Where the RBA rate cut will make a difference

Record low interest rates could underpin a rebound in consumer spending and see funds pour into the residential property.

The Reserve Bank‘s move to slash interest rates to record low levels is expected to underpin a rebound in consumer spending and see funds pour into the residential property.

The rate cuts laid out on Tuesday are intended to lay the ground for a broader recovery from the coronavirus crisis with governments also seeking to spark business investment and urging banks to pass on lower finance costs.

The COVID-19 pandemic has already fuelled a spending bonanza at retailers like Harvey Norman, with consumers spending up even while in lockdown.

“It’s been huge, huge. We put out a profit guidance for July/August and we were up 185 per cent profit on last year. If we were up 10-20 per cent, that’s huge. 185 per cent for two months is extraordinary,” Gerry Harvey told The Australian.

“The sales in retail out there at the moment, have never been anything like as good as they are at the moment ever in history.”

But Mr Harvey said it was unlikely the RBA cutting interest rates to a record low of 0.1 per cent would stimulate spending further, and said Australia was heading in the same direction as Japan, which deployed its first quantitative easing in 1997.

“I don’t think it will turbocharge it (spending) because it’s not that big of a rate cut. When you go from 0.25 to 0.1 per cent, it’s hardly a big rate cut. It will help, but won’t make that big of a difference.

The billionaire retailer warned that global interest rates had fallen to unprecedented levels, creating uncertainty about the direction of major economies.

“Now you have got a situation where this is happening pretty much across the Western world – America and Europe and Asia. Everyone is pretty much on zero interest rates,“ he said.

“It (Negative interest rates) has been happening in Japan for 20 or more years. It’s been a phenomena in Japan for such a long time. The same thing could happen here – we could all follow Japan or maybe we’ll come out of it. No one knows.”

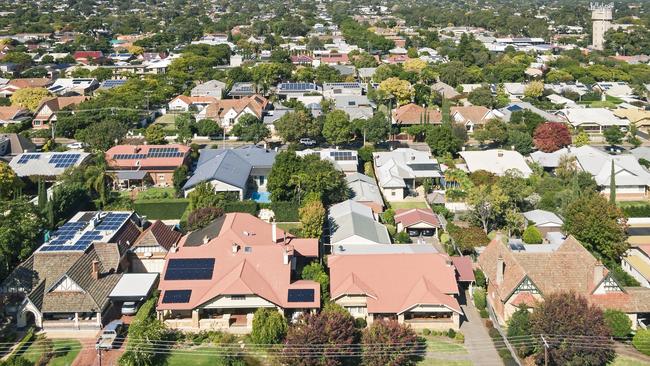

Historically low interest rates are also tipped to spur a jump in Sydney and Melbourne home prices with established housing and land estates on city outskirts expected to see heavy flows.

The cut to interest rates is a fresh spur for the market, which has already seen rising auction clearance rates and a lift in borrowing, with the government promoting the property sector as sparking broader economic activity.

The loser monetary policy may come up against the cutting back of support measures early next year, however a large pool of borrowers is expected to buy property, staving off what could have been a deeper crisis for the sector.

Ray White managing director Dan White said the central bank had taken a pre-emptive and forward looking approach in setting interest rates.

“This rate cut will help our customers who have been struggling in this economy and particularly during COVID,” he said.

Mr White said the residential real estate market was performing at a high level, and the rate cut came on the back of the group’s biggest month of sales.

Despite the lockdown in Victoria and the state election in Queensland, Ray White had a 30 per cent year on year jump in sales in October to $5.7bn.

Mr White said the RBA knew the property market was “one of the central pillars in the Australian economy” and called on banks to pass on the full cut.

The impact of the RBA‘s rate cut would become clearer in coming weeks, according to First Sentier Investors.

The firm’s head of fixed income, short term investments and global credit, Tony Togher, said banks would need to determine the margins they feel were necessary to pay on their various deposit products.

“Lenders will need to determine what metrics will need to be built into their lending margins, and what level of competition will likely be forthcoming as mortgage rates are reduced to all time low levels,” he said.

Economists noted that the Reserve Bank had also unveiled a shorter six month time frame over which its $100bn quantitative easing program would be deployed and they expect further measures.

Deutsche Bank economist Phil O‘Donaghoe said it was “virtually impossible” that the RBA would be in a position to simply end its intervention after six months.

“Our early expectation is that it will be replaced with another program, for another six months. Assuming the first is successful, we assume for now the second will be smaller, and we would consider a tapered ‘QE Mark II’ program as a measure of success,” he said.

The residential property sector is expected to be driven by cheaper funds with forecasts that banks can offer three to five-year fixed rate deals at well below two per cent.

Managing director of property investment company Custodian James Fitzgerald predicts a home price surge in coming years.

“The bottom line is with homebuyer stimulus, median house prices in Australia will accelerate to $1m as early as 2023,” he said.

BetaShares chief economist David Bassanese said the RBA had changed its policy approach and called out the potential risk of unleashing a major bubble in both house and equity prices.

“Fear of the impact of persistent low interest rates on the financial system has been jettisoned, as has the fear of creating runaway asset prices,” he said.

Home listings have already come back in the last two months as prices hold in most major capital cities. The lift in listings, reported by research house SQM Research, is being driven by the gateway markets of Sydney and Melbourne.

The surge sets the scene for a late spring selling season that could flow over into December and elevate housing activity early next year.

“It seems like we are moving back to the usual spring selling season with all capital city listings rising in October,” said SQM managing director Louis Christopher.

“Melbourne in particular, has bounced back in a big way after the relaxing of stage four restrictions. In fact, we are expecting another big rise in listings during the month of November for Melbourne.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout