ASX finishes flat on US election jitters, Crown dealt blow

Stocks finished flat amid US election jitters, while Crown casino licence hopes took a hit.

- Crown ‘not suitable’ for casino licence

- Coca-Cola Amatil takeover firms

- Ant Group’s record IPO suspended

That’s all from the Trading Day blog for Wednesday, November 4. Australian stocks closed flat amid US election jitters, after Wall Street had surged in the lead-up to counting. The Dow rose 2.1 per cent, the S&P 500 gained 1.8 per cent and the Nasdaq added 1.9 per cent. Locally, Woolworths released a first quarter update, and ABS retail sales figures weren’t as bad as expected. Crown’s casino licence hopes were dented, and Harold Mitchell was fined.

Damon Kitney 8.01pm: Crown findings could force Coonan’s hand

It has taken nearly 50 days of evidence but now we finally have it in writing: James Packer and Crown Resorts are “unsuitable” to hold a Sydney casino licence.

Adam Bell, counsel assisting the Bergin inquiry, didn’t waste time cutting to the chase on Wednesday morning as he declared that the influence of Packer and his private investment vehicle Consolidated Press Holdings had a “deleterious impact on the good governance of Crown”.

Then came Bell’s killer line: “We submit the evidence presented to this inquiry demonstrates that the licensee is not a suitable person to continue to give effect to the licence and that Crown Resorts is not a suitable person to be a close associate of the licensee.”

Bell is only making recommendations and it will be up to inquiry head Patricia Bergin to make her own findings about Crown’s suitability.

5.55pm: ANZ cuts some business and home loan rates

ANZ has matched its peers by cutting fixed home loan and business lending rates while keeping its standard variable mortgage rates steady in the wake of the RBA’s interest rate cuts yesterday.

The bank is cutting fixed home loan rates for owner occupiers by between 0.2 per cent and 0.4 per cent.

Businesses eligible for the government guarantee will be cut 0.75pc to 4.25pc on ANZ’s unsecured business loan.

ANZ said it will reduce interest rates on a range of business and home lending products to help boost business growth and jobs while supporting households and the Australian economy as it recovers from the COVID-19 pandemic.

Interest rate reductions for businesses eligible for the Government Guarantee include a 0.75%pa decrease to 4.24%pa on ANZ’s unsecured Next Step Business Loan and new fixed rates from 2.85%pa for those borrowing up to $1m for new vehicle and equipment purchases. Both will be effective from 11 November.

To support home owners, ANZ will decrease its fixed home loan rates across one to five-year terms by between 0.20%pa - 0.40%pa for owner occupier customers paying principal and interest on ANZ’s Breakfree package, providing its lowest fixed rates on record.

Perry Williams 4.54pm: AGL forced to repair wind turbines

Australia’s largest wind farm will be forced into a series of repairs after problems were discovered during the commissioning process.

Queensland’s $850m Coopers Gap facility, operated by AGL Energy, has taken one turbine out of service to be replaced and will switch out generators in 50 of the 122 other turbines to ensure the equipment is reliable.

Faults were found during the commissioning process for the 453 megawatt renewable plant - 250km north-west of Brisbane - which was developed by AGL’s Powering Australian Renewables Fund, which counts the Future Fund and QIC as co-investors.

“During the commissioning process, rigorous tests were carried out to ensure the long-term operational capability and reliability of each component. However, recent testing by GE has identified that one of their wind turbines will need to be replaced. An exclusion zone has been erected around the turbine to ensure safety,” an AGL spokeswoman said.

“GE will also replace a number of generators to ensure long term, reliable operations.”

GE in a joint venture with contractor Catcon built the wind farm and said it’s now working on a program to fix the faults without detailing the cost or timeline of repairs.

“During GE’s routine inspection and testing, it was identified that one of the turbines will need to be replaced. This turbine has been taken out of service while the Coopers Gap project continues to remain operational,” a GE spokesman said.

“GE takes reliability of our equipment seriously and is taking a proactive approach to change out generators, a component inside the nacelle, in 50 of the turbines. We have already commenced planning for a repair program conducted in phases to minimise disruption.”

The $450m Silverton wind farm in north-western NSW and $150m Broken Hill solar plant in western NSW were also developed by the $1bn PARF fund.

There had been concern a year ago that several of the PARF plants would face a sharp dive in revenue in the 2020-21 financial year as power grid congestion issues add a fresh layer of volatility to the sector.

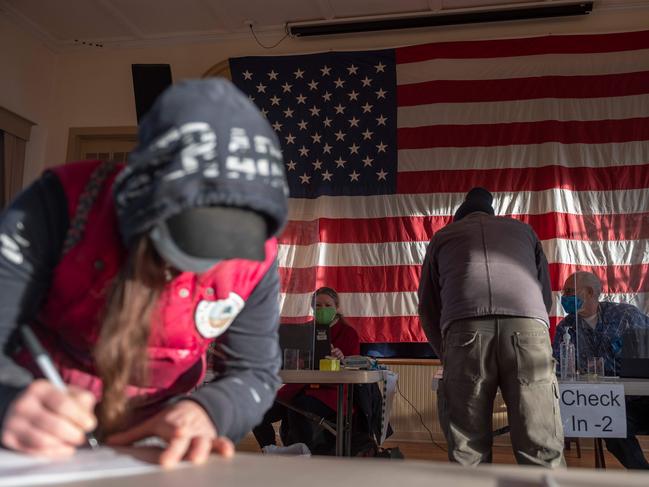

4.38pm: ASX finishes flat

Australia’s share market ended flat after a volatile and low volume trading day as US election votes were counted.

The S&P/ASX 200 finished down 4.3 points or less than 0.1pc at 6066.1.

After rising 0.2pc as global risk markets jumped in anticipation of a decisive win by Democrats leading to major fiscal stimulus, the S&P/ASX 200 dived 1.3pc as US futures and copper prices tumbled on a stronger-than-expected showing by Trump.

But fear of a contested election soon turned to hope of a Trump victory avoiding tax hikes and regulation - albeit with less fiscal stimulus - with the Nasdaq surging 3.5pc and S&P 500 futures rising 1.8pc.

The local market pared those gains before the close as global markets also faded but remained risk-on.

Tech by far the strongest, while industrials, real estate, consumer discretionary, communications and healthcare outperformed.

Consumer Staples, Materials and Financials underperformed.

The Australian dollar reversed from a 6-day high of 0.7222 to an intraday low of 0.7049 before bouncing to 0.7138.

Lachlan Moffet Gray 4.33pm: Barangaroo casino opening could be delayed

Counsel Assisting Adam Bell has submitted that the risk management failures that led to the arrest of 19 Crown Resorts staff in China was the result of a poor corporate culture and the “compromise” of risk reporting lines by a gang of James Packer-aligned executives.

Mr Bell said that only one Crown Resorts director had a full knowledge of all of the risks leading up to the arrest of 19 Crown staff in China in 2016. That was Michael Johnston, who is also an executive of Mr Packer’s holding company, CPH.

“So far as the board of Crown Resorts was concerned, individual directors had different levels of understanding about relevant events, and that itself reflects a failure of risk management and corporate governance,” Mr Bell said.

“The one member of the board who was aware of all of the escalating risk factors and who chose not to share it with the rest of the board was Mr Johnston.

“We submit that it should be found that Mr Johnston must have appreciated that there was a risk of arrest, detention and conviction.”

Mr Bell also submitted that Crown’s business model placed staff in China at a “material risk” of arrest.

“Even on Crown Resorts’ idiosyncratic interpretation of business laws in China, a conscious decision was made to operate without a business license and not tell any of the offices,” he said, adding that the failure of the board to be informed, but also the board’s failure to be inquisitive also escalated the risk.

“If the risk management for Crown Resorts had been engaged and properly appraised of the risk which existed in 2015 - 2016, different steps probably would have been taken to respond to the risk.

“Crown Resorts board failed at its fundamental responsibilities to set and monitor risk appetite.

“To the extent that the board informally communicated a risk appetite was excessive and inappropriate by a casino licensee.”

The inquiry has been adjourned until tomorrow morning at 10am, although a private hearing will commence this afternoon.

NSW Premier Gladys Berejiklian said she would seek urgent advice about the findings of unsuitability by the counsel assisting and did not rule out delaying the December 14 opening of the Barangaroo Casino.

Eli Greenblat 4.30pm: China poised to slap tariffs on Australian wine

The prickly trade relationship between China and Australia now looks to have further ensnared Australia’s biggest winemaker Treasury Wine Estates, which has been advised that a powerful drinks industry group within China has called for retrospective tariffs to be slapped on its wine.

Treasury Wine, which makes popular brands such as Penfolds and Wolf Blass, said the China Alcoholic Drinks Association has submitted a written request to the Chinese Ministry of Commerce that imports of Australian wine in containers of two litres or less into China be subject to retrospective tariffs.

The Chinese Ministry of Commerce recently announced an anti-dumping investigation into Australian winemakers for allegedly dumping wine in China, with many seeing the accusation and current investigation a payback for recent political decisions taken by the Australian government.

Chinese pressure on Australian exporters have included tariffs on barley, restrictions on meat exports and more recently holding up the shipment of Australian rock lobsters to China as well as Australian timber exports.

Treasury Wine shares closed down 3.1 per cent at $8.67.

Joyce Moullakis 3.58pm: NAB leaves variable home loan rates unchanged

National Australia Bank has joined two of its big bank rivals and reduced fixed rate mortgage pricing, rather than variable home loan rates.

In a statement on Wednesday NAB said its rate four year fixed rate home loan would be cut 81 basis points to 1.98 per cent per annum effective from November 10 for new loans.

NAB, Australia’s biggest business bank, will also cut 200 basis points from the rates on its QuickBiz Loan for the next three months. Those rates are effective from November 6.

NAB joins Westpac and Commonwealth Bank in looking to cut pricing on fixed rate mortgages and business loans rather than standard variable rates on home loans, in light of the Reserve Bank’s official 15 basis point rate cut on Tuesday.

The RBA and the federal government have urged the major banks to pass on the reductions, to help spur economic activity.

On mortgages, NAB cut its one-year fixed rate by 10 basis points to 2.19 per annum, while its two-year fixed home loan saw the same quantum of decline to 2.09 per cent.

The three year fixed mortgage declined 20 basis in price to 2.09 per cent.

NAB personal banking executive Rachel Slade said: “These changes are designed to provide certainty to our customers with our lowest fixed rates ever, boost confidence and support credit recovery.

“This is the sixth reduction in the cash rate during the past 18 months. With interest rates at record lows we are doing what we can to support homebuyers and business owners through COVID-19, while also balancing the impact on our deposit and savings customers.

NAB’s head of business and private banking Andrew Irvine said businesses would drive Australia’s economic recovery.

Lachlan Moffet Gray 3.49pm: Inquiry questions Packer’s evidence

Counsel assisting Adam Bell has suggested James Packer’s evidence to the inquiry about his knowledge of the concern of Crown Chinese staff over being targeted by the authorities for illegally promoting gambling, may not be accepted.

Noting that Packer confidants Ishan Ratnam, Michael Johnston and Barry Felstead were all aware of the crackdown on foreign casinos, he wondered how it could be that Mr Packer was not informed of the issue, given he described them as loyal.

“Nevertheless, Mr Packer’s evidence was that he was not informed by Mr Ratnam, Mr Johnston, Mr Felstead or otherwise of events constituting an obvious escalation in risk,” Mr Bell said.

Commissioner Patricia Bergin suggested it could have been a fear of sharing bad news with Mr Packer, who is a “powerful personality.”

“Perhaps it was the case that Mr Packer’s powerful personality meant that managers at Crown Resorts didn’t want to bring bad news to his attention.

“It’s either that or the evidence of Mr Packer can’t be accepted.”

3.47pm: Markets are betting polls are wrong: Sheridan

With Trump well ahead in Florida with well over 90pc of the votes counted, The Australian’s Foreign Editor, Greg Sheridan, makes the point that almost every Florida poll has got the state wrong.

While the key battleground states including Florida, Ohio, Georgia, Pennsylvania, Michigan and North Carolina are still undecided, Trump’s unassailable lead in Florida has the markets thinking where else the polls could be wrong.

“It also seems that Trump’s energy at the end of the campaign has had an effect,” Mr Sheridan says.

“This is genuinely a desperately close result, at least at this stage.”

Biden still has about 209 Electoral College votes vs about 118 for Trump, with 270 needed to win.

Bridget Carter 3.37pm: Brookfield set to price DBCT IPO

Prospective investors are expected to learn the price of the Dalrymple Bay Coal Terminal as early as Wednesday afternoon, with the private equity owner Brookfield pressing on with its initial public offering of the asset despite the result of the US election.

DataRoom understands that the pricing will involve a yield offered to investors of between 6.75 per cent and 7 per cent.

It comes after analyst research was released on the coal terminal last month, with Credit Suisse suggesting that the Queensland infrastructure asset was worth between $3.25bn and $3.56bn, including debt.

Brookfield was hoping to raise between $800m and $1bn for its IPO, with the terminal’s market value to be between $1.6bn and $1.7bn.

It was earlier believed that Brookfield had been hoping for a yield of around 6 per cent but may have needed to lock in a 7 per cent yield to secure strong demand.

The understanding is that Brookfield has been targeting retail investors for the IPO at a time a number of institutional investors shy away from gaining exposure to assets linked to the coal industry.

The Queensland Investment Corporation was earlier thought to be an investor.

Bank of America, HSBC, Citi and Credit Suisse are working on the float, while co-lead managers include Wilsons, Ord Minnett, Bell Potter and Morgans.

The DBCT is one of Queensland’s major metallurgical coal export facilities that handles about 20 per cent of the world’s seaborne metallurgical coal trade and will be sold with take or pay contracts in place.

Brookfield gained control of the terminal during the financial crisis in 2009 when it embarked on a $1.8bn recapitalisation of Babcock and Brown Infrastructure, which essentially comprised the DBCT.

Lachlan Moffet Gray 3.30pm: Crown, CHP working group ‘compomised reporting lines’

Counsel assisting Adam Bell has told the NSW inquiry into Crown that the decision of numerous VIP executives not to inform the wider Crown board of the arrest of South Korean gambling promoters in China in 2015 was a failure to manage risk.

“We submit that the South Korea arrests were an escalation of risk that should have been formally reported to the board of Crown Resorts and the Crown Resorts risk management committee,” Mr Bell said.

“To allow them an opportunity to evaluate through its proper processes and channels whether the continuation of business China remained within its risk appetite.

“The asymmetrical provision of incomplete information to only some members is another example of the breakdown in the risk management of Crown Resorts at the time.”

The questioning of two Crown employees in China by Chinese authorities that followed three weeks later was also an “obvious” risk that was not passed on to wider parts of the company.

Barry Felstead instead passed the news on to Ishan Ratnam and Michael Johnston via an email, with Mr Johnston later telling the inquiry that he did not understand the significance of the event at the time.

Mr Bell said that his assertion “Is not credible” given his involvement in the VIP business, his knowledge of the wider crackdown in China, the fact that Mr Felstead was concerned, and that legal advice was being sought in relation to the email.

“We submit that you should find that Mr Johnston failed without justifiable reason to inform his colleagues on the Crown Resorts board the questioning of staff by the Chinese police and the provision to Chinese police of a letter,” Mr Bell said.

“We submit that you should also find that he failed without justifiable reason to inform all his colleagues on the board of a crackdown on foreign casinos luring Chinese citizens to gambling abroad.

“We also submit that you should find Mr Felstead failed without justifiable reason to inform his colleagues on the board of Crown Melbourne and to inform all of the directors of Crown Resorts on the questioning of staff by the Chinese Police,”

“We submit you should also find that he failed without justifiable reason to inform the board of Crown Melbourne nor the members of the boards of Crown Resorts on the crackdown of foreign casinos.”

Mr Bell also said that, “Mr Johnson was not the only person outside of this formal reporting structure Mr Felstead told about the questioning of the employee,” as Packer confidant Mr Ratnam was also told.

Mr Bell said this was proof that the VIP/CPH working group constituted a compromise of the usual line of reporting that “caused harm to Crown Resorts”.

3.10pm: Trump wins Florida: Fox

Fox has just called Florida for Trump.

It’s not over yet but Florida typically lines up with the national vote.

Nasdaq futures are outperforming with a 3.5pc rise since 10-year bond yields are down 7bps as Trump would spend less and regulate less than Biden.

2.49pm: Are markets pricing in Trump win?

Axi chief global markets strategist, Stephen Innes is seeing signs that the global markets are now pricing In Trump win.

“The Nasdaq is outperforming, yields are lower, the curve flatter, and the US dollar is up,” he notes.

“That is basically the opposite of what we saw when Trump tested positive for COVID-19. In other words, the market seems to be pricing in a Trump win.

Growth is certainly outperforming and value is lagging - Nasdaq futures rose as much as 3.5pc, briefly triggering a trading halt.

S&P 500 futures rose up 1.8pc, DJIA futures rose just 0.7pc and Australia’s value heavy S&P/ASX 200 is up just 0.4pc.

Certainty Trump now looks set to win a few contested battleground states that will boost his re-election chances.

But while Trump’s chances have certainly improved as the votes are counted, it’s a big call to say he will legitimately be able to declare victory tonight.

More likely, he won’t just concede defeat. If he declares victory too early, risk markets could panic.

2.40pm: Inquiry hears of Crown’s China misteps

The inquiry has resumed with counsel assisting Adam Bell recounting the missteps Crown Resorts made in running its China business, which ultimately resulted in the arrest of 19 staff by Chinese authorities for illegally promoting gambling in 2016.

In particular, Mr Bell mentioned the “clandestine” office set up in Guangzhou without signage to avoid attracting the attention of authorities, and how it was not drawn to the attention of the risk management committee.

He also mentioned how the Chinese government in 2015 announced it would crackdown on foreign casinos promoting gambling to Chinese citizens and that members of the Crown board were not aware of this fact, despite Crown’s man in China Michael Chen seeking legal advice on the topic and senior executive, including Barry Felstead, restricting executive travel to China.

Commissioner Patricia Bergin interjected to note that although the counsel assisting does not submit that anyone was knowingly breaking the law at Crown, she had difficulty understanding what the “subterfuge” on the part of VIP executives was “all about”.

“The VIP international executives and Mr Johnston knew that there was an arrest and detention and conviction of their staff...because they understood the risk factors were increasing dramatically,” Mr Bell said.

Mr Bell said that Mr Felstead on a call informed Mr Johnston about the crackdown, making Mr Johnston the only director on the Crown Board to tell the inquiry that had knowledge of the inquiry.

“Mr Johnston said he was told of the crackdown by Crown resorts executives in about March of 2015,” Mr Bell said.

“There’s no evidence before the inquiry to indicate Mr Johnston took any steps to escalate the news of the foreign casino crackdown within Crown Resorts or to discuss with the VIP executives the steps they took or ought to take,” Mr Bell said.

Mr Packer, Mr Craigie, Mr Rankin learnt about the crackdown at a later date in the context of South Korean casino operators being arrested in China 2015 but nothing more was done at Crown.

“Ultimately, those people chose to manage the risks themselves,” Mr Bell said.

2.16pm: ASX turns positive

Australia’s S&P/ASX 200 share index has turned up 0.2pc to 6078 after falling 1.3pc to 6081.

The remarkable rebound comes as S&P 500 futures rebound strongly to be up 1.9pc after falling 0.5pc intraday.

WTI crude extended its rise to 2.5pc and copper futures were down 0.6pc after falling 1.8pc

It’s not clear where the optimism is coming from though.

Bloomberg just tweeted that Trump’s war room as of right now is confident of winning Florida, Georgia, North Carolina and Ohio.

North Carolina has form for picking the election, so if that’s called for Trump, risk assets could tank again.

2pm: Copper futures slide

Comex copper futures fell as much as 1.8pc to an intraday low of $US3.044 a pound.

That coincided with AUS/USD diving 1.6pc from its NY closing level, US 10-year bond yields diving 10bps and S&P 500 futures tipping 0.5pc.

But S&P 500 futures have suddenly turned up 0.5pc and copper futures pared their fall to 1pc.

Highlighting the closer than expected US electoral race Fox says Florida won’t be called any time soon.

North Carolina is getting a lot of attention given that the outcome there picked 4 of the last 5 presidential elections and it has just 15 Electoral College votes.

With state officials there having been processing mail in votes for weeks, they said Monday they expect 97pc of all ballots cast in the election to be counted by Tuesday night.

AP called the state for Trump at 3pm AEDT in 2016.

Ben Wilmot 1.48pm: Mitchell fined over director duty breach

Businessman Harold Mitchell has been hit with a $90,000 fine for failing to discharge his director‘s duties properly while on the board of Tennis Australia as it undertook intense negotiations over television rights.

The Federal Court levied the fine after a controversial case brought by the Australian Securities Investments Commission, which was only partially successful.

The court found that Mr Mitchell had failed to exercise his powers with the degree of care and due diligence that a “reasonable person” would have if they were a director of a corporation in Tennis Australia‘s position.

1.43pm: Aussie dives on election doubts

The Australian dollar is plunging along with global risk assets as markets start to doubt their assumption of a decisive win by Democrats leading to major US fiscal stimulus and a lower dollar

AUD/USD dived 1.2pc to an intraday low of US70.67 after earlier surging 0.8pc to a 3-week high of US72.22.

In doing so it has fallen back below resistance from a major descending triangle pattern, near US71.30, and has also fallen back below the 100-day moving average at US71.18.

After what looks like a “false break” of resistance, the descending triangle pattern remains in play.

The target, on a decisive break of the horizontal support line at US70.00, would be US65.90.

Conversely, if it were to break today’s high, the target would be US75.55.

The impending start of QE in Australia has seen the AU-US 10-year bond yield gap turn negative for the first time since March, although the gap is narrowing as US bond yields plunge today.

The AUD/USD was last US70.66.

1.30pm: US bond yields plummet amid vote uncertainty

US bond yields are plummeting and the curve is flattening as the market starts to price out a decisive win by Democrats and immediate large-scale fiscal stimulus.

The 10-year yield is down 8bps after falling almost 10bps to a 3-day low of 0.8048pc after earlier rising more than 4bps to a 5-month high of 0.9435pc.

The 30-year bond yield is down 11bps at 1.565pc.

Daily closes below 0.8993pc and 1.6280pc respectively would form a bearish key reversal patterns on a daily chart.

A close below the downsloping 200-day moving average on the 10 year yield at 0.8196 would suggest the long-term downtrend is reasserting itself.

1.25pm: HK stocks hit by Ant IPO suspension

Hong Kong stocks fell at the start of trade, with Alibaba plunging nearly 10 percent after the debut of its financial unit Ant Group was suspended.

The Hang Seng Index fell 0.60 percent, or 149.73 points, to 24,790.00. The benchmark Shanghai Composite Index dipped 0.08 percent, or 2.54 points, to 3,268.53, while the Shenzhen Composite Index on China’s second exchange added 0.12 percent, or 2.79 points, to 2,252.30.

Earlier, Tokyo’s key Nikkei 225 index opened more than two percent higher, tracking rises on US markets a day earlier, as polls began closing in the US presidential vote.

The benchmark Nikkei 225 index was up 2.01 percent or 468.27 points at 23,763.75 in early trade, while the broader Topix index gained 1.50 percent or 24.08 points to 1,632.03.

AFP

Lachlan Moffet Gray 1.10pm: Crown’s ‘double-down’ approach

Crown executives Michael Johnston and Ishan Ratnam regularly updated James Packer on the details of the VIP business, even after he resigned as a director of the business, as they were “completely loyal”, the NSW casino inquiry heard.

In 2014-15, when a growing crackdown on gambling in China presented an opportunity for Crown Australia to steal VIP market share away from Macau, VIP executive Michael Chen told Australian resorts CEO Barry Felstead that the company could take the “double down approach” and step up activity in China.

“It all really depends on the risk appetite of the company, the double down approach is probably easy to get buy in for but we will expose the company to a lot more risk,” Mr Chen said in an email read by counsel assisting Mr Bell.

“The decision about the double down approach was made by the VIP working group led by Mr Johnston,” Mr Bell explained, referring to the group that made decisions on VIP business strategy outside of typical risk structures.

As a realisation of this strategy, Mr Bell said that certain executives and staff in China received incentives for maximising VIP turnover despite the company receiving legal advice, primarily from WilmerHale, outlining the risks of promoting gambling in China.

Most Crown staff within the VIP business generally believed that their activities were within the bound of the law due to not organising gambling tours in excess of 10 people and not paying direct commissions to their staff in China.

They also believed they could operate without a licence if they did not breach these laws or establish an office.

Mr Bell described this as a “fine” distinction and noted many directors previously told the inquiry that had not been shown the legal advice underpinning this interpretation.

“This is despite the fact the key executives of VIP international were obtaining legal advices at a time they were aware that Chinese authorities were tightening regulatory controls,” Mr Bell said.

Mr Bell said the ultimate responsibility of this matter rested with Barry Felstead, but noted many other executives who knew about the legal advice such as Rowen Craigie and Michael Johnston did not ask to view it or have Crown’s legal team review it.

Legal advice also encouraged Crown to establish a licensed office, which Crown did not follow, continuing to operate from a concealed office on the recommendation of Mr Felstead.

The inquiry adjourned for lunch until 2pm.

12.24pm: Pendal slumps on full-year update

Shares in wealth manager Pendal have slumped more than 8 per cent after the company posted a 25 per cent slump in full-year net profit and flagged a lift in fixed cost for the year ahead.

Pendal, formally known as BT Investment Management, declared a 22c per share final dividend, 10 per cent franked, bringing its full-year payout to 37c per share.

Pendal shares last down 7.8 per cent at $6.35.

Read more: Pendal to catch responsible investing wave, profit slumps

12.13pm: Trivago loses hotel ad appeal

Holiday booking website Trivago has lost its appeal after misleading consumers over hotel ads.

The federal court ruled in January that Trivago misled consumers by representing that its website would quickly and easily help users identify the cheapest hotel room, but in actual fact, it placed significant weight on paid listings.

The judge said at the time that Trivago did not sufficiently disclose to users that its algorithm gave prominence to accommodation providers paying higher fees.

The Full Federal Court upheld that decision today.

“This is a win for consumers and is an important warning to comparison sites that they must not mislead consumers about the results they recommend,” ACCC chair Rod Sims said.

“We brought this case because we were concerned that consumers were being misled by Trivago’s claims that their site was getting the best deal for consumers, when in fact they were shown the deals that benefited Trivago.”

The consumer watchdog is seeking orders for declarations, penalties and costs.

12.05am: Risk assets dive on US election doubts

Risk assets are diving now after early gains as a strong showing by President Trump in Miami-Dade County Florida will make it harder for Joe Biden to win, raising fears the market won’t get the clear election outcome has priced for.

The S&P/ASX 200 dived 1.1pc to 5997 after rising 0.2pc, AUD/USD fell 0.3pc to 0.7125 after rising 0.8pc, S&P 500 futures dived 0.5pc after surging 1pc, Comex copper fell 0.5pc after rising 0.5pc and Nymex crude futures were up 0.7pc after rising 2pc.

Lachlan Moffet Gray 11.49am: Packer ‘central’ to Crown strategy group

Counsel assisting Adam Bell has said that James Packer supported the formation of a “VIP working group” within Crown, which set the direction and the strategy of Crown’s international business outside of normal management structures and risk management systems.

“In 2013, quite possibly at Mr Packer’s instigation but certainly with his approval, the VIP working group or CPH working group, was established,” Mr Bell told the inquiry.

“That group was comprised of VIP international executives and senior CPH personnel,” he said, naming Michael Johnston, Barry Felstead, Michael Chen and others that have features prominently throughout the inquiry.

The VIP working group met monthly with CPH executives providing advice on how to grow the VIP business and further access the Chinese market.

“Most significantly Mr Felstead said that the VIP working group was working separately from the official reporting structure into the Crown Resorts’ CEO, Mr (Rowen) Craigie,” Mr Bell said.

“He also accepted that on occasion he provided more information about the international business to the VIP working group than to the Crown Resorts senior CEO meeting group.

“We submit that you should find that Mr Packer was central to the genesis and objectives of the VIP working group notwithstanding that Mr Packer himself was not attendee.”

Mr Bell said that Mr Johnston said his involvement in the group was on Mr Packer’s behalf and that Mr Cragie characterised the relationship between Mr Johnston and the rest of the group as “consistent” with Mr Packer’s point of view.

Crown’s international operations have come under close scrutny at the inquiry following the arrest of Crown staff in China.

11.37am: Retail sales beat expectations

Monthly and quarterly retail sales data for September have beaten Bloomberg’s consensus estimates.

Retail sales fell 1.1pc on month, beating the consensus estimate of a 1.5pc fall.

Real retail sales rose 6.5pc on quarter, which also beat the consensus of a 6pc rise.

11.20am: ASX dips 0.3pc despite gains elsewhere

Australia’s S&P/ASX 200 share index fell 0.3pc to an intraday low of 6047.2 in choppy trading after rising as much as 0.2pc.

Major sectors including health Materials, Healthcare, Financials and Utilities turned down.

But other risk assets continue to rise with S&P 500 futures up 1pc, Comex copper up 0.6pc, WTI crude up 2.1pc and AUD/USD up 0.8pc.

Lachlan Moffet Gray 11.08am: Crown ‘not suitable’ to hold casino licence

Counsel assisting a NSW casino inquiry has argued in oral submissions that the James Packer-backed Crown Resorts is not suitable to hold a NSW casino licence.

Scott Bell also said Mr Packer’s shareholding in the company had had a “deleterious impact” on the “corporate governance of Crown” with the influence of his holding company CPH “compromising” the reporting lines which ultimately led to the arrest of Crown staff in China.

The NSW Independent Liquor and Gaming Authority’s Inquiry has been looking into the suitability of Crown Resorts to hold a casino licence in the state ahead of the opening of Crown’s Barangaroo casino, which is due to open in December.

“In summary we submit that the evidence presented to this inquiry demonstrates that the licensee is not a suitable person to continue to give effect to the licence and that Crown Resorts is not a suitable person to be a close associate of the licensee,” counsel assisting Scott Bell has told Commissioner Patrica Bergin.

The move raises the question of whether the inquiry could produce an interim report

arguing that Crown should delay the casino’s opening.

In continuing to give evidence to the inquiry Mr Bell framed the concepts of suitability and established that the ethical and cultural aspects of a company is comprised of the people who comprise its board and management.

He said suitability, “ebbs and flows with the composition” of a company’s board and management and said that people who adversely affect suitability should be removed from the company.

“However, that would only be possible if the wrong done and the wrong doers could be isolated from the remaining personnel,” Mr Bell said, in what could be a veiled reference to James Packer’s significant shareholding in the company.

Mr Bell has also addressed the arrest of 19 Crown staff in China in 2016 for illegally promoting gambling in the country.

Mr Bell said that although Crown clearly instructed the staff to engage in illegal gambling promotion and sought to hide that from the authorities, he submitted that the Crown board was not aware of this at the time.

The NSW Independent Liquor and Gaming Authority’s Inquiry into the suitability of Crown Resorts to operate the Barangaroo Casino licence has opened with a bang, with the counsel assisting arguing that Crown is not a suitable licensee of the casino due to open in December.

“In summary we submit the evidence presented to this inquiry demonstrates that the licensee is not a suitable person to continue to give effect to the licence and that Crown Resorts is not a suitable person to be a close associate of the licensee,” Counsel Assisting Scott Bell has told Commissioner Patrica Bergin.

The move raises the question of whether the inquiry could produce an interim report

arguing that Crown should delay the opening.

In continuing to give evidence to the inquiry Mr Bell framed the concepts of suitability and established that the ethical and cultural aspects of a company is comprised of the people who comprise its board and management.

He said suitability “ebbs and flows with the composition” of a company’s board and management and said that people who adversely affect suitability should be removed from the company.

“However, that would only be possible if the wrong done and the wrong doers could be isolated from the remaining personnel,” Mr Bell said, in what could be a veiled reference to James Packer’s significant shareholding in the company.

Mr Bell has also addressed the arrest of 19 Crown Staff in China in 2016 for illegally promoting gambling in the country.

Mr Bell said that although Crown clearly instructed the staff to engage in illegal gambling promotion and sought to hide that from the authorities, he submitted that the Crown board was not aware of this at the time.

Will Glasgow 11.03am: Exporters halt China trade on ban ‘rumour’

Australia’s lobster and wine industries have halted exports to China following “unverified reports” of a sweeping ban to be imposed on Friday, which is said to also include Australian sugar, copper, timber and coal.

The decision by China’s biggest lobster and wine supplier came after reports of an unusual, and unverified, meeting by Chinese officials, who are said to have coordinated a ban on imports from Australia across seven categories worth more than $6bn a year.

If unresolved, the halt of supply from Australia - one of the world’s few almost COVID-19 free agriculture suppliers - will lead to price spikes in products for Chinese consumers in the lead up to the Lunar New Year holiday and end-of-year wedding season.

The Labor Party has used the uncertainty to ramp up its attack on the federal government’s China trade policy.

“The Morrison Government must come up with an urgent plan to address the escalating concerns of Australian exporters,” said Labor trade spokesperson Madeleine King.

Ambiguous responses by Australia’s biggest trading partner have increased calls for diversification from China. Long standing champions of the bilateral relationship have been reluctant to comment on the opaque situation.

The Seafood Trade Advisory Group, which has been working with the industry since almost $2m of live lobsters were spoiled in a 4-day hold up at Shanghai airport, said Australian producers were waiting for more information before resuming trade following “unverified reports” of the impending ban.

10.44am: Eagers Automotive acquires Castle Hill site

Eagers Automotive shares have lost ground in early trade despite the listed car dealer announcing a site acquisition that would deliver at about $15m in cost savings.

The company said in a statement to the market this morning that it would acquire a well-located Castle Hill site in Sydney from Charter Hall, for $76.25m.

Still, the site was poorly configured and under-utilised, comprising of three showrooms, 67 associated service bays and a number of outdated factory units, Eagers said.

Eagers Automotive shares last down 1 per cent at $11.50.

10.32am: ASX gains after opening dip

Australia’s S&P/ASX 200 rose 0.2pc to 6078.3 as other risk jumped with S&P 500 futures up 0.8pc, WTI crude up 1.1pc, Comex copper up 0.4pc and AUD/USD up 0.4pc.

All sectors are now in the green bar Materials, with Afterpay up 1.5pc and Fortescue down 2.3pc.

10.20am: ASX dips at open as US futures, Aussie surge

Australia’s S&P/ASX 200 share index dipped slightly in opening trade to be down 0.2pc at 6057.

The major sectors were mixed, with falls in the healthcare, materials, consumer discretionary, energy and financials sectors offsetting gains in tech, industrials, communications, utilities, real estate and consumer staples.

CSL, Fortescue, BHP, CBA and Wesfarmers are the top five drags with falls of 0.8pc, 2.9pc, 0.7pc, 0.4pc and 0.8pc respectively.

Macquarie, NAB, Afterpay, Brambles and James Hardie were supporting with gains of 0.6, 0.5pc, 1pc, 0.8pc and 0.7pc respectively.

Pendal shares fell 4.2pc after missing profit estimates.

On a positive note, S&P 500 futures have surged 0.8pc in early trading and AUD/USD has jumped 0.4pc to a three-week high of 0.7195.

That’s despite a slightly disconcerting tweet in capitals from US President Trump that: “We are looking really good all over the country. Thank you!”.

That doesn’t sound like a man who will easily concede defeat, as risk asset markets seem to be assuming.

Eli Greenblat 9.47am: Coca-Cola Amatil takeover firms

Coca-Cola European Partners has announced it has entered into binding agreements to acquire Coca-Cola Amatil, in a bid priced at $12.75 per share, that values the bottler at $9.3 billion.

The European bottler, the biggest bottler of Coca-Cola in the world, said it has completed its confirmatory due diligence and entered into a binding scheme implementation deed (SID) with Coca-Cola Amatil.

Under the terms of the SID, Coca-Cola European Partners will offer to acquire 69.2 per cent of the entire existing issued share capital of CC Amatil which is held by shareholders other than The Coca-Cola Company for $12.75 per share in cash.

Coca-Cola Amatil directors have already backed the $9.3bn deal, which emerged last month.

“This is a fantastic opportunity to bring together two of the world’s best bottlers to drive faster and more sustainable growth,” Coca-Cola European Partners chief executive Damian Gammell said in a statement.

Coca-Cola European Partners has also entered into a co-operation and sale deed with The Coca-Cola Company with respect to the acquisition of its 30.8 per cent interest in CC Amatil conditional upon the implementation of the scheme with CC Amatil.

Under the co-operation and sale deed, The Coca-Cola Company will be entitled to receive $9.57 per share in cash for part of their shareholding, which comprises 10.8 per cent of CC Amatil’s shares. It will acquire all of The Coca- Cola Company’s remaining 20 per cent shareholding in CC Amatil for $10.75 per share, either in cash or a combination of cash and the issue of Coca-Cola European Partners shares at an agreed conversion ratio.

Lachlan Moffet Gray 9.43am: CBA defies RBA, Treasurer on rates

Despite warnings from the treasurer and the Reserve Bank governor, Commonwealth Bank will not pass on any of Tuesday’s interest cuts to any of its variable loans, instead reducing a range of interest rates on other products.

Following the RBA’s decision to cut the cash rate to a record low of 0.1 per cent on Tuesday, the nation’s largest bank announced on Wednesday it would lower four-year fixed rates on owner-occupier loans by 100 basis points to 1.99 per cent.

The reduction marks the bank’s lowest ever advertised rate.

But the bulk of Australian mortgages, including those held by CBA customers, carry variable interest rates.

CBA also announced a 15 basis point reduction to 2.14 per cent on two and three year fixed rate home loans for owner occupiers paying principal and interest in the wealth package;

a 10 basis point reduction to 2.19 per cent p.a. on new one year fixed rate home loans for owner occupiers paying principal and interest in the wealth package; a 2.99 per cent secured and 3.99 per cent unsecured business loans rates through the fovernment’s SME loan guarantee scheme – a reduction of up to 51 basis points – as well as a 2.49 per cent rates on new three, four and five year fully secured business loans, a reduction of approximately 50 basis points.

9.40am: What’s impressing analysts?

Brambles raised to Add: Morgans Financial

CSR raised to Neutral: GS

Pilbara Minerals cut to Hold: Canaccord

SCA Property cut to Sell: Morningstar

Stockland cut to Sell: Morningstar

Afterpay target price raised 6pc to $30; Sell rating kept: UBS

9.30am: ASX to look to early US poll counting

Australia’s share market may have upside risk from strong gains on Wall Street in anticipation of a decisive win by Democrats in the US election.

But much will depend on indications from early counting of votes in key US swing states.

If those results aren’t decisive and US President Trump doesn’t concede defeat today, risk assets could sell off again.

In that case the S&P 500 could fall about 4 per cent to a support line across recent lows and

the Australian market would face a similar fall as the associated volatility would trigger de-risking.

Still, any sharp declines may be limited by expectations of dovish comments and potentially more QE from the Fed, with its policy announcement due at 6am (AEDT) Thursday.

And if Trump concedes defeat today, risk assets can be expected to boom. In that case the S&P 500 can be expected to jump 4.7pc and the S&P/ASX 200 would likely rise about 3pc to test its recent high.

Ahead of the early results from US swing states around midday Australian time, overnight futures relative to fair failure suggest the S&P/ASX 200 will open flat after surging 1.9pc to 6066.3 on Tuesday.

Tuesday’s rise came mostly ahead of the RBA policy easing, which was widely anticipated, although the pace of its QE was more aggressive than expected.

The US market rose about twice as much as indicated by futures at the Australian close on Tuesday, with the S&P 500 up 1.8pc at 3369.6

Hence the Australian market should have upside risk this morning. Chinese bans on Australian imports are a concern, though with Bloomberg saying new bans are coming next week.

The Russell 2000 small caps index surged 3.2pc in a rush to value stocks amid expectations that a decisive win by Democrats will unleash about $US3tn of fiscal stimulus.

Consistent with an expected win by Democrats leading to US fiscal stimulus, the US 10-year bond yield rose 6bps to 0.899pc, driving the KBW Bank index up 2.7pc.

But the Energy sector fell 0.8pc despite a 3.4pc rise in WTI crude to $US38.06 a barrel as OPEC’s president said the Saudi’s and Russians are pushing to delay a looming supply hike.

Woolworths may jump after delivering a comparable 1Q food sales rose 11.5pc on year though it said sales moderated in October.

Monthly and quarterly retail sales data are due at 11.30am (AEDT).

9.25am: South Pacific Laundry dumps Spotless bid

South Pacific Laundry has withdrawn its bid for Spotless’ garment laundering business and withdrawn its request for ACCC merger clearance on the proposed acquisition.

It comes after US-owned laundry giant Alsco dumped its takeover bid for the company and withdrew a request for ACCC approval on a merger with Spotless two weeks ago.

Spotless Garments is part of Spotless Group Holdings Limited, which is wholly-owned by Downer EDI Limited.

The competition watchdog began its informal review of the proposed South Pacific merger in May and expressed preliminary concerns about the transaction in August.

South Pacific Laundry is wholly-owned by Australian private equity firm Anchorage Capital Partners.

9.08am: CBA cuts fixed home loan rates, variable unchanged

Commonwealth Bank has reduced fixed home loan rates following the Reserve Bank’s cut to the official cash rate to 0.1pc, but has left variable rates unchanged.

CBA said it was cutting its four-year fixed home loan rate for owner-occupiers by 100 basis points to 1.99pc, its lowest ever fixed rate.

One, two and three year fixed rates for new owner-occupier loans have been reduced by between 10 and 15 basis points.

Yesterday, several small lenders reduced variable home loan rates.

Eli Greenblat 8.50am: Online helps lift Woolworths sales 11.5pc

Woolworths has posted an 11.5 per cent lift in first quarter same-store sales, fuelled by a doubling of online sales during the coronavirus pandemic as well as strong gains by its liquor arm.

Releasing its first quarter sales results on Wednesday, Woolworths said it had been a pleasing start to fiscal 2021 with all retail businesses delivering strong sales growth and customer metrics remaining solid.

The retailer also said the costs of COVID-19, including the cleaning of its stores, extra hygiene protocols and staff to monitor customer interactions and social distancing, had moderated, with total coronavirus costs hitting $176 million for the first quarter.

The Woolworths supermarkets results confirms the strength of grocery retailers through the health crisis, with total Australian food sales for the quarter up 12.9 per cent to $12 billion and comparable sales increasing 11.5 per cent.

Online was particularly strong with e-commerce sales up 100 per cent to $961 million with sales penetration in the quarter reaching 8 per cent. Woolworths said sales continued to benefit from COVID-driven higher in-home consumption as well as the success of its Ooshies giveaway campaign.

Sales growth in Victoria was approximately 20 per cent in the quarter due to the more stringent restrictions in place. Excluding Victoria, Australian food total sales increased by 10.6 per cent.

8.05am: ASX to edge higher as global markets surge

Australian stocks are set to open a little higher after world markets posted firm rises as Americans headed to the polls.

At around 8.20am (AEDT) the SPI futures index was up four points, after see-sawing for much of the morning.

Yesterday, the ASX gained 1.9 per cent after the RBA cut the cash rate to a new record low of 0.1 per cent and unveiled a $100bn bond-buying program to help spur economic recovery.

The Australian dollar was this morning higher at US71.58.

Brent oil was up 1.9 per cent to $US39.71.

8.05am: US stocks finish election day higher

Wall Street rose as millions of Americans headed to the polls, setting markets up for a second consecutive session of strong gains.

The Dow Jones Industrial Average rose 2.1 per cent while the S&P 500 gained 1.8 per cent and the tech-heavy Nasdaq Composite added 1.9 per cent. After losing 5.6 per cent last week, the S&P 500 gained 1.2 per cent Monday.

Historically, stocks have fared well on Election Day. Ahead of Tuesday, the S&P 500 rose 0.8 per cent on average on the nine days from 1984 to 2016 that Americans went to the polls to elect a president. The index climbed on seven of those occasions.

Equities have also generally performed well under President Trump -- the S&P 500 has surged 55 per cent since the 2016 election. But the market lately is being buoyed partly by bets that former Vice President Joe Biden will win the White House and Democrats will take control of Congress.

The stock market usually feels more apprehensive about Democrats than Republicans, but “this is a unique year and a unique election,” said Solita Marcelli, the Americas chief investment officer at UBS Global Wealth Management.

Elections and stocks do have a relationship, though it is impossible to say definitively which drives the other. For election years since 1928 in which the S&P 500 is positive in the three months before election day, the incumbent party has won 87 per cent of the time, according to brokerage firm BTIG.

The market has warmed to the chances of a “blue wave” outcome, in which Democrats win both the White House and control of Congress, Ms Marcelli said, because it would make it more likely lawmakers approve a generous stimulus package to spur economic activity under the new administration.

“A lot of people were very fearful of a blue wave and Biden, pricing in what it would mean for taxes and regulations,” she said. Those fears have receded though. “The market has come around quite a bit.”

If Democrats emerge as the winners, the government could spend an additional $US3 trillion to bolster the U.S. economy, said Stephane Monier, chief investment officer at Lombard Odier. That would give fresh impetus to a stock-market rally that has waned in recent weeks.

The biggest reaction to the elections might be in currency markets, rather than in stocks, said Eoin Murray, head of investments at Federated Hermes.

“An outright Biden win and the assumption around stimulus: You might see the dollar drop,” said Mr Murray. If Mr. Trump wins a second term, “there’s a likelihood of more trade tensions and protectionism: you could see the dollar strengthen.”

Despite the focus on the election, the long-term implications are less significant than most think, said Jason Pride, the chief investment officer of private wealth at Glenmede.

The firm broke down market performance by presidential administrations going back to 1872 and discovered that the market’s long-term performance regardless of who held the White House and Congress was no more than 1 per cent to 2 per cent different than the overall average.

In commodities, US crude oil futures gained 2.3 per cent to $US37.66, following broader markets higher.

Overseas, the pan-continental Stoxx Europe 600 added 2.3 per cent on optimism about global economic growth prospects. In Asia, most major benchmarks advanced. The Shanghai Composite Index rose 1.4pc, and Hong Kong’s Hang Seng climbed 2pc. Japanese markets are closed for a holiday.

Dow Jones Newswires

7.50am: Pushpay lifts FY guidance

Pushpay, the ASX-listed operator of a donations app used by US churches, raised its full-year earnings guidance on strong growth and said it’s considering acquisitions to broaden its business.

Underlying earnings for the financial year ending March 31 are expected between $US54 million and $US58 million, the company, also listed in New Zealand, said Wednesday.

Online payment methods have gained in popularity because of the coronavirus pandemic. The company’s earnings have also been significantly boosted by its acquisition last year of a US church software business.

Pushpay reported first-half net profit of $US13.4 million, more than double a year earlier. First-half underlying earnings increased nearly threefold to $US26.7 million.

Pushpay said it is evaluating potential acquisitions that would broaden its business and add value to existing operations. It is also planning a four-for-one share split.

Dow Jones Newswires

Bridget Carter 7.01am: Nuix valued ahead of IPO

Forensic software company Nuix is worth between $2.4 billion and $3.4bn, according to analysts from Morgan Stanley.

The valuation estimates of the business including its debt come as the company has plans to launch an initial public offering in the coming weeks.

The pricing equates to between 12.5 and 17.5 times the company’s forecast sales for the 2021 financial year of $194m, growing at about 19 per cent annually over three years on a compound basis.

Nuix is part owned by Macquarie Group and is listing through Morgan Stanley and is 65 per cent owned by Macquarie Capital.

The business has been compared by analysts to high growth Australian software companies operating globally and profitable domestic digital companies.

Nuix has software that allows users to process and make sense of huge amounts of data.

It hopes to lock in cornerstone investors for its listing this week.

John Stensholt 6.44am: Rinehart’s Hancock posts massive profit

Gina Rinehart’s Hancock Prospecting has posted a monster $4bn profit, as iron ore prices surged and exports of the commodity to China showed little signs of slowing during the coronavirus pandemic.

The profit was one of the largest in recent Australian corporate history and came after revenue for Mrs Rinehart’s Hancock rose to $10.5bn and the business paid a huge $1.5bn in corporate tax for the year.

Hancock declared a $710m dividend to Mrs Rinehart and her family, compared with $483m last year, the group’s 2020 financial report obtained by The Australian reveals.

Profit for the business rose an impressive 60 per cent compared to 2019 and the amount of tax it paid rose almost $450m. Revenue was up 25 per cent.

5.40am: Wall Street extends gains as US goes to polls

US stocks rose as millions of Americans head to the polls, setting markets up for a second consecutive session of strong gains.

In early afternoon trade the Dow Jones Industrial Average rose 470 points, or 1.7 per cent, while the S&P 500 gained 1.6 per cent and the tech-heavy Nasdaq Composite added 1.6 per cent. After losing 5.6 per cent last week, the S&P 500 gained 1.2 per cent Monday.

Equities have generally done well under President Donald Trump -- the S&P 500 has surged 55 per cent since the 2016 election. But the market lately is being buoyed partly by bets that former Vice President Joe Biden will win the White House, and Democrats will take control of Congress.

The stock market usually feels more apprehensive about Democrats than Republicans, but “this is a unique year and a unique election,” said Solita Marcelli, the Americas chief investment officer at UBS Global Wealth Management.

Elections and stocks do have a relationship, though it’s impossible to say definitively which drives the other. For election years since 1928 in which the S&P 500 is positive in the three months before election day, the incumbent party has won 87 per cent of the time, according to brokerage firm BTIG.

Including this morning’s gains, the S&P 500 is up more than 2 per cent since August 3.

The market has warmed to the odds of a “blue wave” outcome, where one party wins both the White House and control of Congress, Ms Marcelli said, because it would make it more likely lawmakers approve a generous stimulus package to spur economic activity under the new administration.

If Democrats emerge as the winners, the government could spend an additional $US3 trillion to bolster the U.S. economy, said Stephane Monier, chief investment officer at Lombard Odier. That would give fresh impetus to a stockmarket rally that has waned in recent weeks.

A Biden win could mean “more fiscal stimulus, where we could get stronger growth outcomes and higher inflation,” said Seamus Mac Gorain, head of global rates at JP Morgan Asset Management. This would weigh on the government debt market, which tends to underperform in times of higher economic growth. “If we see a Democratic sweep, [10-year Treasury] yields could go up to 1pc or potentially higher,” he said.

The WSJ Dollar Index, which measures the greenback against a basket of currencies, declined 0.6pc to the lowest level in a week. The biggest reaction to the elections might be in currency markets, rather than in stocks, said Eoin Murray, head of investments at Federated Hermes.

Among corporate issues, shares of Alibaba Group Holding slumped 7.4pc after the Shanghai Stock Exchange postponed technology start-up Ant Group’s blockbuster initial public offering. Alibaba owns a 33 per cent stake in Ant.

In commodities, US crude oil futures gained 3.7 per cent to $US38.17, following broader markets higher.

Overseas, the pan-continental Stoxx Europe 600 added 2.2 per cent on optimism about global economic growth prospects.

In Asia, most major benchmarks advanced. The Shanghai Composite Index rose 1.4 per cent, and Hong Kong’s Hang Seng climbed 2 per cent.

Dow Jones Newswires

4.57am: Macquarie in Alaska takeover

Alaska Communications Systems Group has agreed to be bought by investment firms Macquarie Capital and GCM Grosvenor in an all-cash deal valued at about $US300 million, including debt.

The takeover will result in the Alaskan broadband and information technology-services company becoming privately held, with the transaction expected to close in the second half of next year.

Alaska Communications said Tuesday said the deal was an opportunity for the company to strengthen its financial position and better expand its resources.

“Macquarie Capital has a proven track record of delivering large and complex transactions globally on accelerated timelines, and GCM’s Labor Impact Fund provides strategy driven capital that we expect will generate real value for our customers and the Alaska Communications workforce,” David Karp, chairman of Alaska Communications, said.

Under the terms of the agreement, an affiliate of Macquarie and GCM will buy the outstanding shares of the company for $US3 each in cash, marking a roughly 57pc premium to the closing price Monday. The deal remains subject to the approval of Alaska Communications’ shareholders and regulators, the company said.

Dow Jones Newswires

4.55am: Spain offers Air Europa a lifeline

The Spanish government said it would offer a 475-million-euro ($US553-million) lifeline to Air Europa to help see the airline through the coronavirus pandemic.

The aid is to come from a 10-billion-euro fund set up in August to help strategic companies weather the crisis, government spokeswoman Maria Jesus Montero said after the weekly cabinet meeting.

“Air Europa provides an essential service to guarantee connectivity in Spain,” she said.

The firm, which serves long-haul routes to the Americas and the Caribbean, is the second-most popular Spanish carrier for international destinations, Montero said.

AFP

4.52am: Markets surge, dollar slumps as Americans vote

Global stock markets surged and the dollar weakened as Americans cast their ballots, with Republican President Donald Trump seeking to defy forecasts and defeat Democrat challenger Joe Biden.

The election is seen by Trump’s opponents as a referendum on his handling of the coronavirus pandemic in the world’s worst-hit nation -- which is now also experiencing a deadly resurgence.

Traders are looking at it largely through the prism of the election’s impact on the US economic response to the pandemic, in particular whether and how much stimulus could be expected.

Asian, European and US equities rallied, with traders betting on a Democratic sweep of both the White House and Congress that would likely herald a huge new economic stimulus package to fight the coronavirus crisis.

The US dollar slid against other major currencies, reflecting traders’ expectations of more stimulus money that would weaken the value of the greenback.

Meanwhile, oil prices jumped higher, clawing back more of their recent losses.

“The markets tempted fate on Tuesday, forgetting the lessons of 2016 as they pre-emptively celebrated a Joe Biden victory,” said Spreadex analyst Connor Campbell, referring to Trump’s surprise victory over Hillary Clinton four years ago.

“Choosing to ignore the slim -- but not slim enough -- likelihood of Trump winning a second term, the markets continued to aggressively rebound,” Campbell said.

“The main reason why a Biden win is so sought after from a market perspective, is that a ‘blue wave’ -- i.e. the Democrats crucially taking the Senate -- would see a stimulus plan far greater than anything Republicans would be willing to go for.”

Traders nevertheless remain fearful that a contested result could spell fresh market turmoil, legal chaos and even violent unrest in a nation already bitterly divided.

London closed up 2.3 per cent, Frankfurt rose 2.6 per cent and Paris added 2.4 per cent.

AFP

4.51am: French company abandons plans to import US gas

French energy group Engie said it had abandoned its plan to import liquefied natural gas (LNG) from the United States, a proposal which had met resistance from environmental activists and the French state.

“Engie has decided not to continue business talks with NextDecade on the project to supply gas,” an Engie spokeswoman said.

The company had been in talks on a nearly $US7 billion contract to supply LNG from a liquefaction facility that NextDecade plans to build in Texas to use the ample supplies of natural gas from fracking in the region.

While the imports would have reduced France’s dependence upon Russian gas, French environmentalists are strongly opposed to fracking and the process, which involves using explosives to create cracks in rock formations to release oil and gas deposits, is banned in the country.

The French state, which holds a 24 per cent stake in Engie, had also opposed the project.

“It doesn’t correspond to our climate transition policy,” said a government source.

AFP

4.48am: China’s Ant Group IPO postponed

China’s Ant Group must postpone its record-breaking IPO, the Shanghai Stock Exchange said, as the fintech giant co-founded by Alibaba’s Jack Ma faces growing pressure from Chinese regulators over potential risks.

The bourse decided to push back the $US34 billion listing originally set to take place in Hong Kong and Shanghai this week, citing concerns that Ant would “fail to meet the issuance and listing conditions or information disclosure requirements”, it said in a statement.

The notice comes after Ma and other executives were summoned to an unusual meeting with regulators on Monday, while state media have recently issued warnings about potential financial instability that could result from Ant Group’s rapid growth.

The firm, which has more than 700 million monthly active users, helped revolutionise commerce and personal finance in China, with consumers using the smartphone app to pay for everything from meals to groceries and travel tickets.

But Ant’s lending, wealth management and insurance ventures have also prompted concern in China’s state-controlled finance sector.

The Shanghai bourse said on Tuesday that the company had itself “reported major issues such as changes in the fintech supervisory environment”, and that concern over these unspecified issues had prompted the postponement.

AFP

4.45am: Writedowns, lawsuits push Bayer into fresh loss

Bayer has posted another huge loss due to steep impairment charges at its agrochemical division and increased legal costs over its glyphosate weed killer linked by plaintiffs to cases of cancer.

The German pharmaceuticals and chemicals giant made a third quarter net loss of 2.7 billion euros ($3US.2 billion), compared with a profit of 1.04 billion euros in the same quarter last year.

The results were well down on analyst estimates for 798 million euros in profit, according to the FactSet financial information service.

Bayer’s 63-billion-euro acquisition of US agrochemical group Monsanto, completed in 2018, has exposed the Leverkusen-based company to multi-billion euro suits over its Roundup glyphosate weedkiller while it has also been hit hard by the coronavirus pandemic.

The company said it would take a non-cash impairment charge of 9.3 billion euros due to “reduced growth expectations” on various assets in its agricultural business, as COVID-19 places “additional strain” on the unit, finance chief Wolfgang Nickl said in a statement.

Sales fell 13.5 per cent to 8.5 billion euros.

However, the quarterly result improves on the 9.5-billion-euro loss Bayer posted in the second quarter, which included provisions for more than $US10 billion (8.5 billion euros) in settlements for most lawsuits over Roundup announced in June.

AFP

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout