CBA, Westpac, NAB and ANZ will not pass on variable rate cuts to mortgage customers

The nation’s four biggest banks ignore calls to pass on all of RBA’s record-setting cut, holding firm on variable mortgages.

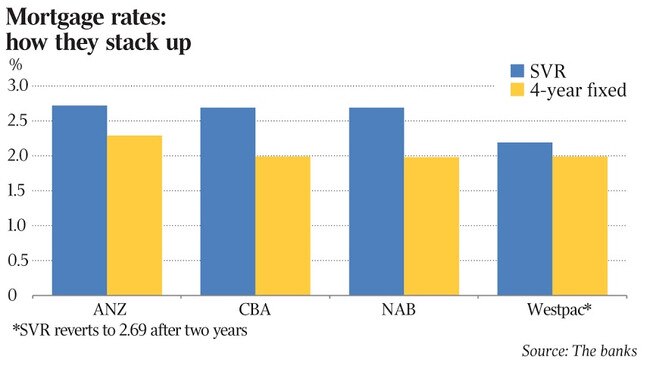

The major banks have piled onto the same strategy of not passing on an official rate cut to the majority of home loan borrowers, instead reducing fixed rate mortgage pricing and taking some of those loans below 2 per cent for the first time.

ANZ was the last of the major banks to join the well trodden path through Wednesday of holding variable mortgage rates steady, despite a 15 basis point cut in the cash rate by the Reserve Bank a day earlier.

With official rates not far off zero — at 0.1 per cent — the banks argue the hit to profit margins is too great to cut variable rates, given they are unable to reduce deposit rates much further. The counter argument is that they have access to cheaper funding via the RBA’s term funding facility.

Following the RBA’s decision to cut the cash rate to a record low on Tuesday, Commonwealth Bank was first among its peers to announce on Wednesday the lower pricing, cutting four-year fixed rates on owner-occupier loans by 100 basis points to 1.99 per cent.

The reduction marks the bank’s lowest advertised mortgage rate and comes as more borrowers take up fixed home loans due to record low official interest rates, which will remain close to zero for at least three years. The majority of existing mortgages across the banking system — or 70 per cent to 80 per cent — are, however, in variable rate products.

In its financial results for the 2020 financial year, CBA reported variable rate mortgages accounted for 77 per cent of home loan lending.

Westpac, National Australia Bank and ANZ followed CBA’s lead on Wednesday, leaving their variable home loan rate unchanged but cutting fixed home loan interest rates as well as pricing on loans for small businesses.

The changes see some big bank fixed rates fall below 2 per cent and Westpac offering the lowest fixed rate in the market — at 1.89 per cent for a four-year fixed mortgage with a deposit at least 30 per cent — according to RateCity.

CBA’s reductions included a 15 basis point cut to 2.14 per cent on two- and three-year fixed rate home loans for owner occupiers paying principal and interest in the wealth package, and a decline of 51 basis points to 3.99 per cent on unsecured business loans rates through the government’s SME loan guarantee scheme.

CBA’s retail banking chief Angus Sullivan highlighted the bank was still managing COVID-19 repayment pauses and had vowed to not repossess the homes of borrowers that were on time with payments prior to the pandemic if they were unable to restart after March. CBA’s pledge runs until at least September 2021.

Westpac reduced a string of fixed rate mortgage rates and said new small business customers on the government’s coronavirus SME loan scheme could receive a fixed interest rate of 2.38 per cent for terms of three-to-five years.

“We recognise it has been a tough time for many Australian households, and these changes mean that customers will be able to access even lower interest rates on our home loan and small business loans,” said Westpac’s consumer division acting chief executive, Richard Burton.

“However, we are in an extraordinary period with the official cash rate at a historical low and unconventional monetary policy measures in place. It is critical we carefully manage interest rate changes.”

But big banks have shrugged off calls by the RBA governor and Treasurer Josh Frydenberg on Tuesday urging them to pass on the RBA’s record-setting rate cut. A handful of small non-bank lenders did announce reductions to their variable rates on the afternoon of the central bank’s announcement.

“I would expect and hope that these interest rate reductions get passed through to all borrowers,” RBA governor Philip Lowe said on Tuesday. “I think the best outcome would be for standard variable rates to be lowered, but if that doesn't occur I am confident that there will be pass through occurring through renegotiating and switching.”

NAB said its four-year fixed rate home loan would be cut 81 basis points to 1.98 per cent per annum, effective from November 10.

NAB, Australia’s biggest business bank, will also cut 200 basis points from the rates on its unsecured QuickBiz Loan for the next three months.

ANZ is decreasing its fixed home loan rates across one- to five-year terms by between 0.2 per cent to 0.4 per cent, for owner occupier customers paying principal and interest. The bank also made a price reduction for loans under the government’s SME scheme.

RateCity research director Sally Tindall said many of CBA’s variable customers would be disappointed by the bank’s decisions to not pass on the RBA’s rate cut.

“A lot of people who don’t want to fix their home loan, don’t like that it is less flexible and might not want to keep their home for four years,” she said.

But Ms Tindall did acknowledge fixed home loans were growing in popularity.

“CBA data shows 40 per cent of new home loans are fixed,” she said.

“The home loan market was that traditionally customers opted for a variable, which is changing, but there are still hundreds of thousands of mortgage owners on a variable rate.”

NAB personal banking executive Rachel Slade said: “These changes are designed to provide certainty to our customers with our lowest fixed rates ever, boost confidence and support credit recovery.

“This is the sixth reduction in the cash rate during the past 18 months. With interest rates at record lows we are doing what we can to support homebuyers and business owners through COVID-19, while also balancing the impact on our deposit and savings customers.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout