ASX stalls as world hits top gear

While the Australian sharemarket’s fortunes may be improving, it is a clear global underachiever.

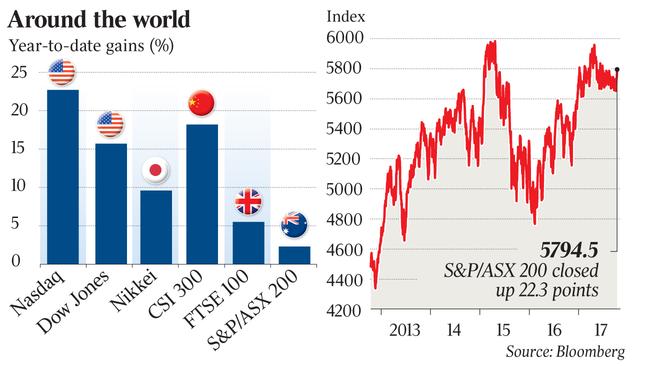

While the Australian sharemarket’s fortunes may be improving after a 2.5 per cent rise in the past five days — its best five-day run since March — it remains the clear underachiever on the global stage.

Australia’s benchmark S&P/ASX 200 Index remains stuck in low gear, still some 15 per cent below its record high while key markets around the world have been pushing fresh highs.

Japan’s Nikkei Stock Average yesterday continued to push its highest level in 21 years. The Stoxx Europe 600 rose for nine straight trading days through to Tuesday, its longest winning streak in more than two years, while Wall Street’s Dow Jones Industrial Average and Nasdaq Composite closed at fresh highs yesterday. Shares in New Zealand, where the outcome of last month’s election remains uncertain, inched up 0.1 per cent to an eighth straight closing record.

Fund managers still see better opportunities in offshore markets. “Australian equities have been in a relative performance downtrend since around 2010,” says Nader Naeimi, head of dynamic markets for the multi-asset group of AMP Capital, which has about $179 billion under management.

“Around the downtrend we have seen occasional lifts and some short-term outperformance phases, but I am not hopeful this time and I have not added to Australian equity exposure. We find much more worthwhile opportunities offshore.”

Including yesterday’s 0.4 per cent gain, Australia’s benchmark S&P/ASX 200 share index was up 2.3 per cent this year. Heavy falls in Telstra, real estate and big banks through the year have offset gains in healthcare, industrials, materials, consumer staples and energy stocks. Small caps were doing better with a 7.1 per cent rise.

The performance of Australian shares this year continues to pale versus global markets.

In US dollar terms, the S&P/ASX 200 is up 11 per cent this year due to a stronger Australian dollar. However, Wall Street’s S&P 500 is up 14 per cent and Europe’s Stoxx 50 is up 23 per cent in US dollars. Emerging markets are even stronger, with the MSCI Emerging Markets Index up 30 per cent.

Mr Naeimi expects the outlook for Australian equities to be restrained by opposing forces.

“Australian equities are somewhat polarised with banks on one side and resources the other,” he said.

“Concerns around household credit growth and housing market keeps us away from the banks, and for resources, we prefer a more diversified global resources exposure as well as direct exposure to global commodities.”

According to a report by HSBC, emerging markets have been the biggest drivers of global growth since the financial crisis and the confluence of three mega-trends — demographics, urbanisation and technology — could see this pace accelerate.

HSBC global economist James Pomeroy says the widespread adoption of smartphones in emerging markets — from current levels around 5 per cent versus 80 per cent in developed markets — will give access to financial networks which on some estimates could add $US3.7 trillion ($4.75 trillion) or 6 per cent to the economic growth in emerging markets by 2025.

As the young and growing populations of the emerging world transition to middle-class incomes, Mr Pomeroy said their demand for products and services would increase, so that by 2025, as much as 80 per cent of the world’s middle-class consumers would be in countries now known as emerging markets.

“This will be supported by urbanisation — which will continue to be a big trend in emerging markets at a time when developed market urbanisation rates may be peaking,” Mr Pomeroy said.

“We see scope for even more infrastructure investment in emerging markets — creating demand and employment in the short term but also raising potential growth further down the line.”

These factors together are expected to see emerging markets play a bigger role in global growth.

“Based on our forecasts, in 2018-19 India will contribute as much growth to the world economy as the entire eurozone. Indonesia and Brazil will each add more than the UK, and the Philippines will play a bigger role than Spain,” Mr Pomeroy said.

“The positive stories for global growth may come from new sources.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout