Lendlease tumbles as retirement stake sale disappoints

Investors have marked down construction and development giant Lendlease, sending shares plunging.

Investors have mauled construction and development giant Lendlease, sending its shares plunging after it sold a smaller stake of its retirement living business than hoped, dampening the prospects of a share buyback, and revealed problems in its construction unit.

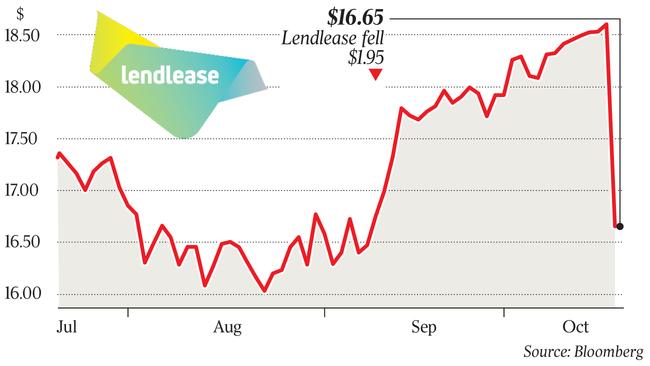

Lendlease shares fell 10.5 per cent to $16.65 yesterday in one of the biggest plunges during the reign of veteran chief executive Steve McCann, as investors were surprised by the sale of only a quarter stake in $1.7 billion retirement living division instead of the 50 per cent stake put on the block this year.

Despite the local jitters, the Dutch buyer, APG Asset Management, spruiked the retirement living sector’s potential on the back of demand from an ageing population and a shortage of supply.

Investors were unnerved by the weaker outlook for the construction business, which prompted them to downgrade forecasts, and rekindled concerns about margins on the major projects the company is winning.

Lendlease sold a 25 per cent slice of its retirement living business for a price north of $425m to the Dutch manager, which has a real estate portfolio in Australia of more than €2 billion ($3bn). Investors had expected a larger deal.

A Lendlease spokesman said the group’s strategy is still to look for capital partners for up to 50 per cent of the retirement living business.

Macquarie downgraded its recommendation to neutral, calling the update “disappointing” and noting that no share buyback had been announced.

“We had anticipated a larger stake to be sold (50 per cent), and while this is potentially a signal of limited demand, Lendlease are likely to sell a further stake in time,” Macquarie said in a note.

The construction update, where Lendlease warned some engineering projects would hit its full-year 2018 result, “gives cause for concern”, Macquarie said.

Shaw and Partners said the retirement living sale would have a “mild negative impact” on group earnings until the funds were reinvested, but highlighted an upbeat outlook for development.

UBS also downgraded Lendlease and said it could redeploy the proceeds of the sale overseas and particularly to the US with a mix of development and investment.

Folkestone Maxim Asset Management managing director Winston Sammut said the market had been expecting a larger sale and possible buyback, which, combined with the weaker outlook for the construction business, was not sparking enthusiasm. Even so, he said the sale could rerate other retirement village operators.

The deal is APG’s third partnership with Lendlease and its first investment in retirement living in the Asia-Pacific region.

“The retirement living sector in Australia has a severe shortage of supply while demand from retirees is significant and continues to expand,” APG spokesman Harmen Geers said. “We believe the Lendlease Retirement Living business has a best-in-class operating team, a well-diversified portfolio and significant scale to make it an attractive investment.”

APG declined to say why it bought only a 25 per cent stake and whether it has the rights to increase its holding in the future. The deal will be structured as a joint venture.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout