Trading Day: live markets coverage; ASX hits highest level since June; plus analysis and opinion

The ASX seals fresh highs as policy reform hope boosts healthcare, while China data reveals an iron ore binge.

Welcome to Trading Day for Friday, October 13.

Samantha Woodhill 4.35pm: Stocks hit highest level since June

The local share market booked its best run over six sessions since March to close at a near four-month high, healthcare stocks led gains after the Federal government announced industry reforms and insurers pledged to pass on cost savings.

The benchmark S & P/ASX200 was up 19.734 points, or 0.34 per cent, at 5814.2 points. The broader All Ordinaries index was up 20.601 points, or 0.35 per cent, at 5884.7 points.

“The stronger sectors are the health insurers reacting to the news coming out about what’s going to happen to private health cover,” Citibank equity sales director Karen Jorritsma said.

Ramsay Health Care jumped 3.6 per cent to $65.91 and Medibank gained 1.97 per cent to $3.10. Healthscope rose 2.5 per cent to $1.845.

In financials, NAB rose 0.34 per cent to $32.17. Commonwealth Bank added 0.33 per cent to $76.66. Westpac gained 0.52 per cent to $33.00 and ANZ edged up 0.07 per cent to $30.06.

Bank of Queensland lost 1.83 per cent to 12.85 after analysts pitched the stock has run its course. It comes after the bank’s stocks sealed a 10 per cent rally over the last 3 months at yesterday’s close following FY17 results — read more

4.10pm: Chinese iron ore imports soar

China’s monthly imports of iron ore breached the 100 million tonne mark for the first time ever in September, according to official trade data released today.

The world’s largest steel producer said it imported 102.83 million tonnes of the steelmaking ingredient in September, taking the year-to-date volumes to over 815 million tonnes and putting the country on track to import more than 1 billion tonnes over the course of the calendar year.

China’s imports have been growing at a double-digit pace since January, with imports of all products from Australia leaping over 40 per cent in the first nine months of the year to more than $US70bn, according to the country’s General Administration of Customs — read more

Dow Jones Newwires

3.50pm: Australia’s turn at golden week

Last week China had it’s national “Golden Week” holidays that saw the nation switch off activity for 1/52 of the year. Next week its our turn.

Unfortunately, it doesn’t involve five consecutive public holidays.

Australia’s golden week is all about — you guess it — gold miners. The sector unloads its September quarter results and Credit Suisse has served gold bug clients a preview of what to expect from the nation’s haulers.

Santa Barbara (Neutral, target price $2.95)

“SBM history of conservative guidance and production outperformance driven by both stronger than forecast ore production and higher grades.”

“FY18 guidance for Gwalia appears conservative, assuming no high grade shoots, but [there is] production disruption from the Gwalia extension project.”

Evolution Mining (Neutral, target price: $2.22)

“We perceive risk that (recently divested) Edna May could soften SepQ group production and provide some cost offset to the positive benefit expected from Ernest Henry.”

Northern Star Resources (Neutral, target price: $4.55)

“WA gold royalty cost [now] avoided, 100pc of NST’s gold production is from WA. The proposed increase to 3.75pc was an 11cps risk to our net-present-value.”

“No specific Sept-Q guidance and quarterly production has been historically very volatile, but guidance generally achieved on a full year basis.”

Perseus Mining (Outperform, target price: $0.78)

“We’ll be looking for the SepQ to demonstrate stability in the Edikan operating performance, meeting production and cost budget.”

“Edikan’s LOM plan suggests it is now in an extended period of lower costs and capital outlays which should deliver ongoing positive net cash flow subject to gold price.”

Paul Garvey 3.20pm: Kingsgate limps to $200m policy suit

Former high-flying gold miner Kingsgate Consolidated is suing its insurers after they knocked back a payout of Kingsgate’s $200 million political risk policy.

Sydney-based Kingsgate, which was forced to close its Chatree gold mine in Thailand at the end of last year following orders from the Thai government, said this morning that it had decided to start proceedings against Zurich Insurance Australia in the NSW Supreme Court.

Kingsgate had argued that it was entitled to a payout as its policy provided coverage for ‘expropriatory acts in violation of the Thailand-Australia Free Trade Agreement’, but the company revealed today that Zurich had knocked back its claim.

High-profile barrister Dr Andrew Bell will act as Kingsgate’s senior counsel on the matter.

Kingsgate was once one of the biggest gold miners listed in Australia, with a share price of more than $11 and a market capitalisation in excess of $1 billion, but its shares collapsed to as low as 20c each last year after the move by Thai authorities to shut Chatree.

The company also revealed today that it would carry out a buyback of up to 10 per cent of its shares in response to its low share price, while it also said it would consider options including a joint venture or full or partial sale of its undeveloped Nueva Esperanza gold project in Chile.

KCN last up 6.6 per cent at $0.32

2.50pm: ASX200 counts gains, China exports lift

The local sharemarket edges toward a close at its highest level since June as it tests the bounds of a tight trading range established earlier that month.

The S & P/ASX200 index hits new intraday highs of 0.4 per cent higher at 5817 in afternoon trade.

Healthcare and health insurers lead gains after the government announced new industry reforms, Mediabank Private trades 2.1 per cent higher, Nib adds 1 per cent and Ramsay Healthcare lifts 3.5 per cent.

Heavyweight banks and miners post gains between 0.2-0.6 per cent, while our largest trading partner China’s growth hunger came to light earlier on official data revealing higher-than-expected 19.5 per cent export growth in September year-on-year compared with 14.4 per cent in August (see below). Also in yuan terms, exports grew a softer-than-expected 9 per cent.

The nation will remain global market’s key focus next week, according to AMP Capital’s Shane Oliver, with the Communist Party Congress due to start Wednesday and more economic data to be released.

In terms of equity investment: “beyond short term uncertainties we remain in a sweet spot in the investment cycle,” said Dr. Oliver, “[signalled by] okay valuations particularly outside of the US, solid global growth and improving profits but still benign monetary conditions.”

“We remain of the view that the broad trend in share markets will remain up.”

Meanwhile, the Australian dollar has rallied over 1 cent US in the last week after a month-long downtrend against a stronger greenback.

The local currency last traded 0.2 per cent higher at US78.34 cents.

Samantha Woodhill 2.20pm: Borrowers lift rate hike shield

Australians are locking their mortgages into fixed rates to shield themselves from rate rises, according to a report released by broker AFG.

The proportion of Australians who have locked in their mortgage interest rates has soared by more than 10 percentage points since last year to over a quarter of the whole market.

The increase “confirms many Australians are anticipating that the next time interest rate move will be up”, AFG CEO David Bailey said.

For the first quarter of the 2018 financial year, 26.3 per cent of the mortgage market was made up of fixed-interest loans, the highest proportion since 2013 and up sharply from the 16 per cent registered for the same period last year.

John Durie 1.55pm: ACCC launches Foxtel merger inquiry

The ACCC has launched a formal inquiry into the proposed merger between Foxtel and Fox Sports which will give News Corp (NWS) a 65 per cent stake in Foxtel.

News presently owns Fox Sports and 50 per cent of Foxtel with Telstra (TLS).

The inquiry will consider the impact of the merger on the acquisition of sports content, the supply of telecommunications services and the supply of broadband services on fixed and mobile lines.

Michael Roddan 1.25pm: RBA fears property ‘payment shock’

The Reserve Bank has revealed deep concerns about the property market, warning interest-only borrowers are vulnerable to “payment shock” and that many households could be forced to dump their homes onto the market.

In a stark admission of the heightened threat to financial stability amid endless increases in household debt and rampant property prices, the RBA will launch “top down stress tests” of the banking system, which will be carried out on top of the supervision from the Australian Prudential Regulation Authority.

It’s another layer of scrutiny on the banking system, which being investigated by the corporate watchdog for possible breaches of responsible lending laws when interest-only loans are sold to customers. APRA in March told banks to limit the sale of interest-only loans, which don’t require any payment on principal for a period of around five years. Investment bank UBS has found one-third of interest-only borrowers are unaware they aren’t paying off their mortgage.

1.10pm: Morrison’s message to Wall Street

Treasurer Scott Morrison has taken his better-days-ahead message to New York, telling a business audience the government is unashamedly prioritising growth strategies.

But he warned while a brighter economic picture was emerging amid a renewed sense of optimism within the global economy, complacency is still the enemy. “We cannot afford to rest on our laurels; to sit back and wait for growth to magically fall from the sky, ” Mr Morrison told the Citigroup gathering overnight — read more

AAP

12.50pm: ASX leaps as reform hopes boost health

The Australian share market has reached its highest level since June, led by a strong healthcare sector.

The benchmark S & P/ASX200 index was up by 0.1 per cent to 5,800.1 points at 1200 AEDT on Friday.

NIB Holdings grew 0.67 per cent to $6.05 while Medibank Private rose 2.14 per cent to $3.11 after the federal government announced plans to release a raft of proposed health insurance changes, promising Australians cheaper premiums and easier access to mental healthcare.

The financial sector was flat, with all four big banks barely moved. ANZ and Westpac were each up about 0.1 per cent, National Australia Bank was flat, and Commonwealth Bank was about 0.1 per cent lower after announcing it will remove financial incentives for selling products from bank teller bonuses.

Despite a fall in iron ore prices overnight, mining stocks were stronger, with BHP Billiton, Rio Tinto both up 0.7 per cent and 0.3 per cent respectively.

However, energy shares were mostly lower, following a slip in oil prices after the US Energy Department reported a larger-than-expected decline in US inventories and a fall-off in weekly production. Woodside, Santos and Oil Search were down between 0.1 per cent and 0.3 per cent.

The Australian dollar was flat against its US counterpart, worth 78.37 US cents, up just slightly from 78.21 US cents on Thursday.

AAP

12.30pm: Insider trading probe widens

Byron Tau writes:

A New York Republican congressman used his public office to benefit an Australian biotechnology company in which he is a major investor and board member, according to a new report from a nonpartisan agency that investigates allegations of wrongdoing by members of Congress.

The Office of Congressional Ethics also said Chris Collins may have shared nonpublic information about Sydney-based Innate Immunotherapeutics with other investors.

In a report released overnight, the ethics office said it found “substantial reason” to believe both allegations and voted unanimously to send the case to the House Ethics Committee for further investigation. The office said the conduct may have violated federal law — read more

IIL last down 3.2pc at $0.03

12.08pm: Market entertains Nine’s ‘#1’ prospects

Nine Entertainments shares soar over 4 per cent as the best performing ASX200 stock in early trade after Credit Suisse turned up on the volume on its forecasts for the “number one” main Aussie TV channel with 38.2 per cent market share.

Nine is well-placed to own its new standing at the top of the podium, according to Credit Suisse analysts, set to bring home a 12.5 per cent increase net-profit-after-tax of $130m and will flesh out its market share of revenue to 38.5 per cent this fiscal year.

The network’s FY18 guidance remains 37.5 per cent market share.

“In our view NEC is cheap on a PE multiple of 9.7x FY18F and 6.5pc dividend yield,” say the analysts, “we believe that TV structural pressures are priced in at these levels.”

Industry shakings too have Credit Suisse giddy, more upside potentially Nine-bound in the wake of Ten Network’s acquisition by US giant CBS network, according to its analysts.

“There is a reasonable chance that CBS may look to buy a stake in Stan,” says Credit Suisse.

“We believe this would make more sense for CBS than trying to build a streaming presence organically through CBS All-Access.”

NEC last up 4.5 per cent at $1.52; Credit Suisse’s 12-month target price $1.60.

12.05pm: Rules helping home prices: RBA

Moves by regulators to tighten standards for housing loans are working and have helped ease Australia’s overheated property market, the Reserve Bank says.

The central bank has maintained its view that key risks to the country’s financial system stem from high levels of household borrowing but said it has seen growth in riskier types of lending ease.

Investor lending has slowed significantly across all states as a result of steps by the Australian Prudential Regulation Authority (APRA) to restrict growth in loans, the RBA said in its half-yearly Financial Stability Review.

11.55am: The Trading Day ahead

Join the conversation with our Trading Day experts for breaking news and analysis in financial markets here and on Sky News Business (Ch: 602)

NOW: Simon Segal — Dealbook

12.00pm: Henry Jennings — Marcus Today, Ric Spooner — Chief Market Analyst, CMC Markets

12.15pm: Janu Chan — Senior Economist, St. George

1.00pm: Ben Le Brun — OptionsXpress

1.50pm: Live cross — Bloomberg Asia

2.00pm: Andrew Wielandt — Dornbusch Partners

2.10pm: Justin Smirk — Senior Economist, Westpac

(All times in AEST)

Elizabeth Redman 11.40am: House price growth cools: NAB

House prices are set to grow more slowly than previously thought next year, although unit price growth could be better than expected, according to new forecasts from NAB.

Even so, confidence in the housing market is rising as both rents and prices continue to increase in most states, a survey of property professionals by the bank found.

Sentiment rose six points to +20 in the third quarter and improved in all states except NSW, according to the NAB Residential Property Index.

But worsening affordability and a possible hike in interest rates could crimp price growth next year.

10.50am: ASX200: Grinners and groaners

The S & P/ASX200 index extends a five-day winning streak and lifts 0.3 per cent 5811.1 — grinners and groaners in early trade:

10.34am: The Trading Day ahead

Join the conversation with our Trading Day experts for breaking news and analysis in financial markets here and on Sky News Business (Ch: 602)

10.45am: Julia Lee — Bell Direct

11.00am: Ben Le Brun — OptionsXpress

11.15am: Chris Gosselin — CEO, Australian Fund Monitors, Rudi Filapek-Vandyck — Editor, FNArena

11.45pm: Simon Segal — Dealbook

12.00pm: Henry Jennings — Marcus Today, Ric Spooner — Chief Market Analyst, CMC Markets

12.15pm: Janu Chan — Senior Economist, St. George

(All times in AEST)

10.30am: ASX200 bucks offshore lead at open

Australia’s S & P/ASX 200 share index is bucking weaker offshore leads today.

This follows South Korea’s confirmation that a North Korean quake was natural.

The index rose as much as 0.3pc to a 3.5-month high of 5808.8 in early trading.

Utilities are leading broadbased gains in all sectors except energy.

Nine Entertainment, Galaxy Resources, Medibank, Aconex and Dominos are strongest.

Index last up 0.1pc at 5803.

10.25am: CBA scraps teller incentives scheme

Commonwealth Bank has announced it plans to scrap sales-based financial incentives for 2000 customer service personelle, known as tellers, in an overhaul of its frontline staff remuneration scheme.

The announcement comes shortly after the bank removed ATM fees for non-customers and allegations by financial intelligence agency Austrac of over 50,000 cases of noncompliance with money laundering measures — read more

CBA last down 0.1 per cent at $76.34

Sarah-Jane Tasker 10.00am: Health insurers eye $1bn remedy

Updated:

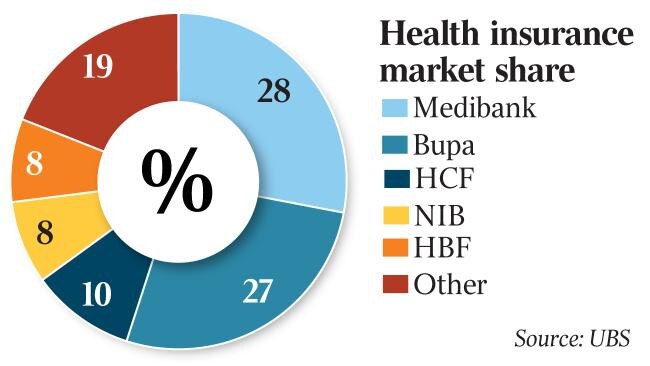

Australia’s health insurers have backed the most comprehensive reforms to hit the industry in almost 20 years and promised to deliver lower premium increases after winning more than $1 billion in savings on the cost of medical devices.

Health Minister Greg Hunt will today announce a list of private health insurance reforms, including categorising policies as Gold, Silver, Bronze and Basic Bronze, a discount for young people and more power for the Private Health Insurance Ombudsman — read more

Producers note: Medibank Private (MPL) up 2.1 per cent at 14-month high of $3.11, NIB Holdings (NHF) up 1.1 per cent at $6.08.

9.55am: ASX200 likely flat despite Wall St falls

Australia’s S & P/ASX 200 is likely to be flat despite slight falls on Wall Street.

The S & P 500 fell 0.2pc as Citi and JPMorgan dived after the market latched onto the bank’s increasing consumer loan loss provisions.

However, those results aren’t relevant for Australia and have by no means killed the US equities rally.

There was also a hint of risk aversion in the US afternoon but this has since abated.

US bond yields and USD/JPY fell after USGS said it couldn’t confirm whether a North Korea quake was natural or man-made.

But after the close of US trading South Korea said a 2.7 earthquake that shook near the site of previous North Korean nuclear tests this morning was a natural phenomena.

Commodities were mixed, with spot iron ore up 0.7pc to $US60.09, Brent crude down 1pc to $US56.37, spot gold up 0.6pc at $US1,293 and coking coal down 0.5pc at $US181.

The RBA’s financial stability review at 11.30am (AEDT) today will be watched for clues on monetary policy.

China’s monthly international trade data is due later today, while its money supply and loans data are due in coming days.

US CPI, retail sales and revised GDP data will be in focus tonight.

On the charts, the S & P/ASX 200 is rising toward key resistance in the 5800-5936 area.

Support may be as close as 5777.7 and the 200-DMA at 5753 is potentially solid.

Index last at 5794.5.

Anthony Klan 9.53am: Westpac lift insurance ‘rip-off’

Westpac has ripped off its own banking customers by selling them overpriced life insurance products identical to cheaper policies it sells to the public through independent financial advisers, a class action legal case alleges.

Shine Lawyers has lodged the action against the nation’s second-biggest bank, alleging it abused its position of power and breached its fiduciary duties by using its in-house financial planners to sell its customers policies it had loaded with “excess premiums” — read more

WBC last $25.17

Michael Roddan 9.45am: Magellan pitches $11m outside off

The $50 billion Magellan Financial Group is turning to high-fee retail investors, launching an $11 million campaign to lure cricket fans into the company’s funds amid market-wide pushback against active investment management.

Speaking at the group’s annual general meeting in Sydney yesterday, Magellan chief executive Hamish Douglass, a BRW rich-lister with a wealth of more than $500m, said the company was also creating funds for institutions that wanted low-carbon options.

“More and more institutional investors are starting to focus on the carbon exposure of their portfolios, almost despite what the politicians are doing,” Mr Douglass said — read more

MFG last $25.17

9.35am: Giants keen on Indooropilly

Bridget Carter and Scott Murdoch write:

Australia’s shopping centre sector appears to be torn between soaring values for key assets and sluggish growth and sliding values across much of the rest.

At the premium end, all eyes are on the race for the Commonwealth Superannuation Corporation’s half-stake in the Indooroopilly Shopping Centre in Brisbane.

The deal, being handled by JLL and Colliers International, could see the fund take home up to $1 billion for the half-interest. But the real drawcard is the valuable management rights that come with the super-regional shopping centre, which is the first to hit the market carrying such rights for more than a decade.

Read more from DataRoom

9.15am: Analysts sour on BOQ valuation

Analysts have soured Bank of Queensland’s share price outlook and pitch the stock has run its course after it sealed a 10 per cent rally over the last 3 months at yesterday’s close following FY17 results.

Citi says the regional lender “duly delivered” with its $378m FY17 cash earnings above the investment bank’s own estimates, however the market has priced in the legwork already and revenue growth from recent mortgage repricing will “hit the wall” in the second-half of the calendar year.

“While BOQ is relatively well positioned against a challenging industry backdrop; it has outperformed for investors this year and no longer offers much upside,” say Citi analysts.

CLSA and Morgan Stanley also downgraded the stock this morning on valuation grounds.

BOQ last $13.09

9.00am: Analyst rating changes

Bank of Queensland cut to Underperform — CLSA

Bank of Queensland cut to Underweight — Morgan Stanley

Bank of Queensland cut to Neutral — Citi

Whitehaven cut to Neutral — Credit Suisse

Regis Resources cut to Sell — Morningstar

Mantra cut to Hold — Ord Minnett

8.55am: HNA circled Mantra before Accor bid

Bridget Carter and Scott Murdoch write:

The Chinese party eager to buy Mantra before Accor swooped on the accommodation provider is now known to be HNA.

The group had been aggressively targeting the Australian market in the past year before it started being investigated by authorities.

HNA owns 20 per cent of Virgin Australia. It has $218 billion of assets and employs 410,000 people — read more from DataRoom

MTR last $3.88

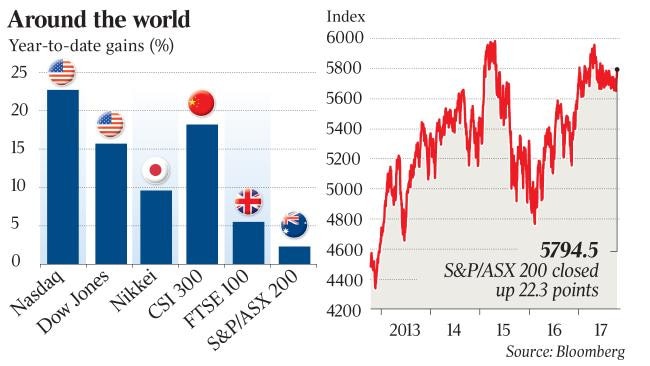

8.50am: ASX stalls as world hits top gear

While the Australian sharemarket’s fortunes may be improving after a 2.5 per cent rise in the past five days — its best five-day run since March — it remains the clear underachiever on the global stage.

Australia’s benchmark S & P/ASX 200 Index remains stuck in low gear, still some 15 per cent below its record high while key markets around the world have been pushing fresh highs.

Japan’s Nikkei Stock Average yesterday continued to push its highest level in 21 years. The Stoxx Europe 600 rose for nine straight trading days through to Tuesday, its longest winning streak in more than two years, while Wall Street’s Dow Jones Industrial Average and Nasdaq Composite closed at fresh highs yesterday. Shares in New Zealand, where the outcome of last month’s election remains uncertain, inched up 0.1 per cent to an eighth straight closing record — read more

S & P/ASX200 last 5794.5

8.40am: Court rules ResMed in patent battle

A German court has found a Resmed sleep mask model has not infringed a Fisher & Paykel patent, while a second filing by the company in relation to RedMed’s AirSense 10 model is still in progress.

The ruling comes after ResMed conceded the revocation of two of its patents in the UK, with a third still underway including RedMed’s own counterclaim.

RMD last $9.86

Adam Creighton 8.23am: Costello lobs super grenade

Peter Costello has lobbed a grenade into the Coalition’s long-stalled superannuation reforms, arguing that the flow of billions of dollars in workers’ compulsory contributions had given funds controlled by banks and unions a huge advantage, and the money should instead be invested by the government.

In a speech in Melbourne, the former Treasurer and current chairman of the Future Fund urged the government to “show some interest in managing (super) in a cost-efficient way”.

The government has tasked the Productivity Commission to come up with ways to prise default super contributions out of the hands of union-backed industry funds.

Bridget Carter 8.20am: Tension behind Credit Suisse exit

The sudden departure of high-profile Credit Suisse deal-maker Michael Stock on Wednesday has sent shockwaves through the nation’s tight investment banking industry, with some pointing to a clash with Australia and New Zealand chief executive John Knox as the reason behind his exit only 16 months into the job.

The Australian reported online on Wednesday night that Mr Stock, Credit Suisse’s local head of investment banking, was no longer with the bank after Mr Knox called staff into a meeting to inform them that he had resigned.

Ben Butler 8.15am: Scamble to find new ASIC chair

The Turnbull government’s process to appoint a new head of the corporate regulator is in disarray following the formal withdrawal of the leading candidate, John O’Sullivan.

With just five weeks left to run in incumbent Greg Medcraft’s term, the government is now scrambling to find a replacement Australian Securities & Investments Commission chairman capable of dealing with significant challenges including a monster lawsuit against the big banks that starts within a fortnight.

7.40am: Local shares to open flat

The Australian share market is poised for a steady open after Wall Street took a breather from its recent run of gains.

At 7.40am (AEDT), the local share price futures index was down two points, or 0.03 per cent, at 5,766.

In the US, Wall Street stock indexes fell as earnings season kicked off with a whimper.

Banks and media companies were the biggest drags on the S & P 500 as AT & T fuelled concerns about video subscribers and investors took fright at comments from JPMorgan and Citigroup’s earnings calls.

The Dow Jones Industrial Average fell 31.88 points, or 0.14 per cent, to end at 22,841.01, the S & P 500 lost 4.31 points, or 0.17 per cent, to 2,550.93 and the Nasdaq Composite dropped 12.04 points, or 0.18 per cent, to 6,591.51.

The Australian share market overcame early falls yesterday to close higher, as Bank of Queensland’s profit growth boosted the financial sector and energy producers were boosted by forecasts of stronger oil demand.

The benchmark S & P/ASX200 index rose 0.39 per cent to 5,794.5 points, its highest level since June 29.

In local news today, the Reserve Bank of Australia is due to publish its latest Financial Stability Review, which should offer its perspective on home loan borrowing and offer clues about the next move in the cash rate.

The Australian dollar was flat against its US counterpart, as the greenback drifted after the Federal Reserve showed a more guarded view towards inflation.

The local unit was worth US78.22 cents, up just slightly from US78.21 US cents yesterday.

AAP

7.10am: US stocks slip as banks begin earnings

Declines in bank shares pulled US stock indexes away from records overnight.

The latest earnings season kicked off in earnest this week, with several large lenders scheduled to report quarterly results tonight (AEDT).

Strong earnings growth has supported major stock indexes this year, helping the S & P 500 notch 44 record closes and the Dow Jones Industrial Average hit 48 closing highs so far in 2017.

If results are solid again this quarter, that should help US stocks keep climbing, some analysts said, even as many raise concerns about valuations that look pricey.

“Growth may not be stellar, but it’s enough to create a good tailwind for company earnings,” said Karyn Cavanaugh, senior market strategist at Voya Investment Management.

The Dow Jones Industrial Average fell 32 points, or 0.1 per cent, to 22841 after finishing at a record yesterday. The S & P 500 edged down 0.2 per cent, while the Nasdaq Composite fell 0.2 per cent.

Australian stocks are set to follow suit. At 7am (AEDT, the SPI futures index was down seven points.

Financial shares in the S & P 500 were among the biggest laggards of the broad index’s 11 sectors.

JP Morgan Chase shares declined 0.9 per cent after the company beat expectations for earnings and revenue, but said revenue from fixed-income trading fell. Shares of Citigroup lost 3.4 per cent after the bank topped analysts’ forecasts for revenue and earnings. Still, the company’s return on equity continued to lag behind its peers.

Despite the declines, some analysts said they remain upbeat about the near-term prospects of big banks.

“We’re positive on financials,” said Antoine Lesné, who runs a research and strategy team at State Street Global Advisors. The potential for Washington to orchestrate tax cuts and deregulate the sector should benefit share prices, while worries about Spanish and Italian lenders’ health are for now offset by a still strong economic environment in Europe, he said.

Dow Jones Newswires

6.55am: Aussie dollar edges up

The Australian dollar has edged higher against its US counterpart, as the greenback drifted while investors waited on US inflation figures.

At 6.30am (AEDT), the local unit was worth US87.27 cents, up slightly from US87.21 cents yesterday.

The Australian dollar rose past US78 cents yesterday, boosted by a surprisingly strong consumer confidence indicator, and has remained above the mark since.

The Aussie dollar was also marginally higher against the Japanese yen and the euro.

AAP

6.40am: Europe stocks steady

Europe’s stock markets held mostly steady as tensions eased over Catalonia and Wall Street drifted after its latest record-busting performance.

Frankfurt briefly made it above the key 13,000 point mark on the Dax index for the first time in a market lifted by Lufthansa shares rising strongly after the carrier said it would swallow up the lion’s share of failed Air Berlin.

“Favourable market conditions, relief on the back of a reduced threat of Catalonian secession from Spain and record low interest rates and QE combined have all helped to lift the German DAX to a new record level of 13,000 today,” said Fawad Razaqzada, a market analyst at Forex.com.

London also pushed moderately higher, helped along by weakness in the pound which boosts earnings of exporters in the FTSE index.

But shares in HSBC slipped after the British banking giant announced it had promoted head of its retail operations John Flint to the post of chief executive.

Madrid investors, meanwhile, took profits a day after a relief rally to push the Ibex a touch lower in closing trade. Spanish shares had surged Wednesday after Catalan leader Carles Puigdemont called for independence to be suspended to allow for talks with the Spanish government.

The euro conceded ground to the dollar.

London closed up 0.3 per cent, Frankfurt ended up 0.1 per cent and Paris was down 0.03 per cent.

AFP