Shares rebound 1.8pc in broad lift despite record GDP drop

Shares made back all of Tuesday’s losses, even as the economy fell into a recession for the first time in three decades.

- June GDP drops 7pc into recession

- AMP announces portfolio review

- MLC buy too big, too risky for IOOF

- Westpac needs an asset sale too: CS

That’s all from the Trading Day blog for Wednesday, September 2. Australian stocks rebounded by 1.8pc with gains across all sectors, despite June GDP figures showing the economy had sunk to a recession for the first time in three decades.

The threat of further competition prompted jitters in BNPL stocks including Afterpay and Zip, while AMP’s review and potential asset sales sent shares up 5pc.

John Durie 7.56pm: AMP chair draws line in the sand

New AMP chair Debra Hazelton should take a bow, having made the right call in effectively putting the 170-year-old company up for sale.

Whether it comes to that remains to be seen, but the portfolio review announced on Wednesday at the very least puts a line in the sand from which a future may be possible to build.

Just whether the plaudits are still due will depend on what decisions are eventually taken.

This is a company that has long lost its way and can no longer be regarded as the natural owner of just about any asset.

The recent events around former Australian boss Alex Wade and AMP Capital boss Boe Pahari were just simply poor behaviour.

What has happened over the past two decades is the tragic decline of a national icon through basic corporate mismanagement.

This has been a combination of dumb deals, like doubling up by spending $4bn on AXA 10 years ago when all it bought was scale in the wrong areas.

John Durie 6.50pm: Cbus boss looking for more mergers

New Cbus chief Justin Arter said the $55bn industry superannuation fund would look at more merger candidates when it had completed the $8bn Media Super deal in the first quarter of next year.

Arter was speaking on his eighth day running the industry fund after replacing long-time boss David Atkins late last month. He also urged the federal government to not abandon legislated plans to increase the superannuation guarantee from 9.5 per cent to 12 per cent from the middle of next year.

“There will always be a reason not to stick with the commitment but it is hard to see a 0.5 per cent increase having an impact on employment,” he said.

Arter backed reported comments by former NAB chair Ken Henry who said: “People can always argue that it’s never the right time to increase the rate of the superannuation guarantee. I would say this is long-term structural reform.”

6.26pm: Pointsbet raising capital

Pointsbet Holdings has requested a trading halt pending it releasing an announcement regarding a capital raising. It said the trading halt would remain in place until 9 September or when the announcement is released to the market.

Joyce Moullakis 6.05pm: KKR eyes AMP investment platform

Private equity giant KKR & Co has made an informal approach to under-pressure AMP about buying the wealth group’s investment platform business, according to sources.

The Australian understands while the offer wasn’t final or binding, KKR wants a seat at the table should the entire AMP business be broken up. The private equity firm expressed interest in recent weeks in the $46bn in assets on AMP’s North investment platform, which also saw net cashflows increase in the six months ended June 30.

An AMP spokesman declined to comment on any specific interest fielded by the company to buy its business units. A KRR spokesman also wouldn’t comment.

5.40pm: Xero block trade underway

Goldman Sachs is working on a $198m block trade out of accounting software provider Xero for founder Rod Dury. Read more.

4.34pm: IOOF dives, Xero sets record high

The market was a sea of green on Wednesday, with gains led by miners and utilities, as the buy now, pay later rally took a breather.

There was no stopping Xero, who set a new record high of $103, after chairman David Thodey added to his holdings, while GWA outperformed with a 8.2pc jump on seemingly no news.

On the downside, IOOF took a 22.7pc hit on its return to trade, after issuing shares at a discount in its raise to fund its MLC buy.

Here’s the biggest movers at the close:

4.12pm: Recession no match for market optimism

The economy first recession in almost 30 years was no worry for the local stockmarket on Wednesday, with shares gaining as much as 2 per cent through the day.

Offshore optimism and hope of further stimulus locally helped the benchmark ASX200 to jump by 110 points at the close, or 1.84 per cent to 6063.2.

BHP was one of the biggest contributors as it added 2.7pc, while the major banks put on between 1.3pc and 1.6pc.

Afterpay was the biggest drag, coming back from a 10pc drop to finish the session down 1.9pc to $82.50.

Eli Greenblat 4.03pm: Woolies chief snaps up more shares

A solid year of returns from Woolworths, with second half sales and earnings fuelled by panic buying in the face of the COVID-19 pandemic, has helped chief executive Brad Banducci snap up more shares in the retailer.

In a notice to the ASX, Woolworths said share rights vested on August 27 and transferred to a family trust the following day helped Mr Banducci lift his holding by 186,835 shares.

These shares are valued at around $7.335m. The vested shares almost double his total holdings in Woolworths to 382,643 shares.

The bulk of the new shares, 125,566, vested as part of the 2018 long term incentive plan.

3.49pm: Don’t expect recovery til Q4: CBA

Despite the record drop in GDP this quarter, the economy has further to fall, so notes Commonwealth Bank.

Head of Australian economics Gareth Aird writes that the Victorian lockdown will “have a sufficiently big negative impact on the national economy to see output contract”, albeit only small.

“We therefore think that the ‘economic recovery’ is very much a story for Q4 20, as most states in Australia are currently in the recovery phase. The Australian economy has the capacity to rebound quite quickly with the right policy settings and most importantly no further outbreaks of COVID-19 that result in the reimposition of restrictions.”

He adds that the 3.5pc contraction in output for the first half versus the same time last year compared favourably with many other advanced economies, what he said was a testament to Australia’s initial efforts to control the spread of COVID-19.

Read more: The weirdest recession we’ve ‘had to have’

3.36pm: Bidding war for Cardinal Resources

A bidding war has broken out for West African gold explorer Cardinal Resources, with UK-based Nordgold going head-to-head with state-owned Chinese gold miner Shandong.

In the latest escalation, Nordgold today raised its offer price to 90c per share, valuing the company at roughly $380m and an increase on its previous 66c per share bid.

Cardinal has told shareholders to take no action on the bid, despite it beating the previously-recommended 70c per share bid from Shandong, noting it had several obligations under its bid implementation agreement, including matching rights.

CDV shares are up 28pc to 92.5c on the news.

3.22pm: AMP Capital tips rate cut to 0.1pc

AMP Capital’s chief economist Shane Oliver predicts the RBA will cut the cash rate to 0.1pc in the months ahead.

Dr Oliver tips the bank to also increase and broaden its bond buying program and adopt an even more dovish commitment to not raise rates until inflation is actually and sustainably back in the 2 to 3 per cent target band.

Deutsche Bank has also predicted more easing by the RBA.

2.46pm: ASX headed for best day in 6 weeks

Yesterday may have been the market’s worst drop in four weeks, but its bouncing back today to notch its best day in six weeks.

The S&P/ASX 200 rose 2pc to a 2-day high of 6075.7. A rise of more than 1.88pc today would mark its best day since a 2.6pc gain on July 21.

US index gains have helped but the main driver today is broadbased buying after the index hit a 4-week low of 5908.9 on Tuesday.

Even with the massive voluntary withdrawals from super funds post-coronavirus, it looks like the build up of cash from inflows is burning a hole in their pockets.

Standouts in the top 20 stocks include, BHP up 3.3pc, CSL up 2.1pc, Transurban up 4.3pc, Woolworths up 2.9pc, Wesfarmers up 2.2pc, Telstra up 2.7pc, Goodman up 2.6pc, Fortescue up 2.3pc.

2.21pm: Petrol margins good for retailers

Record-high margins for petrol retailers in the June quarter are a good sign for petrol retailers.

The fact that they were able to boost their margins as inflation-adjusted petrol prices hit a 21-year low in the June quarter amid a 27pc Y/Y fall in sales volume shows a lot of pricing power.

It leaves Ampol and Viva Energy well placed to benefit from a pick-up in sales volumes once coronavirus lockdowns in Victoria come to an end.

ALD was last up 3.5pc at $26.51, but Viva was down 0.6pc at $1.64.

1.41pm: Westpac needs an asset sale too: CS

As investors mull the potential for asset sales at AMP, Credit Suisse notes that Westpac is in need of a few divestments too.

The broker writes that Westpac “needs an asset sale (or three)” especially given its tier 1 capital ratio currently sits a 10.8pc, the lowest of the major banks.

Westpac’s capital position means its likely to dip into its capital buffers, “leading to uncertainty around its capacity to resume dividends in the near term together with capital raising fears”.

Credit Suisse suggests the bank’s specialist businesses – non-core assets in banking, auto finance, superannuation, life insurance and general insurance – will be on the chopping block, with a review already underway.

“We estimate these assets could be worth $3.3bn to $4.8bn and the sale of them would see its CET1 ratio increase by an estimated 70-110bp, taking pro-forma CET1 to between 11.5pc and 11.9pc,” the broker says.

“Recent transactions by CBA and NAB show there is an improved appetite for these types of assets.”

Read more: AMP considers asset sales as part of review

Bridget Carter 1.05pm: Jarden hires Schauer

DataRoom | Jarden is taking on the big players in the Australian real estate investment banking space, hiring Mitch Schauer from UBS.

Mr Schauer will head up Jarden’s Australian real estate investment banking coverage as a Managing Director.

The investment banker of 13 years has spent 11 years at UBS under the leadership of outgoing Australian real estate investment banking head Tim Church.

Prior to that, Mr Schauer worked at JPMorgan, also under Mr Church’s leadership.

Among the deals that Mr Schauer has been involved with are recent equity raisings for blue chip listed real estate investment trusts including GPT, Mirvac Group and Lendlease.

1.01pm: ASX recovery builds to 1.6pc

While all eyes were on GDP, the local market has edged slightly higher, recovering by 1.6pc at half time.

The benchmark ASX200 built to highs of 6052.1 and last traded up 95 points or 1.6 per cent to 6048.7.

Afterpay is a key factor in the pop higher, coming back from losses as much as 10pc to trade down by just 0.7pc at the halfway mark, offset by outperformance in the major miners.

IOOF is taking a 21pc hit on its return to trade after raising funds at a discount, while AMP is a standout with a 6.8pc jump on potential of an asset sale.

Here’s the biggest movers at 1pm:

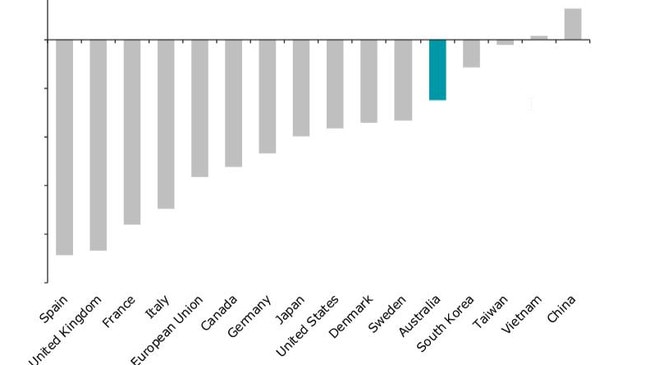

12.51pm: How our recession stacks up globally

The local recession may be the first since the 1990s, with the biggest drop on record, but Deloitte notes Australia’s drop is far more mild than that of many of our global counterparts.

Senior economist Sheraan Underwood notes that China, Vietnam, Taiwan and South Korea are the only to ride out the pandemic better in economic terms, “mainly as they’ve also done better than us at keeping the virus contained”.

A graph from the consulting group shows Australia’s GDP growth rate has fared better even than Sweden, who has been the poster child for the herd immunity strategy.

“Australia has seen both less economic damage and relatively fewer lives lost than most nations, including the US, the UK and most of Europe, including Sweden, which has taken a different path than many others,” Mr Underwood notes.

“Australia’s fight against the virus hasn’t been perfect, but it has still been much more successful than in most other nations around the world.”

12.41pm: Pressure on RBA to lift stimulus: Capital Eco

While a record-breaking 7pc quarterly drop in GDP wasn’t much larger than the RBA had anticipated, it will keep pressure on the Bank to announce more stimulus, according to Capital Economics senior economist Marcel Thieliant.

Key surprises were a 12.1pc quarterly fall in consumption after a much deeper than expected 17.6pc slump in services spending.

Mr Thieliant notes that with household disposable income rising by 2.2pc Q/Q in the wake of a record jump in social assistance benefits, the saving rate surged to 19.8pc, the highest it has been in almost half a century.

A 4.9pc Q/Q drop in total investment was also much larger than expected, with dwelling construction slumping and a further rise in mining investment not enough to prevent a drop in non-dwelling construction.

Looking ahead, he notes output will have fallen further in Victoria as restrictions on activity were tightened further in the wake of its second wave, but activity elsewhere will have rebounded.

“We suspect that the rebound outside Victoria will be sufficient to generate a small 0.5pc Q/Q rise in the September quarter,” Mr Thieliant says.

Read more: Cold bucket of reality: why a recession matters

12.30pm: Household incomes defy recession: Westpac

A massive household income boost that significantly bolstered household savings was a key feature of the June quarter national accounts data, according to Westpac.

“Household incomes rose despite the recession and the collapse in the labour market,” notes Westpac senior economist Andrew Hanlan. “This is because of the wage subsidy scheme and other income transfers from the government sector.”

Wage incomes fell just 2.5pc and gross disposable income surged 2.2pc, or up by a “massive” 2.9pc in real terms.

The household savings rate spiked to 19.8pc from 6pc, “providing households with a considerable buffer to draw upon in coming quarters”, Mr Hanlan says.

Read more: Economy contracts 7pc in June quarter

11.59am: NSW, Victoria a drag on the nation

Detail on state final demand shows the biggest drag on the national economy is from NSW and Victoria.

Total final consumption in NSW fell by 9.4 per cent as household consumption fell 13.3pc with decreased expenditure on hotels, cafes and restaurants, offset somewhat by a 2.9pc increase in government consumption.

In Victoria, household consumption dropped 13.7pc driven by 64.1pc fall in hotels, cafes and restaurants and 88.4pc fall in transport services.

Across the rest of the country, final demand fell 7.4pc in Tasmania, while WA fell 6pc, South Australia fell 5.8pc and Queensland fell 5.9pc.

Read more: From recession reality to ‘what’s next’?

11.41am: Household savings ratio soars

Aside from the headline data in the GDP release, the details show a heavy hit to the economy from the coronavirus lockdowns:

- The household saving-to-income ratio rose to 19.8pc from 6pc, driven by the fall in consumption expenditure

- Hours worked fell a record 9.8pc, outpacing the record 2.5pc decline in wages

- Social benefits in cash rose a record 41.6pc, due to an increased number of recipients and additional support payments

Read more: Largest drop on record: economy contracts 7pc

While the economy tanked 7%, household income actually ROSE 2.2% during the second quarter, suggesting we might have gone a little overboard on stimulus.

— Adam Creighton (@Adam_Creighton) September 2, 2020

And unincorporated businesses enjoyed a 22% earnings bump! pic.twitter.com/CzwX0coqRr

11.30am: GDP drop larger than tipped

Australia has officially entered a recession, as June quarter GDP fell by 7 per cent.

That’s larger than the 6pc fall tipped by consensus and follows a 0.3pc fall in the March quarter.

“This is, by a wide margin, the largest fall in quarterly GDP since records began in 1959,” the ABS said.

AUDUSD is falling on the news, last down 0.36pc to US73.44c, a 16 basis point drop since before the data was released.

11.12am: What to watch in GDP

Australia’s 2Q national accounts are due for release at 11.30am.

GDP is expected to fall 6pc Q/Q and 5.1pc Y/Y according to Bloomberg’s consensus estimates.

A 6pc Q/Q fall would be the biggest since WWII and a fall would also start a recession, defined by two consecutive negative quarters.

Read more: Brace for severe contraction: Cormann

11.09am: ASX quick to regain 50-day average

Tuesday’s 2.5pc intraday fall in the S&P/ASX could be the pause that refreshes the market.

The index has surged as much as 1.7pc to 6046.8 today, suggesting investors saw relative value after the index hit a 4-week low of 5908.9.

Like the late July/early August dip, the index has not spent much time below its 50-day moving average, regaining that line today at 6031.

If it closes above that line today, the ASX200 could soon be back up trying for a sustained break above its 200-day moving average at 6129.

Obviously the large, persistent selling of recent days has been completed or paused, although with the Australian dollar starting to appear on the RBA’s radar, offshore selling remains a risk.

Certainly Wall Street is back on track. Notwithstanding persistently-high volatility last night, the US market showed the risks of getting out too early in a bubble.

11.01am: Results showed ‘surprising resilience’: UBS

Australia’s recently concluded August reporting season was better than feared according to UBS quantitative analyst Pieter Stoltz, who notes a number of stocks showed “surprising resilience to COVID-19”.

Consumer Staples, Building Materials, Discretionary Retail, Gaming, General Industrials and Insurance were among the more resilience in terms of revenues and /or margins, while market reaction to results – particularly guidance beats – was very positive.

The median stock was up 0.7pc after reporting, the best reaction to results in at least five years.

Still, the market consensus estimate for FY21 EPS growth was revised down from 9pc to 8.3pc over the reporting period, with weakness led by Industrials ex-Financials and Financials, while Resources saw big upgrades. Industrials ex-Financials are now only seen delivering 2.3pc EPS growth, down from 8.3pc before reporting season.

Also helping the overall assessment were solid cash flows, dividends and revenues, albeit cost control was mixed, with a number of companies reporting higher than expected COVID-19 costs.

“The key upside surprise this reporting season has been to cash flows, with a net 20pc of stocks beating,” Mr stoltz says. “We think this reflects a combination of falling inventories and rapid rise in bank deposits.”

Strong cash flows also saw dividend beats, with FY20 DPS revised up 3.3pc over the reporting season, albeit reflecting overly pessimistic DPS forecasts rather than rising dividends.

Meanwhile, the beat-to-miss ratio of 1.3 was the best since the Aug-18 reporting season.

10.38am: More BNPL competition, regulation to come

UBS has highlighted the potential for further competition and more regulation in the buy now, pay later sector, after the launch of PayPal’s ‘Pay in 4’ service this week.

The broker has been one of very few bears on the stock, rating it at a Sell and noting it was grossly overvalued.

In its latest note, analyst Tom Beadle writes that the entry of PayPal to the sector was further evidence of competition, especially from well-resourced incumbents.

“This is consistent with our view that the faster BNPL grows and succeeds it will inevitably attract new competition and/or regulation, that will either reduce the economics currently enjoyed by participants, or limits their long term growth potential,” Mr Beadle say, adding that a ‘Pay in 4’ launch in Europe was likely not far off.

“With the proliferation of BNPL operators we also think possible regulatory risks increase. For example, as BNPL is not currently considered credit and credit checks are not made, consumers can sign up to multiple BNPL services.”

He rates Afterpay and Zip both at Sell, with targets of $28.25 and $5.70 respectively.

APT last traded down 7.7pc to $77.6 after hitting $73.68 while Zip loses 13.8pc to $6.89.

Read more: Analysts Afterpay target prices vary wildly

BNPL stocks continue to fall on news that PayPal will look to offer pay later services in the US.

— CommSec (@CommSec) September 2, 2020

Openpay $OPY -6%

Afterpay $APT -7%

Splitit $SPT -9%

Sezzle $SZL -12%

ZipCo $Z1P -13%#ausbiz #fintech

10.21am: IOOF drops 20pc after discounted raise

IOOF shares are dropping 20 per cent on their return to trade, after the completion of its institutional raise to buy MLC.

The wealth manager this morning said it had raised $734m in an institutional placement and entitlement offer with new shares offered at $3.50 apiece.

Under the entitlement offer, shareholders could subscribe for 2.09 shares for every 1 held, attracting more than 92pc of eligible holders and a total of $282m, while the placement attracted “significant demand from new and existing institutional investors”, and raised $452m.

“We are also pleased that investors recognise that the strategic and value propositions are compelling. However, as CEO and as a company, we understand the obligations that attach to this,” chief Renato Mota said.

“We will be entirely focused on delivering the promised better outcomes for all our stakeholders; our clients, members, advisers, the community and our shareholders.”

IFL shares last traded down 20.3pc to $3.69.

Read more: MLC buy too big, too risky for IOOF: BP

10.11am: Shares rebound by 1pc

Shares are rebounding strongly from yesterday’s heavy losses, adding 1 per cent early with tech the only sector in the red.

At the open, the ASX200 is higher by 61 points or 1.02 per cent to 6014.1.

The key driver is the materials sector as BHP and Fortescue jump 3.8pc and Rio Tinto rises 2.8pc.

But all sectors bar Tech are up after the local bourse was hit by what looked like large offshore selling yesterday and as Afterpay dives more than 8pc after a bearish note from UBS.

Wall Street’s overnight surge has put the local market back on track and S&P 500 futures are up a further 0.3pc this morning.

Eli Greenblat 10.03am: Future Fund return falls

The nation’s sovereign wealth fund, the Future Fund, has felt the pain of collapsing share prices and asset values sparked by the COVID-19 pandemic with its return for fiscal 2020 falling 0.9 per cent.

However, the slip hasn‘t dented its long-term performance with the fund easily beating its benchmarked target return.

The Future Fund revealed on Wednesday that it has rebalanced its portfolio to a neutral stance in the face of huge volatility and uncertainty in the global economy and also reduced its risk appetite in its private equity portfolio.

Releasing its results for the 2020 financial year, the Future Fund said although its returns had fallen just under 1 per cent for the year, its 10-year return of 9.2 per cent per annum exceeds its benchmark target of 6.1 per cent per year.

Read more: Future Fund’s negative return after COVID-19 hit

9.41am: Deutsche tips RBA cut to 0.1pc

Deutsche Bank Australia chief economist Phil O’Donaghoe now predicts a further cut in the RBA’s cash rate and 3-year bond rate targets to 0.1pc by February from 0.25pc now, and he doesn’t rule out such a move occurring before year end.

Mr O’Donaghoe says the extension of the RBA’s term funding facility after its policy meeting on Tuesday was “incrementally stimulatory, but increasingly at risk of not being enough”.

“Our issue with current policy settings relates to weak demand for credit,” he says.

“While the RBA Governor thinks much of this weak demand is ‘price insensitive’ – driven by pandemic fears rather than interest rates – we are not as convinced. Even if it is price insensitive, the longer it persists, the larger the negative output gap that policy will ultimately need to fill.”

In his view, an expanded QE program focused on the five to ten year part of the Australian government bond curve “looks increasingly possible” though he hasn’t included it in his base case as yet, and a negative cash rate also “looks less improbable”.

“The RBA’s self-imposed hurdle to a negative policy rate is high, but it is not insurmountable,” he says. “Again, however, that remains outside of our baseline for now.”

Read more: Reserve Bank boosts bank funding

9.35am: What’s on the broker radar?

- Blackmores raised to Buy – Morningstar

- CSL raised to Hold – Morningstar

- De Grey Mining rated new Speculative Buy – Canaccord

- Sims raised to Buy – Morningstar

- Telix rated new Buy – Jefferies

- Zip cut to Sell – Citi

9.28am: ASX to rebound on offshore gains

Australia’s share market is expected to rise slightly after strong gains on Wall Street.

Overnight futures relative to fair value suggest the S&P/ASX 200 will open up 0.2pc at 5965.3.

If Tuesday’s large selling is complete, the index may soon regain its 50-day moving average at 6030 as Wall Street continues to surge but the high Australian dollar could continue to draw offshore selling after it reached a 2-year high of 0.7414 on Wednesday.

AMP shares should jump after the company announced a portfolio review in response to “an increase in interest” in its assets.

While the prospect of a close US election may yet cool US share market enthusiasm, the bubble continued to expand on better economic data and hints of more monetary stimulus.

Overnight the S&P 500 rose 0.8pc to a record high close of 3526.65 after ISM manufacturing data beat estimates and the Fed’s Brainard noted that “in coming months, it will be important for monetary policy to pivot from stabilisation to accommodation.”

S&P 500 gains broadened to eight sectors, led by Materials, with BHP ADR’s equivalent close at $38.52 a 2.7pc premium to BHP’s Sydney close. The Energy sector fell despite a 0.6pc rise in WTI crude amid shrinking stockpiles.

Spot iron ore rose 0.9pc to $US125.45, while the LME index rose 0.7pc led by nickel and zinc.

The Nasdaq surged 1.8pc to a record high close of 11939.67, Apple up 4pc on strong 5G phone orders while Tesla dived 4.7pc after flagging a $5bn capital raising, Amazon rose 1.4pc and Alphabet gained 1.6pc.

Focus turns to domestic 2Q GDP data at 11.30am, with GDP expected to set a post-war record fall of 6pc Q/Q and 5.1pc Y/Y.

Amcor, Iress, Medibank and Treasury Wine trade ex-dividend.

9.11am: MLC buy too big, too risky for IOOF

Bell Potter has issued a warning on IOOF’s proposed $1.5bn acquisition of MLC, saying the transaction was “too risky, too big and too complicated for IOOF to embark on in its current state”.

The deal, unveiled to the market on Monday, has been touted as a natural fit for IOOF, said to create Australia’s leading advice-led wealth manager.

But analyst Lafitani Sotiriou isn’t convinced, he notes that under his “real world scenario” the deal is dilutive, versus IOOF’s guided headline rate of 20pc EPS accretion, and its balance sheet position is “a real concern”.

“We estimate a further $200m debt is required at deal completion to meet these expenses (including remediation, integration and one-off compliance costs), bringing the debt position to around $1.1 billion,” he notes.

Bell Potter downgrades its earnings per share forecasts for IOOF, taking its price target to $3.40 from $4.20 and keeps its rating at Sell.

Read more: Mota’s challenge is to integrate MLC into IOOF successfully

Samantha Bailey 9.06am: Nufarm flags $215m impairment

Agricultural chemical company Nufarm has flagged $215 million in impairment charges and a lower full-year earnings result to be announced later this month.

In an update to the ASX this morning, Nufarm said it expects to deliver underlying earnings before interest, tax, depreciation and amortisation of between $290m and $300m, compared to $420m the prior year.

The company blamed reduced earnings in Europe and the divestment of its South American business for the impairment, saying it managed to deliver positive momentum in the second half.

“Drought breaking rains on the east coast of Australia in late January and good follow up rainfall has provided welcome relief for farmers and generated strong demand for crop protection products,” chief executive Greg Hunt said.

8.53am: Thodey tops up Xero stake

Xero chairman David Thodey has splurged more than $400,000 to lift his stake in the company, as its shares rise to record highs.

In a filing to the market this morning, Xero said Mr Thodey, also the chair of the CSIRO and Tyro, had bought 4,000 shares in the group at an average price of $101.34 through his family trust.

That is just shy of the stock’s record high of $102.87 reached last week.

8.34am: Mnuchin urges passage of stimulus

US Treasury Secretary Steven Mnuchin urged Congress to appropriate more money to combat the effects of the coronavirus pandemic, saying at a hearing that he was ready to sit down with Democratic leaders to resume negotiations at any time.

For more than a month since key provisions of the landmark Cares Act expired, Democrats and Republicans have been at loggerheads over the size and content of another relief package. House Democrats in May proposed an additional $US3.5 trillion of relief, while Senate Republicans rolled out a $US1 trillion bill in July. Without a new agreement, jobless workers have gone without a $US600 federal supplement to weekly unemployment insurance since July 31, and a federal eviction moratorium expired on July 25, leaving millions of tenants at risk of losing their homes.

Appearing before a congressional panel, Mr Mnuchin suggested the gap between the two sides may be narrowing and mentioned a new, higher number for the administration’s proposed ceiling for a follow-on bill: $US1.5 trillion. The secretary also indicated that the Trump administration has softened its opposition to a Democratic proposal to apportion more money for state and local governments.

“Whether it’s one trillion or one-and-a-half trillion, again, let’s not get caught on a number,” Mr. Mnuchin said. He added that Democrats and Republicans agree that more money is needed for grants for small businesses, enhanced unemployment insurance and direct payments to households.

Dow Jones

7.46am: AMP announces portfolio review

Embattled AMP says it will conduct a portfolio review of the group’s businesses to “assess all options” for potential asset sales.

It says the move comes after an increase in interest and inquiries about its assets and businesses, but the review may not end up with any deals.

“The board has … decided to undertake a portfolio review to assess all opportunities in a considered and holistic manner, evaluating the relative merits as well as potential separation costs and dis-synergies, with a focus on maximising shareholder value,” AMP said in a statement.

“The review may conclude that AMP’s current mix of assets and businesses delivers the best value for shareholders and may not result in a recommendation to pursue any specific transaction.”

AMP said it remained committed to its transformation strategy and was confident this would deliver long-term value for shareholders. AMP recently completed the sale of AMP Life.

New AMP chair Debra Hazelton said: “The board believes that AMP has high-quality businesses with significant strategic value. The board and management firmly believe in our existing strategy, including a repivot to private markets in AMP Capital and are confident that this will deliver long-term value for shareholders.

“However, we have taken a decisive step to undertake a portfolio review to ensure we appropriately assess all options to maximise shareholder value in a considered and disciplined manner.”

Credit Suisse, Goldman Sachs and King & Wood Mallesons have been appointed as AMP’s advisers to manage the review.

Read more: AMP considers asset sales as part of review

7.40am: Zoom shares soar

Zoom Video Communications’ stock soared a day after the video-chat company that has gained popularity during the pandemic reported another big jump in users and raised its financial forecast.

Shares of the company ended up 41 per cent at $US457.69, giving the company a market value of about $US131 billion. Shares rose as much as 47 per cent earlier in the trading session. Zoom completed a public offering in April of last year, pricing shares at $US36 each.

Yesterday, the California company beat expectations for its July quarter, reporting a profit of $US185.7 million on sales that had increased about fivefold from the year earlier to $US663.5 million.

The company’s video-chat application, where users join so-called meeting rooms, has emerged as a critical tool for companies with workforces scattered out of closed offices, individuals reaching friends and families during COVID-19 quarantines and for organisations like schools and medical institutions.

Dow Jones

7.32am: Restaurant Brands seals US buy

Restaurant Brands NZ says it’s got consent from KFC and Taco Bell for the purchase of 58 KFC stores and 11 multibrand KFC and Taco Bell stores in the US from an existing franchisee.

Despite COVID-19 disruptions, the acquired business has maintained a 12 month trailing turnover of $US95 million and store EBITDA of in excess of $US12 million, it said

CEO Russel Creedy said: “We are pleased with the strong trading performance of the acquired stores during the COVID-19 pandemic in California and are excited about the future prospects in the US market.”

Restaurant Brands paid $US80.7m, including spending on store refurbishments, with the sum funded from existing debt facilities.

6.20am: ASX to open higher ahead of GDP

Australian stocks are tipped to open higher after gains on Wall Street, and ahead of second quarter GDP figures expected to confirm Australia is in recession.

Around 6am (AEST) the SPI futures index was up 28 points, or 0.5 per cent.

On Tuesday, Australian stocks dived to their lowest levels in a month, but finished a more moderate 1.8pc lower.

The Australian dollar was lower at US73.67.

Brent oil was up 0.7 per cent to $US45.58 a barrel. Spot iron ore was up 0.9 per cent to $US125.45 a tonne.

The June quarter national accounts are expected to reveal two consecutive quarters of negative growth, the accepted definition of a recession.

“The June national accounts will be one for the history books. The COVID‑19 pandemic and resultant moves from policymakers to shut down large parts of the Australian economy will have a massive negative impact on production in the June quarter,” said Commonwealth Bank economist Gareth Aird.

CBA is expecting an economic contraction of 5.4 per cent over the three month period. The Reserve Bank expects the June quarter GDP to be 6 per cent smaller than the same quarter last year.

6.10am: Wall St higher on factory data

US stocks rose after manufacturing data showed the economy continues to bounce back from the coronavirus shutdown.

The S&P 500 was 0.8 per cent higher, advancing further into record territory and opening September with modest gains after its best August since 1986. The Nasdaq Composite rose 1.4 per cent a day after the technology-heavy index closed at a record. The Dow Jones Industrial Average rose 0.8 per cent.

US manufacturing activity accelerated in August, growing for the third straight month and topping the expectations of economists, according to data from the Institute for Supply Management. The growth was driven by new demand and faster export orders, though the picture for hiring was mixed, a pair of surveys released Tuesday showed.

“The continuation of this recovery is being priced in already,” said Esty Dwek, head of global market strategy at Natixis Investment Managers. “As long as it keeps going, I think markets can continue advancing.”

The economic rebound has some investors preparing for a more normalised investing environment that could favour beaten-down sectors like transports.

CHART] Wall St advanced overnight - better manufacturing data helped the outlook for the US economic recovery. The Dow rose by 215 points or 0.8%. The S&P500 lifted 0.8% and the Nasdaq index rose 164 points or 1.4% - both closing at record highs. #ausbiz Bloomberg pic.twitter.com/U1266klAly

— CommSec (@CommSec) September 1, 2020

Still, technology companies helped lead the S&P 500 higher on Tuesday, with Netflix and Nvidia up 5 per cent and 3 per cent, respectively. Zoom Video Communications jumped more than 40 per cent after the video-chatting software developer raised its outlook for the year for the second time in recent months.

Data out from parts of Asia and Europe showed that factories are slowly recovering from the sharp output cuts that accompanied coronavirus lockdowns, but have continued to pare jobs in the face of an uncertain outlook.

Germany, Europe’s industrial powerhouse, recorded a stronger recovery, with the purchasing managers index rising to the highest level in almost two years. But even with a revival in previously weak export orders, manufacturers reported that they were cutting jobs.

The pan-continental Stoxx Europe 600 fell 0.3 per cent.

A gauge of China’s manufacturing activity for last month rose to its highest level in nearly a decade, supported by strong domestic and external demand and faster production activity. It marked the fourth consecutive month that the Caixin China purchasing managers index held above 50, the mark separating contraction from expansion. The Shanghai Composite Index ended the day up 0.4 per cent.

Copper for delivery in three months rose 1.9 per cent on the back of China’s manufacturing report.

Gold rose 0.2 per cent to $US1,981.70 a troy ounce. Its gains were partly due to the weaker dollar as the precious metal is priced in the greenback, according to Stephane Monier, chief investment officer at Lombard Odier.

“The price of gold is also to a large extent a sign of confidence of investors into the financial systems,” he said. “Some people are worried that central banks are printing a lot of money and want a refuge.”

Dow Jones Newswires

5.50am: Copper hits two-year high

Copper prices hit a two-year high on evidence that China’s economic recovery motored ahead in August, extending a recent rally for the industrial metal.

Three-month copper forwards on the London Metal Exchange, the benchmark in international metal markets, jumped 2.3 per cent to $US6,830 a tonne in morning trading before slipping back. That was their highest level since June 2018. Nickel, zinc, lead and other industrial metals also advanced.

Metal prices were spurred by data showing that Chinese manufacturing activity last month grew at its fastest pace in almost a decade.

The weakening dollar has given copper prices an extra boost of late by making commodities cheaper for consumers outside the U.S., bolstering demand. The WSJ Dollar Index, which tracks the U.S. currency against a basket of others, fell for a fifth consecutive month in August.

Dow Jones

5.40am: Rolls-Royce launches new Ghost

Rolls-Royce launched its eagerly-awaited new “Ghost” model, even as the luxury carmaker’s chief warned that coronavirus would impact the automotive market for several years.

The new model, complete with a 6.75-litre twin-turbo V12 engine, minimalist design, and even a branded umbrella, will cost some £222,000 ($US298,000).

Nevertheless, the lure of a new status symbol car for the super-rich would not be enough to soften the blow of the pandemic in the short-term, the group warned.

“We expect COVID-19 to remain (a difficulty) for some time, until a vaccine is available,” said Rolls-Royce Managing Director Torsten Mueller-Oetvoes in a telephone interview.

In the first half of this year, Rolls-Royce’s sales fell by 30 per cent compared with the same period in 2019, said Mueller-Oetvoes, but pointed out that last year was a “record” year.

However, he noted that Rolls-Royce had not implemented any lay-offs during the pandemic and remained “cautiously optimistic” for next year.

AFP

5.35am: US government aid ‘essential’

Government spending will be “essential” to help struggling businesses and families weather the downturn caused by the coronavirus pandemic, Federal Reserve governor Lael Brainard said.

With the White House and Congress still at an impasse over a new emergency relief package, Brainard warned that “the economy continues to face considerable uncertainty associated with the vagaries of the COVID-19 pandemic” and business shutdowns risk becoming permanent.

“Fiscal support will remain essential to sustaining many families and businesses,” she said.

AFP

5.32am: European markets end lower

Most European stock markets closed lower and London fell sharply after data showed that consumer inflation in the euro area fell in August and manufacturing activity began to soften.

In Asia earlier, stock prices had been buoyed in part by a survey of Chinese manufacturing that indicated a pick-up in activity, offering reassurance that the world’s second biggest economy is recovering from the coronavirus pandemic.

But IG analyst Chris Beauchamp said caution was warranted ahead of US elections in November.

“With the US election now some eight weeks away there will be heightened expectations of renewed volatility,” he predicted.

On Wall Street, the Dow Jones index was 0.3 per cent higher in midday trading. Signs of a pick-up in coronavirus infections around the world and a lack of movement on a new US stimulus package for the world’s top economy also appeared to be keeping many buyers at bay.

On foreign exchange markets, the euro was mixed against major currencies on news that eurozone inflation slipped into negative territory in August for the first time since May 2016.

The EU’s Eurostat data agency said the rate stood at negative 0.2 per cent. That marked a steep slowdown from a positive 0.4 per cent in July and was even further from the European Central Bank’s official target of close to but just under 2.0 per cent.

The slowdown into deflationary territory comes despite historic stimulus measures by the ECB to push prices upwards and breathe life into the European economy.

Meanwhile, a key barometer of economic activity, the PMI purchasing managers’ index, suggested that eurozone industrial growth began to run out of steam in August, economists at Oxford Economics noted.

The PMI index for Germany was revised sharply downwards and the index for France remained in contraction territory, Daniela Ordonez and Nicola Nobile said in an analyst comment.

London closed down 1.7 per cent, Frankfurt added 0.2 per cent and Paris fell 0.2 per cent.

AFP

5.30am: Tesla eyes up to $US5bn in new stock sales

US electric carmaker Tesla said Tuesday it plans to sell up to $US5 billion worth of new shares, following weeks of market euphoria around its stock.

The announcement that up to $US5 billion worth of new stakes in the company would be on offer came in a filing with the US market regulator, the SEC.

The Californian manufacturer had already announced in August that it would divide its stock by five — leaving investors with the same value of holdings spread across five times as many shares.

That change took effect after markets closed on August 28.

Tesla’s share price has been on a months-long tear, overtaking the market capitalisation of the world’s biggest carmakers.

On Monday alone, the stock gained 12.6 per cent in New York trades.

AFP

5.25am: Walmart challenge to Amazon

Walmart said it will soon launch a long-discussed membership program to provide free delivery and compete directly with Amazon’s popular “Prime” service.

The world’s biggest retailer will offer Walmart+ starting September 15, charging $US98 annually or $US12.95 a month to provide free delivery as soon as the same day along with discounts on fuel and other features.

“Life feels more complicated than ever. Walmart+ is designed to make it easier — giving customers an option not to have to sacrifice on cost or convenience,” said Janey Whiteside, chief customer officer at Walmart.

Walmart+ replaces the retail giant’s “Delivery Unlimited” subscription service that offered home delivery of more than 160,000 items.

The new Walmart venture will also provide discounts of up to five cents a gallon at Walmart gasoline stations and a “scan and go” feature that lets consumers pay for items by scanning them with a smartphone application.

AFP

5.22am: Brazil economy shrinks record 9.7pc

Brazil’s economy, the biggest in Latin America, contracted by a record 9.7 per cent in the second quarter of 2020, plunging into recession as coronavirus lockdowns hit home, the official statistics agency said.

Brazil has been hit hard by the pandemic, with the second-highest number of infections and deaths worldwide after the United States, and stay-at-home measures to contain the virus have taken a heavy toll.

“GDP is now at the same level as late 2009, at the height of the global financial crisis,” the Brazilian Institute of Geography and Statistics (IBGE) said in a statement.

The contraction was worse than the 9.2 per cent average forecast by 49 economists polled by business daily Valor.

However, it was better than the 11.1 per cent drop economists were predicting in May.

AFP

5.20am: Germany sees strong economic rebound

Germany is in a V-shaped economic recovery and should avoid a new phase of lockdowns, the economy minister said, despite a resurgence of coronavirus cases.

German GDP is expected to fall 5.8 per cent in 2020, a narrower recession than the 6.3 per cent drop projected earlier, Peter Altmaier said, signalling that the country is emerging from the worst of the crisis.

Altmaier said Germany “can and will” avoid lockdowns like Germans lived through in March and April.

“Rising infection rates will be countered by targeted and regionally limited measures, so that the economic recovery can continue to develop gradually in the coming months,” he said.

AFP

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout