Cheaper plans ‘at risk’ under NBN changes

Changes to NBN pricing could pose a risk to customers choosing a basic service on the National Broadband Network.

Changes to NBN Co’s pricing model could pose a risk to customers choosing a basic service on the National Broadband Network, with the cheapest plans likely to disappear.

The warning comes from internet service provider Aussie Broadband’s managing director Phillip Britt, who said any potential tweaks to the pricing model, including lowering or eliminating the controversial connectivity virtual circuit price, could have unintended consequences.

“It’s one of the many models NBN Co is pitching to us, but the issue with the blended product set is that the older demographic are disadvantaged by that because the AVC price goes up under that mode,” Mr Britt told The Australian.

“(For NBN) it’s all about getting to that magical $52 figure that lets them recover the cost of building the network, so if they blend it then your average price goes up and you will see the cheap plans that appeal to the over 50-60 age group disappear.”

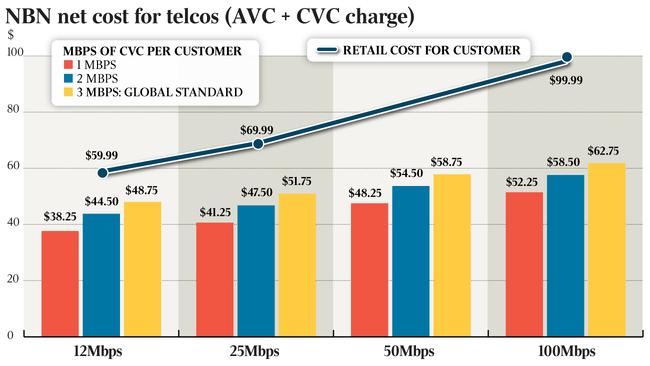

The CVC is the price retail service providers pay to move data from the NBN to their networks. The amount of CVC a RSP buys impacts the network speeds, particularly at peak usage times.

NBN Co also charges telcos a monthly line service fee, known as the access virtual circuit. This cost rises depending on the speed tiers available on the NBN — AVC for an entry-level 12/1 plan stands at $24, while a 50/20 plan cops an AVC of $34.

NBN Co boss Bill Morrow last week flagged the company would introduce a new price option for telcos, encouraging them to sell higher speed plans to consumers, preferably the 50/20 offer.

The sticking point for the industry is the high wholesale price charged by NBN Co, especially the CVC, which the industry says is an artificial tax imposed on capacity.

The RSPs are on average buying 1.2Mbps of CVC, and despite their claims even premium players like Telstra and Optus aren’t provisioning the 3Mbps of CVC necessary for reliable service delivery on unlimited plans. “The rumours we heard six months ago was that Optus was needing to buy around 2.5Mbps of CVC to sustain its unlimited product and even then customers weren’t happy with the performance,” Mr Britt said.

According to the telcos, the overall wholesale cost (CVC plus AVC) even for the basic 12/1 service at 3Mbps of CVC is too high at $48.75 per customer per month.

The wholesale cost combined with the marketing, staffing and maintenance costs incurred by the RSP means that a reliable entry-level NBN service needs to be priced well north of $50. The lowest entry-level unlimited NBN plan in the market starts at $40.

Mr Britt warned that consumers simply would not pay, or could not afford, high prices for basic plans and that left NBN Co and the telcos in a bind. “Consumers are unaware of what’s happening in the background,” he warned.

“They buy these $59 a month unlimited services and expect excellent performance but the economics just don’t stack up.

“The wholesale price is very high but at the end of the day you have to work with what you have been given.

“The pricing was set seven to eight years ago and the AVC price has not changed since then,” Mr Britt added. The CVC price has come down, and under the current model the more CVC that RSPs buy the less they pay per Mbps.

The trouble for telcos, according to Mr Britt, is that the CVC discount doesn’t help their margins, especially as they are offering customers prices that are unsustainable in the long run.

Meanwhile, NBN Co needs the telcos to buy more bandwidth to make a modest return and keep the $50 billion project off the federal budget.

Caught between the so-called “telco land grab” — where the telcos push unsustainable offers to homes — and rising customer complaints, NBN Co is running out of options.

“The telcos are bleeding in a big way,” Mr Britt said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout