Trading Day: ASX rally reverses as mining, real estate stocks pull back

Shares were close to staging a bull run this morning, but a sharp reversal in sentiment has wiped the market’s weekly gain to just 0.5pc.

- PM floats ‘hibernation’ plan for business

- Solomon Lew escalates war against landlords

- New virus cases in China jolt risk sentiment

- Woodside defers three major projects

- US virus count the highest in the world

That’s it for the Trading Day blog for Friday, March 27. The ASX added more than 2pc at the open and was on track for its fourth day of gains but a sharp reversal in sentiment sent shares down 5.3pc by the close - trimming weekly gains to just 0.5pc.

It comes as companies continue to detail job losses, hitting retail landlords the hardest, and withdraw guidance. Energy producers are in focus as Woodside Petroleum and Beach Energy each scrap capital expenditure plans and both Viva Energy and South32 suspend buybacks.

Today’s decline comes despite the Dow Jones ending a short-lived bear market overnight as the Senate passed a massive US stimulus package aimed at reviving the economy in the wake of the coronavirus outbreak. The Dow closed up 6.4 per cent, the S&P 500 jumped 6.2 per cent and the Nasdaq gained 5.6 per cent.

4.26pm: Trump, Xi have “detailed” virus chat

US President Donald Trump and China’s President Xi Jinping have discussed the virus “in great detail”, according to Mr Trump and China’s state media.

Trump says China has developed a strong understanding of the virus and he’s working closely on this with China.

But this is doing nothing for US stock index futures. S&P 500 futures last down 2pc.

Just finished a very good conversation with President Xi of China. Discussed in great detail the CoronaVirus that is ravaging large parts of our Planet. China has been through much & has developed a strong understanding of the Virus. We are working closely together. Much respect!

— Donald J. Trump (@realDonaldTrump) March 27, 2020

4.13pm: ASX unwinds rally in 7.5pc swing

Strong stockmarket gains at the open evaporated by lunch, with renewed selling trimming the benchmark’s weekly rise to just 0.5 per cent.

An early boost from US optimism helped the ASX200 to a nine-day high of 5236.7 in the first hour, but sentiment soured as the US coronavirus case count rose to be the largest in the world, and as retail landlords came under further pressure from store closures.

By the close, the benchmark was trading at daily lows of 4842.4 - a 271 point or 5.3 per cent daily loss.

Meanwhile, the All Ords finished lower by 261 points or 5.1 per cent to 4874.2.

Eli Greenblat 4.01pm: Scentre quashes Premier virus claims

Shopping centre landlord Scentre Group this afternoon hit back at suggestions from Solomon Lew’s Premier Investments that it disregarded safety rules around a possible coronavirus contact at its centre in Carindale, Queensland, and said it followed correct health protocols set down by the state.

“The health and wellbeing of our customers, retail partners and people is our highest priority. We have very high standards of cleanliness and hygiene across our centres and have adopted the necessary precautions in our operations,’’ a spokeswoman for Scentre told The Australian.

“In relation to Westfield Carindale, our retail partners and centre management followed the correct Qld Health protocols. The Qld Health advice was these individuals posed no risk to any customers, retailers or employees.

“As a precaution, the relevant retailers closed their stores temporarily for deep cleaning. Centre management also conducted additional cleaning.”

This afternoon, in an escalation of his war of words with shopping centre landlords, Mr Lew and his Premier group accused Scentre of ignoring a possible spread of the coronavirus within its centre.

Read more: Virus warning: Westfield owner accused

Lisa Allen 3.45pm: Hoteliers cheer quarantine measures

The nation’s hoteliers have reacted positively to the federal government’s decision to force returning international travellers to undergo mandatory quarantine in hotels and other accommodation facilities for 14 days.

One of the nation’s largest hoteliers, multi-billionaire Harry Triguboff, who controls 20 Meriton serviced apartments on the eastern seaboard, told The Australian “definitely this is good news”.

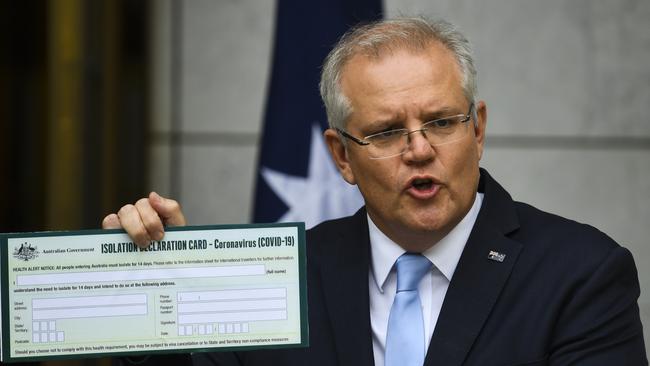

Prime Minister Scott Morrison said the new quarantine measures to contain COVID-19 would be enforced by the State and Territory Governments with the assistance of the Australian Defence Force.

“Of course this is good news,” said Mr Triguboff, owner of five Sydney CBD serviced apartments, as well as serviced apartment towers in Brisbane, Melbourne and the Gold Coast.

But Mr Triguboff said he would not yet move to re-open the ones he had already closed saying “we will re-open when business has significantly improved.”

Earlier this week Mr Triguboff said he would close 14 of his 20 serviced apartments. The new measures will begin from midnight March 28.

Read more: Meriton’s east coast serviced units shut

3.21pm: Scentre extends loss as Lew takes aim

Shares in retail landlord Scentre have taken a 10 per cent hit in afternoon trade, as key tenant Premier Investment, and founder Solomon Lew, escalated its rental war, claiming the group twice failed to take action about coronavirus contact at one of its malls.

REITs have been under pressure in today’s trade, but Scentre stepped markedly lower in the wake of the new attack - hitting a low of $1.52, down 10pc.

Elsewhere in the sector, Charter Hall Retail REIT islower by 14pc to $2.99, SCA property is lower by 9.9 per cent to $2.28 and GPT Group is lower by 9.6pc to $3.35.

Read more: Virus warning: Westfield owner accused

3.01pm: Fiscal stimulus needs to be bigger: UBS

UBS Australia chief economist George Tharenou said Australia needs a far bigger fiscal stimulus, including a “wage subsidy” to avoid a worse outcome than the 10pc on quarter slump in growth and 10pc unemployment rate he’s forecasting.

“Critically, without far larger fiscal stimulus in the very near-term – like several countries paying a large share of salaries for 3 plus months if small businesses keep them employed – there is a clear risk unemployment surges even more to the highest since the last depression,” Mr Tharenou warns. “That dire scenario would also see an ‘L-shaped’ GDP recovery versus our expected ‘V’, keeping unemployment elevated at 10 per cent plus versus our expected retracement.

“While operational difficulties could mute and/or delay the rollout of a wage subsidy program, it can be tailored from other major economies doing much larger packages. We think it is critical to underpin confidence right now.”

Mr Tharenou argues that even just the ‘announcement effect’ would give some hope of a ‘bridge to recovery’ to help minimise the temporary loss of jobs - a supply side shock where businesses temporarily ‘shutter’ and ‘stand’ down workers - instead becoming more permanent – given that more than 2.5m or one-quarter of employees have no leave entitlements and can be stood down without pay.

Elias Visontay 2.55pm: PM floats business ‘hibernation’ plan

Scott Morrison has announced a plan to “hibernate” Australian businesses to help those that are forced to shut due to COVID-19 to reopen after the pandemic.

The Prime Minister said the plan would be announced when the “third tranche” of economic support is unveiled, and will include assistance on rental payments, debt, and “other liabilities”.

“The idea is pretty simple,” Mr Morrison said. “There are businesses which will have to close their doors. They will have to keep them closed, either because we have made it necessary for them to do so or simply there is just not the business to keep their doors open.

“We want those businesses to start again... we do not want over the course of the next six months or as long as it takes for those businesses to be so saddled by debt, so saddled by rental payments, so saddled by other liabilities that they will not be able to start again on the other side.

“We want these businesses to effectively go into a hibernation. Which means on the other side, the employees come back, the opportunities come back, the economy comes back. This will underpin our strategy, as we go to the third tranche (of economic support).”

Read more: PM ramps up quarantine for new arrivals

Eli Greenblat 2.40pm: Premier escalates landlord war

Billionaire retailer Solomon Lew has escalated his war of words with shopping centre landlords, launching a savage attack on their decision to remain open despite the threat of spreading the coronavirus, dismissing the shopping centre’s patriotic call for a ‘team Australia’ approach to sharing the pain.

Just one day after Mr Lew decided to close down more than 1200 of his stores spread across chains such as Just Jeans, Portmans, Dotti and Smiggle, and announce that he would refuse to pay rent to the shopping centres, Mr Lew’s Premier Investments has also accused one of the biggest shopping centre owners in Australia, Scentre Group, of doing nothing about a virus outbreak in Queensland.

Mr Lew’s loyal lieutenant and CEO of his Premier retail business, Mark McInnes, has accused Scentre of doing nothing when a case of possible transmission of the coronavirus at their Carindale property in Queensland was brought to their attention.

“This issue is very real for Premier Retail – we have had two incidents in Scentre Group’s Carindale mall where our team members were exposed to COVID-19-positive customers, and in both instances, when Scentre was notified, they took no action,’’ Mr McInnes said in a statement this afternoon.

Read more: Landlords hit back at Premier in retail showdown

2.16pm: Jobless rate to hit 12pc by June: NAB

NAB economists warn that Australia now faces a “deep recession” and an unemployment rate of 12pc by June.

“We now expect a deep recession,” say NAB Group chief economist Alan Oster and senior economist Gareth Spence in a report.

“While the situation is very fluid, the type of falls we are seeing offshore of around 5 per cent in GDP in Q2 may well occur in Australia (and) it could quite easily be larger depending on the extent of containment actions.”

They note that the future path of both GDP and unemployment will “very much depend on the time taken to bring the virus under control and the Government’s economic responses to quarantine its spread and ultimately relax these measures”.

“Like offshore governments, Australia is increasingly shutting down activity to achieve that outcome,” they say.

“While we appreciate that both monetary and fiscal policy have responded strongly and will likely respond further, these actions are unlikely to fully offset the short-term impact of the large economic shock under way.”

NAB will formally update is forecasts after releasing its NAB monthly business survey in mid-April.

Leo Shanahan 2.07pm: oOh!media sheds 30pc after raise

oOh!media has successfully completed the institutional placement of its planned $167m equity raising in a bid to boost equity in the struggling company amid the coronavirus crisis.

Coming out of a trading halt today, oOh!media announced the completion of the institutional raising, prompting a near-30 per cent share slide after the new stock was sold at a discount.

“We were very pleased with the strong level of support of the offering from both our existing and new shareholders. The equity raising is part of our initiatives to provide the Company with significant liquidity to trade through uncertain times ahead, and position oOh!media to continue leading the out of home industry which we believe is a long-term structural growth sector,” CEO Brendan Cook said.

The company said the institutional entitlement offer had so far raised $156 million at 53c a share, with a take up rate from institutional investors of approximately 91pc.

OML shares last down 27.4pc to 61c.

Read more: oOh!media pushing ahead with $167m raising

1.52pm: Bull, bear swings the new normal

It looks as if the market is falling prey to a trend of Friday selling, according to one trader who predicts a new record for US stocks to fall back into a bear market.

On the local market, the S&P/ASX 200 fell as much as 2.7pc to 4973.4 after earlier setting new 9-day highs of 5236.7 - a 5pc swing intraday. And even that lift was more moderate than the 4.3pc jump as projected by overnight futures relative to fair value.

“Markets tend to reverse the weeks trend on a Friday (and) given that we had rallied 18pc from Monday’s low, it was always a chance that we would sell off going into the weekend, says a private client advisor,

“I don’t know a single person who believed this rally ... it is nothing more than a bear market rally. You have quarter end next week, which may hold the market, but I don’t think we have seen the lows yet.”

He also points out that the Dow actually entered a bull market last night, with a 21pc rise from the low. “With the bear market being the shortest on record, I think this new bull market will also be the shortest on record,” he says.

Lot of talk how a new bull market started today.

— Ryan Detrick, CMT (@RyanDetrick) March 27, 2020

Just remember, the ‘73/‘74 bear saw a 20% bounce.

‘01/‘02 bear had 22%, 25%, 24% and 24% rallies before ultimately falling 51%.

And the ‘08/‘09 bear saw a 27% rally before falling 56%.

We aren’t out of the woods quite yet.

1.33pm: Surge in US virus cases adds to caution

Risk avoidance is dominating as the market turns down 2.5 per cent before the weekend where “anything could happen”.

“No one will want to be doing too much given lockdown talk in Australia and US cases,” says Bell Potter’s Richard Coppleson.

“Given the volatility and the fact that the US is up 21 per cent, its biggest 3-day rally since 1933, most will assume that the US will have some sort of pullback next week.”

“The US cases seem to have gone exponential and so what will happen when Monday comes?”

In his view it’s “safer to sit this one out today” as “there will be plenty of time to get in”.

“So no one is chasing it today as most institutional traders don’t believe this rally will continue,” Mr Coppleson adds, saying that a 1.1pc decline in US futures could be adding to the caution.

Read more: US leads world in COVID-19 cases, 1200 dead

Geoff Chambers 1.18pm: AGL defers bills, pauses disconnections

AGL on Friday announced its COVID-19 customer support program, which will provide fast-tracked access to defer payments and a commitment to suspend disconnections until July 31 for customers under financial stress.

AGL chief executive Brett Redman said they would provide “direct relief to AGL residential and small and medium business customers who aren’t able to pay their bill because they have lost their job or business, or their health has been impacted”.

“For those under financial stress, we have extended payment terms and will suspend disconnections for customers on the program until 31 July,” Mr Redman said.

Mr Redman said the measures were in addition to AGL’s “well-established hardship programs most recently used to provide relief during the summer bushfires”.

Read more: ‘Protect business, households through hibernation’

1.02pm: Shares in swift decline

The local market is swiftly erasing all of the day’s progress, falling by 2 per cent at lunch amid concerns that virus cases in China are rising, and as the local case count rises.

Shares had put on 2.4 per cent early, to touch 9-day highs, but are now lower by 1.6 per cent or 82 points to 5031.8. That’s a massive 4.3pc slide from the high today.

Only industrials, tech and utilities are maintaining the momentum, as REITs pull even lower - last down 5.pc.

A 38.3pc month-on-month fall in China’s industrial profits coincided with a further retreat, but it has been basically one way since 11:15am. S&P 500 futures are down 1.1pc (which in normal times would cause alarm bells) but it’s not stopping gains in Asia.

“I just think the bounce was technical due to oversold levels,” a trader says. “I think we will have another big leg down.”

Here’s the biggest movers at 1pm:

12.58pm: Just how bad was the US jobless data?

A chart of unemployment claims. Today's figure is a 30X standard deviation from norm pic.twitter.com/SO6FVDNbBC

— Nouriel Roubini (@Nouriel) March 27, 2020

Geoff Chambers 12.44pm: Small biz get power bill relief

The Australian Energy Regulator is putting pressure on the nation’s energy retailers and networks to protect households and small businesses through a “hibernation” period as they cope with the economic shock of COVID-19.

Josh Frydenberg and Angus Taylor said the government would closely monitor retailer and network compliance with the new AER measures.

Under the AER statement of expectations, the regulator has urged retailers to waive any disconnection, reconnection and contract break fees for small businesses who have “gone into hibernation”.

They’ve also called for a waiving of daily supply charges to retailers during any period of disconnection through to at least July 31.

The AER wants the major energy companies to offer “all households and small businesses who indicate they may be in financial stress a payment plan or hardship arrangement” and to not disconnect customers without their agreement over the next four months.

Read more: ‘Protect business, households through hibernation’

Lachlan Moffet Gray 12.38pm: New virus cases in China sap ASX optimism

Just as China was seemingly coming out the other side of the coronavirus crisis, authorities today reported the country’s first locally transmitted coronavirus case in three days.

On Friday, China’s National Health Commission said there were 55 new cases confirmed on Thursday, with all but one being “imported cases”.

The high proportion of imported cases in mainland China have prompted harsh travel restrictions for those coming into the country while lockdowns are gradually relaxed for residents who have been subject to harsh regulations for weeks.

On Wednesday, China announced it was lifting travel restrictions on Hubei province, except for the city of Wuhan, allowing people to flow in and out of the state.

The following day the government announced that most foreign nationals would be temporarily barred from entering the country from Saturday.

The moves are sapping risk sentiment on the market, sparking a 0.9 per cent decline on the local market as US futures slip by 1.1pc.

Follow all the latest coronavirus updates at our live blog

12.30pm: Tokyo stocks jump 3pc

Tokyo stocks opened more than three per cent higher on Friday, tracking rallies on Wall Street on a massive US economic relief package.

The benchmark Nikkei 225 index jumped 3.42 per cent or 639.04 points to 19,303.64 in early trade, while the broader Topix index was up 3.08 per cent or 43.14 points at 1,442.46.

“Japanese shares are seen testing the rebound trend, encouraged by surges in US shares,” Yoshihiro Ito, chief strategist at Okasan Online Securities, said in a commentary.

The Japanese government’s plans to fire additional stimulus to counter the impact from the new coronavirus would provide further relief to investors, he added.

The dollar fetched 109.13 yen in early Asian trade, against 109.44 yen in New York on Thursday.

In Tokyo, major shares were higher across the board, with Toyota gaining 2.40 percent to 6,879 yen and Sony trading up 3.16 percent at 6,602 yen.

Uniqlo casual wear operator Fast Retailing was up 4.66 percent at 45,840 yen and chip-making equipment manufacturer Tokyo Electron was up 4.70 percent at 21,275 yen.

AFP

12.05pm: Sharp reversal sends ASX into the red

Shares have fallen into the red at noon, giving up as much as 2 per cent gains as miners and REITs pull lower.

The benchmark ASX200 is lower by 18 points or 0.35 per cent to daily lows of 5056 after hitting a nine-day high of 5236.7 earlier.

All sectors had been trading higher in the first hours of trade, but REITs are now leading the fall with a 3.3pc decline amid concerns of tenant defaults as companies increasingly shutter stores. Miners are lower by 1pc while Consumer Staples are giving back 1.8pc.

It comes as S&P 500 futures turn down 0.6pc after rising 0.5pc earlier today.

Adeshola Ore 11.49am: Cue, Veronika Maine to shut stores

Australian womens clothing brands Cue and Veronika Maine will temporarily close their stores from today in response to the coronavirus pandemic.

In an Instagram post, the company announced it would close all its Australian stores, including concessions within Myer and David Jones, from Friday at the close of business.

“As a family owned and operated business, we have had to make the most difficult decision in our 51 years,” the post signed by the founder and managing director Rod Levis read.

“Our team are looking forward to welcoming you back in-store.”

Late last year, speculation loomed that the brands were being closely watched by deal-makers in the fashion space and owner Mr Levis had been contemplating selling.

Read more in our Coronavirus Crisis live blog

11.42am: Bull run is approaching

Shares are holding higher by 1.2 per cent in the second hour of trade, marking a fourth day of gains.

InvestSmart analyst Evan Lucas points out that this week’s strong rebound has put the market on the verge of a bull run - just as the US market turned bullish overnight.

At the current trading level of 5171.3 the market is 17 per cent from its lows of 4402.5 hit on Monday.

Still, its 26 per cent from the market’s record highs on February 20.

This makes my head hurt.... #ASX is 1% away from a bull run...... #ausbiz #falsedawn pic.twitter.com/INYYAZ31CU

— Evan Lucas (@EvanLucas_INV) March 27, 2020

Michael Roddan 11.33am: Bank loan losses set to jump: Macq

Banks that loosened lending standards over the last two years amid record-low credit growth and during a period of ultra-low interest rates may be hit by loan defaults triggered by the coronavirus economic shutdown exceeding the levels seen during the global financial crisis, according to Macquarie Wealth analysts.

Such a hit could force the vulnerable banking sector to seek to raise capital on the markets at a time when financial market volatility has already scuppered a number of capital raising.

The warning from the leading brokerage comes after global ratings agency Standard & Poor’s warned the local residential mortgage-backed securitisation sector was about to see payments dry up as a result of the newly-launched six-month loan repayment holiday launched by the banking sector for borrowers hit by hardship.

In a note to clients today, Macquarie analyst Victor German said lending standards were bound to deteriorate at a time of subdued credit growth and low interest rates, which was what had occurred just before the onset of the COVID-19 crisis.

“As a result, we believe an economic slowdown will potentially result in a considerable increase in loan losses,” Mr German said.

Macquarie said the threat to banking earnings could exceed its current level expected impairments, which were below GFC levels.

Read more: Liquidity squeeze looms for RMBS

11.20am: Who will be next to raise equity?

G8 Education, Nearmap and Superloop are among Aussie stocks that may need to raise equity this year, according to RBC analyst Garry Sherriff

“Under our stress-testing scenarios the balance sheet positions of these names may come under pressure in calendar 2020 either from high debt metric ratios (G8, Superloop) or possible cash injections as net cash balance reduces (Nearmap),” he says

“These names may need to raise capital should difficult business conditions persist.”

Hansen Technologies, PushPay and NextDC are “less stressed”, with high levels of recurring or contracted revenue and who do not have debt facility maturity concerns within the next 12 months, and adequate funding flexibility options.

Xero, Pro Medicus, Megaport, Elmo Software, Infomedia, Altium and Appen cause him the least concern from a balance sheet perspective as they generally have high net cash positions with no funding issues in calendar 2020.

His top picks are still Xero, Appen, NextDC, Megaport and Pro Medicus for their solid balance sheets, high recurring and contracted revenue and positioning to consolidate their top 3 position in their respective fields, particularly over the medium term as less resilient competition is likely eroded.

11.12am: Analyst forecasts are unreliable: Smartgroup

Employee management outfit Smartgroup says its starting to see signs of reduced business activity as a result of measures to stop the spread of coronavirus, and planning for reduced trading conditions to persist.

The group said its sales leads for new novated leases was most affected so far, and that while it doesn’t provide its own earnings guidance, it considers any earnings forecasts from analysts to be unreliable “in the present circumstances”.

Performance for the two months to the end of February had been in line with the previous period last year and that its client base was diversified with roughly 96pc of employee customers working in state and federal government and departments, healthcare, education or not for profit segments.

The group has current available cash balances more than $60m, and net debt of $36m.

SIQ last traded up 5.4pc to $5.08.

11.03am: Incitec pauses CSG joint venture

Incitec Pivot has put development at its 50/50 CSG joint venture with Central Petroleum in Queensland’s Surat Basin on ice amid disruption from the oil price volatility and coronavirus pandemic.

In a notice to the market, Incitec said development has been paused at the request of its partner, but it still “remained committed to the domestic gas project”.

It said its supply agreement with Central for its Gibson Island site ended in December, with supply for the plant’s needs sourced from Australia Pacific LNG from April 1 to December 31 next year.

IPL shares last up 4.1pc to $2.03.

10.54am: Woodside capex cuts to maintain payout: RBC

RBC’s Ben Wilson keeps his Sector-Perform rating and $22 target on Woodside after it slashed capex by 60pc and deferred longer-dated projects including Scarborough, Pluto and Browse.

“Overall, as with the other E&P (exploration and production) companies, we view this process of slashing expenditure as the prudent approach in what are challenging market conditions,” he says.

“We ultimately see Woodside’s LNG growth options as challenged considering a relatively weak LNG, oil and broader market environment and ever-decreasing contractual slopes.

“We see the proposed Scarborough/Pluto sell downs as extremely unlikely; however, the capex deferrals should in our view see the 80 per cent dividend payout ratio maintained.”

WPL last traded up 2.7pc at $18.49.

Read more: Woodside in $50bn LNG delay

10.42am: Look past near-term Macq risk: CS

Brokerage Credit Suisse says while there is near term earnings risk for Macquarie Group, it still upgrades its recommendation to “outperform” from “neutral”.

The move comes after Macquarie shares taken a beating in recent weeks, falling to a low of $72.02. Credit Suisse says the impact of COVID‐19 has seen Macquarie’s markets activity “significantly impacted” in the second half of the investment bank’s March quarter.

Macquarie’s guidance was retained at financial year 2020 being slightly below FY19’ at its operational briefing in February “but markets deteriorated since that time,” Credit Suisse notes.

“We see further risk to FY21 given annuity businesses are likely to start from a lower base and performance fees are likely to fall given asset price deflation. This environment is likely to see increased impairments which could be recognised in FY20 and/or FY21”.

Still, Credit Suisse said while there is a near term risk to earnings it considers Macquarie to be a “quality business and will likely rebound quickly”.

Given the near 40 per cent share price fall since mid‐February it shifts to an Outperform and a price target of $110 each. Macquarie on Friday is up 5 per cent at $89.40.

MQG last traded up 3.5pc to $88.09.

10.29am: South32 suspends buyback, cuts spend

South32 has suspended its share buyback program and will cut around $US160m in spending over the next 15 months as it responds to the coronavirus pandemic.

South32 said the decision to ice the buyback was taken with $US121m remaining. Still, the mining company said there would be an opportunity to extend the buyback program ahead of its expiry on September 4.

“Our financial priorities remain unchanged, and today’s actions, including the suspension of our on-market share buyback, are a prudent response to the current exceptional circumstances and consistent with our commitment to maintain a strong financial position,” said Chief Executive Graham Kerr.

South32 said $US150m in planned capital expenditure to sustain its operations won’t now happen, representing a 10pc cut in the year through June and an 18pc reduction in the 2021 fiscal year. It would also seek to cut $US10m from its budget for exploring for new deposits of metals and minerals.

Management said it is reviewing activity to find ways to cut controllable costs meaningfully. “We expect to see the benefit of this work and lower producer currencies reflected in our FY 2021 operating unit cost guidance,” the company said in a regulatory filing.

Dow Jones Newswires

Perry Williams 10.22am: Viva delays $680m buyback

Fuels retailer Viva Energy has delayed plans for a $680m off market buyback with coronavirus market volatility hammering its share price.

Viva, which owns Shell-branded petrol stations and the former Shell refinery in Geelong, launched a $680m share buyback on February 24 after selling out of its petrol station property trust.

The company then decided on March 18 to start an on-market buyback prior to the off market buyback, reflecting market conditions and its share price.

It’s now decided to only keep the on-market buyback – when it buys its own shares on the market – while deferring the off-market scheme.

“In light of the COVID-19 impact on the economy, market conditions and the prevailing share price, the Board has determined to delay the intended offmarket buyback program,” Viva said.

“The company will continue to monitor the market and will, subject to market conditions and developments of the COVID-19 situation, seek the required shareholder approval to enable it to pursue an off-market buyback at an appropriate time.”

Viva shares have fallen 35 per cent so far this year, and last traded at $1.29.

10.13am: Shares lift on US optimism

Shares are pushing higher for a fourth day, after optimism on US stimulus spurred a jump on Wall Street overnight.

The benchmark ASX200 lifted by 120 points or 2.4 per cent at the open to 5234.1 – still a more moderate lift than had been tipped by overnight futures.

All sectors bar REITs are trading in the green, led by outsized gains in tech stocks as Afterpay again strides higher.

The local bourse seems to be restrained by choppy trading in US stock index futures.

S&P 500 futures are about flat after rising 0.5pc then falling 0.6pc after a massive 6.2pc rise in the index overnight.

Perry Williams 10.03am: Beach to slash a third of spending

Beach Energy has cut its earnings guidance by 8 per cent for 2020 and will slash nearly a third of its spending next year due to the oil crash as Australian energy producers scramble to reduce their exposure to plunging prices.

Underlying earnings for the 2020 financial year are expected to fall 8 per cent to $1.175bn to $1.25bn from the midpoint of a prior range of $1.275bn to $1.35bn due to lower oil prices.

The new guidance range is based on a Brent oil price of $US30 a barrel from March until June and an Australian dollar at US60c and a realised oil price of $100 a barrel in January and February.

“To ensure we are in the best possible position, we are taking steps to defer or minimise some near-term discretionary capital expenditure,” Beach chief executive Matt Kay said. “This is consistent with our mantra of conservatism and maintaining financial strength, as evidenced by our $151m net cash position at the end of February.”

Beach, controlled by billionaire Kerry Stokes, said growth investment for 2021 will be slashed by 30 per cent from earlier estimates by deferring drilling and development activity or where it sees risks due to coronavirus travel restrictions.

The company has $151m of net cash at the end of February with access to $600m in liquidity via a $450m revolving credit facility.

Read more: Delays could cost Australia its global LNG crown

Eli Greenblat 9.57am: Adairs to close all Aus stores

Home furnishings retailer Adairs this morning announced that it will temporarily close all of its 160 Australian stores from the close of trade on Sunday, and stand down all of its retail and customer support staff.

The six Adairs stores in New Zealand and Mocka’s New Zealand operations were closed from Tuesday in accordance with New Zealand Government requirements.

“The escalation of the COVID-19 outbreak together with Australian and New Zealand Government’s requests for everyone to stay at home, other than for essential needs, has led to this temporary closure,” the company said.

Stores will be closed for an initial period of 4-6 weeks. Their reopening will be dependent upon health and safety assessments, the prevailing environment and Government direction and advice at that time.

“During this period, the store team and the majority of our customer support office team will be stood down but will be able to access their leave entitlements. We expect that the online channels of both Adairs and Mocka will continue to operate.”

The company currently has a net debt position of $48m, with access to a further $12m in undrawn debt facilities. It also has a net cash position of $36m.

with Gerard Cockburn

9.40am: IAG to pause some small biz premiums

Insurance Australia Group will allow small businesses to defer premiums for six months if they are experiencing financial hardship, as part of a raft of measures designed to cushion the impact of the coronavirus pandemic.

Australia’s largest general insurer said it would also provide refunds to small businesses who end their insurance, with no administration and cancellation fees. For those small businesses which must close their premises due to the pandemic, IAG said they can maintain full insurance cover on the premises with no changes to premiums. Vacant premises are higher risk and typically attract higher premiums.

“We are working hard to implement these measures as soon as possible and we recognise that this is one more disaster our communities have to face in what has been a catastrophic start to 2020,” said Peter Harmer, IAG’s chief executive officer.

IAG said the small business relief applies to small businesses with an annual turnover of less than $50m.

Customers who have taken out travel insurance can get refunds for any unused proportion of premiums, including full refunds where customers have not yet travelled and have not claimed under their policy, with no administration or cancellation fees.

IAG expects these measures to be in place by March 30. The key measures, which apply to direct and brokered insurance offered through IAG’s NRMA Insurance, CGU, WFI, SGIO and SGIC brands.

Dow Jones Newswires

9.33am: What stocks are hot, what’s not

- Afterpay cut to Equal-weight – Morgan Stanley

- Bathurst Resources cut to Speculative Hold – Bell Potter

- Bendigo and Adelaide Bank raised to Neutral – Macquarie

- CIMIC cut to Neutral – Macquarie

- Genworth cut to Neutral – Evans and Partners

- Healius cut to Hold – Jefferies

- IGL raised to Buy – Citi

- James Hardie ADRs raised to Buy – CLSA

- Japara raised to Neutral – JP Morgan

- Macquarie Group raised to Outperform – Credit Suisse

- NAB target price cut 23pc to $17 – Macquarie

- Northern Star cut to Neutral – JP Morgan

- OZ Minerals raised to Sector Perform – RBC

- OZ Minerals raised to Buy – Citi

- Premier Investments cut tot Neutral – Credit Suisse

- ResMed GDRs cut to Neutral – Credit Suisse

- Sandfire Resources raised to Buy – Citi

- Steadfast raised to Outperform – Credit Suisse

- Suncorp raised to Neutral – Credit Suisse

- Transurban raised to Positive – Evans and Partners

- Virgin Money UK target price cut 44pc to $2.25 – Macquarie

9.22am: Shares on path to 9-day high

The local market is set to extend its lift in Friday’s session, after US stocks notched their first three-day gain since February thanks to optimism of the passing of a massive US stimulus package.

Futures relative to fair value suggest an early gain of 4.3 per cent – which would take the ASX200 to a new nine day high of 5333.2 – but given the recent volatility there is no certainty that it could hold those levels to the close.

If trade reaches those levels, the market would still be at a 25pc discount from February’s record highs – though a notable 11 per cent higher for the week.

In another boost to sentiment, there is an expectation of large scale rebalancing by asset managers from bonds to equities before month end which could drive the Australian sharemarket higher.

On the charts, there’s resistance from former highs at 5300, then 5470 (38.2pc Fibonacci retracement of Feb-Mar fall) and 5500, while support remains at 5000.

The bad news from corporate Australia continues, with Breville withdrawing earnings guidance, Woodside deferring investment decisions Pluto, Scarborough and Browse and Kathmandu suspending its dividend.

The consensus 12-month forward EPS estimate continues to fall and there are about twice as many ratings downgrades as there upgrades today.

Lachlan Moffat Gray 9.12am: Pack your own bags: Coles

Coles will ask customers at their checkout lines to pack their own bags and can the slicing of bread on demand in an effort to reduce any potential transmission of COVID-19 in any of their supermarkets.

On Friday Coles Group CEO Steven Cain said in a statement the supermarket giant was working closely with the Department of Health to ensure they safety of their customers.

The biggest change is the requirement for shoppers – who just a few years ago could have free bags packed by staff – to pack their own bags from home or purchased in-store.

“We’ll also ask you to pack your own bags to minimise both handling and close contact time,” Mr Cain said, adding that card payments will be encouraged.

“When paying, we recommend card payments instead of cash, and we encourage you to use tap and go to make checking out as easy as possible.”

Gerard Cockburn 9.03am: Appliance demand could support Breville

Breville has withdrawn its full year earnings guidance but says it had been on track to meet its target before the coronavirus disruption, with recovery likely supported by its home-focused product range.

The kitchen appliance manufacturer had previously forecast earnings of $110m for FY20.

Still, Breville said the “relevance of our products to customers spending more time at home (as shown in recent sell out trends), puts us in a strong position to continue to supply our retail partners and support our consumers through these difficult times”.

“These factors will help ensure that we keep our capabilities in place to emerge running strongly when we come out of this difficult period,” it added.

The group said it has a consolidated cash balance of $64m and has drawn $98m on its $273m working capital facility.

Lachlan Moffet Gray 8.55am: US virus count to surpass China

US President Donald Trump has addressed the nation on the eve of the potential passing of a $US2.2 trillion stimulus package which contains several unprecedented measures to tackle a growing crisis, with the number of confirmed cases in the country set to surpass those in China.

According to John Hopkins University, the United States had confirmed 80,021 cases on Friday, with over 1000 deaths, compared to China’s 81,782 cases and 3169 deaths.

President Trump said the increasing number of cases was “a testament to our testing” and implied the Chinese government was not being forthcoming with their data, telling a reporter “You don’t know what the numbers are in China.”

Signifying the rapidly deteriorating situation in New York City, which has experienced over a quarter of the total deaths in the country, President Trump said the USNS Comfort navy hospital ship will be dispatched this Saturday, weeks ahead of the original date.

President Trump said he might go to Virginia to see the ship leave and “kiss it goodbye.”

President Trump said “we will vanquish this virus” and encouraged Americans to maintain social distancing while simultaneously claiming Americans “want to go back to work”.

The U.S. has officially passed China in having the most reported cases of coronavirus.https://t.co/1wRqiwMM0I pic.twitter.com/zepEX8k9qW

— Tracy Alloway (@tracyalloway) March 26, 2020

8.52am: Woodside defers three major projects

Woodside Petroleum said it was deferring three major projects to expand its liquefied natural gas production by at least one year as it seeks to conserve cash until the coronavirus pandemic is contained and oil prices recover.

Woodside said it won’t decide whether to proceed with construction of the Scarborough gas project offshore Western Australia state until 2021, while pushing back the timing of a decision on a second processing unit at the active Pluto LNG facility to the same time.

A final investment decision on developing the Browse gas resource will also be delayed, but without a new target date.

Woodside said its response to the pandemic and steep fall in oil prices would cut its total expenditure this year by around 50pc to $US2.4bn. The Perth-based company had $US4.9bn cash on hand at the end of February, and total liquidity of $US7.9bn.

Dow Jones Newswires

Damon Kitney 8.46am: Bosch develops rapid COVID-19 test

The Healthcare division of German industrial technology giant Robert Bosch has launched a new rapid molecular diagnostic test for coronavirus.

Developed in just six weeks, the rapid test can detect a SARS-CoV-2 coronavirus infection in patients in under two and a half hours — measured from the time the sample is taken to the time the result arrives – and the test can be performed directly at the point of care. This eliminates the need to transport samples also means patients quickly gain certainty about their state of health, while allowing infected individuals to be identified and isolated immediately.

With the tests currently in use, patients must usually wait one to two days for a result.

“We want the Bosch rapid COVID-19 test to play a part in containing the coronavirus pandemic as quickly as possible. It will speed up the identification and isolation of infected patients,” says Dr. Volkmar Denner, chairman of the board of management of Robert Bosch GmbH.

8.30am: Retail Food Group cuts staff, hours

Retail Food Group says it is either standing down or cutting the hours of most of its workers amid the rapid escalation of coronavirus restrictions.

RFG includes chains such as Gloria Jean’s Coffees, Brumby’s Bakeries, Donut King, Michel’s Patisserie.

“In order to safeguard as many jobs as possible over the longer term, and to better preserve and protect the sustainability of its franchise network, the company is implementing a reduction in the total working hours across the Group, in consultation with its personnel, by either standing down, or reducing the working hours of, the majority of RFG’s team members,” it told the ASX.

“Those team members most impacted by this measure will be assisted where possible through this difficult period.”

RFG says while Brumby’s has exceeded expectations in recent weeks, the company is facing a “significant reduction in customer count” in its domestic franchise network, most acutely in shopping centres.

Eli Greenblat 8.10am: Kathmandu to close stores

Outdoor adventure wear and equipment chain Kathmandu is the latest retailer to close its doors and suspend paying dividends to shareholders in the wake of the coronavirus pandemic, as its Australian and New Zealand stores close and around 2000 staff are stood down.

Most Australian staff face at least four weeks without pay.

Kathmandu, which is listed on the Australian and New Zealand sharemarkets and which last year bought surfwear brand Rip Curl, says senior executives will take a 20 per cent pay cut and it is expecting an earnings hit in the second half.

It said all of the group’s major head offices are closed with staff working from home to minimise the spread of the virus.

All New Zealand retail stores and distribution centres were closed on March 24 in advance of that nation’s lockdown, which began on March 25 and will continue for a period of at least four weeks.

Kathmandu has around 170 stores in Australia and New Zealand, as well as 118 Rip Curl outlets.

It says it is in the process of closing its Australian retail network by 5pm today, reflecting the need to ensure the health and safety of staff and customers, rapidly declining footfall and social distancing measures.

7.55am: Fitch maintains US rating

Fitch Ratings has reaffirmed the United States’s AAA credit rating, even as the country faces rising unemployment and a looming recession as the coronavirus pandemic exacts its toll.

“The US sovereign rating is supported by structural strengths that include the size of the economy, high per capita income and a dynamic business environment,” Fitch said.

AFP

7.48am: Cruise lines won’t get US aid

A last-minute legislative change has shut major cruise ship lines out of the roughly $US2 trillion coronavirus stimulus package headed for a House vote, despite being one of the hard-hit industries President Trump has pledged to help.

The cruise industry was among the first to take a public hit from the virus, along with airlines and hotels, as vacationers cancelled plans, local governments halted tourism and passengers on board fell ill, leading to entire vessels full of passengers being quarantined.

But the aid package approved by the Senate and now headed for the House limits aid to US-incorporated companies with a majority of workers based in the US — two criteria that effectively exclude the major cruise-ship operators like Carnival Corp., Norwegian Cruise Line Holdings and Royal Caribbean Cruises.

That is despite comments from Mr. Trump and Treasury Secretary Steven Mnuchin that the administration intended to help the industry, whose publicly traded major players have seen their stock prices crushed since the coronavirus crisis began.

Dow Jones

7.35am: Copper slips

Copper prices fell on overnight as volatile markets and a hit to metals demand from the coronavirus pandemic eclipsed the boost from a massive US stimulus package.

Benchmark copper on the London Metal Exchange was down one per cent at $US4,805 tonne. The metal, used as a gauge of economic health, rose by five per cent over the last two sessions.

Reuters

7.17am: ASX poised for another rise

Australia’s share market is poised for a fourth day of gains after another sharp rise in US equities.

At 7am (AEDT) the SPI200 futures contract was up 184 points, or 3.6 per cent, at 5,149 points, suggesting another good day for the local bourse.

The S&P/ASX200 benchmark index has had three straight days of gains after finishing Thursday up 2.3 per cent while the All Ordinaries index closed up 2.58 per cent.

Overnight US stocks rose sharply after the US Senate passed an unprecedented $3.3 trillion emergency aid bill to shore up the world’s largest economy amid the coronavirus outbreak.

The Australian dollar was buying 60.66 US cents at 7am, up from US59.14c.

AAP

7.10am: Dow escapes bear market

US stocks soared higher, even after data showed the ranks of unemployed Americans surged in the past week, signalling that investors remain hopeful that a $US2 trillion stimulus package can help save the country’s weakening economy.

The Dow industrials finished the day up 1351.62 points, or 6.4pc, to close at 22,552.17, launching the blue-chip index back into bull market territory. The jump ends an 11-day bear market for the index — the shortest in history for the index — which reached its bear-market low just three days ago.

The S&P 500 also ended the day higher, climbing 154.41 points, or 6.2pc to 2,630.07. The tech-heavy Nasdaq composite jumped 413.24 points, or 5.6pc to 7,797.54. Both indexes are still far from returning to a bull market.

Investors had been jittery leading up to the release of the latest unemployment benefits data, unsure of how severely the coronavirus pandemic had ripped through the US labour force. Futures tied to US stocks had declined steeply earlier in the morning, yet pared their losses after it was announced that an unprecedented 3.28 million workers filed for unemployment benefits — five times the previous record high.

The surge in all three indexes after the opening bell marked the third time this week that US stocks opened higher, following a month of steep losses and wild turbulence as the fallout from coronavirus worsened. And even as jobless claims revealed that the economic toll of the outbreak is as severe as anticipated, some investors were already looking ahead to the ultimate passage of the largest fiscal stimulus package in the US in recent memory.

The Senate on Wednesday approved the relief plan, which would provide direct payments to Americans and loans to large and small companies, among other measures. The House is expected to consider the bill Friday. If approved, it would head to President Trump.

“Investors believe data like today will make it more likely that the House will pass the stimulus bill,” said Jeffrey Kleintop, chief global investment strategist at Charles Schwab & Co. “The deeper and the worse the numbers are in the near term, the more possibility there is for a [fiscal] response, which powers the rebound on the other side.”

Dow Jones Newswires

6.20am: Woolworths to hire 20,000

Woolworths says it will hire up to 20,000 new roles across its supermarkets, e-commerce, supply chain and drinks businesses over the next month.

It comes as supermarkets struggle to cope with demand for food as coronavirus restrictions shut down many other shops, restaurants and cafes. The supermarket giant is also trying to step up home deliveries.

Woolworths Group CEO Brad Banducci said: “These are uncertain times for many industries and we have an important role to play keeping Australians employed through this crisis.

“Our top priority as we continue delivering an essential service to the community is upholding customer and team safety through clear social distancing rules and elevated hygiene standards.

“As we do this, we will have more hours for existing team members and additional roles to fill as we focus on meeting the needs of our customers and communities.

“These new roles will not only help us better serve the increase in demand we’re seeing in stores right now, but also allow us to scale up home delivery operations in the months ahead.”

Woolworths says it’s preparing to offer up to 5000 short-term roles to Qantas employees taking leave without pay, and is planning similar streamlined application processes for a number of other companies which have laid off staff.

6.15am: Oil slides

Oil prices slid, paring nearly all of their weekly rebound as traders weighed signs that fuel demand and economic activity could fall even more than feared due to the coronavirus.

U.S. crude-oil futures fell 7.7pc to $US22.60 a barrel on the New York Mercantile Exchange, dropping back toward the 18-year low they hit last week and extending a stretch of extreme volatility. Prices are down 63pc for the year, slammed by an unprecedented decline in fuel consumption globally and a price war between Saudi Arabia and Russia that threatens to increase supply.

Brent crude, the global gauge of oil prices, dropped 3.8pc to $US26.34 a barrel on the Intercontinental Exchange.

Dow Jones

5.50am: Wall St jumps again

US stocks soared higher, even after data showed the ranks of unemployed Americans surged in the past week, signalling that investors remain hopeful that a $US2 trillion stimulus package can help save the country’s weakening economy.

The Dow Jones Industrial Average climbed 4.5pc by midafternoon, putting the blue-chip index on track to possibly finish the day in a bull market — a move that would mark the shortest bear market for the index in history. The S&P 500 gained 4.6pc, and tech-heavy Nasdaq Composite added 4pc.

In Australia, after posting a third day of gains yesterday, the ASX looks set to open higher. At 5.45am (AEDT) the SPI futures index was up 158 points, or more than 3 per cent.

The Aussie dollar is back above US60c, rising to US60.65c.

Investors had been jittery leading up to the release of the latest unemployment benefits data, unsure of how severely the coronavirus pandemic had ripped through the US labour force. Futures tied to US stocks had declined steeply earlier in the morning, yet pared their losses after it was announced that an unprecedented 3.28 million workers filed for unemployment benefits — five times the previous record high.

The surge in all three indexes after the opening bell marked the third time this week that US stocks opened higher, following a month of steep losses and wild turbulence as the fallout from coronavirus worsened.

And even as jobless claims revealed that the economic toll of the outbreak is as severe as anticipated, some investors were already looking ahead to the ultimate passage of the largest fiscal stimulus package in the US in recent memory.

The Senate on Wednesday approved the relief plan, which would provide direct payments to Americans and loans to large and small companies, among other measures. The House is expected to consider the bill Friday. If approved, it would head to President Trump.

“Investors believe data like today will make it more likely that the House will pass the stimulus bill,” said Jeffrey Kleintop, chief global investment strategist at Charles Schwab & Co. “The deeper and the worse the numbers are in the near term, the more possibility there is for a (fiscal) response, which powers the rebound on the other side.”

If the Dow industrials are to reach a bull market, it would occur just three days after the index reached its recent low. The S&P 500 and the Nasdaq still remain far from a possible bull market.

Oil prices slid. Brent crude, the global gauge of oil prices, dropped 2.7pc to $29.19.

Outside the US, the pan-continental Stoxx Europe 600 rallied 2.6pc after declining for part of the day. The European Central Bank “broke new ground,” said Florian Hense, an economist at Berenberg Bank in a note, after it gave itself more flexibility on its additional EUR750bn ($821bn) bond-purchase program.

Dow Jones Newswires

5.38am: Stocks extend rally

Stocks shot higher as investors brushed aside a record surge in US unemployment benefit claims, instead focusing on progress towards a massive stimulus plan and a pledge by world leaders for a “united front” in the fight against the coronavirus pandemic.

Federal Reserve Chairman Jerome Powell said the US central bank would continue to “aggressively” pump liquidity into the economy and added that “we’re not going to run out of ammunition” to support lending.

The dollar fell sharply against its main rivals on the developments. Powell acknowledged there would be a sharp downturn as more and more countries confine people at home and close non-essential businesses to slow the spread of the respiratory ailment COVID-19.

In one of the latest indications of that impact, the US Labor Department said first time unemployment claims soared to 3.3 million last week — the highest number ever recorded.

That compares to 281,000 first-time filers in the prior week and blows away the previous record of 695,000 set in October 1982.

“US markets are roaring ahead again, after Jerome Powell’s promise of more actions if needed outweighed a shocking rise in US jobless claims,” said Chris Beauchamp, chief market analyst at online trading firm IG.

There was also movement on a massive $US2 trillion stimulus bill, with the House of Representatives expected to vote Friday on the measure approved Wednesday by the Senate.

Meanwhile, G20 nations pledged a “united front” in the fight against coronavirus, saying they were injecting $5 trillion into the global economy to counter the pandemic amid forecasts of a deep recession.

The G20 pledge helped pull European stocks into positive territory. They had spent most of the day in the red after the international ratings agency S&P Global warned that the coronavirus will push Britain and the euro area into recession this year, with their economies expected to shrink by as much as two per cent.

London closed up 2.2pc, Frankfut rose 1.3pc and Paris ended 2.5pc higher.

In Asia on Thursday, Tokyo’s main stocks index ended down 4.5 per cent after surging by almost one fifth over the previous three days, while Hong Kong shed 0.7 per cent and Shanghai eased 0.6 per cent.

Singapore lost more than one per cent as the city-state said its economy contracted sharply owing to virus fallout. Compared with the previous quarter, GDP dived 10.6 per cent, as all sectors of the economy were battered.

AFP

5.36am: World leaders vow to co-ordinate response

The head of the United Nations told leaders of the world’s 20 major industrialised nations during an emergency virtual summit Thursday that “we are at war with a virus – and not winning it” despite dramatic measures by countries to seal their borders, shutter businesses and enforce home isolation for well over a quarter of the world’s population.

The unusual video call in lieu of a physical gathering comes as governments around the world stress the importance of social distancing to curb the spread of the highly infectious virus, which has prompted closures, curfews and lockdowns globally.

The Group of 20 nations, which faces criticism for not taking cohesive action against the virus or its economic impact, vowed to work together.

The group said they are collectively injecting more than $US4.8 trillion into the global economy to counteract the social and financial impacts of the pandemic. In a final statement after the meeting, the G20 said they were committed to strengthening the World Health Organisation’s mandate.

AP

5.35am: Airbnb offer to responders

Airbnb said it would provide free or subsidised housing for up to 100,000 relief workers responding to the coronavirus pandemic around the world.

The homesharing platform said it would subsidise the stays for health professionals and other emergency responders to enable them to live closer to their work locations.

The move is being made in co-operation with the International Federation of the Red Cross and Red Crescent Societies, the International Rescue Committee, International Medical Corps and other non-profit organisations, Airbnb said in a statement.

Chief executive Brian Chesky tweeted that Airbnb hosts may opt in to offer homes that respect safety and cleanliness protocols.

The company — which is expected to see a massive hit from the pandemic — asked its hosts to offer housing for free, and also said it would be waiving all its fees.

AFP

5.32am: US taking stakes in airlines: report

The US government plans to take stakes in major airlines in exchange for aid included in a $US2 trillion coronavirus economic rescue package, the Wall Street Journal reported.

Treasury Secretary Steven Mnuchin indicated the plan for government stakes in conversations with politicians, said the report, which cited unnamed officials.

The newspaper said the precise terms of the arrangement were not yet clear, but one option is that the government could receive a warrant that allows it to buy shares at a certain price.

The bill that passed the Senate includes $US25bn in loans to US airlines and another $US25bn in grants.

AFP

5.30am: Fed pledges lending

Jerome Powell says the Federal Reserve would provide essentially unlimited lending to support the economy as long as it is damaged by the viral outbreak.

In an interview on NBC’s “Today” show, the Fed chair said the bank’s efforts are focused on helping the economy recover quickly once the threat from the virus has passed.

Powell also acknowledged that the economy “may well be” in a recession, but said that this is a unique downturn in that it was caused by efforts to control the disease. The economy itself was strong before the outbreak began, he said. “If we get the virus spread under control fairly quickly, then economic activity can resume, and we want to make that rebound as vigorous as possible,” Powell said.

The Fed has taken numerous steps this month to bolster lending and the economy. It has cut its benchmark interest rate to nearly zero, embarked on an unlimited bond-buying program to pump cash into the financial system, and set up several emergency programs intended to ensure that banks can keep lending to companies and city and state governments.

Powell said the Fed’s ability to lend is somewhat constrained by the amount of capital provide by the Treasury to offset any credit losses. He said the Fed can lend $10 for every $1 of cash that the Treasury provides.

AP

5.28am: Norway’s wealth fund loses

Norway’s sovereign wealth fund, the world’s biggest, has lost 1.33 trillion kroner ($US125bn) since the start of 2020 as markets collapse under the COVID-19 pandemic, its management said Thursday.

As of March 25, the fund was valued at 10.1 trillion kroner ($US949bn) after registering a negative return of 16 per cent since January. Its share portfolio, which accounts for about two-thirds of its holdings, reported a 23-percent drop.

“It’s a strange time for society, it’s a strange time for the economy, and it’s also a strange time for global financial markets,” the outgoing head of the fund, Yngve Slyngstad, told reporters.

The decline does not totally wipe out last year’s gain of 1.69 trillion kroner, he said, while warning that other “major fluctuations” could be expected in the weeks to come.

Slyngstad also noted vast differences between sectors, with oil stocks shedding 45 per cent and the tech sector losing 14 per cent.

AFP

5.26am: BoE warns of ‘sharp’ downturn

The Bank of England warned that the scale and duration of the economic shock stemming from the coronavirus pandemic will be “large and sharp but should ultimately prove temporary.”

The rate-setting Monetary Policy Committee said in a statement that the depth of the downturn will largely depend on whether job losses and business failures can be “minimised.” Early surveys of the economy in Britain are pointing to a virus-related recession even deeper than the one that followed the global financial crisis a decade ago.

Many economists think that the economy could shrink by more than 10pc just in the first half of this year, an almost unprecedented decline in developed economies.

AP

5.25am: US jobless claims soar

Nearly 3.3 million Americans applied for unemployment benefits last week – more than quadruple the previous record set in 1982 – amid a widespread economic shutdown caused by the coronavirus.

The surge in weekly applications was a stunning reflection of the damage the viral outbreak is doing to the economy. Filings for unemployment aid generally reflect the pace of lay-offs.

The pace of lay-offs is sure to accelerate as the U.S. economy sinks into a recession. Revenue has collapsed at restaurants, hotels, movie theatres, gyms, and airlines. Auto sales are plummeting, and car makers have close factories. Most such employers face loan payments and other fixed costs, so they’re cutting jobs to save money.

As job losses mount, some economists say the nation’s unemployment rate could approach 13pc by May. By comparison, the highest jobless rate during the Great Recession, which ended in 2009, was 10pc.

AP

5.22am: China cuts more flights

China is set to drastically cut its international flight routes, capping the number at just one route a week to each country, the civil aviation administration said Thursday.

Airlines flying into China will face the same restrictions, the authority added as concerns mount over imported cases of the new coronavirus.

AFP

5.20am: BoE keeps rates on hold

The Bank of England kept its main interest rate at 0.1 per cent Thursday, a week after cutting the borrowing cost to the record-low level to combat economic fallout from the coronavirus.

The BoE’s Monetary Policy Committee opted to maintain the rate at a scheduled gathering after last week’s emergency meeting in response to the fast-moving COVID-19 outbreak.

AFP

5.18am: Ford pushes for factory restart

Ford says it wants to reopen five North American assembly plants in April that were closed due to the threat of coronavirus.

The three Detroit automakers suspended production at North American factories one week ago under pressure from the United Auto Workers union, which had concerns about members working closely at work stations and possibly spreading the virus.

Union spokesman Brian Rothenberg said UAW is reviewing Ford’s announcement “with great concern and caution.”

The company says it’s aiming to reopen its factory in Hermosillo, Mexico, on April 6, followed by its Dearborn truck plant, Kentucky truck plant, the Ohio Assembly Plant and the Transit van line at the Kansas City plant on April 14. The factories were closed earlier this month under union pressure. The company also wants to reopen parts-making plants to feed the assembly factories on the same day.

AP

5.15am: UK, eurozone face recession: S&P

The coronavirus pandemic will push Britain and the euro area into recession this year, with their economies expected to shrink by as much as two per cent, the international ratings agency S&P Global warned.

“The eurozone and UK are facing recessions. We now expect GDP (gross domestic product) to fall around 2.0 per cent this year due to economic fallout from the coronavirus pandemic,” it wrote in a report.

The spread of COVID-19 has forced three billion people around the world into lockdown and economists say the restrictions could cause the most violent recession in recent history.

AFP

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout