Trading Day: live markets coverage; ASX forgiven Bellamy’s spilt milk?; plus analysis and opinion

The local sharemarket ends the session flat as a positive jobs numbers raise expectations of a rate hike response.

Welcome to Trading Day for Thursday, October 19.

5.00pm: NZ dollar slides on election deal

The New Zealand dollar has slid in its initial market response to Winston Peter’s choice for New Zealand First party to back Labour to form the nation’s new government.

At 5.00pm (AEDT) the New Zealand dollar tumbled 1.3 per cent to US70.61c. Against the Australian dollar the Kiwi was trading at 90.04c, down 1.24 per cent on the day.

The New Zealand dollar had been drifting lower all day speculation of a coalition Labour government started built momentum.

Samanatha Woodhill 4.30pm: ASX flat on mixed jobs signals

The local share market ended flat after stronger than expected employment data reinforced expectations of a rate rise next year.

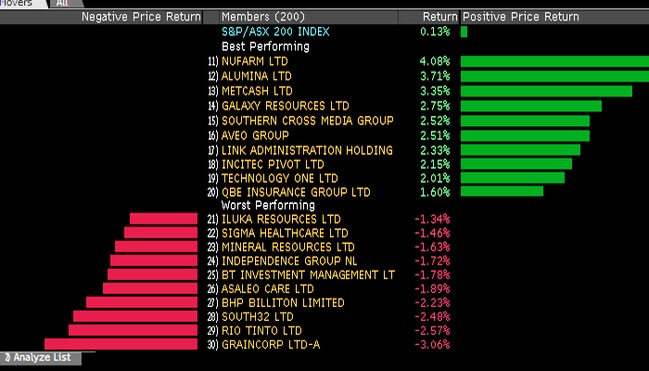

The benchmark S & P/ASX200 was up 5.623 points, or 0.10 per cent, at 5896.1 points. The broader All Ordinaries index was up 4.979 points, or 0.08 per cent, at 5959.801 points.

Australia’s unemployment rate hit a 4.5 year low of 5.5 per cent, undershooting market expectations of 5.6 per cent.

“The unemployment rate is now a touch below the RBA’s August forecast track and forward indicators suggest the RBA will need to make a downward adjustment to their unemployment rate forecasts in the upcoming November Statement on Monetary Policy,” said National Australia Bank Economist Tapas Strickland.

In financials, NAB was unchanged at $32.38. Commonwealth Bank edged up 0.47 per cent to $78.74. Westpac gained 0.57 per cent to $33.45 and ANZ grew 0.82 per cent to $30.60.

BHP shed 2.25 per cent to $26.56. Rio Tinto lost 2.54 per cent to $69.12.

The Australian dollar was trading at 78.56 US cents in late trade — read more

4.15pm: Is Big Oil making a comeback?

Robin Pagnamenta writes:

After a three-year plunge in prices that forced companies such as Shell, Chevron and BP to cut jobs, cancel projects, sell assets and load up on billions of dollars of debt, the oil industry is finally emerging from its funk.

With crude prices nudging $US60 a barrel — more than double the low point of $US27 touched early last year — the bigshots arriving in London this week for the Oil & Money conference, one of the industry’s swankiest annual shindigs, looked quietly confident that they had seen off the worst of a historic industry downturn.

“The swimming pools are draining,” Bob Dudley, the BP chief, quipped cheerfully as he and others at the meeting eyed signs of a tightening market — read more

The Times

3.55pm: Citi mops up spilt milk on Bellmay’s

City has popped the lid open on Bellamy’s, adjusting its 12-month target price on the infant formula milk company’s shares 82pc higher to $14.40 after coming around to its earnings prospects.

“Bellamy’s recent trading update indicates that trading momentum is accelerating and the turnaround is occurring faster than we expected,” says Citi.

“We upgrade FY18e-FY20e EPS by 2pc-25pc given faster than expected turnaround progress.”

Bellamy’s recent grab of Camperdown bottler upward vertical along with growth in its budding supermarket and pharmacy channels are providing momentum, according to the analysts.

Reasons for the stock’s “big” short interest (8pc of float) such as brand damage, excess inventory, balance sheet and CNCA licence issues are also becoming stale, they say.

“While we acknowledge Bellamy’s is not cheap, trading on 37x FY18 EPS, we expect further share price gains.

“We upgrade our recommendation from Sell/High Risk to Buy/High Risk.”

Bellamy’s now trades above the $12.13 level it held in last year before warning the market on China regulatory risk, after which it fell nearly 50 per cent in one day.

BAL last up 7.2 per cent on $12.20

John Durie 3.35pm: BofAML bullish on Treasury’s China sales

Booming China sales will help Treasury Wine double returns on equity in the next three years by boosting the value of its $1.7 billion wine inventory according to BAML analyst David Errington.

In a note released today Errington said the company would increase its asset turn from 0.4 to 0.6 per cent which will help double return on equity to 16 per cent.

Australian wine statistics released today showed the value of wine exported to China increased by 46 per cent by volume and 56 per cent by value to $739 million — read more

TWE last up 3.4pc on $14.78

3.02pm: Can Domino’s new topping lures investors?

Delivery drones, stand-alone pizza lockers, “anywhere” delivery (i.e. to a bus stop) — all things to which Domino’s select European clientele are privileged.

Meanwhile, we wait.

Hope lies in Domino’s latest operational update to the market, the tech-savvy pizza maker telling investors they can expect a national advertising campaign around ‘Domino’s Anywhere’ later this month.

Thankfully, one thing you will not spot on billboard is this:

Yes, you are looking at broccoli on pizza. And corn.

Apparently that’s above board in Germany where Domino’s majority-owned European JV has just splashed out $48m on Hallo Pizza — the above an attempt by the chain to lure innocent German’s eyeballs on Instagram.

The acquisition is set to expand Domino’s JV’s footprint in Germany from 209 to between 300-340 stores.

Analysts are yet to come to arms over the announcement, however the company expects the purchase to “only have a small contribution” to its JV’s underlying earnings.

In the meantime, our billboards are safe. Bring forth the drones.

DMP last up 2.5pc on $48.88

John Durie 2.17pm: The nation short innovation

Australian stock prices have played catch-up in the last two weeks but still lag the world in relative price earnings terms because of the lack of a vibrant technology sector.

On UBS figures, the Australian market is selling at a price earnings ratio of 15.3 per cent against a global ratio of 16.9 per cent, after tracking US stocks for the few years.

Over the last fortnight Australian stocks have bounced just over five per cent to partly bridge that gap.

But the reality is the global drivers have been technology, which has risen some 55 per cent in Asia this year and more than 30 per cent globally.

Back in 2000, at the height of the tech boom, Australia lagged the world in PE terms by around 30 per cent — read more

S & P/ASX200 last 5896.3

1.59pm: Westpac to refund customers $65m

Westpac will refund customers with ‘packaged’ accounts who did not receive entitled benefits a total of $65m, a total after tax cost of $45m.

The issue affected approximately 200,000 customers who held Premier Advantage Packages

with Westpac or Advantage Packages with St. George, BankSA, or Bank of Melbourne from

2010.

The bank says it has now simplified packages and “automated” customer discounts on core products such as home loans, credit cards, or transaction accounts.

WBC last up 0.6 per cent at $33.48

Paul Garvey 1.43pm: Investors back Peel’s ‘copper city’ grit

Cobar in NSW could be home to a big new high-grade zinc discovery after junior explorer Peel Mining released eye-catching exploration results this morning.

Shares in Peel last traded 45.5 per cent higher on the back of the results from drilling at its Southern Nights prospect, which the company said suggested a potential “major high-grade mineral system”.

The eye-catching results included a 21-metre intersection grading 24.5 per cent zinc. The drill hole ended in mineralisation, and Peel now plans to extend the hole deeper. The drilling also returned a broader 70m intersection grading 4.8 per cent zinc.

Peel has been exploring around the region for years with mixed success.

The grades of the mineralisation were determined using a handheld XRF device, so will need to be formally assayed in a lab before the grades are confirmed, but investors clearly like what they see.

“The tenor of mineralisation discovered at Southern Nights ranks as the best zinc-lead-silver mineralisation encountered to date by Peel, and subject to assays, possibly the best intercept encountered since the company’s inception,” Peel said in a statement.

Peel’s discovery sits south of Cobar, the town with a long mining pedigree and which is colloquially known as “Copper City”.

PEX last up 45.5pc at $0.32

1.15pm: China GDP growth slows in 3Q

China’s official GDP growth slowed in the third-quarter to 6.8 per cent year-on-year, down from 6.9 per cent growth on the same basis in the quarter previous.

Official data showed retail sales rose on the same basis by 10.4 per cent, slightly higher than expected, while fixed asset investment ex-rural rose a lower than expected 7.5 per cent.

China’ industrial production ticks along at a steady annual growth rate, the data showing a year-to-date 6.7 per cent increase in activity.

The Australian dollar has pared back gains on stronger than expected domestic jobs data to trade near flat at US78.50 cents — read more

Sarah-Jane Tasker 12.58pm: Healthscope lists ‘must wins’

Private hospital operator Healthscope has warned of continued soft conditions as it rolls out “must win” initiatives to boost its outlook.

Healthscope’s new chief executive Gordon Ballantyne told investors at today’s annual general meeting in Melbourne that there was no doubt he had arrived at the company at the end of a challenging year — read more

HSO last up 2pc at $1.91

Stephen Bartholomeusz 12.43pm: Markets in a world without risk

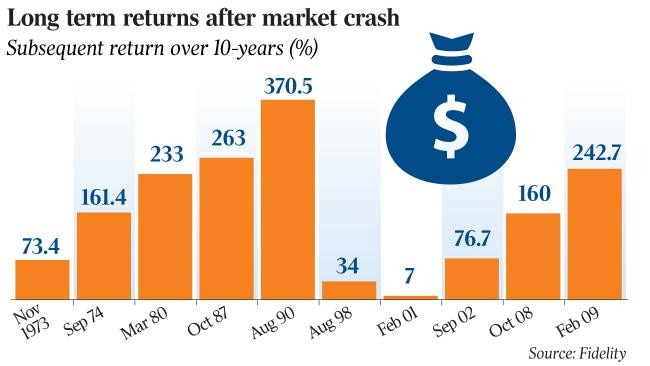

If today’s financial market settings are a guide, we live in a world without risk. Then again, the same could have been said of the settings a decade ago, or thirty years ago.

Thirty years ago today, of course, marked the day the US stockmarket imploded, recording its biggest fall in history on “Black Monday,” on October 19. Last week was the tenth anniversary of the peaking of the US equity market ahead of an accelerating decline as the global financial crisis developed.

Ahead of both those “moments,” there was no sense that something dramatic was about to occur, even though in both instances there were the warning signs of increasingly irrational behaviour by lenders and investors.

Today, volatility in equity and bond markets, as measured by the VIX index, is at historical lows and about half its long-term average.

Elizabeth Redman 11.57am: Housing to avert ‘severe downturn’

Sydney housing price growth is set to cool next year while Melbourne prices will only lose a little of their momentum, new forecasts show.

Price growth looks set to remain positive for both cities and a correction has been avoided because of strong population growth and the bank regulator’s moves to crack down on risky lending, according to SQM Research.

11.52am: 6000 only from ground up: Morgan Stanley

Australia’s share market needs a sustained earnings upgrade cycle in the industrials ex-financials sector in order to sustain a potential rise to 6000 points, according to Morgan Stanley strategists Chris Nicol and Daniel Blake.

“The rally has again stretched market multiples above their standard ranges, with the S & P/ASX 200 forward PE nearing 16 times, while Industrials ex-Financials once again trades more than 1 standard deviation above its long-term average of 19.3 times,” they say.

They also point out that their US Equity Strategy team sees potential for a US share market correction since the S & P 500 has risen 14.1pc this year without the usual 3pc plus correction.

Index last up 0.2 per cent 5903.6.

11.45am: ACCC fires big business warning shot

John Durie and Samantha Woodhill write:

Waste management giant JJ Richards has become the first company to fall foul of new laws governing small business contracts, with the Federal Court declaring its contracts unfair.

In a decision handed down today, the court ruled eight terms of the privately-owned waste company’s contracts were unfair and hence void.

A quick decision in the case validates the Australian Competition and Consumer Commission’s stance in taking action as a warning to other companies.

11.30am: DATA: Jobless rate at 4.5-year low

The unemployment rate fell in September to 5.5 per cent, compared with a steady rate of 5.6 per cent expected by economists, its lowest level since February 2013.

19,800 jobs were created in the month, the majority part-time (13,700) after a favourable full-time split in August.

The participation rate remained steady at 65.2 per cent.

The Australian dollar rose $US20c on the news to $US78.68 cents — read more

11.15am: DATA: Jobless rate to hold

Australia’s unemployment rate is expected to have remained at 5.6pc in September, according to Bloomberg’s consensus estimate.

Employment is expected to have grown by 15,000 after a 54,200 rise in August.

The breakdown of the change in jobs will also be key.

August saw a healthy 40,100 rise in full-time jobs and a 14,100 rise in part time.

While wage growth remains near record lows, the employment picture looks strong.

The economy has created an impressive 268,000 jobs this year, 203,000 of them full time.

Official data are due at 11.30am (AEDT).

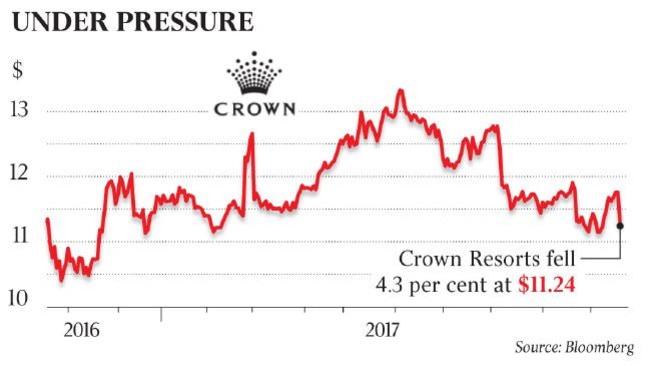

Sarah-Jane Tasker 11.10am: Crown claims ‘political fanfare’: Credit Suisse

Explosive claims against Crown Resorts, including allegations of illegally tampering with poker machines, are “political fanfare”, according to analysts, who argue the revelations are low risk for the casino operator.

Credit Suisse analysts outlined today that federal Parliament was generally not where casino regulation in Australia was enacted.

“Casinos in Australia are licensed and regulated by the states. Therefore, this Parliamentary stand was political fanfare as opposed to an argument for some new casino regulations bill,” the investment bank’s gaming analysts said.

Accusations of money laundering and pokie machine manipulation aired by independent MP Andrew Wilkie in parliament yesterday sparked a negative reaction on the stockmarket yesterday, with Crown shedding $350 million from its market value as its shares fell 4.3 per cent to $11.24. Shares in Crown were off slightly this morning at $11.13 — more to come

CWN last down 1.2 per cent at $11.11

Michael Roddan 10.55am: New home lending alert sounds

Many interest-only borrowers are failing to save any money, even though their monthly mortgage repayments are about 40 per cent lower than home loans paying off principal and interest.

It’s a further concern added to a growing list of worries about the threat interest-only loans present to the financial system.

Interest-only loans, which don’t require any payment on the loan’s principal amount for a period of around five years, have come under intense scrutiny over the last year

10.35am: Santos aims for top-end guidance

Robb M. Stewart writes:

Santos has narrowed its production and sales targets for the year after what it said had been a strong performance in the latest quarter.

The oil-and-gas company lifted the floor on earlier guidance ranges, forecasting output of between 58 million and 60 million barrels of oil equivalent and sales volumes of 79 million-82 million barrels, where it had earlier aimed for production in a 57 million-60 million window and sales of at least 77 million barrels.

In the third quarter, the Australian company produced 15 million barrels, a rise of 2 per cent on the prior quarter. For the nine months through September, output was 4 per cent lower than a year ago at 44.5 million barrels — read more

STO last up 1.4 per cent at $4.29

10.20am: ASX lifts 0.1pc early, Rio claims bite

The S & P/ASX200 index lifts 0.1pc in early trade to 5895.9, biggest swings claim Rio Tinto (-2.6pc) as US fraud probe and class action potential sinks in.

10.05am: Delays hit Woodside’s forecast

Robb M. Stewart writes:

Woodside Petroleum softened its production target for the year to reflect the delayed start-up of a massive new liquefied natural gas plant in Western Australia, even as its existing Pluto LNG operation continued to set production records.

The Australian oil-and-gas producer’s output declined as expected over the recent quarter, though higher prices and an increase in sales volumes on the preceding three months bolstered third-quarter revenue.

Woodside has flagged waning output this year before production picks up again as new projects begin operating. At the heart of near-term growth is Chevron US$34 billion Wheatstone gas-export project, which began producing this month after previously targeting a midyear start.

The company on Thursday said it now expected 2017 production of between 84 million and 86 million barrels of oil equivalent, narrowing its January guidance of a fall in output to 84 million-90 million. It said the change mainly reflected the timing of the start-up of the Wheatstone project’s first production line — read more

WPL last $29.79

9.58am: ASX: Profit takers’ trigger finger quivers

Australia’s S & P/ASX 200 share index faces a cautious start as investors weigh the balance of risk and reward following recent gains, according to CMC Markets.

“Strong gains from current levels will require investors to “rerate” the Australian market to the kind of above average levels currently applied to other international markets,” says CMC’s chief market analyst Ric Spooner.

“Traders may require some indication that this process is getting under way before joining the bandwagon.”

Weaker metals prices overnight and some nervousness in bond markets are also likely to keep the opening tone subdued.

Mr Spooner says today’s employment data could be key to how both the stock market and Aussie Dollar finish the day.

“After a string of strong numbers, many are expecting some mean reversion in job growth,” he says.

“This leads to the possibility that market risk is skewed towards better than data (but) another month of strong job growth would be unambiguously positive and could see both consumer related stocks and the Aussie Dollar supported.”

9.52am: Break for Super Retail: Morgan Stanley

Morgan Stanley has slapped a “Research Tactical Idea” buy recommendation on Super Retail Group, predicting gains in the next 30 days.

It notes that the stock has traded off recently, making short term valuation much more compelling, with the AGM trading update on October 23 a potential catalyst.

“Trading is likely better than feared as SUL navigates a difficult retail environment better relative to peers,” the broker says.

“Trade feedback suggests an easing in competitive tension in the Auto category (and) Amazon’s launch in Australia looks to have been delayed, hence Christmas trade is unlikely to be impacted.”

Valuation looks attractive at 11x FY18 expected EPS, the broker says.

MS has a target price of $10.00 versus yesterday’s close at $8.41.

SUL last $8.49

9.45am: Stay cautious over banks: UBS

Stay cautious banks despite potential gains on “solid, relatively clean results” this month and the ongoing rally in global banks, says Jonathan Mott at UBS.

He says the outlook into 2018 remains “very challenging,” as he expects the housing market to continue to slow, and if this does not occur, further macroprudential tightening is “very likely.”

Mortgage miss-selling risks are also a “growing concern”, pressure on net interest margins is “likely to continue given interest-only switching”, and falling bad debts “can no longer be a tailwind.”

“With a Fed Election likely during 2018 we believe it will be difficult for the banks to outperform,” he adds.

9.25am: BWX raises $100m for US beauty

BWX is raising $100m via a 1 for 5.7 entitlement offer to buy US natural skin, body and hair care brand Andalou Naturals.

It says this is a “strategically compelling acquisition that progresses BWX’s goal to become a global leader in the natural care market.”

BWX last $6.91

9.20am: US frothy, but no crash on horizon

Historical precedents aside, there is no reason to stuff the mattress with cash.

No doubt October holds bad memories for those who lost money in the 1987 crash. Australia’s All Ordinaries index fell an eye-watering 25 per cent the day after the October 19 “Black Monday” crash on Wall Street. The 1928 crash also occurred in October, and the same month marked the start of a 58 per cent fall in the US S & P 500 index during the global financial crisis of 2007-08.

The S & P 500 has now risen a stunning 278 per cent over the 103 months since the financial crisis. It’s the second-longest and second-strongest rise in the global benchmark since World War II.

9.08am: South32 unfazed by weak first-quarter

Robb M. Stewart writes:

South32 is sticking to its annual production guidance after a weak first quarter for many of its commodities, but cautioned it may face higher costs.

Stronger commodity markets bolstered the company’s balance sheet in the latest quarter, but the Australian miner said industry cost curves continued to steepen as the U.S. dollar weakened and raw-material prices increased. Unit costs are tracking to plan, but South32 said it would face headwinds if these pressures persisted through the remainder of the fiscal year.

South32’s production of metallurgical coal used to make steel fell by 66pc year-over-year to 494,000 metric tons in the three months through September as the company’s Appin mine remained suspended. Output resumed at part of the Australian mine last week.

First-quarter energy coal production was also weaker, falling 14pc on-year to 7 million tons, in part as maintenance was completed at operations in South Africa — read more

S32 last $3.23

9.03am: Analyst rating changes

QBE Insurance raised to Neutral — JPMorgan

Echo Resources initiated at Speculative Buy — Canaccord

Nufarm initiated at Overweight — Morgan Stanley

Incited raised to Equalweight — Morgan Stanley

Bellamy’s raised to Buy — Citi

Specialty Fashion cut to Neutral — Citi

Lendlease cut to Neutral — Credit Suisse

8.50am: Oil pares gains as US stockpiles rise

David Gaffen writes:

Oil prices settled slightly higher on Wednesday, with Brent touching three-week highs and then retreating after a surprising drop in U.S. refining rates and an unexpected build in fuel stocks signalled slower demand in the world’s top oil consumer.

Brent crude futures settled up 27 cents to $US58.15 a barrel, off the three-week high of $US58.54 a barrel hit earlier on worries about ongoing tensions around oil-rich Iraq and Iran.

U.S. West Texas Intermediate (WTI) crude futures settled 16 cents higher at $US52.04 a barrel.

U.S. crude inventories fell 5.7 million barrels last week, the Energy Information Administration said, exceeding analysts’ expectations — Reuters

Note: Woodside Petroleum (WPL) and Santos (STO) first-quarter results ahead.

8.32am: Domino’s says Hallo in Germany

Domino’s Pizza has acquired independent German pizza chain Hallo Pizza for $48 million, expanding its Domino’s Pizza Deustchland footprint from 209 to between 300-340 stores.

DMP last $47.70

Cliona O’Dowd 8.27am: ANZ exits $200m Metrocard stake

ANZ will exit a near $200 million stake in the Philippines-based Metrobank Card joint venture as the Australian bank continues its push to simplify operations.

The sale of a 20 per cent stake to joint venture partner Metropolitan Bank & Trust Company (Metrobank), for $US144 million ($184m), may precede a decision for ANZ to exit its holding entirely.

ANZ has also entered a put option which will enable it to sell its remaining 20 per cent stake to Metrobank, which can be exercised in the fourth quarter of fiscal 2018 — read more

ANZ last $30.35

8.20am: Crown denies rigging pokies

Rosie Lewis and Sarah-Jane Tasker write:

Crown casino will be investigated by regulators following explosive allegations staff illegally tampered with poker machines to increase debt losses and attempted to avoid money-laundering laws.

James Packer’s Crown Resorts yesterday demanded Andrew Wilkie “immediately” hand over information about a series of allegations after the anti-gambling independent MP used parliamentary privilege to disclose video evidence from three male anonymous whistleblowers claiming to be former Crown employees.

The allegations, which were rejected by the casino operator and have been aired days before the company’s annual general meeting, sparked a negative reaction on the stockmarket, with Crown (CWN) shedding $350 million from its market value as its shares fell 4.3 per cent to $11.24.

8.15am: Crunch time for Brisbane apartments

Rosanne Barrett and Lisa Allen write:

More than 100 apartments in a high-profile inner-city Brisbane development are yet to settle amid warnings it is “crunch time” for developers in the Queensland capital.

Some 20 per cent of the first tower of property developer Gurner’s 520-unit FV development are yet to settle, although the company maintains sales-to-date have allowed the $180 million in debt linked the project to be repaid in full.

Paul Garvey 8.10am: Class action looms as Rio charged

Mining giant Rio Tinto is bracing for class-action lawsuits out of the US after the Securities and Exchange Commission charged the company and two former executives with fraud.

The SEC yesterday morning filed charges against Rio, its former chief executive Tom Albanese and former chief financial officer Guy Elliott over its disastrous 2011 acquisition of Mozambique coal play Riversdale Mining.

The SEC alleges the company and the executives “sought to hide or delay disclosure” of problems with the Riversdale assets, while also raising $US3 billion in US debt offerings soon after the executives learned of the concerns — read more

RIO last $70.92

7.45am: ASX set for flat start

The Australian share market looks set to open steady or slightly lower, despite strong gains on Wall Street overnight.

At 7am (AEDT), the local share price futures index was down two points, or 0.03 per cent, at 5,868.

US stocks rose to close above 23,000 for the first time, driven by a jump in IBM after the computing giant hinted at a return to revenue growth.

Solid earnings, stronger economic growth and hopes that US President Donald Trump may be able to make progress on tax cuts have helped the market rally this year.

In local equities news, Woodside Petroleum, Santos and South32 will detail their quarterly production, while Healthscope will hold its annual general meeting.

In economic news, the Australian Bureau of Statistics will release jobs data for September.

The Australian share market’s recent run of gains stalled yesterday due to weakness among telcos and miners and heavy falls from Crown Resorts and Lendlease.

The benchmark S & P/ASX200 added just 0.02 per cent to 5,890.5 points, while the broader All Ordinaries index dropped 3.3 points, or 0.06 per cent, to 5,954.8 points.

AAP

7.15am: Dow in record close above 23,000

The Dow Jones Industrial Average closed above 23,000 for the first time, driven by soaring shares of International Business Machines.

Topping 23,000 marks the blue-chip index’s fourth thousand-point milestone in this year’s largely uninterrupted stockmarket rally.

The Dow industrials had never reached more than two such round-number marks in a year before 2017.

Despite concerns that stocks are too pricey and US economic growth remains tepid, the blue-chip index is up 17 per cent this year and on track for its 51st closing record.

Robust corporate earnings in the US and abroad have supported a bull market now in its ninth year. With all 45 economies tracked by the Organization for Economic Cooperation and Development on track to grow this year for the first time in a decade, many analysts and investors say conditions are favourable for stocks to continue to rise.

“We finally have everything clicking at once,” said Ryan Detrick, senior market strategist at LPL Financial. “What we’ve seen this year is really a global resurgence,” he said.

The Dow industrials rose 0.7 per cent to 23157. The index closed about three points shy of 23,000 yesterday after briefly climbing above that level during the day.

Shares of International Business Machines rose 8.9 per cent after the firm exceeded Wall Street’s profit and sales expectations in the most recent quarter. Gains in its hardware and artificial-intelligence divisions encouraged analysts even though revenue and earnings declined.

The stock was on track for its best day since 2009, adding more than 90 points to the Dow industrials. Even with that surge, Boeing was still the biggest contributor to the 30-member index since its last 1000-point milestone.

The S & P 500 and the Nasdaq Composite each advanced less than 0.1 per cent.

Australian stocks are tipped to open steady. At 7am (AEDT) the SPI futures index was down two points.

US third-quarter earnings season has gotten off to a strong start, investors say. Of the S & P 500 companies that have reported third-quarter earnings so far, more than 80 per cent have beat analyst expectations, compared with the five-year average of 69 per cent, according to FactSet.

Expectations for US tax cuts have also delivered a boost to Wall Street in recent sessions, according to some analysts.

Dow Jones Newswires

7.00am: Dollar steady

The Australian dollar is steady against its US counterpart, after the greenback gave up gains from earlier in the session.

At 6.30am (AEDT), the local currency was worth US78.46 cents, nearly the same as US78.45 cents yesterday.

The US dollar found some support from higher US Treasury yields, but then reversed from a small gain to a small decline in afternoon trading.

Westpac senior market strategist Imre Speizer said the Aussie dollar is likely to trade in a narrow range, in line with the US currency, barring a surprise from jobs data later in the session.

The local current was higher against the Japanese yen, but slipped versus the euro.

AAP

6.50am: AMP buys UK airport

Australia’s AMP Capital has taken over the UK’s Leeds Bradford Airport for an undisclosed amount.

The airport, purchased from Bridgepoint Advisers, will be part of its global infrastructure equity platform, AMP announced. The airport services the Yorkshire and Humber region and has seen passenger numbers grow by 40 per cent over the past five years to an annual of four million passengers.

AMP Capital has $178.9 billion in funds under management as of 30 June 2017. The fund manager is a subsidiary of AMP Limited, which was established in 1849, and is one of Australia’s largest retail and corporate pension providers.

AAP

6.45am: Europe markets upbeat

European stock markets advanced solidly overnight as Wall Street set new all-time highs, with even Madrid shrugging off its worries after Spain’s threat to suspend Catalonia’s autonomy.

Analysts cited strong IBM results as the main driving factor for the Dow, which established itself comfortably above the 23,000 level a day after breaching it for the first time.

In Europe, Frankfurt added 0.4 per cent to set a new closing record of 13,043.03 points, having risen to nearly 13,100 points during the session.

London and Paris also gained 0.4 per cent for the day.

Madrid rose 0.6 per cent despite political trouble around Catalonia. Spain said it would take the unprecedented step of seeking to suspend Catalonia’s autonomy if the region’s leader does not abandon his independence bid, on the eve of his deadline to give a final answer.

Analysts said investors were also focused on London which was digesting data showing British unemployment sticking to a 42-year low point.

Sterling fell with markets not certain whether the Bank of England will raise interest rates next month amid rising British inflation, as data has shown wages are not keeping up with price rises despite the tight jobs market.

In Asia, Tokyo’s main stocks index ended up 0.1 per cent at another 21-year high — but Seoul dropped 0.1 per cent, and Taipei, Manila and Jakarta also turned negative.

Hong Kong edged 0.1-per cent higher to rack up a fifth successive day of gains that have left it at a 10-year high, while Sydney and Wellington were both marginally higher.

AFP