ASX trims annual loss to 10.9pc as Aussie dollar dives

ASX adds 1.4%, not enough to save it from the first negative return since 2015-16, while the $A sinks on new Victorian restrictions.

- Labour market recovery stalling: ANZ

- More insolvencies to come: Debelle

- Macquarie slashes gold miners

- WiseTech chief sells down $41m stake

Welcome to the Trading Day blog for Tuesday, June 30. The ASX added 1.4 per cent in the final day of the financial year, but still rounded out the year down 10.9pc. The Aussie dollar took a hit in afternoon trade, falling almost 30 points as Victoria implemented harsh new restrictions in some postcodes.

In local news, deputy RBA governor Guy Debelle said the bank was ready to scale up bond purchases, while a lift in local KFC sales has sent Collins Foods up 14pc.

8.15pm: Britain firm on trade deal

Britain’s government says it will not compromise on the country’s health service, environmental protection, animal welfare and food safety standards in talks with the United States about a post-Brexit trade deal. “Any deal the government strikes must be fair, reciprocal and ultimately in the best interests of the British people and the economy,” trade minister Elizabeth Truss said after a second round of talks with Washington.

“Furthermore, the government remains clear on protecting the NHS (National Health Service) and not compromising on the UK’s high environmental protection, animal welfare and food safety standards.” Truss reiterated that London was not in a rush to get a trade deal with the United States.

“The government is clear there is no set deadline for this agreement,” she said. “Quality is more important than speed.”

Reuters

Perry Williams 8.07pm: Shell blames Aussie LNG for huge writedown

Energy giant Shell said several of its high profile Australian gas projects were to blame for a massive $US8bn to $US9bn ($A11.7bn-$A13.2bn) writedown triggered by lower prices amid a Covid-19 demand shock.

The energy major - one of Australia’s biggest gas producers and foreign investors - will take an impairment of up to $US22bn on its global assets.

The largest write-downs were sparked from its gas business with the $US8-$US9bn figure attributed primarily to Australia including a partial impairment of its Queensland QGC unit and troubled Prelude floating LNG project offshore northern Australia.

The writedowns follow rival BP which took an impairment of up to $US17.5bn after cutting its oil price assumptions by up to 30 per cent out to 2050.

Shell expects Brent oil prices to average just $US35 a barrel this year and $US60 a barrel in the long term, sparking concern that crude may remain at depressed price levels for an extended period as fears grow over the economic hit from a drawn out coronavirus recovery.

Australian oil and gas producers are expected to follow global majors in suffering writedowns in the coming months due to lower oil and gas prices, Macquarie had warned on Tuesday.

Read more: Shell blames Australian gas projects for huge writedown

James Kirby 6.40pm: A tricky year for tax returns

Doing this year’s tax returns is going to come with a twist for many residential property investors: They will be claiming interest on loans on which they have not paid a cent in recent months.

Since March 20 this year property owners who faced crisis related difficulties such as tenants not paying rent - did not have to pay banks their ongoing interest bills: Rather they could defer those payments until after September 20.

It is estimated that at least one third of all ‘deferred’ mortgages in the system are relating to investors rather than owner occupiers (In the last official count, three months ago the system wide total of deferred mortgages was $165 billion)

In short the pandemic crisis and the government’s parallel banning of evictions meant the traditional dynamics of property owner and tenant were turned upside down in FY 20.

It’s what you might call the accidental capitalisation of interest in the residential property sector and it’s going to have major ramifications, obviously for the banks - in terms of defaults and impairments - but less obviously for everyday investors who may not be used to being able to defer anything when it comes to the ATO.

The ATO has made an exception and allowed investors to claim the unpaid interest as it does not cross anti-avoidance rules.

But advisers are warning not to see the ATO allowance as a gift but rather a chance to build a buffer for more difficult days ahead when the accumulated interest bills become due in an environment where property prices are softening.

‘It’s a useful development and there is the principle there already in business ownership that you can claim interest due, but the issue for residential investors is not to spend it - this is the chance to build your cash buffer, that’s what they need to do.” says Andrew Zbik at Creation Wealth.

The problem is the payments are deferred not deleted.

Read more: Why FY2020 tax time could be tricky for property investors

Ben Wilmot 6.08pm: Commercial property ready to bounce back

Commercial property volumes could plunge to about a third of the record levels seen last year as the market slowly unfreezes from the coronavirus crisis.

The dramatic restrictions imposed on economic activity in March effectively derailed about a dozen major deals around Australia, with values plunging particularly for major regional malls and they are all but unsaleable until retail chains pay rent again.

But there are signs of recovery in the logistics market and even for select office towers in capital cities, according to real estate agency JLL, which argues the market is finding its feet after the crisis.

There has been a run of recent deals with Dexus selling a $530m Sydney tower at book value and Macquarie Group engaging with Investa to sell its planned $800m building above Martin Place metro station. On the logistics side Charter Hall, backed by Allianz, snapped up the Aldi portfolio for $648m.

A new report from JLL firm argues that there will be an earlier pathway back towards pre-crisis transaction volumes for commercial property once COVID-19 is contained than experienced in the wake of the GFC.

5.47pm: Mixed start for Europe, UK markets

Europe’s major stock markets wavered on Tuesday in cautious opening deals, despite rebounding share prices in Asia.

In initial trade, London’s benchmark FTSE 100 index of blue-chip firms dropped 0.3 per cent to 6,206.92 points, while Frankfurt’s DAX 30 index added 0.1 per cent to 12,248.33 points and the Paris CAC 40 was also up 0.1 per cent at 4,948.37

5.17pm: Energy jumps while REITs dive

A boost to energy stocks was a key driver of the market bounce on Tuesday – the sector adding 4.3pc as oil rose on bullish data.

Woodside jumped 5.3 per cent to $21.65 as Oil Search added 5 per cent to $3.17, Santos put on 5 per cent to $5.30 and Beach Energy gained 5.9 per cent to $1.52.

In the major miners, BHP added 1.2 per cent to $35.82, Rio Tinto edged higher by 0.7 per cent to $97.96 and Fortescue lifted by 0.7 per cent to $13.85.

Brickworks surged 6.3 per cent to $15.83 while Goodman slipped alongside the rest of the REIT sector, losing 1.2 per cent to $14.85 as the two real estate trusts inked a deal to develop Amazon’s mega robotic distribution centre in Sydney.

Here’s the biggest movers at the close:

5.15pm: Annual drop but record quarter

While the 10.9pc annual drop on the ASX is disappointing, it is worth noting the quarterly rise represented a 16.2 per cent gain from the pandemic wipe-out in March – the benchmark’s best since the September quarter in 2009 thanks to three consecutive monthly gains.

That comes after the market’s worst March quarter since the GFC, when the market lost 24pc.

David Swan 4.45pm: Etherstack rockets higher by 1400pc

The ASX has slapped software maker Etherstack (ASX: ESK) with a speeding ticket, after the company’s share price soared by 1400 per cent on Tuesday following an announcement with tech giant Samsung.

Etherstack said it had landed a “global teaming agreement” with Samsung to “deliver mission critical push-to-talk (MCPTT) technology over long-term evolution (LTE) solutions to telecommunications carriers and governments across the globe”.

Its shares skyrocketed from 18 cents and went as high as $2, before closing at $1.64, up about 1360 per cent.

“We recognised Etherstack’s unique technologies and experience in the global LMR market, so they were the obvious choice to partner with in the MCPTT market,” Samsung Electronics’ Senior Vice President and Head of Product Strategy, Networks Business Wonil Roh said as quoted in Etherstack’s press release.

“Etherstack’s global footprint in mission critical markets and innovative technologies, as well as its commitment to open standards, will allow us to deliver premier solutions to the world’s mobile carriers for MCPTT.”

The ASX requested additional information, and the company issued a statement that “the Global Teaming agreement is expected to have an initial period of two years and contains conditions under which the agreement may be extended for a further period of two years.

4.12pm: Shares trim FY20 loss

Local shares powered higher to close out the financial year, but the surge did little to dent a 10.9 per cent annual drop – the market’s first negative return since FY15/16.

A late afternoon surge sent the ASX200 higher by as much as 2.4pc but by the close the index was higher by a more moderate 83 points or 1.43 per cent at 5897.9.

On the All Ords, shares added 86 points or 1.45 per cent to 6001.3.

4.03pm: Aussie dollar falls on VIC lockdown

The Aussie dollar had been trading higher in the afternoon session, but fell back to flat on news of renewed COVID-19 restrictions in parts of Victoria.

Premier Dan Andrews this afternoon announced a lockdown of hot spot postcodes from 11.59pm on Wednesday, until at least July 29, with police to patrol suburbs and fine those not adhere to the guidelines.

AUDUSD spiked to US68.85c earlier this afternoon, but has pared any gains to trade lower by 0.05pc to US68.61c.

Read more: Victoria imposes lockdowns with police patrols

3.35pm: Shares surging to EOFY

Australia’s share market is surging into financial year end.

In the final hour the S&P/ASX 200 has extended its gain by 1pc.

The index is up 140 points or 2.4pc at a 3-day high of 5955.2.

The energy sector is leading with Woodside up 6.2pc. Woodside is the 22nd-worst performing stock in the financial year to date.

Sydney Airport is up 4pc after falling 32 in the financial year to date. But investors are also buying some of the winners. Afterpay and James Hardie are both up about 7pc.

Perry Williams 2.42pm: Macquarie warns of energy writedowns

Australian oil and gas producers are expected to follow global majors in suffering writedowns due to lower oil and gas prices, Macquarie has warned.

The nation’s top producers have typically used $US70-75 a barrel for impairment testing purposes compared with Brent crude which is trading at $US41 currently, following several months in sub-$US30 territory earlier this year.

“Following some high profile impairments in the global energy sector recently, we expect the Australian energy sector to face heightened impairment risk this half,” Macquarie said.

BP took a writedown of as much as $US17.5bn earlier in June after cutting its oil price assumptions by 30 per cent out to 2050 while in Australia, Shell and PetroChina’s Arrow Energy took a $520m impairment on their gas business.

Futures markets now indicate a long-run price of under $US50 a barrel out until 2023 compared with Woodside Petroleum’s $US68 a barrel forecast in 2022 and Santos’ $US72 a barrel price.

Auditors may struggle to justify signing off company accounts on June 30 which continue to project prices well over double current levels, according to industry sources, which could spell major impairments either for the industry at interim or year-end reporting dates.

Capitalised oil and gas assets total $52bn among the big Australian producers Woodside, Santos, Oil Search and Beach Energy, industry analysis shows, while exploration and evaluation assets total more than $12bn for the same four companies.

Macquarie lowered its 2020 oil price forecast to $US43.75 and its 2021 estimate to $US49.50 with a long-term Brent price unchanged at $US56 a barrel.

Read more: BP may abandon oil assets in rapid green shift

2.10pm: Goodman, Brickworks cheer Amazon deal

ASX-listed Brickworks and Goodman are cheering a deal with Amazon to lease the joint venture’s new distribution development.

Amazon announced the move this morning, set to be the country’s largest roboticised warehouse, which it will lease from a joint venture of the two listed real estate companies for at least 20 years.

“On 14.9 hectares of land, and a base floor area of 53,500 sqm, the 26-metre high-bay facility will comprise three mezzanine levels providing a total of 191,170 sqm of usable floor space,” Brickworks said.

BKW shares are higher by 5.8pc to $15.75 while GMG is slipping by 0.7pc to $14.93.

Read more: Amazon makes massive Sydney robotic logistics move

David Ross 1.51pm: More insolvencies to come: Debelle

Deputy RBA governor Guy Debelle says the bank and APRA were mindful of increasing insolvencies from businesses in the period ahead, despite liquidators so far finding themselves largely unneeded.

“They’re concerned they’ve not got enough work. They’re not quite there yet but give the size of the downturn it’s going to come,” he said.

Mr Debelle warned of the impact job losses across the economy could have on future wage earnings.

“The scarring effects of unemployment absolutely it’s going to have an impact going forward,” he said. “This has been a major event in the economy it is going to have long-lasting effects.”

But he said the Job Keeper scheme was doing well to keep a lid on unemployment.

“If you maintain the attachment between a business and workers then that potentially reduces some of the impacts,” he said

Read more: September end to wage support ‘a problem’

1.34pm: Labour market recovery stalling: ANZ

ANZ economists have described this week’s meagre 0.1pc lift in payroll jobs as a “worrying sign” that the labour market recovery may be stalling.

Senior economist Catherine Birch notes the 0.1pc rise for the fortnight to June 13 is just a fraction of the 0.9pc average from the previous three fortnights.

She adds that jobs declined in NSW, Victoria, Northern Territory and the ACT.

“The latest data ended before Victoria’s surge in COVID-19 cases, which is already affecting spending in Victoria and consumer confidence more broadly,” Ms Birch writes.

“Unfortunately this will likely further undermine the labour market recovery in Victoria and more widely.”

Read more: 30pc of COVID-19 job losses recovered

David Ross 1.22pm: Downturn will be long-lasting: Debelle

Reserve Bank deputy governor Guy Debelle has warned that while the global economic downturn has not been caused by traditional factors, it was still likely to be long-lasting.

Speaking in a webcast from his office at the RBA, Mr Debelle said that while much of the economic support was on the fiscal side, the bank would look to keep borrowing costs low and credit available and stood ready to do more if needed.

But Mr Debelle also warned that an end of government support in September would be a significant issue.

“If everything ceases at the end of September, yes that would be a problem,” he said.

Mr Debelle said the risk of generating excessively high inflation was unlikely, even as the RBA pumps further liquidity into the system.

“Indeed, the opposite seems to be the more likely challenge in the current economic climate, that is, that inflation will remain below the RBA’s target,” he said.

“Nor do I see any issue at all with the capacity of the Government to repay the bonds it has issued.”

“There are no concerns at all about fiscal sustainability from increased debt issuance. This is because growth in the economy will work to lower government debt as a share of nominal GDP.”

RBA: "the Reserve Bank will maintain the current policies to keep borrowing costs low and credit available, and stands ready to do more as the circumstances warrant."#ausbiz #ausecon @CommSec #CommSec @RBAInfo

— CommSec (@CommSec) June 30, 2020

1.01pm: Collins leads, WiseTech lags

Local shares are trimming gains across all sectors bar health care, as global markets follow Wall Street’s strong lead.

At 1pm, the benchmark ASX200 is higher by 1.3pc or 76 points to 5890, after hitting a three-day high of 5925.7 in early trade.

The banks are a key driver – led by a 1.6pc lift in Westpac, while Afterpay adds 4.7pc and Qantas regains ground with a 6.5 per cent jump.

Collins Foods is the best performer after reporting a profit lift for the full year, while WiseTech is lower by 2.8pc as chief Richard White sold down a $41m stake in the group.

Here’s the biggest movers at 1pm:

12.49pm: Jobs recovery hitting hurdles: RBC

A slight improvement in weekly payrolls data suggests the local economic recovery could be hitting some hurdles already, according to RBC.

Macro rates strategist Robert Thompson notes the 0.1pc lift in payrolls sill leaves the index 6.4pc from its mid-March peak, even as it recovers from an initial fall of 8.8pc collapse in April.

“The pace of recovery has clearly slowed, though, which may be a sign that a quick recovery in the labour market as lockdowns ease is not necessarily on the cards, and further highlights the importance of supplementary wage support via the JobKeeper and JobSeeker programs,” Mr Thompson says.

“We still expect the next few labour force surveys to show some rebound in jobs, and mathematically this remains on the cards, but we’re currently looking at a very fragile recovery.”

Read more: 30pc of COVID-19 job losses recovered

James Glynn 12.39pm: RBA ready to scale up bond buying

The Reserve Bank of Australia stands ready to scale up its government-bond purchases if the economy weakens further, Guy Debelle, deputy governor of the central bank, said Tuesday.

The impact of the coronavirus pandemic on the economy has been significant and will be felt for some time, requiring support from both lower interest rates and expanded government spending to continue, Mr Debelle told a conference of economists.

“While much of that support is likely to be on the fiscal side, the Reserve Bank will maintain the current policies to keep borrowing costs low and credit available, and stands ready to do more as the circumstances warrant,” he said.

Recent economic data have indicated the economy hasn’t been hit as hard as initially feared, but the impact has nevertheless been historically large, Mr. Debelle said.

“The fiscal and monetary support that has been provided was, and remains, warranted,” he said.

Dow Jones Newswires

12.35pm: Strong quarter bodes well for shares

A strong rise in Australian shares this quarter bodes well for the next quarter on a purely statistical basis.

The S&P/ASX 200 share index is up 16.3pc this quarter, putting it on track for its best quarter since Q3 2009, when it rose 20pc. Indeed this will be the second-strongest quarter since the inception of the index in 2000.

The longstanding All Ordinaries index is up 17.5pc, which is also its best quarter since 2009.

Since 1935, the All Ords has risen more than 15pc in a quarter only 13 times. In 70pc of those occurrences, the next quarter has been positive. The average quarterly gain after a rise of more than 15pc is 10.8pc.

One of the negative observations, after a quarterly rise of at least 15pc, occurred in the run up to the ‘87 Crash.

At that time it fell 41pc in the quarter after a 27.4pc quarterly rise. Another negative observation was in 1969, when it rose 27pc, then fell 12.5 the next quarter.

12.05pm: NAB preferred on MLC sale: Jefferies

Jefferies has singled out National Australia Bank as its top pick in the sector noting the bank’s positive earnings, capital leverage to a stronger Aussie dollar and potential sale of its wealth unit.

In a note cited by Bloomberg, influential banking analyst Brian Johnson noted that he was underweight on the sector, but NAB was the best pick given its lower exposure to high loan-to-value ratio housing and more focus on well secured small to medium businesses.

The broker added that the sale of the MLC wealth unit may help release to tier 1 capital, while shedding around $2.3bn of goodwill and boosting its return on equity.

Mr Johnson says banks are priced for a V-shaped recovery but the impact of COVID-19 on bank loan loss cycles could be more U-shaped.

NAB shares are higher by 1.6pc to $18.40.

11.57am: Consumer, business credit slips

Total credit issued in May fell by 0.1 per cent, as business and personal lending fell by 0.6pc and 1.2pc respectively.

The figures from the RBA show housing credit was the only to maintain positive growth at a steady 0.2pc for the month.

On a year-ended basis, personal lending was down 10.2pc, while business lending was up by 5.9pc.

Patrick Commins 11.49am: Payrolls show jobs recovery

Australia has recovered around 30 per cent of the jobs lost in the immediate aftermath of the COVID-19 pandemic, new payroll figures show.

Using the middle of March as the baseline – when the country recorded its 100th coronavirus case – job losses peaked at 8.8 per cent by mid-April, and having been tracing a gradual recovery since, the latest payrolls report from the Australian Bureau of Statistics show.

There was a 1 per cent increase in the number of jobs over the month to June 13, to leave 6.4 per cent fewer roles since March.

The sectors hardest hit from the lockdowns have shown the sharpest rate of recovery as restrictions have been eased in recent weeks, although they remain heavily depressed.

Payroll jobs for the under-20s were up 4.1 over the month to June 13. There was a 3.8 per cent lift in the number of jobs in the accommodation and food service sector – although there are still 29 per cent fewer roles than in March.

Payrolls data highlighting that after a bit of a surge in May recovery in employment is slowing (no signif increase in jobs over first half of June). Not unexpected, given no major relaxation in restrictions recently, but does highlight that full recovery will be a long slog

— Sarah Hunter (@sarahjhunter84) June 30, 2020

11.40am: Collins Foods soars on FY20 results

Collins Foods, the owner of KFC in Australia and Europe, as well as the local Taco Bell franchise rights, is soaring by 17 per cent in morning trade, after posting revenue uplift for the year and setting out plans to grow its local footprint.

The group booked earnings of $175.6m for the financial year, and a 5.1pc lift in underlying net profit to $47.3m.

CKF shares are higher by 17.2pc to $9.80 in early trade.

Local KFC sales were a key contributor to the strength with same store sales up by 3.5pc, while its Taco Bell expansion “continues amid high brand engagement, with recent shifts toward drive-thru and delivery channels”.

The group said its Sizzler branded restaurants were worst hit by the pandemic, with revenues down 18pc due to dine-in restrictions.

“Across the KFC Australia business, we will continue to expand the delivery network and build on the consistent growth in app and e-commerce channels. We are targeting 9 – 12 new restaurant builds in FY21 which will feature strengthened and streamlined operational systems and innovation to improve the customer experience, and we will continue to look for ways to accelerate our growth through organic development and acquisitions where possible,” the company said.

Gerard Cockburn 11.32am: Red tape restricting advice access

Peak bodies for financial advisers says regulatory red tape is putting off Australians from obtaining financial planning advice.

Both the Association of Financial Advisers and the Financial Planning Association of Australia told a House economics committee on Tuesday that the economic viability of offering affordable advice is strained under current rules imposed after the banking royal commission.

AFA noted a conservative estimate of the minimum cost of producing a financial plan is roughly $2700, a figure it says is a barrier to broadening access to more people.

“We obviously want to see as many Australians being able to access financial advice,” AFA chief executive Phil Kewin said.

Deputy chair and Labor MP Andrew Leigh noted both the AFA and FPAA had previously opposed changes to financial advice laws, in particular the rules around grandfathered remuneration arrangements, which are scheduled to be banned from the industry in January 2021.

FPAA also flagged professional licensing for financial advisers should be centralised to one qualification body, so standards are uniform across the sector.

11.15am: Freedom Foods boss resigns

Freedom Foods boss Rory Macleod has resigned from the health food company, in the wake of a widescale accounting blunder by the group.

In a brief statement to the market, Freedom said Mr Macleod had resigned from all board and executive positions, after being forced to take leave from the top job last week.

The company added that it had engaged Ashurst and PwC to “advise and assist with ongoing investigations into the company’s financial position”.

Last week, the group said it would write down another $10m of stock, bringing total losses to $60m this year.

FNP shares are halted at $3.01.

Read more: Freedom Foods increases writedowns and cuts staff

Bridget Carter 10.55am: New bids could emerge for Infigen: Ords

DataRoom | The takeover tussle for Infigen Energy could be far from over, say analysts in an Ord Minnett research report, adding that new players could enter the contest.

They say that large exploration companies could be interested in Infigen, noting Shell and Total are looking to enter the Australian retailing market.

It comes after UAC Energy this week lifted its bid for the renewable energy provider to 86c per share from 80c per share, matching the price of an offer already on the table by Iberdrola, although UAC had dropped all of its conditions.

But Iberdrola soon responded with an improvement to its price – lifting its 86c per share bid to 89c.

“Ord Minnett’s view remains that the offer prices look full, representing close to replacement cost, although there is the possibility of further price action with both parties showing clear and ongoing interest,” the analysts said in a research note.

IFN last traded at 91.5c.

Read more: Iberdrola lifts offer in hot battle for Infigen

Ben Wilmot 10.42am: Fletcher Building to pay down debt

Fletcher Building on Tuesday announced it plans to make an early repayment of $US300m of US Private Placement notes.

Chief executive Ross Taylor said the notes, which were issued in 2012 and due to mature in 2022 and 2024, were the company’s most expensive source of debt, with an average cost of funding of 5.4 per cent.

Repayment of the notes would reduce Fletcher’s funding costs by $NZ17m per year, while still leaving the company with significant liquidity of about $NZ1.1bn.

The repayment includes a “make whole” cost as a result of the early termination of the debt, to be partially offset by a receipt by the company from the favourable unwind of its interest rate derivatives.

The net cost of these two amounts is expected to be about $NZ30m, which is included in the total expected repayment of about $NZ350m.

The early repayment costs are more than offset by the avoidance of about $NZ40m of future interest payments.

FBU last traded up 3pc to $3.43.

Read more: Fletcher Building to cut 1500 Australian jobs

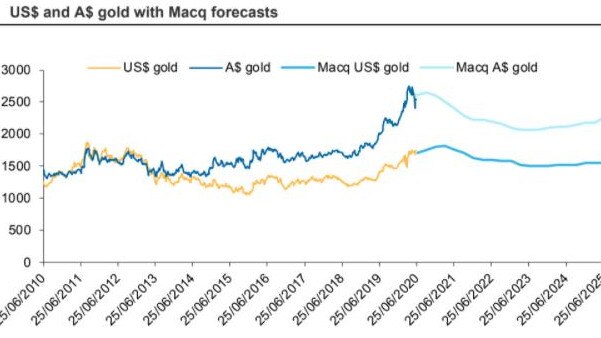

10.31am: Currency takes shine off Aussie gold: Macq

Macquarie Equities has downgraded a number of gold miners after a strong rise in the sector, and as the local dollar holds recent strength.

“Our expectation of continued strengthening of the $A puts a break on earnings,” the broker says, noting potential for earnings risk if the dollar strengthens past US70c.

“This is amplified by our expectation of a disrupted June quarter and that for most, production growth in FY21 is likely to be limited.”

Still, the broker lifts its gold price forecast for CY20 by 5pc and by 2pc in CY21.

Newcrest, Regis, Resolute, St Barbara, Capricorn Metals, West African Resources and Dacian Gold were cut to Underperform, while Saracen Minerals and Alacer Gold were cut to Neutral.

Eli Greenblat 10.25am: RFG escapes ASIC enforcement action

Retail Food Group Limited will not face any enforcement from the corporate regulator following a lengthy investigation into its franchise businesses.

ASIC had issued notices under section 30 of the ASIC Act in relation to an ASIC investigation of potential contraventions of the Corporations Act prior to 25 September 2018, and in respect of a subsequent notice, 9 July 2019.

But those investigations have now concluded with no further action to be taken.

“The company has been advised by ASIC that ASIC has concluded its investigation and has decided that it will not take any enforcement action following its investigation,’’ Retail Food Group said in an ASX statement.

“No inference should be drawn from ASIC’s decision to conclude its investigation without taking enforcement action. ASIC may also recommence its investigation, or commence enforcement action, if circumstances change.”

Retail Food Group faced a string of investigations by ASIC, the ACCC and the ATO following a number of financial and operational scandals at the food group and a collapse in its share price.

Read more: ACCC ‘prolonging RFG investigation’

10.10am: Shares make back yesterday’s drop

Shares are headed higher in early trade, making back yesterday’s drop with a lift of 1.6 per cent.

At the open, the benchmark ASX200 is higher by 95 points or 1.63 per cent to 5910.0.

Industrials, energy and real estate stocks are outperforming, while banks do the heavy lifting with gains of between 1.4pc and 2.7pc.

Woodside is up 3.2pc, James Hardie up by 5pc, Scentre up 4.2pc, Premier Investments rose 4pc and Westpac up 2.8pc. Collins Foods surged 15pc after its results.

WiseTech is lagging with a 0.05pc lift after chief Richard White sold down a $41m stake in the business.

10.01am: Blue Sky, WAM butt heads in manager deal

The transition of management from Blue Sky to Wilson Asset Management has been held up by “differences of understanding” between both parties.

In an update on the manager transition, Blue Sky said it there had “regrettably” been delays in the timetable stemming from COVID-19, but also due to lengthy negotiations on the treatment of different categories of fee rebates as the services are transitions to WAM.

“After lengthy negotiations between the parties, the Board is pleased to say that these issues have now been resolved in principle on terms the Board considers acceptable to be put to shareholders,” Blue Sky said in a statement.

“The parties are progressing the long-form documentation on the basis of the in-principle revised terms and the Board expects that the various parties will be able to agree, finalise and execute the longform legal documentation shortly.”

Ben Wilmot 9.52am: Student housing deals aplenty

Student accommodation is proving the surprise packet of the coronavirus hit property sector with a series of new deals being struck despite the crisis.

Student numbers are forecast to be hard-hit this year even as the federal government looks to entice international students back to Australia to support the recovery of the tertiary education sector.

The uncertain times have not deterred a series of high-profile operators including British company Global Student Accommodation and Singaporean company Wee Hur Holdings, both of which announced new projects on Monday.

The pair are moving on new projects in Adelaide and Sydney respectively. Their plays come just days after German group Allianz snapped up two Melbourne student accommodation facilities for $460m in one of the largest deals of any kind in property in the wake of the COVID-19 crisis.

GSA unveiled plans to build major new student accommodation scheme in Adelaide, which will comprise 725 bedrooms opposite Adelaide’s top universities.

Meanwhile, in Sydney, Singapore-listed Wee Hur picked up a development site in Sydney’s Regent Street, Redfern, for a total of $46m via local investment manager Intergen Property Group.

9.42am: ASX to rise more than 2pc

Australia’s share market is primed for a strong rise on the last day of the financial year.

Overnight futures relative to fair value suggest the S&P/ASX 200 will open up 2.1pc at a 3-day high of 5937.

S&P 500 futures have risen slightly in after hours trading, reinforcing expectations of a strong rise in the local market.

US gains were driven by stronger than expected rebounds in pending home sales and Dallas Fed manufacturing survey data.

WTI crude rose 3.1pc to $US39.70 a barrel, helping the Energy sector, but spot iron ore fell 2.9pc to US$97.80 a tonne. Financials continued to lag.

The market shrugged off news after the close that the US suspended some trade benefits to Hong Kong regarding sensitive technology.

The S&P/ASX 200 has been confined to a 5720-6200 range for the past five weeks amid stretched valuations, but the consensus 12-month forward EPS estimate has risen 2pc since June 5th.

Domestic weekly consumer confidence data at 9.30am AEST will be followed by China’s June PMIs at 11am AEST, June domestic private sector credit data and weekly payrolls & wages data at 11.30am AEST.

RBA deputy governor Guy Debelle has a webinar for the Economic Society on “The Reserve Bank’s policy actions and balance sheet” at 12.30pm AEST.

9.34am: KFC demand a boost for Collins

Collins Foods, the owner of KFC in Australia, says the strength of the brand has helped it to bounce back strongly after lockdowns across the country, to clock same store sales growth of 3.5 per cent for the financial year.

Releasing its full year results, the group said total group revenue was up by 8.9pc to $981.7m, but its European KFC sales were down 5.8pc, mostly due to COVID-19.

The group reported underlying net profit up 5.1pc to $47.3m and declared a final dividend of 10.5c per share, to take the total FY20 dividend to 20c per share, fully franked.

“KFC Australia was also able to quickly pivot toward takeaway channels such as drive-thru and delivery, accelerating customer shifts into those channels and recapturing lost sales from the dine-in channel,” chief Drew O’Malley said.

CKF last traded at $8.36.

9.23am: What’s on the broker radar?

- Alacer Gold cut to Neutral – Macquarie

- Capricorn Metals cut to Underperform – Macquarie

- Dacian Gold cut to Underperform – Macquarie

- Iluka raised to Buy – Morningstar

- Monash IVF raised to Buy – Jefferies

- Newcrest cut to Underperform – Macquarie

- PayGroup rated new Buy – Canaccord

- Regis Resources cut to Underperform – Macquarie

- Resolute Mining cut to Underperform – Macquarie

- Santos cut to Neutral – Macquarie

- Saracen Minerals cut to Neutral – Macquarie

- SCA Property raised to Hold – Morningstar

- Scentre Group raised to Hold – Jefferies

- St Barbara cut to Underperform – Macquarie

- Tabcorp raised to Neutral – Citi

- West African Resources cut to Underperform – Macquarie

- Woodside raised to Outperform – Macquarie

9.08am: WiseTech chief sells $41m in shares

WiseTech chief and founder Richard White has sold 2.4 million shares in the group, netting the tech billionaire $41.3m.

The company said today the Mr White controlled RealWise Holdings had sold 2,445,653 shares, approximately 0.76pc of the total issued capital of the group, at $18.40 apiece.

Still, on completion of the sale, Mr White still retains approximately 46.9pc of the company.

“Richard has confirmed his commitment to WiseTech Global and his intent to remain a significant shareholder for the very long-term,” the company said, adding the sale was “to accommodate year-end personal financial commitments”.

The sale price of his parcel of shares represents a 36.5pc discount to the $29 trading price at the start of the 2020 financial year.

Read more: WiseTech boss in $41m share sale

9.04am: SeaLink deputy tapped for chairman

Ferry operator SeaLink has appointed deputy chairman Jeffrey Ellison as temporary chief, blaming COVID-19 uncertainty for troubles in finding a replacement for outgoing chair Andrew McEvoy.

Mr McEvoy advised the company of his imminent retirement in February, but the board said the “rapidly changing and uncertain business environment” meant it would continue to review the expertise and characteristics required of a leader moving forward.

SeaLink also advised it had appointed former Aurizon chief and BHP exec Lance Hockridge as a non-executive director of the company.

8.49am: Payout unlikely for Virgin shareholders

Administrators for Virgin Australia have told shareholders they are unlikely to receive any distribution for their shares held, after the group entered into a sale agreement with Bain last week.

Deloitte administrators led by Vaughan Strawbridge said in a statement that “we do not expect there will be sufficient recoveries to repay creditors in full”, adding that “we have reasonable grounds to believe that there is no likelihood that shareholders of VAH will receive any distribution for their shares”.

Shares in the airline were halted from trade at 8.6c.

Read more: Bain bid ‘blew them out of the water’

Eli Greenblat 8.10am: Afterpay creates strategy role

Buy now, pay later company Afterpay has created a new role of global chief strategy officer within its organisation to mine the wealth of data flowing from its millions of shoppers and merchants. It has poached highly regarded e-commerce executive Mark Teperson from Accent Group to fill the role.

Mr Teperson is currently chief digital officer for Accent Group, the footwear business whose retail and footwear brands include The Athlete’s Foot, Platypus, HypeDC, Stylerunner, Sketchers, Vans, CAT, Timberland, Merrell, Sperry, Saucony and Subtype.

The digital expert has handed in his resignation at the ASX-listed Accent Group where he had been for 10 years, most recently its chief digital officer and before that director of its multichannel operations.

Read more: Afterpay creates global strategy role

7.59am: Oil rises on economic data

Oil prices rose about $US1 a barrel, after bullish data from Asia and Europe, but investors are wary about sharp spikes in new coronavirus infections around the world.

Brent crude gained 69 US cents, or 1.7 per cent, to settle at $US41.71 a barrel. US crude rose $US1.21, or 3.1 per cent, to settle at $US39.70 a barrel. The recovery of economic sentiment in the euro zone intensified in June with improvements across all sectors, European Commission data showed on Monday. Overall sentiment rose to 75.7 points in June from 67.5 in May, though still short of expectations.

In China, profits at industrial firms rose for the first time in six months in May, suggesting the country’s economic recovery is gaining traction. US stock indexes, which broadly rose on Monday, also added support for oil prices, which at times track with equities.

But fears of a second wave of the pandemic are keeping prices from going higher. The death toll from COVID-19 surpassed half a million people on Sunday, according to a Reuters tally.

Reuters

7.30am: ASX set to open firmly higher

Shares are expected to rise early on the Australian market after US investors drew optimism from better than expected US housing data and plane maker Boeing’s performance.

At 7.05am (AEST) the Australian SPI 200 futures contract was higher by 67.0 points, or 1.15 per cent, to 5,874.0.

In the US, data showed contracts to buy previously owned homes rebounded by the most on record in May, suggesting the housing market was starting to turn around.

Boeing shares jumped more than 14 per cent after a 737 MAX took off on Monday from a Seattle-area airport on the first day of certification flight testing with US Federal Aviation Administration and company test pilots – a crucial moment in Boeing’s worst-ever crisis.

The two factors helped investors forget rising coronavirus cases in the US, and led to major trading indices closing higher.

The Australian dollar was buying US68.64 cents, down from US68.84 cents at the close of trade on Monday.

AAP

6.20am: Recovery depends on containing virus: Fed

Federal Reserve Chairman Jerome Powell says the outlook for the U.S. economy is “extraordinarily uncertain” and the success of the recovery effort will depend in large part on the country’s ability to contain the spread of the coronavirus.

“A full recovery is unlikely until people are confident that it is safe to re- engage in a broad range of activities,” Powell says in testimony he is scheduled to deliver Tuesday in an appearance with Treasury Secretary Steven Mnuchin before the House Financial Services Committee.

In the testimony released by the Fed, Powell repeats a pledge that the central bank will keep interest rates at the current ultra-low level until it is sure that the economy has weathered the pandemic crisis.

His comments come as some parts of the country are experiencing a surge in coronavirus cases that have prompted governors to backtrack some of their steps to reopen their states’ economies.

Both Powell and Mnuchin were expected to face questions from politicians on topics including how much more support Congress will need to provide to bolster the economy.

That question has gained new urgency as the surge in cases in states including California, Texas and Florida have raised concerns about possible setbacks to efforts to rebound from the downturn that was brought on by measures to control the spread of the virus.

AP

6.10am: Wall Street gains

US stocks climbed as investors weighed the rise in coronavirus infections and the likelihood of future lockdowns with hopes for more stimulus from central banks.

The Dow Jones Industrial Average gained 580 points, or 2.3 per cent, finishing near its high on the day after recovering some of the ground it lost last week. The S&P 500 climbed 1.5 per cent, while the tech-heavy Nasdaq Composite was up 1.2 per cent.

After yesterday’s losses, Australian stocks are set to open higher. At 6am (AEST) the SPI futures index was up 69 points, or 1.2 per cent.

Over the weekend, coronavirus cases worldwide passed 10 million, with more than 500,000 deaths. Authorities in Florida, Texas, California and Arizona, which have accounted for much of the recent rise in US cases, have imposed new restrictions and retreated on reopening plans.

Still, stocks have been largely resilient in recent weeks. The S&P 500 is on track to end the month roughly flat. The Nasdaq is poised to close June with gains of more than 3 per cent, largely thanks to a surge in the shares of tech giants like Apple and Microsoft.

While new COVID-19 cases remained at a high level, analysts expect a spate of major economic data releases this week will show sequential improvement from very weak levels.

“The market is trading more on pure speculative optimism now than at any time in my career,” said Philip Blancato, president of Ladenburg Thalmann Asset Management.

Expectations that the US Federal Reserve will keep injecting liquidity into the market have helped fuel rebounds each time fallout from the coronavirus pandemic have sparked sell-offs, Mr. Blancato added. “There’s a safety net under the bond market and the equity market,” he said.

A key measure of turbulence in U.S. stocks, the Cboe Volatility Index, slid Monday but remains higher than where it stood at the beginning of June, suggesting that investors continue to be jittery.

“There’s still a high level of volatility, which shows that the degree of fear is still very elevated,” said Sebastien Galy, a macro strategist at Nordea Asset Management. “I think we’re in the last wave of this relief rally, caused by central banks doing their jobs and passing a lot of liquidity into the market.”

Investors have been buying gold, a traditional haven in times of financial stress. Front-month gold futures in New York ticked up less than 0.1pc on Monday to $US1774.80, their highest settle since October 2012.

Overseas, the pan-continental Stoxx Europe 600 gained 0.4pc, while most major Asian equity benchmarks ended the day lower.

In Asia, Hong Kong’s Hang Seng index fell 1pc, while Japan’s Nikkei 225 index declined 2.3pc.

US oil futures gained 2.9pc to $US39.61 a barrel.

Dow Jones Newswires

5.55am: Buyers line up for NAB’s MLC

KKR & Co and Apollo Global Management are among the potential suitors for National Australia Bank’s wealth-management unit and have conducted diligence, Reuters reports, citing three sources familiar with matter.

The unit, MLC, could sell for more than $1 billion, two of the sources said.

Dow Jones Newswires

5.42am: Boeing 737 MAX in test flight

US regulators launched a test flight of the Boeing 737 MAX, a key step in recertifying a jet grounded for more than a year following two fatal crashes.

A MAX plane took off from Boeing Field in Seattle, a Federal Aviation Administration spokesman said. The initial flight will take “several hours” and will be followed by additional trips expected to take about three days, the spokesman said.

AFP

5.45am: Markets rebound

Stock markets on both sides of the Atlantic rebounded from last week’s losses as optimism over easing lockdowns won out over fear of surging coronavirus infections.

Most of the session was tepid “with the positive implications of easing lockdown measures weighed up against surging COVID-19 cases throughout the US,” said Joshua Mahony, senior market analyst at online trading firm IG.

But by the close, European key markets were more than one per cent higher, helped by steady gains on Wall Street over the New York morning.

“US stocks are trimming some of last week’s tumble that came courtesy of exacerbated concerns regarding a potential second wave of COVID-19,” said analysts at the Charles Schwab brokerage.

London got a mild boost from investors welcoming British Prime Minister Boris Johnson saying the coronavirus crisis needed the type of massive economic response US president Franklin D. Roosevelt mobilised to tackle the Great Depression.

London closed up 1.1 per cent, Frankfurt gained 1.2 per cent and Paris added 0.7 per cent.

Earlier, Asian equity markets had tanked in response to rising virus cases in the US, and after China imposed a strict lockdown on nearly half a million people in a province surrounding Beijing to contain a fresh cluster, with a city official calling the situation “severe and complicated”.

AFP

5.40am: Criticism over COVID drug price

The maker of a drug shown to shorten recovery time for severely ill COVID-19 patients says it will charge $US2340 for a typical treatment course for people covered by government health programs in the United States and other developed countries.

Gilead Sciences announced the price Monday for remdesivir, and said the price would be $US3120 for patients with private insurance. The amount that patients pay out of pocket depends on insurance, income and other factors. “We’re in uncharted territory with pricing a new medicine, a novel medicine, in a pandemic,” Gilead’s chief executive, Dan O’Day, told The Associated Press. “We believe that we had to really deviate from the normal circumstances” and price the drug to ensure wide access rather than based solely on value to patients, he said.

However, the price was swiftly criticised; a consumer group called it “an outrage” because of the amount taxpayers invested toward the drug’s development. The treatment courses that the company has donated to the U.S. and other countries will run out in about a week, and the prices will apply to the drug after that, O’Day said.

AP

5.37am: Kim Kardashian sells beauty stake

Kim Kardashian West has inked a deal to sell 20 per cent of her make-up brand KKW Beauty to American cosmetics giant Coty for $US200 million, the pair announced on Monday.

The agreement values the three-year-old company at $US1 billion. It will see Coty take “overall responsibility” for the brand’s skincare, haircare, personal care and nail products, they said in a statement.

“This relationship will allow me to focus on the creative elements that I’m so passionate about while benefiting from the incredible resources of Coty, and launching my products around the world,” Kardashian said.

The purchase is expected to be completed in the third quarter of the fiscal year 2021 and sees Coty deepen its collaboration with the celebrity Kardashian-Jenner family.

In January, Coty, acquired a 51 per cent stake in Kylie Jenner’s cosmetics brand. Jenner is Kardashian’s half-sister.

AFP

5.35am: Germany backs ECB bond-buying

The German government has backed a European Central Bank bond-buying stimulus program in a row with the country’s top court which demanded a demonstration of the scheme’s “proportionality”, according to a letter seen by AFP.

“The finance ministry is convinced that the ECB council … has convincingly demonstrated its deliberations about proportionality,” according to the letter from Finance Minister Olaf Scholz to parliament president Wolfgang Schaeuble.

The German government had received documents from the ECB justifying the program, after the Federal Constitutional Court charged that governors failed to sufficiently account for their policy’s side effects on the likes of banks and savers.

AFP

5.25am: BP sells petrochemical arm

British energy group BP, hit hard by the coronavirus pandemic slashing demand for oil, announced the sale of its petrochemical business to privately-owned rival Ineos for $US5.0 billion.

“The agreed sale … will further strengthen BP’s balance sheet and delivers its target for agreed divestments a year earlier than originally scheduled,” a statement said.

BP chief executive Bernard Looney added: “I recognise this decision will come as a surprise and we will do our best to minimise uncertainty. I am confident however that the businesses will thrive as part of Ineos, a global leader in petrochemicals.”

BP said that 1700 staff employed by its petrochemical business worldwide were expected to transfer to Ineos on completion of the sale that meets a $US15 billion divestment target one year early.

AFP

5.20am: Thales secures Aust military order

France’s Thales says it has signed a contract worth more than $1 billion to supply Australia’s military with strategic domestic munitions over a 10-year period.

Thales said the contract would secure hundreds of jobs in NSW and Victoria and enable its operations in Australia to secure more than $450 million in exports plus orders from clients other than the Australian Defence Force.

Reuters

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout