Oil crash may force energy firms to write down assets

Energy producers may be forced to write down the value of assets amid concerns low oil prices will persist for the rest of the year.

Australian energy producers may be forced into significant writedowns amid concern that rock bottom oil prices will persist for the rest of the year, pressuring companies to lower their long-run assumptions for the commodity.

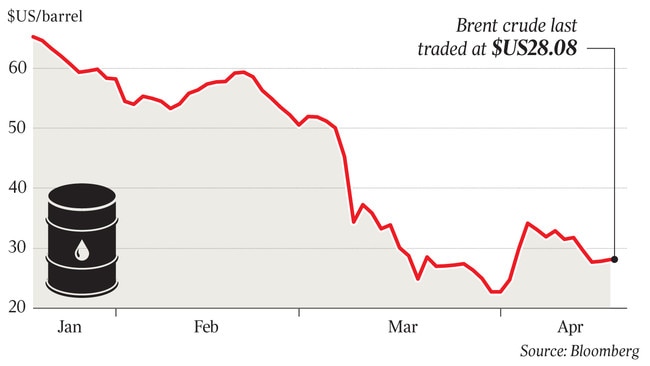

Fears are growing within the industry that the market now faces an oversupply of crude for the remainder of 2020 with COVID-19 destroying demand and smashing oil prices, losing half their value so far this year to trade at just $US28 a barrel.

Futures markets now indicate a long-run price of $US44 a barrel out until 2023 compared with Woodside Petroleum’s $US68 a barrel forecast for 2022 and Santos’s $US72 price.

Auditors may struggle to justify signing off company accounts on June 30 which continue to project prices well over double current levels, according to industry sources, which could spell major impairments for the industry at interim or year-end reporting dates.

Capitalised oil and gas assets total $52bn among the big Australian producers Woodside, Santos, Oil Search and Beach Energy, industry analysis shows, while exploration and evaluation assets total more than $12bn for the same four companies.

For big LNG producers, any hit from the oil slump typically takes three months to flow through to gas prices.

That could mean companies choose to delay changes to long-run pricing assumptions to 2021, deferring non-cash writedowns to the balance sheet. The depreciating Australian dollar will also partially prop up some asset values, sources said.

Woodside said it was too early to make assumptions on the long-run oil price given huge volatility in the market. “We look at different scenarios around slower, medium and rapid recovery, but there is so much information yet to come in because the story is still untold in terms of how this is going to move forward,” Woodside chief financial officer Sherry Duhe said.

While prices below $US30 a barrel would test the entire industry, the duration and severity of any downturn was unclear. “You have to keep in mind that when you look at impairments for assets — which is something we test twice a year — you’ve got to look at the long-term view on pricing,” Ms Duhe said.

“So you’d have to have a pretty profound shift in the short-term pricing only to drive an impairment. It’s more around whether you think there’s a structural change to the longer term. That’s a normal mid-year and end of year discussion. So we’ll go through that process in the coming months.”

Woodside, Oil Search and Origin Energy shareholder Allan Gray said $US30 oil was not sustainable for the industry.

“When it comes to impairments, it will be a matter of how long the companies choose to factor in these low oil prices,” Allan Gray managing director Simon Mawhinney said. “But it’s inconceivable you can sustain prices anywhere near $US30 for the long term.

“The flow-on effect for the rest of the economy are unimaginably large and it would be a domino that would fall over and with it takes many, many prisoners.”

“This will potentially have a major impact on reserves and economic life of certain assets, some of which may be truncated or have lower forecast cash flow projections and therefore lower net present values,” SHA Energy Consulting director Scott Ashton said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout