US a little frothy, but no crash on the horizon

Historical precedents aside, there is no reason to stuff the mattress with cash this year

Historical precedents aside, there is no reason to stuff the mattress with cash.

No doubt October holds bad memories for those who lost money in the 1987 crash. Australia’s All Ordinaries index fell an eye-watering 25 per cent the day after the October 19 “Black Monday” crash on Wall Street. The 1928 crash also occurred in October, and the same month marked the start of a 58 per cent fall in the US S&P 500 index during the global financial crisis of 2007-08.

The S&P 500 has now risen a stunning 278 per cent over the 103 months since the financial crisis. It’s the second-longest and second-strongest rise in the global benchmark since World War II.

However, comparisons of the prevailing conditions in the global economy and financial markets don’t suggest another crash is imminent, even if the US market is overdue for a pullback.

“There is still little sign of the sort of excesses that precede major economic downturns and major bear markets, suggesting that although US shares are overdue a decent correction, we are still a fair way from the top in the investment cycle,” says Shane Oliver, who helps manage $179 billion worth of assets for AMP Capital.

In his view, we are still in the “sweet spot” of the investment cycle where the global economy is recovering but inflation and excessive interest rate rises are yet to emerge as problems for markets.

“Global economic indicators are strong, growth forecasts are being revised up as highlighted by the IMF, and this is driving stronger profits, but after the slow recovery since the last financial crisis, there are still few signs of the sort of excesses that characterise the ‘euphoria’ phase that ultimately leads to the ‘exhaustion’ of the cyclical bull market and the next bear market,” Oliver says.

He notes that while excesses in US business investment and housing investment preceded the “tech wreck” of 2000 and the US sub-prime crisis of 2007, both are now near or below their long-term averages relative to GDP, notwithstanding a relatively “advanced” recovery in the US.

Private sector debt is modest in most countries (Australian household debt aside) and after years of below trend growth and technological innovation, there’s plenty of spare capacity globally, which is constraining wages and inflation. And while US investor sentiment is bullish, the huge investor flows into bond funds over the past few years have yet to reverse in favour of shares.

In 1987 the US inflation rate rose 3 per cent, bond yields rose 2 per cent and aggressive Fed tightening hit the S&P 500 after an exceptionally strong 39 per cent rise in the year to October 18. The forward PE ratio of the S&P 500 is higher and its dividend yield lower than 1987, but US inflation and bond rates are much lower now. While corrections should be anticipated — with potential for catalysts from Donald Trump, North Korea and the Fed — and the fickleness of investor confidence means we can’t rule out another crash, markets seem a long way from the peak in the investment cycle, says Oliver.

Interestingly, the latest Global Fund Manager Survey from Bank of America Merrill Lynch shows that fund managers’ cash reserves hit a 2½ year low of 4.7 per cent.

While fund manager cash reserves are well below a peak of 5.8 per cent in October 2016, they aren’t low enough to generate a contrarian sell signal for equities, according to BAML’s chief investment strategist Michael Harnett. Indeed, he notes that high cash since early last year has coincided with an $US18 trillion ($23 trillion) increase in global equity market capitalisation. He also notes that expectations of a macroeconomic “goldilocks” period of above-trend growth and below-trend inflation hit a record high, exceeding investor belief in below-trend growth and inflation as the driver of financial markets for the first time since March 2011.

Fidelity’s CIO of Multi Asset James Bateman also points out that Black Monday was the first crash to be blamed on systematic — rules-based — trading, and that quantitative funds that rely on such systems have almost doubled their share of all US stock traders since 1987, “potentially increasing the chance of a quant-driven crash in markets”.

But for the markets to sell off for a prolonged period, they need to be driven by deterioration in economic conditions, which isn’t evident this time. In fact, global growth is accelerating.

“It took 18 months for the S&P 500 to recover its losses after Black Monday in 1987,” Bateman says. “But markets recovered much quicker from the volatility seen in August 2015 and early 2016 in China, as it became clear that Chinese and global growth were healthier than markets realised.”

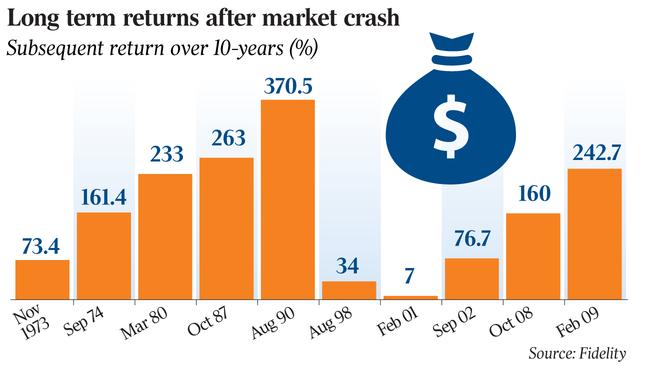

Moreover, all but two of the 10 worst monthly drawdowns in the S&P 500 have been followed by strong returns in the next decade and equity markets offer good returns over the long term.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout