Global energy giant ExxonMobil could be about to launch a multi-billion-dollar asset sale of Australian oil and gas assets, as it approaches investment banks about options for its Gippsland Basin Joint Venture, estimated to be worth close to $US3 billion ($4.3bn).

Speculation is emerging in the market that its 50 per cent stake in the asset it owns with BHP Billiton will soon be placed on the market following the investment banking discussions, with an adviser likely to be appointed soon.

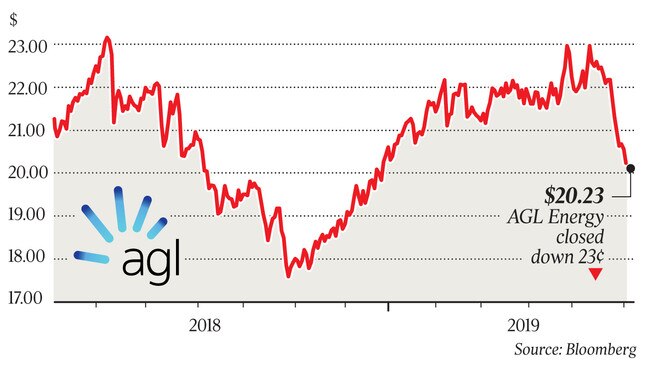

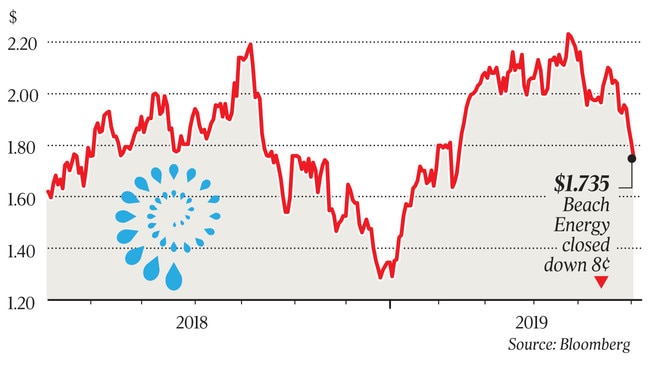

The potential sell-off comes as Beach Energy and AGL Energy are said to be eager acquirers of upstream energy assets.

Some say Beach, which counts Seven Group Holdings as its 25.6 per cent shareholder, will target assets on Australia’s west coast.

However, the 15 per cent interest in Seven Group’s Crux gas field that is up for sale through Morgan Stanley is not on its radar because of perceived conflict issues with its major shareholder, with a sale to Beach probably requiring shareholder approval.

However, the 75 per cent Woodside Petroleum stake in the Scarborough gas project off the coast of Western Australia — estimated to be worth between $500 million and $1bn — could be of interest.

But one view is that Woodside would be eager to sell the Scarborough stake with an off-take agreement in place to a party that would also buy its LNG, as various offshore groups are believed to be circling.

Beach, worth $4.1bn, was always expected to remain on the acquisition trail once it bedded down its $1.4bn purchase of Origin Energy’s Lattice Energy division in 2017, while AGL recently made unsuccessful efforts to buy telecommunications company Vocus, proving the company is acquisitive.

The emergence of AGL in connection with Vocus was first tipped by DataRoom last week and it called on Deutsche Bank and Highbury Partnership as its advisers.

Some sources say that for AGL to buy a major upstream asset like Exxon’s Gippsland Basin project would be a big step and the $13.5bn listed energy retailer would be unlikely to be eager to become an operator of a gas project.

Exxon made moves to sell the oil from its Gippsland Basin project years ago, but the project was too old and did not attract interest because the value was less than its realisation costs.

The Gippsland Basin Joint Venture off the Victorian coast is owned by Exxon in partnership with BHP and produces oil and gas from Bass Strait, with valuation estimates of about $US2bn. It now supplies between 40 per cent and 50 per cent of east coast Australian domestic gas demand.

As part of the joint venture, Exxon also owns the Kipper gas field in the same area, with its 30 per cent interest estimated to be worth about $US800m.

Currently, sources say that in the oil and gas sector, numerous super majors are selling out of projects in the North Sea to independent producers, which may take a look at the Exxon project. Harbour Energy, the former Santos suitor, has been acquiring assets from Shell.

Now may also be the right time to embark on a sale for Exxon given the strong domestic gas price.

Some believe BHP may also sell its interest in the project, with the resources powerhouse viewing the project as too old and too small to retain in its portfolio.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout