Liquidity squeeze looms for residential mortgage-backed securities

Borrowers unable to pay home loans are set to cause a liquidity ‘shortfall’ in the $400bn residential mortgage-backed securities sector.

The $400bn residential mortgage-backed securities sector faces a huge liquidity “shortfall” due to the looming wave of borrowers unable to pay their home loan, which is expected to exceed the increase in arrears sparked by the global financial crisis.

Global ratings agency Standard & Poor’s said the unprecedented intervention by the government and the banking sector designed to save households from defaulting on their loans — by allowing borrowers experiencing hardship a six-month period where they don’t have to pay loans — would make matters worse for collateralised mortgage bonds because it would see payments flowing into the billion-dollar securities dry up.

While it is believed the residential mortgage bond sector generally has about nine months of cash up its sleeve to stave off a situation of widespread bond defaults, Australia’s six-month loan repayment holiday is far shorter than the 18 month break given to Italian borrowers who are suffering through a much more advanced pandemic outbreak.

While the loan repayment holidays will help stabilise borrower creditworthiness, it could “disrupt cash flows to the trusts”, S&P primary credit analyst Erin Kitson said.

“Liquidity stress and an increased proportion of borrowers unable to make scheduled loan repayments will affect the cash flows to Australian RMBS transactions,” she said.

A suspension in loan repayments would lead to a direct fall in the amount of cash flowing to mortgage bond issuers, generally non-lenders that don’t take customer deposits, at the same time as those shadow banks would remain required to pay investors interest to keep the bond from defaulting.

“A significant reduction in collections could therefore lead to a shortfall, resulting in the issuer being unable to pay some or all of the senior costs plus note interest. Non-payment of interest on the most senior class of notes would typically lead to an event of default under the transaction documents,” Ms Kitson said.

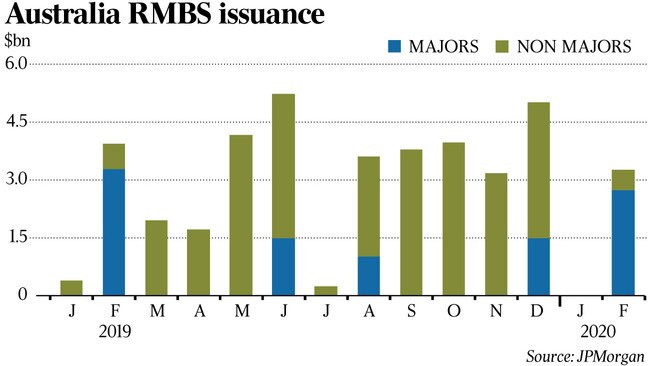

It comes as the non-bank sector, which relies on mortgage securitisation to fund its operations, holds talks with the government about its planned $15bn intervention into securitisation markets, which have frozen amid a spike in wholesale funding costs and as investors dump riskier assets as part of a global liquidation event where large money managers have cashed out of the financial system.

A number of non-bank lenders contacted by The Australian declined to provide comment on the situation.

Genworth Mortgage Insurance, the country’s largest lenders’ mortgage insurer, on Thursday dumped its earnings guidance as the “unprecedented challenges” of the coronavirus crisis and the impact of numerous government interventions to prop up the economy and the financial system “which continue to evolve daily” made it impossible to provide an indication of future profits.

“Genworth is committed to responding to the rapidly evolving situation, regularly engaging with the company’s over 100 lender-customers to help them support borrowers during this time,” the company said, noting it was well capitalised and had sufficient liquidity in its investment portfolio.

“We strongly support the recent initiatives by lenders to ease the financial burden on borrowers during this period,” it said.

Genworth chief executive Pauline Blight-Johnston said the group, which insures banks against borrower defaults, was “mindful of our social responsibility to do our part to support the community”.

“We are working closely with our customers and continue to maintain our standards of service to support them and their borrowers,” Ms Blight-Johnston.

Residential mortgage-backed securities are created by lenders gathering up thousands of home loans into a securitised vehicle, which is then divided into separate coupons and sold to investors, who receive a distribution of interest of the many regular mortgage repayments flowing into the bonds.

While RMBS issuance helps smaller lenders compete with larger banks, as it allows them to shift the risk of defaulting loans off the balance sheet of the lender and on to investors, a widespread collapse in mortgage bond repayments were a key feature of the 2008-09 global financial crisis, a weak link which disrupted the cash flow of large money managers and insurance companies, many of which then faced the threat of insolvency.

In Australia, RMBS transactions are issued with significant cash reserves or liquidity facilities, which act as a structural protection against the threat of a short, sharp contraction in mortgage repayments. According to S&P estimates, the average local RMBS would be able to cover about nine months of expenses and distribution payments to investors if payments fell to zero — a scenario that remains “unlikely”, Ms Kitson said.

But Ms Kitson said the rate of borrowers falling behind on loan repayments will rise much sooner than they did during the financial crisis.

“Australian RMBS was relatively less affected by the financial crisis than other markets,” Ms Kitson said.

“We currently expect increases in arrears to be higher than during the 2008 global financial crisis, given the wide-ranging effects on the economy stemming from the sudden disruption to economic activity.”

Westpac head of covered bond and securitisation strategy Martin Jacques said the S&P update was “very timely”.

“The impact of mortgage relief measures and repayment holidays on Australian RMBS which is arguably the most burning topic amongst investors at the moment,” Mr Jacques said.

“Given the high unlikelihood of all borrowers within a transaction needing to take up these payment holidays, many RMBS structures should be able to accommodate a longer than anticipated duration to this health crisis,” he said.

Across securitisation markets, non-bankers are revisiting pricing expectations and industry participants are keeping close tabs on global developments as markets whipsaw.

Recently, leading Australian non-bank Resimac deferred a securitisation transaction as markets were frozen up or too volatile, and took up negotiations with major lenders to extend its warehouse facilities in a bid for extra borrowing headroom to keep operations healthy.

Analysts are predicting lenders will not raise debt from securitisation markets until calm returns.

Prime Minister Scott Morrison and Treasurer Josh Frydenberg recently earmarked $15bn to be injected into the securitisation market through the Australian Office of Financial Management to get the system operational again.

The AOFM was forced to step in and keep markets functioning during the Global Financial Crisis.