Trading Day: Stocks sink as China moves hit Treasury Wine

China wine tariff news hits producers, accelerating S&P/ ASX 200 falls on Friday.

- Treasury sinks on China hit reports

- Bega shares jump after dairy deal

- Viva raises for gym pump-up

- European stocks dip, Wall St shut

That’s all from the Trading Day blog for Friday, November 27. Australian stocks sank after reports of Chinese anti-dumping moves against Australian winemakers, and despite a Bega Cheese surge. However, the ASX ended the week ahead.

Jared Lynch 7.30pm: Cost savings pressure on Bega

Bega Cheese shares soared as much as 8.5 per cent as investors cheer its biggest acquisition, buying Lion’s dairy and drinks business for $534m.

But the company is under pressure to deliver on its $40m a year cost-saving targets after spending half its market capitalisation on the deal, which will deliver Bega a suite of well known brands, including Big M, Farmers Union, Dairy Farmers and Pura.

Analysts have generally praised the acquisition, which makes Bega Australia’s second-biggest dairy company, processing 1.7 billion litres of milk a year, behind Saputo’s 2.6 billion litres and just ahead of Fonterra’s 1.5 billion.

Perry Williams 6.28pm: Oil Search executive shake-up

Oil Search has suffered an executive shake-up only days after unveiling its new corporate strategy, including the abrupt exit of its chief financial officer in waiting just three months after her appointment.

The Papua New Guinea and Alaska focused oil and gas producer said Ayten Saridas, chief financial officer designate, has resigned “to pursue other opportunities” and will depart on December 1 by mutual agreement.

Ms Saridas - who previously worked at coal producer Coronado along with Ausgrid and Santos - had only joined Oil Search in mid-August and was working on a transition basis with current finance boss Stephen Gardiner ahead of assuming the role in early 2021.

The announcement comes just eight days after its investor day where it reactivated a series of growth plans after being forced in April to launch an emergency $US700m capital raising and slash jobs amid the deepest oil market crash in a generation.

Oil Search’s explanation failed to pass the “sniff test”, according to Credit Suisse.

Ms Saridas’s departure is “hardly a good sign as clearly the reasoning provided doesn’t pass the sniff test in our view,” Credit Suisse analyst Saul Kavonic said. “Such senior management churn isn’t a signal that provides confidence in the leadership.”

A string of other senior executives are also set to leave the company’s Sydney headquarters, industry sources told The Australian.

Richard Gluyas 6.15pm: ANZ leads on data for open banking

ANZ Bank has emerged as the clear leader among the major banks in rolling out the consumer data right which underpins open banking, according to an ACCC progress report.

The report, published earlier this week by the Australian Competition and Consumer Commission, reveals the main outstanding issues for the big four, as well as a rectification timetable agreed with the regulator.

ANZ has a single unresolved issue related to account details, including discounts and fees and some funds management accounts distributed through third parties.

Rectification is due by February 1 next year.

The schedules for the other three lenders are more lengthy, some of them with longer resolution timelines.

Commonwealth Bank CDR consumers, for example, are unable to share their scheduled payments data in two scenarios

The first is where there is a joint account and the payments data relates to the other account holder, and the second is where the data was created by CBA staff on behalf of the customer.

The first item is due to be rectified by May 1, 2021, and the second item by November 1, 2021.

The CDR was launched last July, with customers of the four majors able to share their banking data from a range of personal accounts, such as savings accounts and term deposits.

From the start of this month, customers were able to share their banking data from home loans and personal loans.

Joint accounts, closed accounts, direct debits, scheduled payments and payees were also available.

The CDR will be implemented next in the energy industry.

The government decided to legislate for a CDR after a review into open banking by the King & Wood Mallesons partner Scott Farrell.

The move was designed to empower customers to share their data with trusted recipients, but only for authorised purposes.

It was first implemented in the banking industry, to be followed by the energy sector.

The intention is to make it economy-wide.

More recently, the decision was made to transfer responsibility for oversight of the CDR from the ACCC to Treasury, given the importance of the key reform to the nation’s competitive landscape.

Open data is a key building block for an emerging data economy, involving trade in data between organisations and/or governments, and the products, such as algorithms, insights and applications, that arise from previously unobtainable data.

Management consultancy McKinsey & Co has estimated that open data is generating more than $3 trillion in annual economic value across a range of sectors, from healthcare to transportation to consumer finance.

Elise Shaw 5.22pm: How a douple-dip recession in the US could hit the dollar: CBA

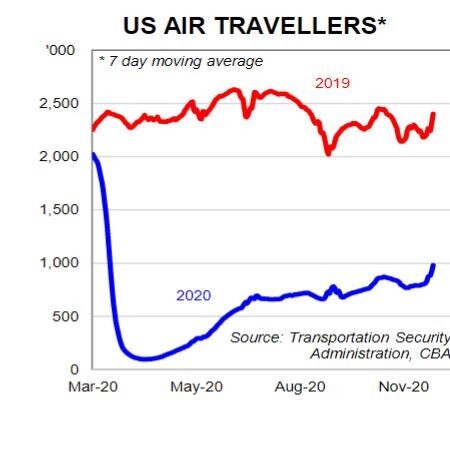

The aviation industry is perhaps the biggest victim of the ongoing coronavirus crisis, Commonwealth Bank’s Global Markets Research team notes.

“The number of US air travellers collapsed to just below 100,000 per day in April. By comparison, an average of 2.3m passengers travelled by air daily last year.

“Both government imposed restrictions (e.g.border closures) and fears of catching the virus contributed to the plunge in air travel.

“However, air travel has picked up in recent months and climbed to the highest since March because of the Thanksgiving holiday.

“Increased air travellers raise the risk of more widespread virus outbreaks and lockdowns in the US. Lockdowns will slow economic activity. The challenge for the US economy will be whether it can avoid another recession ifl ockdowns spread before a vaccine is available.

“If markets start pricing in a double-dip recession in the US, the USD could lift materially.”

Elise Shaw 5.11pm: Wine tariff a downside risk to CBA $A forecast

Commonwealth Bank’s Global Markets Research team notes AUD/USD lifted towards its year‑to‑date high near US73.75c, despite the announcement that China will impose anti‑dumping duties of as high as 212pc on Australian wine starting from tomorrow.

“While China is the biggest buyer of Australian wine exports, wine only accounted for less than 1pc of total Australian merchandise exports to China in 2019-20. Nonetheless, this duty imposition reflects the broader deterioration in the Australia‑China relationship.

“China has previously placed restrictions on Australian imports of coal, barley, copper, sugar, lobsters and timber. Trade tensions between Australia and China are a downside risk to our forecast for AUD to lift towards US78c next year,” the Global Markets Research team said.

4.18pm: Wine sours as cheese has a cracker on the ASX

Wine maker stocks took a pummelling on Friday after China hit Australian producers with tariffs of up to 200pc. By the close of Friday’s session, the S&P/ASX 200 was down 0.5pc, or 35 points, at 6601.1, still managing to finish the week up about 1 per cent after coming within one point of entering positive calendar year territory on Wednesday - putting the market on a four-week winning steak.

But the tariff surprise did rattle the markets, with all sectors falling into the red except the Real Estate index, which was up 0.33 per cent after Charter Hall and Mirvac managed to post gains of 1.52 per cent and 0.77 per cent respectively.

The leader of the day was Bega Cheese, which jumped 8.91 per cent after it emerged from a trading halt following its acquisition of Lion Drinks & Dairy while Fisher & Paykel Healthcare came from behind to lift 3.60 per cent.

Gold miners overperformed as the spot price managed not to drop below $US1800 an ounce through the trading day with Deterra Royalties up 3.33 per cent, Perseus Mining up 3.10 per cent and Gold Road Resources up 2.05 per cent.

Platinum Asset Management managed to rally a further 3.06 per cent, making it the best performing stock of the week, up a total of 14.77 per cent.

Treasury Wine Estates was the worst performing stock, falling 11.25 per cent to enter a trading halt following the tariff news after falling as much as 14.3 per cent.

Energy stocks also underperformed after oil prices slipped on Thursday, with Beach Energy down 3.81 per cent and Oil Search down 3.69 per cent.

The worst performing stock for the week was Virgin Money, which slipped 12.6 per cent after abandoning 2022 guidance earlier in the week.

By late Friday afternoon, the Australian dollar was trading slightly stronger against the US dollar, around US73.75c.

Perry Williams 4.15pm: ExxonMobil cans sale of Bass Strait gas fields

ExxonMobil has canned the multi billion dollar sale of its 50 per cent stake in the Bass Strait gas fields offshore Victoria with prices from potential bidders thought to have fallen well short of expectations.

The US energy giant announced its intention to sell its half share in September 2019, in a move that would have brought an end to a multi decade venture with partner BHP which is a major supplier of gas to Australia’s east coast market.

However, from the start some suitors saw as a roadblock liabilities likely to run into billions of dollars to clean up the ageing assets.

Exxon said it would now keep the energy assets on its books, ending the sales process.

“After completing an extensive market evaluation, ExxonMobil has decided to retain its operated Gippsland Basin producing assets in Australia,” Exxon said in a statement on Friday.

“Projects in our portfolio are evaluated for robustness against competition, internal alternative investments and across a range of prices and scenarios. We believe Gippsland Basin and the Kipper unit are more valuable as part of our portfolio and we will continue to operate rather than divest.”

The decision may now raise doubts over whether BHP will proceed with its own sale after the resources operator signalled it would sell out of its non-operating 50 per cent stake.

BHP said it would assess Exxon’s decision and its own mooted sale.

“We continue to assess our divestment plans for Bass Strait,” a BHP spokesman said.

“ This is a complex process and will take time, and we will consider the implications of recent announcements. While that work is ongoing, we will continue to work closely with the operator to deliver gas and liquids to customers, and generate value for the community and our shareholders.”

Several analysts have previously raised the issue of hefty liabilities to clean up the historic oil and gas assets, likely to run into the billions of dollars, and potentially ruling out some suitors worried about abandonment risks.

Exxon‘s assets up for sale had included offshore oil and gas facilities along with the Longford and Long Island Point plants in Victoria. It follows an unsuccessful bid by the energy duo to sell declining oilfields in the Strait back in 2016 with hefty remediation costs seen as a major obstacle for buyers.

Since the 1960s, Exxon has produced more than 4 billion barrels of oil from Bass Strait, which at its peak was producing 500,000 barrels of oil a day, making it one of the world’s biggest producing regions.

Exxon now produces just one-tenth of the volume of oil it was pumping in the 1980s from the Bass Strait while its big legacy gas fields - Marlin, Barracouta and Snapper - are also on their last legs.

Although the Bass Strait remains eastern Australia‘s biggest gas player, its share of the market has fallen by about a third in the last few years sparking a costly hunt for new resources.

Beach, backed by billionaire Kerry Stokes, is seen as a top contender for the assets while Santos could also be tempted although more likely as part of a consortium potentially, according to Credit Suisse.

Exxon in September started a voluntary redundancy program for its Australian staff after warning of unprecedented market conditions following the oil rout earlier in the year.

The US major considered backing a potential LNG import plant to meet market demand, but dropped that plan a year ago blaming insufficient interest from customers to sign long-term contracts.

Exxon also operates Victoria’s Altona refinery, one of only four refineries still operating in Australia, but has signalled doubts over its future with the facility trading at a loss.

3.53pm: GetSwift ‘hopeful’ on Canada move

GetSwift says it is hopeful of its plans to relist on Canada’s NEO exchange under the Holdco umbrella despite the objections of ASIC will go ahead, informing the market that the Federal Court indicated at a hearing today that it will not object to the scheme of arrangement.

The matter has been adjourned until Monday December 7 to give GetSwift extra time to receive Foreign Investment Review Board approval for the move.

One of the applicants to a class action case, Raffaele Webb, has dropped his opposition to the scheme while based on a plan put forward by GetSwift to ensure it will meet its obligations, while ASIC is separately pushing for a $20m penalty against GetSwift for alleged past breaches of continuous disclosure obligations and misleading conduct and believes the company is trying to dodge consequences by redomiciling.

3.02pm: ASX desperate to hold week’s gains

The local sharemarket was holding out in afternoon trade, determined not to erase all of the gains made this week despite China’s decision to impose tariffs on Australian wine rattling investor confidence.

The ASX 200 was trading at around 6600 points mid-afternoon, down some 36 points - or 0.55 per cent - for the day, but still well above the 6539.20 ponts the index opened at on Monday, with the index steadily climbing from its intraday low of 6587 points it hit at 1.10pm.

The tariff shock knocked most indexes into the red, with the energy index falling 1.98 per cent and the utilities index, 1.26 per cent, with a slight improvement in the brent oil price to $US47.93 a barrel unable to keep the sector from underperforming.

Oil Search is underperforming, down 3.96 per cent after its designated CFO resigned while AGL energy is down 3.04 per cent and Beach Energy, 2.86 per cent.

The worst performing stock is still Treasury Wine Estates, which entered a trading halt following the tariff news down 11.25 per cent.

Bega Cheese remained the best performing stock of the day, up 8.31 per cent after it emerged from a trading halt following its acquisition of Lion Dairy & Drinks while Fisher & Paykel Healthcare came from behind to take second, up 4.28 per cent.

Gold miners stayed within the top 10 despite the gold spot price slipping back down to $US1809 an ounce, with Evolution Mining and Gold Road Resources growing 2.4 and 2.25 per cent respectively.

As the AstraZeneca vaccine enthusiasm subsided after it emerged more trials must be conducted, stocks that would benefit from a vaccine continued to decrease: Flight Centre was down 3.85 per cent and Webjet 3.57 per cent.

Nine Entertainment Co. fell 2.54 per cent while Domino’s Pizza jumped 2.60 per cent.

2.39pm: Australian Vintage Limited takes a beating on wine tariff news

Shares in ASX listed wine company Australian Vintage Limited have taken a beating following China’s decision to hit Australian wine with punitive tariffs.

Shortly after 2pm the $165m company which owns McGuigan Wines, Tempus Two, Nepenthe and the Barossa Valley Wine Company was trading at $0.57 a share, down 8.8 per cent.

This is despite the company’s sales to China comprising less than two per cent of the total in 2020.

Australian Vintage Limited will now have to pay a tariff of 160.6 per cent on wine sent to China based on a Chinese Ministry of Commerce document seen by The Australian.

2.05pm: Listed: winemakers hit by China measures

The Chinese Ministry of Commerce has released a list of each of the tariffs to be applied to different Australian wine companies, with Treasury Wine Estates facing the largest tariff attributed to an individual company.

Treasury Wine Estates Vintners Limited - 169.3%

Casella Wines Pty. Limited - 160.2%

Australia Swan Vintage Pty Ltd - 107.1%

Australia Farm And Land Investment Pty Ltd - 160.6%

Accolade Wines Australia Limited - 160.6%

Octtava Wines Pty Ltd - 160.6%

Australian Vintage Limited - 160.6%

Pernod Ricard Winemakers Pty Ltd -160.6%

Bogdan Investments Pty Ltd - 160.6%

Brown Brothers Milawa Vineyard Pty.limited - 160.6%

Agreen Pty Ltd - 160.6%

Dorrien Estate Winery Pty Ltd - 160.6%

Ferngrove Vineyards Ltd - 160.6%

Fowles Wine Pty Ltd - 160.6%

Furunde Wine Co. Pty Ltd - 160.6%

Kilikanoon Wines Pty Ltd - 160.6%

The Red Kangaroo Wine Company Pty. Ltd - 160.6%

Chapel Hill Winery Pty Ltd - 160.6%

Portia Valley Wines Pty Ltd - 160.6%

Zilzie Wines Pty Ltd - 160.6%

S. Smith & Son Pty. Limited - 160.6%

Terra Felix Pty. Ltd. - 160.6%

Australian Food & Beverage Group Pty Ltd - 160.6%

Wingara Wine Group Pty. Ltd - 160.6%

All Others - 212.1%

Eli Greenblat 1.27pm: Treasury in halt after China hit

Treasury Wine Estates called for a trading halt in its shares as it sought clarification from the Chinese government over reports that it will face tariffs, or some other kind of import duty, on its wine exports to the region.

The winemaker, whose brands include Penfolds and Wolf Blass, said in a brief statement to the ASX on Friday that it had requested a trading halt pending a statement on the decision by the Chinese Ministry of Commerce to apply provisional anti-dumping measures to Australian wine imports into China.

“Treasury Wine is reviewing the details of the provisional measures as a matter of urgency in order to update the market. The company requests that the trading halt be effective immediately and remain in place until the earlier of the commencement of normal trading on Tuesday 1 December 2020, or the release of an announcement by the company in relation to this matter.”

Shares in Treasury Wine fell more than 11 per cent before the trading halt was put in place. The winemaker earns around 40 per cent of its earnings from Asia, of which the bulk are sourced from wine sales into China.

The Ministry of Commerce has posted a statement on its site saying that there had been a preliminary finding that Australian winemakers had engaged in dumping and that “measures” against imported Australian wine would take place from Saturday.

1.20pm: ASX extends falls on China moves

Australia’s S&P/ASX200 sank after reports of China anti-dumping measures against Australian wine producers.

After being down about 0.3 per cent at noon, the ASX was 0.6 per cent lower at 1.20pm (AEDT).

Eli Greenblat 1.03pm: Winemakers probe China dumping claim

Australia’s $45 billion wine industry is seeking clarification from Beijing over an announcement that suggests it could face a crippling duty of more than 200 per cent from midnight to their biggest export market.

The Beijing-based Ministry of Commerce said in a statement on Friday that it had found a “causal relationship” between the dumping of Australian wine and damage to China’s domestic wine industry.

The South China Morning Post has reported that duties ranging from 107.1 per cent to 212.1 per cent will be imposed on Australian wine from Saturday.

Australian wine makers are desperately seeking clarification on the new trade measures.

They put at risk $1.3 billion a year in exports of Australian wine to China and comes as Australia faces a number of damaging trade disputes with the country that has seen 80 coal ships stuck offshore as customs at Chinese ports declines to process them as well as recent examples of Australian seafood, namely rock lobster, refused port entry and other commodities such as timber and cotton also blocked.

The Ministry of Commerce statement on its website also reveals the Chinese government will take action against imported Australian wine, likely tariffs, from Saturday although it is unclear what that action could be and the size of any tariffs placed on Australian wine.

Shares in Australia’s biggest winemaker, Treasury Wine Estates which owns iconic brands such as Penfolds and Wolf Blass, fell more than 11 per cent in Friday trade and are currently in a trading halt as the company seeks clarification.

Eli Greenblat 12.48pm: Treasury sinks on ‘tariffs’ reports

Shares in Treasury Wine Estates fell more than 11 per cent and were placed in a trading halt after reports from China of anti-dumping measures and possibly even tariffs against Australian wines.

Winemakers were seeking clarification of reports Australian winemakers had been found guilty of dumping wine in China and harming its local industry.

There has been speculation since earlier this month that China would stop Australian wine from being passed through customs at the ports from November 6, with reports from local winemakers such as Victoria’s Tahbilk that wine shipments were now being blocked in Chinese ports.

Treasury Wine earns around 40 per cent of its earnings from Asia, of which the bulk are generated from wine sales into China.

Its shares fell $1.17, or 11.25 per cent, to $9.23 on the news, before going into a trading halt.

Treasury Wine later said in a statement: “TWE is reviewing the details of the provisional measures as a matter of urgency in order to update the market.”

The Chinese government began investigating anti-dumping allegations against Australian winemakers earlier this year and had sent off an 80-page questionnaire to a range of Australian winemakers on their exports.

12.25pm: ASX lower at midday

The local sharemarket lost ground to lunch as news reports emerged of Chinese tariffs on Australian wines, and after oil prices fell from eight month highs.

The ASX falls followed gains earlier in the week that saw the S&P/ASX200 come within a point of erasing losses suffered after the pandemic struck in March.

At noon the index was trading down 21 points, or 0.3 per cent, at 6615.7 points.

Shortly after noon Treasury Wine Estates shares dived 11.25 per cent to $9.23 after reports emerged that China had imposed anti-dumping measures on Australian wine.

Shortly afterwards, Treasury shares were paused.

Earlier the tech index, which showed some early promise, declined by 0.83 per cent with Technology One down 2.77 per cent, while the real estate index was the only one showing any meaningful growth, up one per cent.

Bega Cheese was leading the ASX 200 by a long shot, up 9.92 per cent following its acquisition of Lion Drinks & Dairy, while Mirvac Group supported the real estate index by lifting 1.74 per cent.

Gold miners continued to hold steady despite the gold spot price slipping slightly to $US1811.32/oz, with Gold Road Resources up 2.60 per cent, Silver Lake Resources up 1.86 per cent and Perseus Mining up 1.99 per cent.

But the real growth among the miners was lithium stocks, after UBS analysts upgraded Orocobre, Galaxy Resources and Syrah Resources to buy. These companies were up 3.99 per cent, 6.39 per cent and 8.86 per cent respectively.

After falling overnight, with Brent Crude declining 1.7 per cent to $US47.80 a barrel, oil prices picked up, increasing eight cents to $US47.88 when trading resumed, but energy stocks were still down.

AGL Energy was down 2.26 per cent, Beach Energy by 2.72 per cent while Oil Search declined by 3.17 per cent after its CFO designate Ayten Saridas resigned.

Stocks that would benefit from a COVID-19 vaccine also performed poorly, with Flight Centre down 4.24 per cent and Webjet down 4.08 per cent.

Yesterday, the S&P/ASX200 suffered its largest fall in almost a month, declining 0.7 per cent to end at a day’s low of 6636.40 points.

However yesterday’s close was still around 80 points higher than at the start of the week and the market is still looking to end November with a significant monthly gain. As it stands, November remains on course to be the best month for the S&P/ASX200 since it launched in March 2000.

Bridget Carter 11.47am: HWL Ebsworth drops IPO

Law firm HWL Ebsworth abandoned plans for its initial public offering on Thursday night, say sources.

It is understood that the company was in search of an additional $25m, before opting to walk away from the deal.

The group, which was to be renamed Alarcon when listed, had already recut its terms to make itself more appealing to prospective investors.

They were understood to have been deterred from participating in the prospective float of the business because it plans to list with a $232.5m net debt pile.

Market sources said investors sidestepped the deal due to concerns the debt would be used to pay partners a major pre-IPO dividend.

Prospective investors also expressed caution about a lack of clarity around the old and new models of partner remuneration, and they lacked conviction about the strength of the firm’s management.

The company told fund managers investors on Tuesday that it had scaled back the size of its initial public offering to $151m from earlier ambitions of raising between $232m and $255m.

It had a $2.30 per share IPO price.

HWL Ebsworth is a full-service Australian corporate law firm that is a significant player in the local legal services market, providing legal services to corporate and government clients.

The law firm hoped to move to a public company structure from a partnership model and started its management roadshow last week.

11.18am: Bega shares jump after Lion Dairy deal

Shares in Bega Cheese jumped up by 8.51 per cent in morning trade to $5.40 a share after it emerges from a trading halt following its $534m acquisition of Lion Dairy & Drinks.

The acquisition has been praised by analysts as well as investors, who note the deal will be double digit accretive to earnings per share once it is completed in January.

Analysts at Goldman Sachs noted that the acquisition benefits Bega by increasing its critical mass in the Australian dairy market, allow for the realisation of synergies, and accelerate the company’s shift towards branded products.

UBS analysts estimated the synergy opportunities at $41m and the will increase branded products EBITDA from 64 per cent to 76 per cent of revenue.

Perry Williams 11.09am: Coking coal exports to China slump

Australia’s coking coal exports to China crashed in October, with Beijing rushing to secure supplies from rival producers in the latest sign of heightened trade tensions between the two countries.

China’s overall coal imports for October fell by 47 per cent compared with a year earlier and declined 27 per cent on the September level reflecting the country’s strict import quotas.

However, a breakdown of the numbers released on Friday shows imports of Australian coal fell 21 per cent on the same period last year compared with big jumps for rival producers.

“The breakdown of China’s coking coal imports showed that imports from Australia tracked well below peers last month,” CBA analyst Vivek Dhar said.

“China’s coking coal imports from Australia declined ~21 per cent/yr in October. Meanwhile, China’s coking coal imports from Mongolia, Canada and Russia lifted 14 per cent/year, 136 per cent/year and 20 per cent/year respectively. The import breakdown is a strong signal that China, as many have speculated, is limiting its coal imports from Australia.”

The Australian revealed on Friday the coal flotilla stuck off the Chinese coast has swollen to more than 80 ships carrying blacklisted cargo worth more than $1.1bn, provoking the Morrison government to raise concerns about “discriminatory action”.

Bridget Carter 11.08am: Knauf offloads plasterboard assets

The Knauf Group has agreed to sell its Australian plasterboard assets to Etex Group after they were placed on the market through Bank of America.

Belgium-based Etex is a family-owned global manufacturer of lightweight building products that operates in 42 countries.

It tapped JPMorgan for the acquisition.

DataRoom revealed the interest by Etex on October 28 and at that time, the portfolio was thought to be worth about $400m.

Also looking at the assets had been Saint-Gobain of France and China National Building Material, or CNBM.

Boral had a plasterboard joint venture across Asia, Australia and New Zealand with USG, but Knauf bought out USG in a deal last year worth $US7bn.

However, Knauf recently announced it would buy Boral’s half-share of their USG plasterboard venture for $1.43bn.

The plasterboard factories sold are those Knauf had before it purchased the USG assets in Australia and Asia, owned in a Boral partnership.

The transaction is subject to regulatory approvals and the deal is set to be completed in the first quarter of 2021.

11.02am: Bank buyback return in doubt: analysts

Analysts at Morgan Stanley believe it is unlikely the big four banks will resume share buybacks in 2021, pointing to less than sufficient excess capital levels and APRA restrictions on payouts to shareholders.

In order for share buybacks to resume, the analysts believe that there needs to be a removal of these restrictions, the completion of all announced asset sales, more certainty on the magnitude of risk weight density migration, clarity on APRA’s new capital framework, reduced economic uncertainty and progress on a COVID-19 vaccine.

Even if those conditions are met, the analysts believe Commonwealth Bank is the only one of the big four that should resume share buy backs, although they add dividend payouts should increase to a 60-70 per cent proportion of profits once APRA removes its restriction of 50 per cent.

Robyn Ironside 11.00am: Unions fail in Qantas sick pay bid

Unions have failed for a second time to force Qantas to pay its stood down workers sick pay.

The Communications, Electrical, Electronic, Energy, Information Postal, Plumbing, Allied Services Union (CEPU), the Australian Manufacturing Workers Union and the Australian Workers Union, appealed a Federal Court ruling which found in favour of Qantas.

On Friday, a decision by the Full Federal Court dismissed the appeal with Judges Steven Rares and Craig Colvin finding the original judgment was correct.

They agreed that an employee who was stood down, was under no obligation to present for work from which leave could be taken, or absence authorised.

Judge Mordecai Bromberg disagreed with their ruling, saying in his opinion Qantas was not authorised to withhold sick leave payments regardless of whether the employees were working or not.

10.53am: Trump to leave White House if Biden win confirmed

President Donald Trump said he would leave the White House if Joe Biden is officially confirmed the winner of the US election, but he repeated that he may not concede defeat.

“Certainly I will. And you know that,” Mr Trump said when asked if he would leave the White House if the Electoral College confirmed Biden’s victory.

But “if they do, they made a mistake,” he said, adding “it’s going to be a very hard thing to concede.”

AFP

10.51am: What’s impressing analysts?

Bega Cheese upgraded to Add at Morgans

Empire Energy Group Introduced as speculative buy at Morgans

Orocobre upgraded to buy at UBS

Galaxy Resources upgraded to buy at UBS

Syrah Resources upgraded to buy at UBS

Ben Wilmot 10.42am: Grocon calls in administrators

The Grocon construction business is now in the hands of administrators KordaMentha after a week of backroom talks about the future of the business.

Grocon’s Daniel Grollo had flagged it would call in administrators last week and now Andrew Knight, Craig Shepard and Mark Korda of KordaMentha Restructuring have been appointed.

They will take control of 39 Grocon Group companies, which have been dubbed the legacy elements of the prominent construction, development and property group.

Mr Knight said the administrators were appointed to the 39 entities but not the companies associated with Grocon’s current ongoing projects, including a stalled project in Melbourne’s Collingwood and Sydney’s The Ribbon development.

“We understand that these projects will continue while the future of the Grocon Group is decided. The Grocon companies involved in litigation with the NSW Government are also not in Administration and remain in the control of Daniel Grollo,” Mr Knight said.

Grocon is suing the NSW government agency Infrastructure NSW for $270m over what it claims is unconscionable conduct over the Central Barangaroo development.

In a nod to the complexity of the business, with subcontractors claiming to be owed millions on the Melbourne project, Mr Knight said the priority was to “assess the business and begin to work towards finding the best outcome for all stakeholders”.

Mr Knight said the first meeting of creditors would be held on 9 December 2020. The future of Grocon would be decided at the second meeting of creditors, which is likely to be held mid to late December.

10.20am: ASX opens down, dents week’s gains

The local sharemarket opened lower, further pulling back from gains earlier in the week that saw the S&P/ASX200 come within a point of erasing losses suffered after the pandemic struck in March.

Shortly after opening the market was down 16.878 points, or 0.25 per cent to 6619.5, with the technology index pushing upwards for a second day following mixed trade in Europe, where the STOXX 600 tech index one of the few gaining ground.

With Wall Street closed for the Thanksgiving holiday, markets may struggle for direction and trading is expected to be relatively light.

Yesterday, the S&P/ASX200 suffered its largest fall in almost a month, declining 0.7 per cent to end at a day’s low of 6636.40 points.

However yesterday’s close was still around 80 points higher than the start of the week and the market is still looking to end November with a significant monthly gain. As it stands, November remains on course to be the best month for the S&P/ASX200 since it launched in March 2000.

Moving the local tech index this morning was Xero, up 1.18 per cent, and Wisetech Global, up 1.58 per cent. Gold Road Resources rebounded 1.64 per cent after the spot gold price rallied to $US1815/oz, up 0.27 per cent.

The industrial and consumer staples index were also slightly up while the energy index slipped 1.12 per cent on opening after global oil prices fell from an eight-month high, with Brent crude falling 1.7 per cent to $US47.80 a barrel.

Santos slipped 1.41 per cent in early trade, Beach Energy by 2.45 per cent and Oil Search fell by 2.37 per cent.

The market seemed split on stocks that may benefit from a COVID-19 vaccine, with Unibail-Rodamco-Westfield up 1.80 per cent at opening, Sydney Airport up 1.35 per cent, but Flight Centre down 2.01 per cent and Webjet, 2.04 per cent.

Ahead, Wall Street will only be open for a half-day tonight (AEDT).

The Australian dollar is lower at US73.54.

10.10am: Cheese Bega completes institutional raise

Bega has completed its institutional capital raising to help buy Kirin’s Lion Drinks & Dairy, raising around $284m to put towards the $534m acquisition.

The company said the placement saw a 96 per cent take-up rate among shareholders, resulting in the issue of 62 million new shares.

Bega Cheese’s Executive Chairman, Barry Irvin said he was delighted with the result.

“We are delighted with the support we received for this company transforming acquisition,” he said. “We have always enjoyed strong support from our shareholders and once again they embraced our vision of creating ‘The great Australian food company.”

A retail entitlement officer will open on Wednesday, December 2.

10.07am: Helloworld pins hopes on domestic travel

Helloworld CEO and managing director Andrew Burnes says he anticipates bilateral travel bubbles will be set up with some Asian countries in the new year, but does not expect travel to Europe or the US to meaningfully return until the end of 2021.

Accordingly, most of the company’s future revenue generation activities will come from domestic travel in Australia and New Zealand, with the travel agency already seeing “massive demand.”

“In our corporate sector over 70 per cent of all travel is domestic and so with the opening up of the state borders and the Trans-Tasman international border we believe this will drive a significant uplift in corporate business from January onwards,” Mr Burnes told shareholders at the company’s AGM.

However, beyond 2021 Mr Burnes said he anticipated there would be a return in demand for travel agencies like Helloworld due to the complexities of travel in the post COVID-19 world.

Helloworld would also benefit from shrinking competition.

Mr Burnes said the company will continue to incur underlying EBITDA losses of $1.5m-$2, for the remainder of the financial year unless certain international bubbles open, creating the possibility of a break even scenario.

9.52am: Azure to raise $37m

Azure Minerals has announced it has received commitments for a $37m capital raising from clients of Euroz Hartleys, the lead manager of the deal.

Fifty million shares were offered at $0.74 cents each, representing a 9.8 per cent discount to the last closing price.

Managing Director Tony Rovira said the proceeds would be used for exploration and drilling at the company’s nickel and gold projects.

9.26am: Viva to raise $30m for gym pump-up

Gym and swimming pool operator Viva Leisure has announced a $30m fully underwritten equity raising to fund the acquisition and establishment of more than 300 fitness centres within the next five years.

The company, which operates the newly-acquired brand gym brand Plus Fitness, says all existing centres are open following the COVID-19 lockdowns, more than 20 new locations will be opened within the current financial year, and there is the opportunity to acquire smaller health club groups.

The company also says it is in discussion with Plus Fitness franchisees concerning a corporate buyout of their clubs in a current total range of $9m-10m.

The move will see the company’s 100 locations expand to more than 400 by 2025.

Member visitation at current locations has recovered to pre-COVID levels.

The equity raising will result in the issue of 10.3m new fully paid ordinary shares, or 14.5 per cent of shares on issue.

The placement will be priced at $2.90 a share, a 4.3 per cent discount on the last trading price of $3.03 on Thursday and will occur today.

John Durie 9.19am: McCormack assumes chair at Central Petroleum

Former APA boss Mick McCormack has moved quickly to take over as chair of Central Petroleum, four months ahead of schedule.

The company said in a statement that Wrix Gasteen would step down immediately as chair

with McCormack to take his place.

He was appointed to the board earlier this year after stepping down from APA last year.

McCormack is a big promoter of gas and is now a champion of a cross-country pipeline.

9.08am: Westpac joins savings rate cuts

Westpac is the last of the big four banks to cut savings rates following the RBA’s decision to cut the cash rate to a record low of 0.1 per cent earlier this month.

On Friday the bank announced that its Westpac life max rate would fall 20 basis points from 0.75 per cent to 0.55 per cent.

The base rate has also been slashed 20 basis points, from 0.40 per cent to 0.20 per cent.

The Westpac e-saver five month intro rate has been slashed 20 basis points from 0.75 per cent to 0.55 per cent but the ongoing rate will remain steady at 0.05 per cent.

The rate for Westpac’s saving account for people between 18 and 29 has remained unchanged at 3 per cent.

The average maximum interest rate across all four banks has now fallen from 1.53 per cent in January to 0.54 per cent, a decline of 0.99 per cent.

8.57am: Oil Search looking for new CFO

Oil Seach’s CFO designate Ayten Saridas has resigned and will depart from the company on December 1 2020.

Stephen Gardiner, the company’s current CFO will continue in the role until May 31 2020 to help find a new candidate for the role and assist them in transitioning into the position.

An international search for a new CFO has commenced, the company said.

8.32am: First home buyer mortgage surge

Australian Finance Group CEO David Bailey says record mortgage lodgements for the mortgage broker in October have continued into November, with the first home buyer share of mortgage activity increasing from 15 per cent to 23 per cent year on year.

But the refinancing boom which defined the housing market through the height of the COVID-19 pandemic appears to be subsiding, with Mr Bailey telling shareholders at the company’s AGM that refinancing applications have “returned to more traditional levels” of 21 per cent of share, compared to 38 per cent in April.

Mr Bailey said strong government incentives for first home buyers helped them grow their share of mortgage activity, while overall “upgraders” who felt financially confident throughout the pandemic supported broader economic activity.

Western Australia was the strongest state for the company in October, with the volume of lodgements increasing 41 per cent year on year while Queensland increased by 30 per cent, South Australia 25 per cent, NSW 7 per cent and Victoria 11 per cent.

AFG customers in full deferral make up 0.38 per cent of the total loan book while those who converted to interest-only payments remain at 1.6 per cent.

Mr Bailey said he expected property price growth to remain consistent looking forward.

“Looking at the market, today we are seeing property prices being supported by a strong underlying demand for residential mortgage finance,” he said.

“Record low interest rates are expected to be maintained for an extended period and in fact the RBA has signalled this.”

7.29am: Genesis may sell NZ gas stake

Genesis Energy said it may sell its stake in the offshore Kupe gas field that provides a substantial portion of New Zealand’s gas needs and expects to make a decision by mid-2021.

Genesis, one of New Zealand’s main electricity generation companies, said on Friday that it’s reviewing its 46 per cent stake because the Kupe joint venture is considering further development including drilling and exploration that “changes the risk and opportunity profile.”

Kupe has estimated reserves of 340.5 petajoules and meets about 15 per cent of New Zealand’s annual demand for natural gas. It’s operated by Beach Energy, which owns 50 per cent of the joint venture.

New Zealand’s government is trying to accelerate plans to reach 100 per cent renewable energy, which could make new investments in oil and gas unattractive.

Genesis said the outcome of the review wouldn’t affect its ability to maintain dividends or its long-term contractual rights to all gas from the Kupe field.

“The board will assess whether continued ownership or a sale is in the best interest of shareholders,” it said.

Dow Jones Newswires

7.09am: ASX poised to open lower

Australian stocks are set for a weaker start, extending yesterday’s slide, following falls on European markets overnight.

With Wall Street closed for the Thanksgiving holiday, markets may struggle for direction.

At around 7am (AEDT) the SPI futures index was down 19 points, or 0.3 per cent.

Yesterday, the S&P/ASX200 suffered its largest fall in almost a month, declining 0.7 per cent to end at day’s low of 6636.40 points.

However yesterday’s close was still 80 points higher than the start of the week and the market is still looking to end November with a significant monthly gain. To date, the market is up around 12 per cent, its best month since the late 1980s.

And this week the ASX 200 hit a new nine-month high as it effectively erased all its losses since the pandemic struck in March.

Ahead, Wall Street will only be open for a half-day tonight (AEDT).

The Australian dollar is lower at US73.64.

Spot iron ore rose 1.4 per cent to $US129.95 a tonne.

Global oil prices fell from eight-month highs on Thursday as signs of growing supplies helped to halt a rally driven by optimism that COVID-19 vaccines will revive fuel demand. Brent crude fell by US81 cents or 1.7 per cent to $US47.80 a barrel.

Angelica Snowden 6.27am: AstraZeneca plans more studies on vaccine

The COVID-19 vaccine manufacturer AstraZeneca will need to conduct further studies on the drug after questions emerged about the protection it offers, but the additional testing is unlikely to affect regulatory approval in Europe.

AstraZeneca and its partner, the University of Oxford, announced on Monday it was seeking regulatory approval for the vaccine after it showed an average 70-percent effectiveness.

That rate jumped to 90 per cent when an initial half-dose then a full dose was given, similar to that in rival vaccines in development by Pfizer/BioNTech and Moderna.

But US scientists have said the higher rate of effectiveness came during tests in people aged 55 and under, and was discovered by accident during the clinical trials.

The head of the Oxford Vaccine Group, Andrew Pollard, said this week that further evidence will be available next month, but the result was still “highly significant”.

“Now that we’ve found what looks like a better efficacy, we have to validate this, so we need to do an additional study,” AstraZeneca chief executive Pascal Soriot told Bloomberg.

He said he expected that to be another “international study but this one could be faster because we know the efficacy is high, so we need a smaller number of patients”.

The additional trial was not likely to delay regulatory approval in Britain and the European Union, Mr Soriot said.

6.15am: Disney warns of more layoffs

Walt Disney Co. plans to lay off a total of 32,000 employees by March, the company said, a further reduction in its workforce that comes as the pandemic hits the entertainment company’s theme-park businesses especially hard.

The number of layoffs is about 4000 more employees than the previously reported 28,000 job cuts announced in September. Most of the job losses will come in the company’s theme-park ranks, where thousands of workers have already been furloughed or laid off.

The severe cuts to Disney’s theme-park division accentuates a new reality at the company since the pandemic cancelled most live entertainment. Once a reliable moneymaker, the Disney theme parks are now either operating at reduced capacity or closed altogether, with one location -- Disneyland in Anaheim, California -- not expected to reopen until at least next year.

That has forced Disney executives to reorganise the company and shift focus toward its year-old streaming service, Disney+. The service’s success in finding early subscribers has saved Disney’s share price, which is trading at pre-pandemic levels as investors warm to its growth potential. Even with several vaccines in development and possibly available next year, Disney is betting that its growth for the foreseeable future will come in the living room, not at the theme-park turnstile.

Dow Jones

5.00am: US airports’ busiest day since March

More than a million travellers were screened at US airports Wednesday, marking the busiest air-travel day since the start of the COVID-19 pandemic in mid-March.

The Transportation Security Administration said in a tweet that TSA officers screened 1,070,967 passengers. It was the fourth time since March 16 that more than one million people passed through U.S. airports. Two of those million-plus days were recorded last weekend, as holiday travel started in earnest.

As many as 50 million people were expected to travel for the Thanksgiving holiday, despite warnings from the Centers for Disease Control and Prevention that people should stay home to help stem the spread of COVID-19, according to an AAA survey conducted before the last CDC warning.

AAA estimated that travel would be down about 10% compared to last year, though air travel was predicted to drop by roughly 47.5 per cent.

Some air travellers said they knew there were risks to travel, but were planning to take precautions to keep themselves safe.

Dow Jones

4.52am: European stocks dip, Wall Street shut

European equities dipped Thursday as dealers nervously eyed coronavirus restrictions in subdued trade, with Wall Street shut for the Thanksgiving holiday.

London’s stock market declined 0.4 per cent as investors digested news on the latest COVID-19 restrictions that will be imposed after England’s current four-week partial lockdown ends next week.

In the eurozone, both Paris and Frankfurt shed less than 0.1 per cent, shrugging off a broadly positive session in Asia that followed this month’s vaccine-fuelled markets rally.

Oil prices stepped lower, while the US dollar rose against the euro but fell against the yen.

“There is always a certain weariness about European markets on Thanksgiving Day, knowing that they are almost certainly condemned to a directionless session with little volume and not much movement,” said analyst Chris Beauchamp at trading firm IG.

“Even when there is (movement) it is likely to be quickly unwound once the Americans get fully back in the saddle from Monday.”

Market analyst David Madden at CMC Markets UK also noted that “traders continue to take profit from the strong gains that were posted on Tuesday.”

Most Asian stocks rose but traders moved cautiously, with an eye on rising virus infections that are forcing governments to impose containment measures across the globe.

With at least three breakthrough COVID-19 vaccines in the pipeline and possibly rolled out within weeks, the general mood on trading floors is upbeat for 2021.

However, a fresh batch of US data underlined the immediate impact of the disease and the long road ahead for economies.

Minutes from the Federal Reserve’s latest policy meeting warned that the country’s recovery would be tougher without a new stimulus package.

Official figures showed new jobless applications rose for a second straight week as businesses were hit by a sharp increase in new infections and deaths that have led several major cities including New York and Los Angeles to close bars and restaurants.

The readings gave traders a dose of reality following weeks of fervent buying in reaction to vaccine successes and Joe Biden’s election victory.

“The US data on Wednesday highlighted the economic fragility as the country battles an even more severe wave of COVID-19 than it was faced with earlier this year which is likely to continue to weigh in the coming weeks,” said OANDA Europe analyst Craig Erlam.

“The Fed minutes did not directly hint at more bond buying in December but given the COVID-19 spike and lack of a fiscal response, it is still looking very likely.”

Ahead of the Thanksgiving break, the Dow and S&P 500 ended lower Wednesday after hitting records the day before, while the Nasdaq hit a new all-time high as tech firms surged.

“It’s going to be a very quiet end to the week with the US Thanksgiving bank holiday -- and extended weekend for many -- leaving a massive void in the markets,” Erlam said.

“The economic calendar was front-loaded this week as a result of the holiday, leaving just a few low-impact releases over the next couple of days and no major central bank decisions.”

AFP

4.45am: German Amazon workers strike

Some 2500 Amazon workers in Germany started a three-day strike timed to disrupt the online retailer’s “Black Friday” sales bonanza.

The strike, called by the powerful Verdi union, is set to last until Saturday and marks the latest escalation in a years-long battle with Amazon for better pay and working conditions.

“We estimate that around 2500 people went on strike today, a higher number than in similar actions in the past and given the difficult circumstances caused by the pandemic, it’s a big success,” a Verdi spokesman told AFP.

To limit the risk of COVID-19 infections, the union said it was not staging any rallies during the strike.

Amazon in a statement said the walkouts were not affecting customer deliveries since “the majority of employees are working as normal”.

The stoppage affected Amazon distribution facilities in Leipzig, Bad Hersfeld, Augsburg, Rheinberg, Werne and Koblenz.

Verdi has long wanted Amazon to sign on to regional wage agreements covering retail and e-commerce, and has organised numerous walkouts in recent years.

It also wants Amazon to improve health and safety at work, accusing the retail giant of not doing enough to protect staff from the coronavirus at some of its German sites.

Amazon defended its policies, saying it offered “excellent” wages, benefits and career opportunities in a “modern, safe” work environment.

AFP

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout