, “buy”):

“We reiterate that MQG ticks all the right boxes as a long-term investment.”

Credit Suisse ($105, “outperform”):

“Our upgrade to ”outperform” reflects our view of an upside earnings risk for MQG near term, notably in relation to principal investments.”

Deustche Bank ($94.80, “hold”):

“We view the beat as largely driven by lower quality factors (lower tax rate and strong performance fees), rather than recurring operational trends.”

Morgan Stanley ($100, “equal-weight”):

“If the operating environment remains supportive and company-specific tailwinds continue to drive an upgrade cycle, MQG could trade towards our bull case of ~A$125 per share.”

Morgans ($97.43, “hold”):

“MQG continues to deliver, but we still feel the current market cycle is somewhat favourable to the company given its significant business skew towards real asset classes.”

MQG last up 1.1pc on $99.00

3.38pm: ASX oil supply concerns well lit

As the ASX200 index taps new intraday highs, energy names remain the clear outperformers of the session so far:

Heavyweight Woodside and Origin boast gains over 1.5 per cent, Oil Search north of 1 per cent higher while Santos streaks ahead to trade 3 per cent in the black.

Smoking guns? Well lit fears — lingering oil supply concerns are helping buoy the price of Brent crude above $US/60 barrel for the first time in two years.

“An apparent cease fire between the Kurds and Iraqis was found to be incorrect, while flows out of the Turkish port of Ceyhan remain below normal levels,” says ANZ economist Giulia Specchia.

“With strong compliance to OPEC’s production curbs already supporting prices, comments from the Saudi Arabian Crown Prince that suggested the production cut agreement should be extended added to gains.”

Brent crude last $US60.42/barrel.

3.20pm: ASX tracks fresh 5-month high

The S&P/ASX200 index hits a fresh intraday of 5927.6 in late trade, representing a fresh 5-month high on a closing basis.

The index heads toward the near 2-year high it hit in May of 5956.5 after it broke a months-long trading range established in early June.

The index failed to realise a 0.7pc rise indicated by futures trade ahead of the open after US stocks hit new records. Asian trade of S&P500 index futures tip Wall St to cool over 0.2 per cent.

Asian selling pressures lurk, China’s Shenzen Composite down 1.2 per cent.

The Australian dollar continues to trade at 3 month lows after its worst week of the year (-1.8pc) at US76.78 cents.

Eli Greenblat 3.02pm: Myer hits back at hostile ‘Lew’

Solomon Lew has come out swinging today at Myer and its board, just two days out from Myer’s crucial strategy day, repeating that he was misled into spending more than $100 million to buy a stake in the struggling department store owner and that legal options were being considered to “urgently needed change to ensure that Myer shares are trading in an informed market”.

In another blistering statement from Mr Lew’s Premier Investments (PMV), which in March bought 10.8 per cent of Myer, the retail billionaire’s fashion conglomerate said it remained concerned that Myer shares were trading on an uninformed basis in the lead up to Myer’s strategy day on Wednesday and that Myer must update the market with its first quarter trading results — read more

MYR last down 2.5pc on 77 cents.

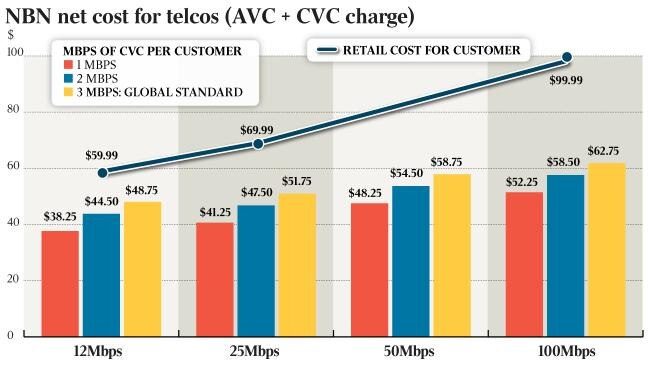

2.52pm: Telstra dividend pressure remains: Citi

Telstra’s dividend remains threatened by downward pressure on earnings, according to Citi.

Citi analyst David Kaynes warns that Telstra’s core earnings decline may accelerate as industry growth in both mobile and broadband matures at the same time that competitive intensity is rising.

And Telstra is unlikely to maintain both its market share and its price premium, with over $600 million of EBITDA is at risk if Telstra’s Mobile market share returns to FY11 levels.

He estimates that core EPS will fall 43 per cent to 17 caps by the end of the NBN rollout in FY21.

Under that scenario, a dividend of 15 cps would be more realistic once the special dividends decline, Kaynes says.

He notes that, excluding the special dividend payments, Telstra is currently trades on a 4.5 per cent.

Kaynes has kept his Sell rating and lowered his target to $3.25 vs. $3.35.

TLS last down 0.9pc at $3.52

2.09pm: Aramco UK deal scuttled

Aimmee Donnellan writes:

Pressure from investors appears to have scuppered a controversial plan to let Saudi Arabia’s state oil company bypass stockmarket rules in order to list on the London stock exchange.

Britain’s Financial Conduct Authority has indicated that it may back down on a scheme that would have allowed Saudi Aramco to join the market by listing just 5 per cent of its shares, in contravention of the regulator’s rules.

Read more from The Times here, or follow the latest move in Brent crude above $US60/barrel here

1.51pm: Scope for ASX catch-up: Citi

Australian shares have scope to catch up with offshore markets, according to Citi.

Equity strategist Tony Brennan says the S&P/ASX 200 is still likely to hit 6250 by mid-2018.

Earnings revisions show a gradual lessening of downgrades relative to upgrades and spot commodity prices still imply further upgrades for the resources sector.

Despite uncertainty over the transition from housing-led to more business and infrastructure investment driven growth in Australia, the stronger global economy lessens risks and aids confidence, Brennan adds.

Index last up 0.4 per cent on 5926.5

1.28pm: Westpac BBSW trial to go ahead

Ben Butler and Richard Gluyas write:

Both ANZ and NAB have this morning told the Federal Court that they have signed agreements with ASIC over its rate-rigging case against them.

However, the third bank sued by ASIC, Westpac (WBC), is holding firm and the trial against it will begin tomorrow morning, barring a last-minute settlement.

ANZ and NAB have agreed to admit to unconscionable conduct by trying to rig the benchmark BBSW rate between 2010 and 2012 and pay a total of about $100m in penalties, costs and donations.

Eli Greenblat 12.45pm: Lew’s Premier ‘misled’ into Myer stake

Solomon Lew has come out swinging today at Myer and its board, just two days out from Myer’s crucial strategy day, repeating that he was misled into spending more than $100 million to buy a stake in the struggling department store owner and that legal options were being considered to “urgently needed change to ensure that Myer shares are trading in an informed market”.

In another blistering statement from Mr Lew’s Premier Investments, which in March bought 10.8 per cent of Myer, the retail billionaire’s fashion conglomerate said it remained concerned that Myer shares were trading on an uninformed basis in the lead up to Myer’s strategy day on Wednesday and that Myer must update the market with its first quarter trading results — read more

MYR last down 2.5pc at 77 cents.

Alan Kohler 12.25pm: China daigous’ imperial complex

Forget Uber and Airbnb, the biggest, fastest growing and most interesting peer-to-peer business in Australia could be daigou shopping.

I had some surprising conversations on the subject this week, not least with Livia Wang, who runs a business that advises firms about selling into China and also organises and helps daigous themselves.

I asked her how many parcels she thinks are being sent to friends and family in China by shoppers in Australia. She said 50,000 to 60,000 per day. I thought I must have misheard.

“Sorry, say that again, how many?’’

Wang: “50,000 to 60,000 per day.”

“Per day?”

Wang: “Yeah. It’s a big business.”

The contrast between this manifestation of China’s nimble entrepreneurial capitalism and the ponderous, self-important socialism on display in Beijing this week could not be greater.

12.03pm: ‘Business as usual’ in Crown lull

It’s “business as usual” for Crown casino until the Victorian regulator finishes a probe into allegations of machine rigging and money laundering, state Gaming Minister Marlene Kairouz says.

The Victorian Commission for Gambling and Liquor Regulation is investigating allegations by federal independent MP Andrew Wilkie that Crown tampered with poker machines at its Melbourne establishment to increase profits, and allowed gamblers to dodge money laundering laws.

When asked on Monday if punters could trust Crown machines, Ms Kairouz said so far there is “no evidence whatsoever in relation to these allegations, it’s business as usual” and will not comment further until she receives the VCGLR report — AAP

CWN last down 0.2pc at $11.38

Samantha Woodhill 11.40am: Reliance leaves copper caveat

Plumbing products maker Reliance Worldwide Corporation says it’s on track to deliver on its financial year earnings guidance of between $145 million and $150 million.

It comes after the company, which listed on the ASX in August last year, beat its prospectus forecasts in its full year result for 2017, reporting net profit up 25.9 per cent to $65.6 million.

In an address to shareholders, CEO Heath Sharp said trading has met expectations year-to-date and should continue to do so as long as there is no significant change to exchange rates or cost of raw materials, including the copper price.

But he did say that a move in the copper rice would probably mean a move on pricing across the market — more to come

Bridget Carter 11.20am: Credit Suisse pens Wagners price tag

Queensland-based building materials company Wagners should list as a business worth between $353 million and $437 million, according to analysts from Credit Suisse.

It means they believe the business is worth between 8.3 and 9.9 times its enterprise value to earnings before interest, tax, depreciation and amortisation.

On an enterprise value basis, the business is worth between $414 million and $497 million, the analysts say.

Analysts will now begin marketing the business ahead of an initial public offering scheduled to happen before Christmas, with their research into the business landing on prospective investors desks today.

Read more from DataRoom.

Samantha Woodhill 11.15pm: Pilbara seals Great Wall deal

Listed lithium developer Pilbara Minerals has sealed the first direct investment deal by an automobile manufacturer into an Australian supplier of raw lithium materials.

The equity investment deal, struck with Chinese car manufacturer Great Wall and worth $28 million, will see Pilbara will supply the car manufacturer with up to 150,000 tonnes a year of spodumene concentrate for use in the car maker’s electric and hybrid vehicles — more to come

PLS last up 1.3pc at $0.79

11.03am: ASX telcos, CBA buffet updraft

Australia’s S&P/ASX 200 share index is up 0.2pc at 5915 on broadbased gains.

But it’s undershooting a 0.7pc rise implied by Friday night futures versus fair value.

US stock index futures are slightly weaker so the market might be anticipating a slight pullback on Wall Street.

And while most sectors are positive, the market is being restrained by falls in telcos, materials and CBA.

Telstra is down 0.9pc after Citi upped its warning on the potential for further dividend cuts.

Iron ore and base metals producers are down after falls in iron ore and copper.

CBA shares are down 0.3pc after shying off the 100 DMA last week.

Other disappointments today include Domino’s, Blackmores and QBE.

11.00am: The Trading Day ahead

Join the conversation with our Trading Day experts for breaking news and analysis in financial markets here and on Sky News Business (Ch: 602)

NOW: Ben Le Brun — OptionsXpress

11.45am: Tim Officer — Shaw and Partners

12.00pm: Tony Davison — Henderson Maxwell

12.15pm: James King — AFEX Australia

12.45pm: Stephen Walters — Chief Economist, AJCD

(All times in AEST)

10.15am: Cimic hits fresh post-GFC high

Construction giant Cimic (CIM) has hit a fresh post-GFC high of $48.34 with an opening rise of over 1 per cent.

10.05am: Macquarie $105 within 12m: Bell Potter

Macquarie Bank shares are set to hit $105 within the next 12 months, says both Bell Potter and Credit Suisse, the investment banks joining in a tide of analysts set into motion after Macquarie booked a record first-half profit of $1.25 billion and gave an upbeat FY18 update on Friday.

Bell Potter: Growth story is “underpinned by surplus capital, a well-diversified earnings base, unmatched expertise in global asset and risk management and the ability to adapt to changing market conditions to secure higher sustainable returns.”

“We reiterate that MQG ticks all the right boxes as a long-term investment.”

Credit Suisse: “[We liked] exceptional performance fee generation; growth in balances of loans (a turnaround here), EUM and equity investments; ongoing rise in ROE and pre- tax operating margins; A$1bn buyback approval.”

Meanwhile, Deutche Bank remains cautious, edging up its own 12-month target price but below the centurion to $94.80.

“At current levels valuation is full with MQG’s fwd PE ~2pc above the majors,” say Deutche Bank analysts.

MQG up 1.3pc at the open to $99.10

10.00am: ASX tipped for strong opening rise

Australia’s S&P/ASX 200 index is expected to open up 0.7pc at 5947 after strong gains on Wall Street.

The reaction to the year-to-date high at 5956 could have some bearing on whether the index tests major resistance around 6000 this week.

Focus turns to China’s manufacturing PMI data on Tuesday ahead of the FOMC decision on Wednesday and US jobs data on Friday.

The market is also waiting for Trump’s US Fed Chair appointment, expected this week.

Index last 5903.2

9.45am: Powell in poll position for Fed

Kate Davidson and Peter Nicholas write:

President Donald Trump is likely to announce Federal Reserve governor Jerome Powell as his nominee to be the next chairman of the US central bank next week, according to a person familiar with the matter.

The president hasn’t made a formal decision and could still change his mind, several people familiar with the matter said — read more

Dow Jones Newswires

9.40am: The Trading Day ahead

Join the conversation with our Trading Day experts for breaking news and analysis in financial markets here and on Sky News Business (Ch: 602)

10.00am: Alex Leyland — Leyland Private Asset Management

10.15am: Bridget Carter — The Australian’s DataRoom

10.30pm: Tano Pelosi — Antares Capital

11.00am: Ben Le Brun — OptionsXpress

(All times in AEST)

Supratim Adhikari 9.35am: Cheaper NBN plans ‘at risk’

Changes to NBN Co’s pricing model could pose a risk to customers choosing a basic service on the National Broadband Network, with the cheapest plans likely to disappear.

The warning comes from internet service provider Aussie Broadband’s managing director Phillip Britt, who said any potential tweaks to the pricing model, including lowering or eliminating the controversial connectivity virtual circuit price, could have unintended consequences.

9.03am: Analyst rating changes

Macquarie raised to Outperform — Credit Suisse

Macquarie target price (12m) raised 10pc to $114; Buy rating kept — CLSA

Resmed target price (12m) raised 8pc to $11; Outperform rating kept — CLSA

Charter Hall raised to Overweight — JPMorgan

Isentia raised to Hold — Shaw and Partners

MYOB cut to Hold — Morningstar

Westfield initiated at Neutral; 12-month target price $8.42 — Goldman Sachs

Orocobre raised to Buy — Citi

Macquarie target price (12m) raised 5.9pc to $94.80, Hold rating kept — Deustche Bank

Aurizon raised to Sector Perform — RBC Capital Markets

8.55am: The Trading Day ahead

Join the conversation with our Trading Day experts for breaking news and analysis in financial markets here and on Sky News Business (Ch: 602)

9.15am: Chris Weston — Chief Market Strategist, IG

9.30am: Mark Bayley — FIIG Securities

10.15am: Bridget Carter — The Australian’s DataRoom

10.30pm: Tano Pelosi — Antares Capital

(All times in AEST)

Scott Murdoch 8.35am: Macquarie urges Asian capital

Macquarie’s Asia chief executive Ben Way has urged Australian companies and governments to tap into the region’s deepening capital pools to help fund infrastructure development and shore up future growth prospects.

Mr Way was appointed three years ago to lead the investment bank’s regional operations and has oversight of its five core business groups that operate in Asia.

Read more here, or follow the latest on Macquarie’s share price march toward $100.

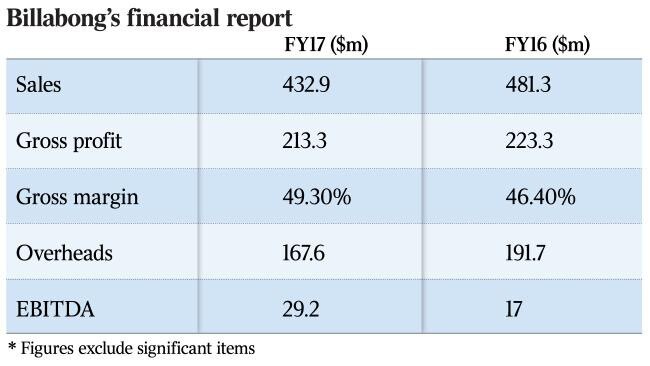

8.28am: Billabong eyes RipCurl takeover

Bridget Carter and Scott Murdoch write:

Surf wear company Billabong is believed to be in exclusive due diligence to buy rival Rip Curl, which has been up for sale through boutique advisory firm Gresham.

The move follows reports that Billabong is also circling the troubled online retail company SurfStitch, which it once partially owned, as it fights its way back to profitability after a brief period where it came close to collapse — read more from DataRoom here

BBG last 62 cents

Rachel Baxendale 8.23am: Maverick may back bank inquiry

Crossbench MPs claim Coalition maverick George Christensen could join with them to legislate for a banking royal commission, while the ACTU is seeking legal advice on challenging federal parliament’s penalty rates vote.

The Turnbull government is facing a multi-pronged attack on its authority in the wake of the High Court citizenship ruling, while Barnaby Joyce fights to win back his seat at a December 2 by-election.

8.20am: Heat on Westpac in rate-rig row

Ben Butler and Richard Gluyas write:

The pressure on Westpac to admit to rate-rigging allegations brought against it by the corporate regulator is expected to intensify dramatically this morning when rival banks ANZ and NAB deliver signed settlements to the Federal Court.

Negotiations between Westpac and the Australian Securities & Investments Commission over the weekend appear to have been fruitless, with the bank last night maintaining it was ready to defend the case in court — read more

WBC last $33.08

7.42am: ASX tipped to lift at open

The Australian market looks set to open more than half a per cent higher after major US indexes lifted on a strong tech sector, an annualised three per cent GDP growth and talk of President Donald Trump’s pick for Federal Reserve chair. At 7am AEDT, the share price futures index was up 34 points, or 0.58 per cent, at 5,921.

In the US, Wall Street on Friday closed higher after a surge in the tech sector and a rally in Amazon shares helped push the Nasdaq to its best day in nearly a year.

Third-quarter GDP data showed that the US economy unexpectedly maintained a brisk pace of growth, at a 3 per cent annual rate, and a report said President Trump was favouring Federal Reserve governor Jerome Powell as the head of the US central bank.

The Dow Jones Industrial Average rose 0.14 per cent, the S&P 500 gained 0.81 per cent and the Nasdaq Composite added 2.20 per cent.

Locally, in economic news on Monday, CoreLogic’s capital city house prices survey for the week just ended is due out.

In equities news, AWE is expected to provide its September quarter report.

The Australian market on Friday closed lower on fears the Turnbull government could lose its one-seat majority following the High Court’s ruling disqualifying Deputy Prime Minister Barnaby Joyce from parliament because of his dual citizenship.

The benchmark S&P/ASX200 index lost 13.1 points, or 0.22 per cent, to 5,903.2 points.

The broader All Ordinaries index was down 13.2 points, or also 0.22 per cent, at 5,969.3 points.

Meanwhile, the Australian dollar has risen against a stronger US dollar, with traders appearing to focus on rallying equities rather than the Catalan situation The local currency was trading at US76.78 cents at 7.42am (AEDT) on Monday, from US76.45c on Friday.

AAP

7.28am: Trump expected to unveil Fed pick

President Donald Trump is expected to announce his choice for the next leader of the US central bank next week, a person familiar with the matter said Friday.

Dow Jones

7.04am: Dollar lifts against greenback

The Australian dollar is higher against its rallying US counterpart, as Wall Street equities found fresh record highs on strong company earnings. At 7.24am (AEDT) on Monday, the Australian dollar was worth US76.78 cents, up from US76.45c on Friday.

Westpac’s Imre Speizer says the US dollar index has risen, along with US equities which reached further record highs, helped by strong company earnings. “The US dollar index closed 0.3 per cent higher, gapping to a three-month high,” he said in a Monday morning note.

“(The) AUD rose from 0.7625 (three-month low) to 0.7678, following the lead of US equities at record highs and oil (up 2 per cent at a two-year high), rather than the Catalonian situation.” No local major event risks are expected on Monday, but overseas, in Europe business surveys, economic confidence and business climate indexes are expected, along with Germany’s CPI, while in the US, personal income and spending are expected to lift.

Mr Speizer sees the local currency “falling in response to a stronger US dollar, and could test 0.7600 if the USD rally continues”.

The Aussie dollar is also higher against the yen and the euro.

AAP

6.34am: Tech strength drives Nasdaq higher

A busy week of robust corporate earnings lifted the S&P 500 and Nasdaq Composite to new highs Friday.

More than half of companies in the S&P 500 have reported third-quarter results as of Friday afternoon, and more than three-quarters of those results have surpassed analyst expectations, according to FactSet. Standout corporate results, which ranged from machinery maker Caterpillar to technology stalwart Microsoft, drove broader stockmarket gains.

Among the best performers during the week were Google’s parent Alphabet and Amazon.com, both of which reported strong revenue. Earlier in the week, Twitter shares jumped after the social-media company said it added more new monthly users than analysts expected and boosted its guidance for the fourth quarter.

The strong tech gains propelled the Nasdaq Composite up 144.49, or 2.2 per cent, to 6,701.26 and the S&P 500 up 20.67, or 0.8 per cent, to 2581.07 on Friday.

Both indexes closed at records, and the Nasdaq hit its 61st fresh high of 2017, a tie for the most records in a year since 1999.

Dow Jones

6.28am: Oil lifts, Brent beats $60 a barrel

Oil prices pressed higher Friday, with Brent crude topping the elusive $60-a-barrel mark for the first time in more than two years amid hopes that OPEC will continue curbing output.

Brent, the global benchmark, rose $US1.14, or 1.92 per cent, to $US60.44 — its highest settlement value since July 2, 2015. US crude futures rose $US1.26, or 2.39 per cent, to $US53.90 a barrel — an eight-month high.

Dow Jones

6.14am: US economy posts solid growth

Gross domestic product, the broadest measure of goods and services made in the U.S., expanded at a 3 per cent annual rate in July through September, the Commerce Department said Friday. Economists surveyed by The Wall Street Journal had projected a 2.7 per cent gain.

The stronger-than-expected number bolstered the case for the Federal Reserve to raise rates at a faster pace in coming months. Higher rates tend to make the dollar more attractive to investors seeking yield.

Dow Jones

6.05am: European markets taps 5-month highs:

Europe’s broad-market benchmark closed higher on Friday, even as Spanish stocks tumbled as the Catalonia region moved to separate itself from the central government. A continued pullback in the euro and some well-received corporate earnings have helped to sustain buying momentum.

The Stoxx Europe 600 index rose 0.6 per cent to 393.43, ending at its highest level since May. For the week, the pan-European benchmark gained 0.9 per cent, marking the index’s sixth advance in seven weeks, according to FactSet data. On Friday, Germany’s DAX 30 index rose 0.6 per cent to 13,217.54, logging a fresh all-time closing high. In Paris, the CAC 40 moved up 0.7 per cent to 5,494.13, and in London, the FTSE 100 rose 0.3 per cent to close at 7,505.03.

Dow Jones