Shell and PetroChina’s Arrow gas venture in $520m writedown

Energy giants Shell and PetroChina have been forced into a $520m writedown on their Australian gas business.

Energy giants Shell and PetroChina have been forced into a $520m writedown on their Australian gas business, pushing the venture further into the red with losses now topping $8bn over the past decade.

The duo’s Arrow Energy joint venture saw its 2019 net loss after tax slump further to $866m, from a $752m loss a year earlier, with hefty impairment and depreciation costs hitting the Queensland-based energy operator’s result.

Losses since the Arrow venture was formed in 2010 have now reached $8.1bn, or more than $12.5bn when combined with $4.4bn of acquisition costs, including the $3.5bn paid by the two energy producers to acquire Arrow a decade ago.

“This is the final unwinding of the great Queensland gas rush,” EnergyQuest chief Graeme Bethune told The Australian.

More than $80bn was spent in the state on three big LNG projects at Gladstone, along with a series of M&A deals, as energy producers flocked to grab a slice of vast coal-seam gas reserves with supplies shipped off to Asian buyers.

While vast sums were invested for projects with paybacks spread over several decades, Arrow’s losses show the venture may face an extended wait until its balance sheet improves.

Its annual accounts were ruled off on December 31, well before the current oil crash that has triggered job cuts and slashed costs across the industry.

Arrow acknowledged more writedowns could emerge from the market ructions. “We have also seen macroeconomic uncertainty with regards to prices and demand for oil, gas and electricity products as a result of the COVID-19 outbreak. Furthermore, recent global developments have caused further abnormally large volatility in commodity markets,” Arrow said.

While the crude slump had no impact on its assets in 2019, “the long-term impacts of these developments will however be reconsidered as part of the impairment considerations for the financial year ended December 31, 2020.”

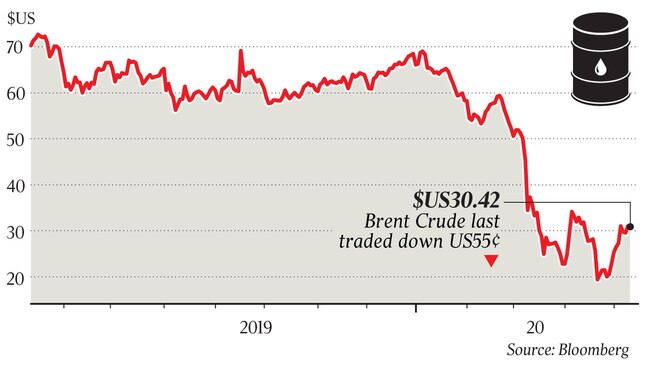

Brent oil crashed by 80 per cent from January to a low of under $US15 a barrel, but has since recovered some losses to $US30 a barrel as countries ease business and social lockdowns.

Talks are again under way to restructure Arrow’s shareholder loans to equity or alternatively refinance or extend the maturity of loans, Arrow said in its annual accounts lodged with ASIC, noting 2010 and 2011 loans that expired last year have been extended by 12 months.

Arrow’s $521m writedown was due to volatility in electricity prices and the exploration and production portion of its gas assets along with an increase in state royalties to 12.5 per cent and changes in national accounting standards.

It recorded no impairment in 2018 but has taken about $2.5bn in writedowns of its assets in the past decade, partly reflecting the high prices paid on untested ground in the rush to access CSG during the commodities boom.

More than 10 per cent of Arrow’s proved and probable gas reserves in the state’s Surat Basin were written down in the year to June 2019, EnergyQuest said.

“One thing that’s been happening is they are cleaning up their reserves book a lot,” Mr Bethune said.

“They now have smaller, but better-quality reserves.”

Despite the financial hit, Shell and PetroChina have opted to double down on their Australian bet by approving the first stage of their $10bn Surat Basin in April in a rare investment boost amid one of the worst downturns for the oil sector in a generation.

Sanctioning the project also enables Arrow to consider a portion of the $1.5bn in unused tax losses to be recognised as a deferred tax asset on the balance sheet during the 2020 financial year, the company said in its annual accounts.

The initial $2bn phase will add 100 petajoules of gas annually from 2021 at peak production, equating to 16 per cent of total east coast demand. The development will miss its initial 2020 target for first supplies, but showed the majors were probably in for the long haul despite tough times for Arrow.

“It was looking like the whole project was stalled as it has taken a long time, but at least it is now coming to fruition,” Mr Bethune said.

The QGC venture, also operated by Shell, will buy supplies from Arrow to feed both its Queensland LNG export plant in Gladstone along with industrial users on the nation’s east coast. Sanctioning the project given the depressed state of the oil market was a surprise, consultancy WoodMackenzie said, with Shell cutting $5bn of its global capital spending this year in response to the oil downturn.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout