Billabong eyes Rip Curl takeover, circles Surfstitch

Surf wear company Billabong is believed to be in exclusive due diligence to buy rival Rip Curl, which has been up for sale through boutique advisory firm Gresham.

The move follows reports that Billabong is also circling the troubled online retail company SurfStitch, which it once partially owned, as it fights its way back to profitability after a brief period where it came close to collapse.

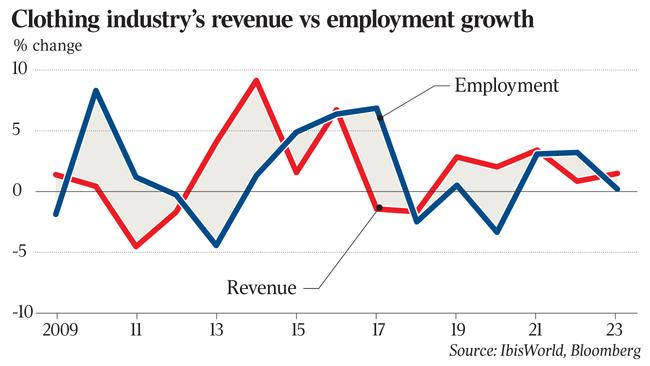

Billabong, Rip Curl and Quicksilver became highly fashionable apparel brands among youth in the 1990s, but while they remain in favour with those who grew up with them, the children of Generation X and Yers are reluctant to be seen in the same attire as their parents, which market analysts say has led to their decline.

Rip Curl has remained focused on the sale of surfing-related products while Billabong has headed more down the mass market route.

Rip Curl is still controlled by founders Doug Warbrick and Brian Singer, who jointly own 72 per cent of the company. They started the business in 1969 at Torquay, Victoria, initially producing surf boards before moving into wetsuits.

The company’s third-biggest shareholder is Francois Payot, who helped create Rip Curl’s European business. Now Rip Curl employs 2653 people and manufactures wetsuits, snow apparel, watches, footwear, cloths and accessories.

In addition to Rip Curl’s Australian operations, the company also has licence agreements with international entities, which manufacture and distribute Rip Curl products in South America, North America, Europe and Asia.

When Rip Curl was for sale in 2013, the owners were hoping to secure $400 million for the business through a sale or float, but two years later, it was valued at $310m when the board approved a share buyback from former executives.

The group generated $485m of revenue in the past financial year and some estimate that it could sell for as much as $450m.

Three years ago, it was generating $23m in annual net profit. It will be interesting to see how Billabong funds any acquisition. Billabong, which counts hedge fund Oaktree as a major investor, sold its Tigerlily swimwear brand to Crescent Capital for $60m this year to boost its bottom line ahead of a debt refinancing through Grant Samuel.

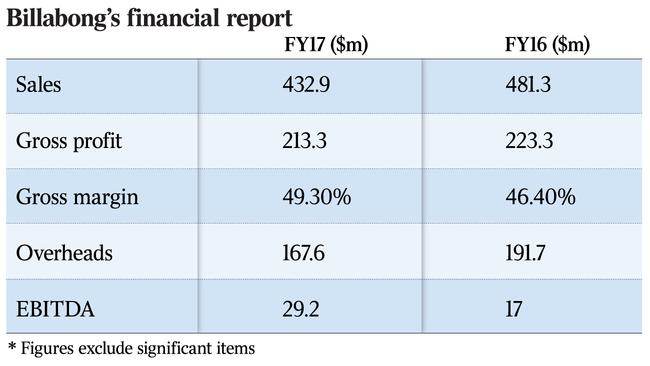

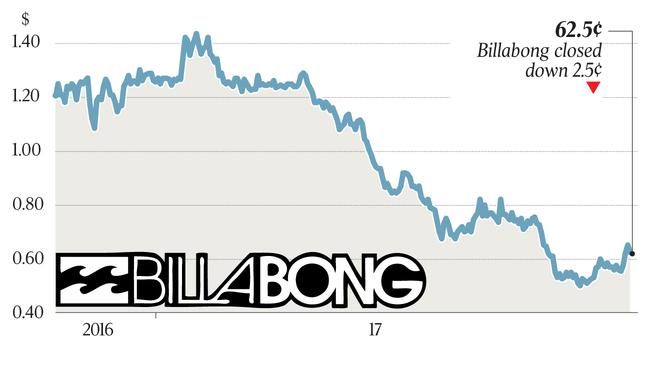

For fiscal 2017, Billabong generated $51m in earnings but booked a $77.1m loss. Its market value has tumbled from the giddy heights of $3.83 billion a decade ago to $122m.

Meanwhile, it is understood that advisory firm Moelis is working on the privatisation of listed luxury retailer Oroton. The talk is that the founding Lane family will buy the business back after its performance deteriorated following the loss of its licence deal with Ralph Lauren.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout