Reserve Bank’s shot in zero-sum rates game and $100bn bonds spree

RBA unleashes quantitative easing program in bid to secure nation’s economic recovery and drive down unemployment.

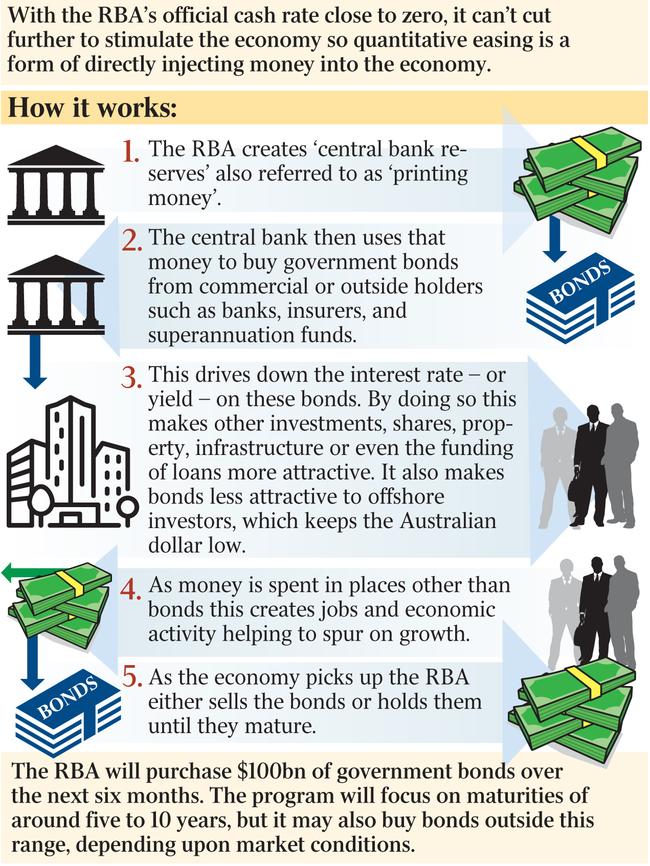

The Reserve Bank has slashed official interest rates to a record low of 0.1 per cent and will buy $100bn in long-term bonds as it unleashes a quantitative easing program for the first time, in a bid to secure the nation’s economic recovery and drive down unemployment.

RBA governor Philip Lowe on Tuesday indicated interest rates would stay pinned to the floor for between three and five years as Josh Frydenberg called on the banks to immediately pass on the rate reduction to mortgage holders and businesses.

Despite the RBA being effectively unable to lower interest rates further without moving into negative territory, Dr Lowe insisted the central bank was “not out of firepower” and was prepared to use “additional monetary policy options” if required.

Unveiling what he labelled a “significant new measure”, Dr Lowe committed to amassing $100bn in five to 10-year bonds over the coming six months, with the aim of lowering longer-term rates. The move will guarantee cheap money for banks and the government to underpin borrowing as the nation recovers from the pandemic.

Known as quantitative easing, or QE, economists said the commitment to buy about $5bn a week in commonwealth and state securities was also aimed at weakening the Australian dollar, which had been rising compared with other currencies as overseas central banks embarked on their own massive bond-buying programs.

In a statement accompanying the decision, Dr Lowe indicated the economic recovery was under way and a return to growth was expected for the September quarter. But he warned Australia faced two years of unemployment above 6 per cent and weak wages growth of less than 2 per cent.

The Treasurer said it was his “expectation that the banks will now look for ways to pass on those rate cuts — pass it on to small businesses, and pass it on to mortgage holders”.

Despite Mr Frydenberg’s demand, none of the major lenders had moved by Tuesday evening.

Dr Lowe echoed Mr Frydenberg’s call, saying the best outcome would be for standard variable rates to be lowered. “We would expect and hope these rate reductions get through to borrowers,” the RBA governor said.

The RBA predicts inflation will rise to 1.5 per cent by the end of 2022, well below the bottom of the central bank’s 2-3 per cent target range. Dr Lowe said rates would not rise until unemployment was below 6 per cent and inflation returned to the target range. “I certainly hope that the economy will be sufficiently strong sometime over the next five years to warrant an increase in the cash rate,” Dr Lowe said.

The bank expects GDP to lift by 6 per cent in 2020-21, up from the 4 per cent pace it predicted in August, with unemployment to peak at a little below 8 per cent by the end of the year — an improvement on its previous estimate of a 10 per cent jobless rate.

“We face the prospect of a long period of higher unemployment and underemployment than we have become used to,” Dr Lowe warned. “The board views addressing the high rate of unemployment as a national priority and it wants to do what it can to support job creation.

“This upgrade to the near-term outlook is clearly welcome news. At the same time though, we need to recognise that the pandemic has inflicted significant damage on our economy. It will take time to repair that damage and it is highly likely that the recovery will be uneven and drawn out.”

Dr Lowe strongly rejected arguments the bank was directly financing government spending through its bond-buying program, arguing it was lowering the cost of government finance and that it was prepared to do more if the circumstances demanded.

“We will continue to closely monitor the economic situation and the impact of our purchases on market functioning. If we need to do more, we can and we will,” he said.

Former prime minister Paul Keating said the RBA had “arisen from its monetary slumber” after lashing out at the central bank in September for not doing enough to stimulate the economy in the midst of the coronavirus recession.

Mr Keating said on Tuesday that, after “much gritting of teeth and after running monetary policy too tightly for half a decade or more”, the central bank had abandoned “its long, fruitless search for the inflation dragon”.

“This, no doubt, is designed to take pressure off the exchange rate, which overvalued, has cost thousands of jobs and diminished competitiveness over the last five to seven years,” Mr Keating said.

Lowy Institute senior fellow and former RBA board member John Edwards said the RBA governor had made a good and “courageous” decision to unleash QE in this country for the first time.

“I think it’s a historic decision and a very big contribution to Australia’s response to COVID,” Dr Edwards said. “It’s a courageous decision because it has involved changing a lot of the basic conventions that the central bank has followed for the last 30 or 40 years. And it’s a big decision because the RBA has not only offered to do a lot, but said it’s willing to do more.”

Dr Edwards said that pushing down longer term rates would help “keep a lid” on the Australian dollar, and most importantly, lower the cost of the government’s response to COVID.

Alongside the cash rate, Dr Lowe lowered the central bank’s three-year bond rate target — a measure it announced as part of an emergency COVID-19 monetary package in March — to 0.1 per cent. The new, lower rate will also apply to the RBA’s term funding facility, or TFF, which has so far provided $83bn in cheap money to banks. “At its core, today’s decision reflects the Reserve Bank’s commitment to do what we reasonably can, with the tools that we have, to support the recovery of the Australian economy,” Dr Lowe said.

Mr Frydenberg said the announcement by the RBA would reduce the cost of borrowing and was “good news for households, good news for small businesses”.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout