ASX down 1.8pc as RBA extends term funding facility

Afterpay and QBE led the ASX to losses of 1.8pc at the close, while economists noted a dovish shift from the RBA at its latest meeting.

- Closest thing to more easing: CBA

- Regan exit may hurt QBE sentiment

- Consumer confidence takes fresh hit

- PayPal entry jolts BNPL sector

That’s all from the Trading Day blog for Tuesday, September 1. Australian stocks dived to their lowest levels in a month, but finished a more moderate 1.8pc lower. QBE is took a 6pc hit after the surprise exit of its chief, while Ampol pledged to defend a lawsuit from Chevron over their Caltex licence.

Locally, the Reserve Bank board kept rates steady, but increased and extended its term funding facility, in what many describe as a dovish shift.

Lisa Allen 8.02pm: Aussies holidaying at home

Forced to holiday in their home states, residents of Queensland, NSW and Western Australia are making the most of it.

Travel agencies are reporting marginal domestic bookings, including for Queensland’s Hayman Island, which reopened on Tuesday. The 166-suite Whitsunday resort, owned by Mulpha Australia and managed by InterContinental Hotels, underwent a $135m renovation before its pandemic-driven closure this year.

“We have had very strong interest in people booking Hayman Island and we are getting a lot of Queenslanders booking, which account for 25 per cent of the domestic mix,” Mulpha Australia chief executive Greg Shaw said.

“But traditionally 75 per cent of our market comes from southern states and clearly the resort will be impacted until we see open travel between borders.”

Helloworld chief executive Andrew Burnes, who delivered the travel agency’s full-year financial results earlier this week, said his agency network was selling intrastate travel to residents of NSW, Western Australia and Queensland. He said air routes such as Brisbane to Cairns and Perth to Broome were the strongest routes in Australia at present.

Like other senior travel executives, Mr Burnes called for an end to the uncertainties around the reopening of state and international borders, saying it was difficult to provide “meaningful guidance” for the Helloworld network until that occurred.

“Clearly the nation needs a cohesive COVID-19 recovery strategy which is properly thought out and well articulated,” he told The Australian on Tuesday night.

7.36pm: China suspends CBH barley imports

Bloomberg is reporting that China has suspended barley imports from Australia’s CBH Grain as harmful weeds were found in the product, according to a statement from Chinese customs.

China has notified Australia of the suspension, the statement says.

4.29pm: RBA willing to ease further: ANZ

The RBA’s boost to the term funding facility (TFF) is a major development and announced sooner than expected, notes ANZ.

Head of Australian economics David Plank notes that the decision reduces the need for banks to go to wholesale market for funding, and will add to the downward pressure on credit spreads.

He adds that the move signals willingness for further easing:

“At the very least, we expect the RBA to eventually add ‘pure’ QE to its current policy of yield curve control aimed at the 3y bond.

“It is possible that the additional steps could also include a ‘micro’ cut in the cash rate to 0.1pc.

“However, with October’s Federal Budget likely to contain considerable additional stimulus and state budgets also expected to add spending at this stage we think it likely that the RBA will hold back on further steps until 2021.”

Bridget Carter 4.19pm: Quadrant prepares to sell Amart

DataRoom | Quadrant Private Equity is believed to be preparing to fire the starting gun on a sales process for its Amart Furniture business, hiring advisory firm Jefferies to sell the asset.

More to come

4.12pm: Shares wind back August gains

The local market has wiped almost all of the previous month’s gains in just one session, with a drop of more than 107 points.

Still, Tuesday’s close at 5953.4, down 1.77 per cent, was an improvement on its intraday losses as much as 2.5pc.

Afterpay was a key drag as it fell 8 per cent, while CSL dropped 1.5pc, and the major banks reversed by between 2.2pc and 3pc.

3.54pm: Closest thing to more easing: CBA

Economists are fixated on one sentence from the RBA’s latest statement, with CBA’s Gareth Aird suggesting it is the closest we’ve been to further easing since the emergency mid-March meeting:

“The Board will maintain highly accommodative settings as long as is required and continues to consider how further monetary measures could support the recovery.”

Mr Aird concedes that more easing is not imminent, but that “it does suggest a slight shift in the Governor’s thinking”.

He adds that any further easing would likely take the form of more aggressive bond buying, which would inject more liquidity into the system and could exert some mild downward pressure on the dollar.

Ahead of tomorrow’s GDP print, he revises his forecasts to a 5.4pc contraction in real GDP.

Read more: RBA doubles banks’ lifeline

3.37pm: RBA more dovish than expected: Westpac

While the Reserve Bank held rates steady at today’s meeting, its extension and increase of the term funding facility, along with some commentary, was more dovish than expected, according to Westpac.

Head of financial market strategy Robert Rennie notes that the $57bn increase in the TFF was a surprise.

“ … Plus the shift in the last paragraph to note that the Board “continues to consider how further monetary measures could support the recovery” highlights this is more dovish than we expected,” he writes.

The board’s comments on the Aussie dollar were the first mention since March too, though he notes that a push up to US75c through September still looks likely and “beyond that, we see heightened risks of a correction as markets start pricing in US election risks”.

Read more: RBA doubles banks’ lifeline

3.25pm: Qantas confirms $500m bond issue

Qantas has confirmed a 10-year, $500m unsecured bond issue to pay down debt, with a coupon significantly lower than previous issues.

Proceeds will be used to strengthen short-term liquidity, and then used to pay $400m in bonds due to expire in June 2021.

Qantas said the coupon for the new bond was oversubscribed at 5.25pc, “significantly lower than the 7.5pc funding it replaces”.

“Qantas is one of few airlines with continued access to long term, unsecured bond markets,” the airline said in a statement.

“Access to this and other funding sources in recent months – including secured debt and equity markets – during the COVID crisis reflects the national carrier’s strong overall position, the importance of aviation to its home market of Australia and its clear recovery plan.”

Bridget Carter 3.21pm: 360 Capital circles Peet

DataRoom | The Tony Pitt-backed 360 Capital Group is understood to have been in the market on Monday night in an effort to amass more stock in the residential developer Peet.

It is believed that the acquisitive 360 was trying to amass enough stock to secure a stake of up to 10 per cent in the company through investment bank UBS, according to fund manager sources.

More to come

Bridget Carter 3.14pm: Moelis tapped for Bluewaters recapitalisation

DataRoom | New lenders to the Bluewaters Power Station are understood to have tapped advisory firm Moelis as well as KordaMentha to assist with a recapitalisation of the troubled coal-fired asset.

More to come

3.05pm: QBE strategy uncertain as CEO exits: S&P

The exit of QBE chief Pat Regan from the top job has introduced strategy uncertainty at the insurer, especially after the exit of other senior execs, notes ratings agency S&P.

Mr Regan’s departure “could harm strategic continuity and raise uncertainty about culture and governance”, S&P said.

“Recently taking the role as group chair, Mike Wilkins has overseen substantial management change and today’s decisive action demonstrates governance standards are high, and important to QBE,” it said.

“However, uncertainty remains, in our view, as to the impact of management changes on the group’s broader strategy and its ability to maintain momentum on strategic objectives.”

QBE last traded down 5.8pc to $9.99.

Read more: QBE CEO exits after complaint, probe

3.00pm: RBA notes two-year high for $A

The RBA board has made mention of the Aussie dollar, but stopped short of passing any judgment on its current highs.

In the past several months the RBA has remained quiet on the dollar, with governor Philip Lowe saying only that he would like it to be lower.

In a brief mention in today’s statement, the board noted that the US dollar had “depreciated against most currencies over recent months”.

“Given this and higher commodity prices, the Australian dollar has appreciated, to be around its highest level in nearly two years.”

2.30pm: Rates steady, funding facility upped

The RBA has held rates steady at its September meeting, as it increases the size of the term funding facility and makes it available for longer.

Under the expanded TFF, banks will have access to additional funding, equivalent to 2pc of their outstanding credit, at a fixed rate of 25 basis points for three years, taking the total amount available to around $200bn.

The bank noted that to date, $52bn has been drawn under the TFF, and further drawings were expected “over coming weeks”.

“This will help keep interest rates low for borrowers and support the provision of credit by providing ADIs greater confidence about continued access to low-cost funding,” the board said.

Read more: RBA on hold as GDP looms

2.05pm: Afterpay down most in 6 months

Afterpay is having its worst day in almost six months.

Shares are down 9.2pc at $83.05 after Citi highlighted US competition from PayPal.

A fall of more than 7.86pc today would be the worst since a 22pc drop on March 9.

Bell Potter’s Richard Coppleson highlights the fact that buy-now-pay-later and other Aussie tech stocks now have heavy retail shareholdings which makes them vulnerable to sharp pullbacks.

But Afterpay and Flexigroup are dominated by institutional investors and “thus less prone to a potential retail panic stampede” in his view.

1.56pm: iSignthis adds $200m to ASX damages claim

iSignthis has ratcheted up its dispute with the market regulator, near doubling its claim against the ASX for damages related to its extended market suspension.

After iSignthis lodged an initial damages claim for $264m two weeks ago, the group said today it was increasing its claim to $464.7m, with “further and better particulars of the damages”.

The latest damages relate to the bourse’s decision to suspend, and keep suspended, the group’s shares, on top of the earlier claim alleging misleading or deceptive conduct.

Chief John Karantzis mainted the case was “a high stakes and material case for the ASX”, adding that “the impact goes beyond monetary damages and challenges ASX’s conduct and suitability to operate a market”.

Read more: iSignthis suing ASX for $264m

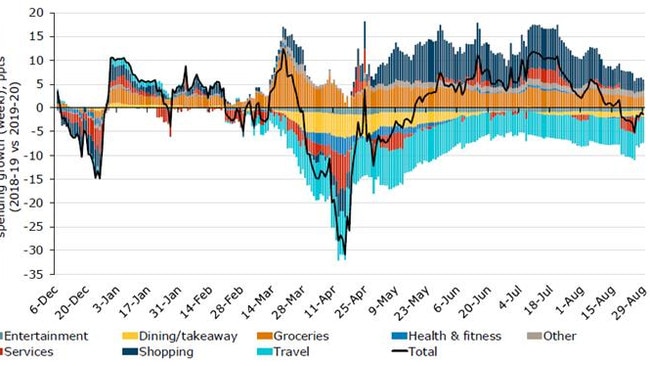

1.38pm: Online retail boom fading: ANZ

National spending growth has stalled as the online retail boom fades and consumers grapple with the potential for longer lasting lockdowns, according to the latest data from ANZ.

The bank’s survey of observed weekly spending shows growth turned negative last week for the first time since mid-May, driven by a 27pc drop in spending in Victoria and creeping across the border to deliver a dip of 0.5pc in NSW.

Economists Adelaide Timbrell and David Plank note that the shift from services to retail has “defined the pandemic’s impact on consumption”, but the upswing is fading.

Retail spending grew 8pc year-on-year for the week to August 29, the weakest since the end of April.

1.01pm: Afterpay leads 2pc share drop

The local market is down by 2pc in choppy trade at lunch, albeit still of its daily lows, as banks and tech stocks pull the market lower.

At 1pm, the ASX200 is off by 118 points or 1.95 per cent to 5942.5.

Afterpay is a key drag as it trades down 7.7pc on a warning from Citi after PayPay launched its answer to instalment payments. Afterpay looks to be filling a breakaway gap above the August 24 at $83.00.

BNPL rivals such as Zip and Splitit are similarly feeling the pain, with declines of 10.2pc and 4.6pc respectively.

Major banks are down between 2.2pc and 3.2pc, while QBE is down by 6.3pc.

Here’s the biggest movers at 1pm:

John Stensholt 12.39pm: BNPL key in Waislitz tech fund rebound

The surging ‘buy now pay later’ stocks have helped boost the performance of billionaire Alex Waislitz’s tech-focused listed investment company in the past three months, though its 2020 financial year ended with a 99pc drop in net profit.

Thorney Technologies (TEK) posted a $200,000 net profit on Tuesday morning, compared with a $22.5m result a year earlier, though Mr Waislitz said the company’s net tangible assets have increased markedly in value since the beginning of the new financial year, up 23pc to 41.7c per share at August 31 from 33.8c at June 30.

Mr Waislitz said the results were boosted by the strong share price performance of BNPL stocks Zip Co, now TEK’s largest holding, and Afterpay, as well as biotech company Mesoblast.

The billionaire investor said 2020 “will no doubt be remembered as one of the most dramatic years in global sharemarket history,” and that TEK’s portfolio has remained resilient, recovering most of its losses experienced during the market slump in March by the end of June.

Mr Waislitz said TEK had at least five unlisted companies in its portfolio that look headed for stockmarket floats in the next 12 months, the first of which was likely Credit Clear – a technology platform to help businesses with their debt recovery processes.

TEK paid Mr Waislitz’s private Thorney investment group $1.36m in management fees for the year, up from $1,18m in 2019. Thorney waived a $126,258 performance free for the first half due to the subsequent market decline.

No dividends were paid to TEK shareholders.

Nick Evans 12.26pm: Ex-BlueScope exec pleads guilty of obstruction

Former BlueScope executive Jason Ellis has pleaded guilty to a charge of obstructing an Australian Competition and Consumer Commission investigation into alleged cartel conduct by the Australian steel producer.

Mr Ellis, son of former BHP chairman Jerry Ellis, entered a guilty plea to one charge of “inciting the obstruction of Commonwealth public officials in the performance of their functions” in a Sydney court.

The ACCC had alleged that Mr Ellis, a former BlueScope sales manager, had incited two fellow BlueScope employees to give false information to the regulator about discussions held with Australian steel importers as the competition watchdog investigated alleged cartel conduct.

The ACCC launched civil action against Mr Ellis and BlueScope over the alleged cartel behaviour in September 2019, accusing the Australian steel major of threatening overseas steelmakers with anti-dumping complaints if they did not lift steel prices into Australia, as part of a scheme to rig Australian steel prices in 2013 to protect the company’s dominant position in the local market.

BSL last down 2.4pc to $12.39.

Read more: BlueScope in anti-dumping threat, ACCC claims

12.05pm: ASX bounces alongside US futures

Australia’s share market is bouncing back strongly intraday alongside US index futures.

After dropping sharply by 2.5pc to a 4-week low of 5908.9, the S&P/ASX 200 bounced just as sharply to 5970.7.

The rebound came as S&P 500 futures turned up 0.2pc after falling 0.4pc intraday.

Caixin’s China manufacturing PMI for August came in at 53.1pc vs 52.5pc expected, the fastest pace in two and half years.

S&P/ASX 200 last down 1.5pc at 5970.

12.01pm: Aussie dollar passes US74c

The Aussie dollar is cheering the latest record current account surplus for the June quarter, surging past US74c to the highest levels in two years.

AUDUSD spiked considerably on the release, to hit US74.01c, and was last up 0.32pc to US73.99c.

The latest data from the ABS showed a $8.7bn jump in the current account surplus to $17.7bn, driven mainly by increased goods and services surplus.

Ben Wilmot 11.46am: Lendlease investment push a win, say analysts

Lendlease’s strategy refresh has won praise from analysts who say it will look more like a real estate investment trust as it undertakes more investing activities.

At the company’s update on Monday it said it would materially ramp up annual development completions to $8bn over the next five years, increase earnings from investment from 35 per cent to 45 per cent, and grow its assets to about $100bn.

The company has already contracted to sell its $350m US Telco Towers operation and is positioning for a recovery in global cities including San Francisco, London and Milan, as well as locally.

“We would have liked greater visibility on the development pipeline in terms of stage 1 built form, funding and completion time-frame to support its target $8bn of annual completions,” JPMorgan analyst Ben Brayshaw said.

“However, the update is a meaningful step forward in redefining strategic parameters and positioning for the next phase of its growth (i.e. exposure to key demographic and capital market drivers). It also increases the likelihood of Lendlease gaining EPRA NAREIT index admission.”

Morgan Stanley analysts Simon Chan and Lauren Berry noted Lendlease will also set up more partnerships, bringing in co-investors into multi-asset projects, rather than at an asset by asset level, creating more development performance fee opportunities.

They added they were awaiting the financial close of Lendlease’s engineering sale to Acciona and expected more projects to be completed, with potential for upside risk if Lendlease can secure tenants and partners earlier than expected.

LLC last traded up 1.6pc to $11.80.

Read more: Lendlease to double developments to $8bn annually

11.42am: July building approvals surge 12pc

Australia’s July building approvals surged 12pc versus a 2 per cent fall expected by economists, while the 2Q current account surplus surged to a record $17.7bn vs $13bn expected.

But net exports contributed 1 percentage point to GDP as expected, so expectations should remain for 6pc fall in 2Q GDP QoQ and a 5.2pc fall YoY when national accounts data are release Wednesday.

Read more: Building approvals back to pre-COVID levels

11.31am: Speedcast weighs revised recapitalisation plans

Chief of satellite technology developer Speedcast Pater Shaper has exited the troubled company, as it weighs two revised recapitalisation proposals from its largest creditors.

The group announced its decision to recapitalise the business through voluntary Chapter 11 proceedings back in April, and has been negotiating with key lenders Black Diamond Capital Management, a renowned activist investor, and Centerbridge Partners.

Speedcast today said Mr Shaper was leaving the group to return to the private equity firm he is affiliated with, with Joe Spytek to continue as president and chief commercial officer.

It also said it had withdrawn a related motion that was due to be heard in the US bankruptcy court for the Southern District of Texas.

Read more: Speedcast caught in funds fight

11.22am: Shares drop to four-week low

Australia’s S&P/ASX 200 share index has fallen 152 points or 2.5pc to a 4-week low of 5908.9, heading for its worst day in 4 weeks.

All sectors are now in the red, with most of the damage coming from the biggest stocks such as a 2.5pc drop in Commonwealth Bank and as much as a 3.5pc fall in ANZ and NAB.

CSL and Fortescue Metals are notable outperformers in the top 20, while Afterpay, QBE and Woodside are notable underperformers.

11.08am: Temple & Webster chief sells $24.3m stake

Temple & Webster chief and co-founder Mark Coulter has sold down a $24m stake in the group, citing tax obligations.

It comes as shares in the online furniture retailer touched fresh heights of $9.88 this morning, the stock a key beneficiary of the shift to online shopping during the coronavirus pandemic.

Mr Coulter sold 2.6 million shares at an average price of $9.09 apiece, netting $24.3m across his ArdenPoint trust and personal holdings.

He told the market the sale was prompted after hitting $1bn valuation and reaching “unicorn status”.

“With this recent achievement I have taken the opportunity to cover my tax obligations and also rebalance a portion of my investments while continuing to have the majority of my wealth tied to the Company,” Mr Coulter said in a statement.

“I am committed to a future with the business, and my next personal milestone is to take Temple & Webster from the largest online retailer to the largest overall retailer of furniture and homewares in Australia, by sales.”

He retains an interest in more than 3.7 million shares, and a further 5 million options.

TPW last traded down 2.4pc to $9.46.

Read more: Temple & Webster sales soar

Bridget Carter 10.53am: Harmoney headed for the ASX

DataRoom | More technology companies are making efforts to list before the end of this year and the latest said to be heading to the boards is understood to be the Australian and New Zealand online lender Harmoney.

It is understood that the company has plans for an initial public offering, raising about $80m to $100m.

Most expect the business to have a market value of about $250m.

Read more: Harmoney poised to join tech listings

10.42am: PayPal entry jolts BNPL sector

The entry of global payments giant PayPal into the buy now, pay later space has spooked locally listed rivals, including heavyweight Afterpay.

PayPal has announced a ‘Pay in 4’ product for users in the US to break purchases into instalments, similar to Afterpay or Zip’s Quadpay, expected to launch in the December quarter.

Citi analyst Siraj Ahmed notes that competition in the sector is heating up in the US, and while it is relatively underpenetrated, especially in comparison to Australia, “the key risk to Afterpay and Zip is PayPal’s network and its almost ubiquitous presence”.

He notes that merchant fees could come under pressure, with the potential for additional investment to be required for co-marketing and product marketing.

“While we see downside risk to both Afterpay and Z1P/Quadpay from PayPal’s entry, Afterpay could be better positioned given its larger consumer and merchant network, and its strong balance sheet gives it flexibility to step up investment,” Mr Ahmed says.

“Quadpay’s ‘Shop Anywhere’ offering is differentiated as it allows users to shop at any store (online or offline) and pay in instalments, however, we see downside risk to Quadpay’s net transaction margins given it charges users $1 per instalment payment for using ‘Shop Anywhere’.”

Still, he lifts his 12-month price target on Afterpay by 42pc to $92.50, and keeps a Neutral rating given its 28x F21e revenue ratio.

APT shares last down 6.3pc to $85.67 as Z1P trades off by 5.9pc to $8.62, and Sezzle dives 10.8pc to $9.16.

Read more: Afterpay halves losses as customer numbers double

Today’s environment has impacted consumers & businesses of all sizes. As a result, @PayPal launched "Pay in 4," a pay later solution allowing consumers to pay for purchases in four, interest-free installments while enabling businesses to drive revenue.https://t.co/SL28YSC8ea pic.twitter.com/nLbNg80vqs

— PayPal News (@PayPalNews) August 31, 2020

10.26am: QBE has chart support on dips

QBE shares dipped 6.1pc to $9.96 in early trade – its lowest in almost 4-weeks – after CEO Pat Regan was sacked for “poor conduct”.

The 50-day moving average at $9.93 may be tested further but QBE shares have been well supported on any dips below this line since May.

Investors are likely keen to buy on dips given that QBE’s recent results were better than expected and the consensus 12-share price target was subsequently revised up to $11.37. The 200-day moving average at $10.72 continues to offer resistance on the chart.

Pat Regan may have been a “steady hand” in some respects but at least interim CEO Mike Wilkins is a known quantity.

QBE last down 5.7pc at $10.00

Read more: QBE chief exits after complaint, probe

Bridget Carter 10.24am: UBS snags Adams from Credit Suisse

DataRoom | Investment bank UBS has hired Andrew Adams to lead its Insurance and Diversified Financials coverage.

Mr Adams will join the business in December after covering the sector for the last ten years at Credit Suisse.

More to come.

10.15am: Shares dive 1.8pc

Shares are diving by 1.8pc to a four-week low in early trade with losses across all sectors bar utilities.

The benchmark ASX200 is down 111 points or 1.8 per cent to 5949.1 and is back below its 50-day moving average at 6030 for the first time in two months after repeatedly shying off its 200-day moving average at 6133 in recent weeks.

QBE is taking a 5.6pc hit to $10.03 after the surprise exit of its chief Pat Regan over a conduct issue, while the major banks are down around 2.2pc to 2.6pc.

Energy, Financials and Industrials are drags as they were on the US market, with Woodside Petroleum, the major banks and Brambles down more than 2pc.

9.56am: Regan exit may hurt QBE sentiment

QBE’s outgoing CEO Pat Regan was seen by the market as a steady hand with a strong grasp of the numbers, and his exit may prompt jitters in the stock, according to JP Morgan.

“We think he was seen as a driver of ‘Brilliant Basics’ which along with the market hardening seems to have led to a sharp improvement in the attritional claims ratio of QBE in the 1H20 result,” analyst Siddharth Parameswaran says.

“His departure may hurt sentiment towards the stock at least in the short run, although some may be happy that the board is taking a firm stand on governance issues that appear to be much more visible/apparent in corporate culture than in the past.”

He also notes that there is an additional hole in QBE’s management team with Vivek Bhatia (head of Australia Pacific) having recently announced he was moving to be CEO of Link.

“The main positive for QBE in the current environment we think remains the hard market – which we think is unchanged.”

QBE last traded at $10.61.

Read more: QBE CEO exits after email probe

9.51am: Confidence takes fresh hit

ANZ’s latest survey of consumer confidence shows a 2.7pc decline, trimming the previous two consecutive gains.

The decline was broadbased, with declines across all subindices led by a 3.6pc slip in “current economic conditions” and 2.7pc drop in “future economic conditions”.

Weakness was driven by those outside of key pandemic-exposed states of Victoria and NSW, with all major cities now below the neutral level of 100.

“Encouragingly, confidence actually rose in Victoria. The continued drop in new COVID-19 cases in Melbourne may be giving hope that the severity of the lockdown can be eased as planned,” ANZ head of Australian economics David Plank says.

“There is still work to be done, however. In the meantime, confidence may be challenged by the expected confirmation this week that Australia’s economy contracted at a record rate in the second quarter.”

ANZ-Roy Morgan Australian Consumer Confidence drops after two weeks of gains. Sentiment remains well below average. #ausecon #ausretail @roymorganonline @DavidPlank12 pic.twitter.com/zbWxnZC5PM

— ANZ_Research (@ANZ_Research) August 31, 2020

9.43am: ASX headed for sharp early fall

Australia’s share market should be well supported after a potentially sharp opening fall.

Overnight futures relative to fair value imply the S&P/ASX 200 will open down 1.2pc at a 4-week low of 5987.46.

That follows a mixed night on Wall Street, with the Nasdaq up 0.7pc but the S&P 500 down 0.2pc and the DJIA down 0.8pc amid falls in Energy and Industrials.

Importantly, the VIX volatility index rose 3.45bp to a 7-week high of 26.41pc. Signs of a bottom in volatility will stymie equity buying.

Reinforcing expectations of an early fall, S&P 500 futures are down 0.3pc and QBE has sacked its CEO for misconduct. BHP ADR’s equivalent close at $37.31 suggests the resources sector heavyweight will open down 1.6pc.

The Australian dollar’s rise to a more than 2-year high of 0.7403 overnight continues to sour the mood for offshore income earners.

There are also a number of stocks including Woolworths trading ex-dividend today.

After an exceptionally strong 7pc rise in the S&P 500 last month, concern about the tight US political race may now give scope for an S&P 500 pullback, possibly to the February peak at 3400 but the Australian market should be better insulated since it didn’t rise as much in recent months and consensus price targets have been revised up since earnings season.

Building approvals and balance of payments data are due at 11.30am, followed by the RBA meeting outcome at 2.30pm, where no change is expected.

Eli Greenblat 9.41am: Woolies rewards healthy choices with BUPA

Woolworths has joined forces with health insurer BUPA to encourage shoppers to make more healthier choices when choosing food in its supermarkets, offering bonus points with its Woolworths Everyday Rewards loyalty program when they pick up fruit, vegetables and other healthy foods.

The partnership, which launched Tuesday, will give Bupa Health Insurance members access to exclusive bonus point offers when they link their Woolworths Everyday Rewards account to Bupa.

To help encourage healthier habits, Bupa customers can collect three points for every dollar spent on fresh fruit and vegetables and Macro Wholefoods Market products for the first 60 days after linking their account.

9.13am: What’s on the broker radar?

- Fleetwood cut to Hold – Moelis

- Panoramic Resources rated new Buy – Foster Stockbroking

- Temple and Webster raised to Buy – Canaccord

8.48am: Chevron suing Ampol over Caltex signage

Global oil heavyweight Chevron is taking Ampol to court alleging breaches of the trade mark licence agreement between the two relating to the use of the Caltex brand.

The proceedings allege breaches and infringements have occurred due to the use of non-compliant signage at 177 Ampol sites, together with an unspecified number of third party sites operating under sub-licence from Ampol.

The court action comes after Chevron issued a termination notice of its licence agreement, requiring Ampol to rebrand from Caltex by December 31, 2022.

“The proceedings do not affect the work out period or Ampol’s transition to the ‘Ampol’ brand during this time frame,” the Ampol board said in a statement this morning.

“With the roll out of our two pilot sites in August and further sites planned for the remainder of 2020, Ampol’s transition plans are on target.”

Ampol said it had been in discussion with Chevron “for some time in an effort to resolve Chevron’s complaints”.

“Ampol does not consider these matters to be a significant part of either party’s business in the context of its transition plans.”

ALD shares last traded at $26.02.

Read more: Caltex to switch to Ampol brand

8.20am: Regan to leave QBE after conduct breach

QBE says CEO Pat Regan will leave the insurer following an external investigation over “poor judgment” relating to workplace communications which did not meet the group’s code of conduct.

The insurer will also set up a review of its culture.

Mr Regan has been QBE CEO for three years.

QBE chairman Mike Wilkins, who will take over as executive chairman, said the board had taken decisive action in relation to the outcomes of the investigation.

“We are committed to having a respectful and inclusive environment for everyone at QBE. The board concluded that he had exercised poor judgment in this regard.

“While these are challenging circumstances the board recognises and thanks Mr Regan for his hard work and contribution to strengthening QBE. However, all employees must be held to the same standards.”

Mr Wilkins said an external international search process was underway for a new CEO, that the business’s fundamentals were strong and QBE was successfully navigating uncertainty during the pandemic.

“To build on the significant work already undertaken to develop a vibrant and inclusive culture at QBE, the board will put in place additional initiatives in the coming weeks. This will commence with a board sponsored and externally supported culture review and the creation of an additional avenue for employees to safely raise concerns and receive support that will supplement existing channels.

“We want our people to have the avenues they need to safely speak up, with the confidence that they will be heard and that all concerns raised will be treated consistently across our workforce.”

7.30am: Zoom sales surge

Zoom Video Communications again raised its full-year outlook after sales more than quadrupled in the most recent quarter, with the video-chat app continuing to enjoy strong use among people working from home and in schools using the system to facilitate remote teaching.

Zoom reported sales of $US663.5 million in the July quarter, up from $US145.8 million a year earlier, as it posted a profit of $US185.7 million. Analysts surveyed by FactSet had expected sales of $US500 million and net income of $US134 million for the three months ended July 31.

The coronavirus pandemic almost overnight turned California-based Zoom from a niche application used by companies to a tool many Americans have come to rely on to stay connected with co-workers, family and friends. Its user numbers have skyrocketed.

Zoom on Monday said the number of its most lucrative customers more than doubled from a year ago. “Organisations are shifting from addressing their immediate business continuity needs to supporting a future of working anywhere, learning anywhere and connecting anywhere,” Zoom chief executive Eric Yuan said.

The company lifted its full-year outlook for sales to a range of $US2.37 billion to $US2.39 billion, with an adjusted operating profit of between $US730 million and $US750 million. It previously raised its outlook to full-year sales to between $US1.78 billion and $US1.8 billion, with adjusted operating income of $US355 million to $US380 million.

Dow Jones

6.20am: ASX set for weak start

Australian stocks are tipped to open firmly lower after a mixed session on Wall Street.

At about 6am (AEST) the SPI futures index was down 62 points, or 1.0 per cent.

Yesterday, the local market closed down 0.22 per cent but held on to a 2.2 per cent monthly gain, its fifth consecutive lift since the pandemic-induced trough in March. At these levels, the benchmark is 33.3 per cent higher than its March low but still 15.4 per cent off its February peak.

The Australian dollar was higher at US73.73.

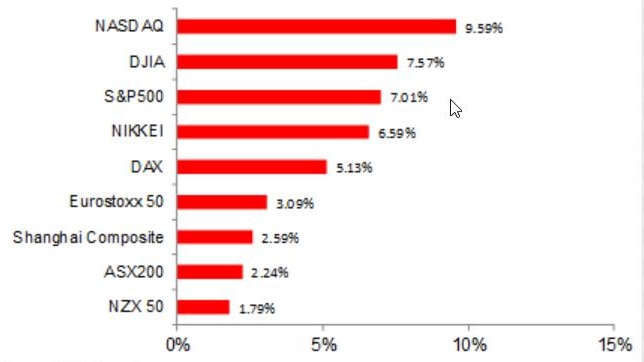

6.10am: S&P 500 ends best month since April

US stocks wavered, though the major equity benchmarks finished their best month since April.

The S&P 500 slipped 0.2 per cent but still advanced 7 per cent in August. It posted gains in all but five trading days this month. The broadbased index has rebounded in every month since April, when it climbed nearly 13 per cent, after suffering brutal losses in February and March.

In Monday’s session, the Dow Jones Industrial Average fell 0.8 per cent, while the technology-heavy Nasdaq Composite Index gained 0.7 per cent. Those indexes finished the month with gains of 7.6 per cent and 9.6 per cent, respectively. For the Dow, it was its best August since 1984.

Both the S&P 500 and the Nasdaq notched all-time highs at the end of last week as the summer-vacation season began drawing to a close. Optimism was buoyed by a shift in the approach to monetary policy from the Federal Reserve, which has signalled that it is likely to keep US borrowing costs down for an extended period.

“They’ve confirmed lower-for-longer rates as far as the eye can see,” said Richard Dunbar, head of multi asset research at Aberdeen Standard Investments. “Alongside that confirmation of cheap money and cheap discount rates, we’ve just come through a US earnings season that’s been a lot better than feared.”

A top Fed official affirmed the US central bank’s new stance on Monday. Fed Vice Chairman Richard Clarida said in a speech that the Fed shouldn’t tighten monetary policy just because of low unemployment, and cast doubt on economic models that the Fed used in the past to justify raising interest rates.

Still, some investors are bracing for a potential reversal in September. US politicians are scheduled to return to work following an August recess and could resume talks to end the gridlock on a new coronavirus stimulus package as November election campaigns go into full swing. A failure by Congress to deliver additional relief measures for American consumers and businesses could weigh on market sentiment.

“There’s uncertainty about future support,” Mr Dunbar said. “Investors are nervous generally, and keen to see support continue through low interest rates and fiscal policy. Any discussion of that being disrupted can make investors nervous.”

Apple shares climbed 4.5 per cent after the company’s 4-for-1 stock split took effect, while Tesla shares jumped 12 per cent after the electric-car maker’s 5-for-1 split. Stock splits, which have been less common in recent years, often result in a bounce in a company’s stock price.

Overseas, the pan-continental Stoxx Europe 600 fell 0.6 per cent.

Major Asian markets closed lower, with the exception of Japan. The Nikkei 225 index rose 1.1 per cent after Warren Buffett’s Berkshire Hathaway said it bought stakes in five of Japan’s top corporate names that have big investments in energy. Berkshire took stakes of slightly more than 5 per cent in Mitsubishi, Mitsui, Sumitomo, Itochu and Marubeni, sending the shares of those companies surging. The five gained between 4.2 per cent and 9.5 per cent.

In commodities, futures on Brent crude, the benchmark for global oil prices, fell 53 cents, or 1.2 per cent, to settle at $US45.28 a barrel.

Dow Jones Newswires

5.45am: Oil settles lower

Oil futures settled modestly lower on Monday, paring their gain for the month as traders continued to weigh the outlook for demand against ongoing OPEC+ production cuts.

“The uptrend has clearly lost momentum since the early stages of the Q2 rebound,” said Tyler Richey, coeditor at Sevens Report Research. However, “the path of least resistance is still higher right now as technical support has been built out” in the low $US40 a barrel level. “That key support area should hold barring another massive demand shock like we saw during the early 2020 global lockdowns,” he said.

October West Texas Intermediate oil fell 36 cents, or 0.8 per cent, to settle at $US42.61 a barrel on the New York Mercantile Exchange. For the month, front-month prices rose 5.8 per cent, according to Dow Jones Market Data.

Dow Jones

5.40am: Apple, Tesla shares rise after stock splits

Apple and Tesla shares rose to new heights after their stock splits took effect, extending their meteoric rallies this year.

Apple added 4.2 per cent to $US130.07 after the tech giant’s shares began trading following a 4-for-1 split, essentially giving investors three more shares for every one they owned. Tesla shares jumped 9.5 per cent to $US484.80 after the electric-vehicle maker’s 5-for-1 split. Both stocks are on course to close at records.

Since announcing plans for the stock split on July 30, Apple has risen 35 per cent, in the process becoming the first US public company to surpass $US2 trillion in market value and extending its gains for the year to 78 per cent. Tesla shares, meanwhile, have surged 77 per cent from the company’s August 11 stock-split announcement and have more than quintupled this year.

The companies have said the splits are intended to make their shares more accessible to a wider base of investors. Stock splits leave the market values of companies unchanged but lower the price tags of individual shares.

Dow Jones

5.35am: Women-led mutual funds beat male funds

Female-managed mutual funds have outperformed male funds this year, thanks to greater holdings in hot technology stocks, Goldman Sachs said.

“In the centenary of women’s suffrage, mutual funds with female portfolio managers are beating their male counterparts,” Goldman said in a report.

“Even after adjusting for risk, female-managed funds have outperformed their counterparts amid pandemic-related market swings.”

In a volatile year, 43 per cent of female-managed funds have outperformed the market compared with just 41 per cent of funds with no female managers, the report said. The two groups produced roughly equivalent results from 2017 through 2019.

The report compared female-managed firms, which account for only about 13 per cent of all large capitalisation US mutual funds, against all-male firms, which comprise more than three-quarters of all funds.

In addition to better results, female-managed funds “withstood many of the market swings” that affected other funds in the early part of the year before the severe stock market pullback in March due to the coronavirus pandemic, the report said.

Goldman attributed the success of the women-managed funds to larger holdings in information technology stocks, especially software, hardware and semiconductor stocks, companies that have boomed with the surge in working from home.

At the same time, the female-managed funds invested relatively smaller sums in financial stocks, which have underperformed the broader market in 2020.

AFP

5.35am: European stocks slide

Stock markets fell back as efforts by US companies to buy TikTok ran into resistance from China, and traders waited for more news on the US jobs market.

London was closed for a public holiday, Paris ended the day with a drop of 1.1 per cent and Frankfurt gave up 0.7 per cent.

In New York, the Dow Jones index had slipped by 0.8 per cent in midday trading. Earlier in the day, Asian shares had closed lower for the most part, with Hong Kong down one per cent as Shanghai dipped 0.2 per cent.

Tokyo gained more than one per cent however, shrugging off concerns over who would succeed Prime Minister Shinzo Abe after news that US investment legend Warren Buffett had bought huge holdings in top Japanese companies.

Positive service sector data in China helped offset slower manufacturing figures and offered reassurance the world’s number two economy is emerging strongly from the coronavirus crisis.

But Beijing’s resistance to letting US companies buy into the popular video app TikTok chilled the atmosphere after New York opened, Bloomberg analysts said.

Traders also appeared to be waiting for some guidance from macro-economic data, in particular US jobs figures that are due to be released later this week.

AFP

5.32am: Aeroflot earnings battered

Russia’s flagship carrier Aeroflot posted steep losses in the second quarter after coronavirus travel restrictions caused a sharp reduction in flights.

Aeroflot, a member of the SkyTeam alliance that includes Air France-KLM, is the leader in the Russian aviation sector.

The carrier said it suffered net losses of 35.8 billion roubles ($US485 million) between April and June, compared with a net profit of 6.9 billion roubles in the same period last year.

Turnover fell by 85.3 per cent year-on-year to 25.5 billion roubles while earnings before interest, taxation, depreciation and amortisation (EBITDA) fell 1.96 billion roubles into the red against 46.96 billion roubles over the same period last year.

The former Soviet carrier, which is nearly a century old, has undergone major reforms in recent years, emerging as one of the world’s most recognisable brands.

But since March, the pandemic has slashed ridership with an 88.8 per cent reduction in numbers from Q2 last year from 15.4 to 1.7 million passengers.

“In the second quarter of 2020, and above all in April and May, most of Aeroflot Group’s fleet was grounded following COVID-related restrictions,” said Andrey Chikhanchin, deputy CEO for commerce and finance.

AFP

5.30am: India growth plunges by 23.9pc

India’s economic growth plunged 23.9 per cent between April and June, the worst contraction on record since New Delhi started publishing quarterly statistics, government data showed, as the country crossed 3.6 million coronavirus cases.

The steep dip in Asia’s third-largest economy in the June-ended quarter reflected the impact of a months-long nationwide shutdown that saw most industrial and manufacturing activity grind to a halt.

AFP

5.25am: Piketty censorship by China?

French “rock star” economist Thomas Piketty said his latest book would probably not be released in China after the publisher demanded too many cuts.

His “Capital and Ideology” surveys the rapid rise of inequality around the world and includes attacks on the “plutocracy” of the Chinese regime, which he says has overtaken Western countries.

“In short, they want to remove all references to contemporary China, and in particular to inequality and transparency in China. I have refused these conditions, and indicated that I will only accept a full translation without any kind of cut,” Piketty told AFP by email.

His 2013 book “Capital in the Twenty-First Century” made him a global star in his field and sold hundreds of thousands of copies in China.

Chinese President Xi Jinping has used his research on rising inequality in the United States and Europe as proof of the superiority of the Chinese communist model.

AFP

5.20am: Gazprom posts massive slump

Russian energy giant Gazprom announced that net profit fell 25-fold in the first half of 2020 due to the economic crisis triggered by the coronavirus pandemic and low oil and gas prices.

The state-controlled group posted a net profit of 32.9 billion roubles ($US447 million) in the six months to June, compared to 836.5 billion roubles in the same period last year.

Turnover fell almost a third to 2.9 trillion roubles.

Hydrocarbon producers globally have been hit hard by a sharp fall in prices and demand as a result of restrictions imposed to combat the coronavirus, especially limits on travel.

Russian producers have been additionally hit by a falling ruble. After a net loss of 116.2 billion roubles in the first quarter, Gazprom recovered slightly in the three months to June, posting a net profit of 149.2 billion roubles.

The figures are mainly the result of lower prices and a drop in sales to Europe which is a crucial market for the gas giant, Gazprom said in a statement.

AFP

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout