ExxonMobil to exit Bass Strait gas and oilfields

Exxon confirms DataRoom report that its $3.6bn stake in the oil and gas field is on the market.

Oil giant ExxonMobil will sell its Bass Strait oil and gas assets off the Victorian coast in a deal which could top $US2.5 billion ($3.65bn) sparking speculation its joint venture partner BHP may follow suit and cash out its stake.

Exxon confirmed a report in The Australian’s DataRoom column that it would place its 50 per cent stake, owned through Esso, on the market after years of speculation the US energy major was looking to quit its holdings. The announcement was made to hundreds of workers by Exxon’s new Australian chairman Nathan Fay on Wednesday.

“ExxonMobil will be testing market interest for a number of assets worldwide, including its operated producing assets in Australia, as part of an ongoing evaluation of its assets. No agreements have been reached and no buyer has been identified,” Exxon said in a statement.

The deal would include offshore oil and gas assets and the Longford and Long Island Point plants in Victoria and follows an unsuccessful bid by the energy duo to sell declining oilfields in the Strait back in 2016 with hefty remediation costs seen as a major obstacle for buyers.

Its Bass Strait partner BHP said it remained committed to supplying the east coast gas market.

“BHP has been notified by Gippsland Basin Joint Venture partner and operator Esso Australia of its intention to market its interests in Bass Strait. BHP recognises the importance of the Gippsland Basin to the reliable supply of gas into the east coast domestic market and we remain committed to maintaining that supply.”

However, sources close to the company said it may look to follow Exxon’s lead given the nature of its joint venture agreement and tax considerations between the two equal partners. The resources powerhouse may also view the project as too old and too small to retain in its portfolio.

Consultancy WoodMackenzie said the planned sale was “big news” for the Australian market and would likely attract buyer interest although among a limited pool of players.

“As a pivotal producer on the east coast, the assets play a key role in supplying gas to Australia’s biggest market. As such, we would expect interest to be strong from domestic players that wish to gain greater exposure to rising gas prices, of which there are a significant number,” said WoodMac analyst Angus Rodger. “That said, these are complex, mature assets. We believe this will lead to a far smaller pool of realistic buyers, who will have to get comfortable with the age of the assets, declining production and significant decommissioning liabilities.”

Beach Energy has previously been seen a likely buyer given its success integrating the Lattice assets acquired from Origin Energy.

“This would be a monster acquisition so may require financial partnering and balance sheet stretching if it can be feasible at all, but would see Beach emerge with panache alongside the three large cap Australian oil and gas names in scale and establish a dominant east coast market leader,” Credit Suisse said.

Since the 1960s, Exxon has produced more than 4 billion barrels of oil from Bass Strait, which at its peak was producing 500,000 barrels of oil a day, making it one of the world’s biggest producing regions.

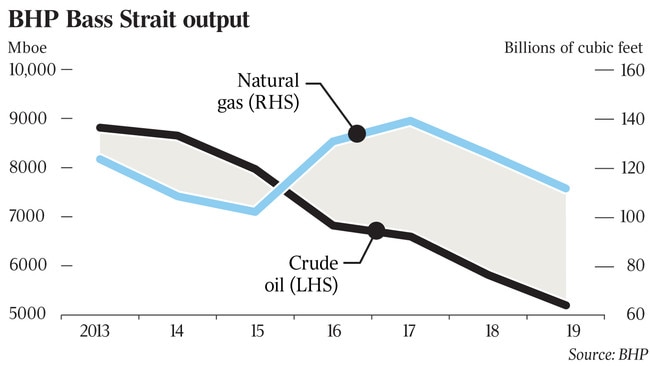

Exxon now produces just one-tenth of the volume of oil it was pumping in the 1980s while its big legacy gas fields — Marlin, Barracouta and Snapper — are also on their last legs.

Although it remains eastern Australia’s biggest gas player, its share of the market has fallen by about a third in the last few years sparking a costly hunt for new resources and even a potential LNG import plant to meet market demand.

Exxon is about to start a new search to drill Australia’s deepest ever oil and gas well, Sculpin, following the failure of its nearby Dory prospect late last year where a $120 million, two-well drilling program failed to yield a discovery.

WoodMac also pointed to the unsuccessful sale of the Bass Strait oil assets which would remain in buyers’ minds considering bids.

“The fact that a previous effort to offload the Gippsland oil assets failed due to uncertainty over abandonment costs highlights how big an issue it will be, but also suggests any new operator would look to extend and increase production from the portfolio to delay the onset of decommissioning spend.”

The Texas based company announced in April a plan to target $15bn in asset sales globally by 2021 after reviewing its exposure to the upstream part of the oil and gas market.

“ExxonMobil continually reviews its assets for their contribution toward meeting the company’s operating needs, financial objectives and their potential value to others,” the company said in a statement. “Operations will continue as normal throughout the effort to sell the assets. Our priorities continue to be effectively meeting the expectations of our customers, employees and business partners, while maintaining a consistent focus on safe and efficient operations.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout