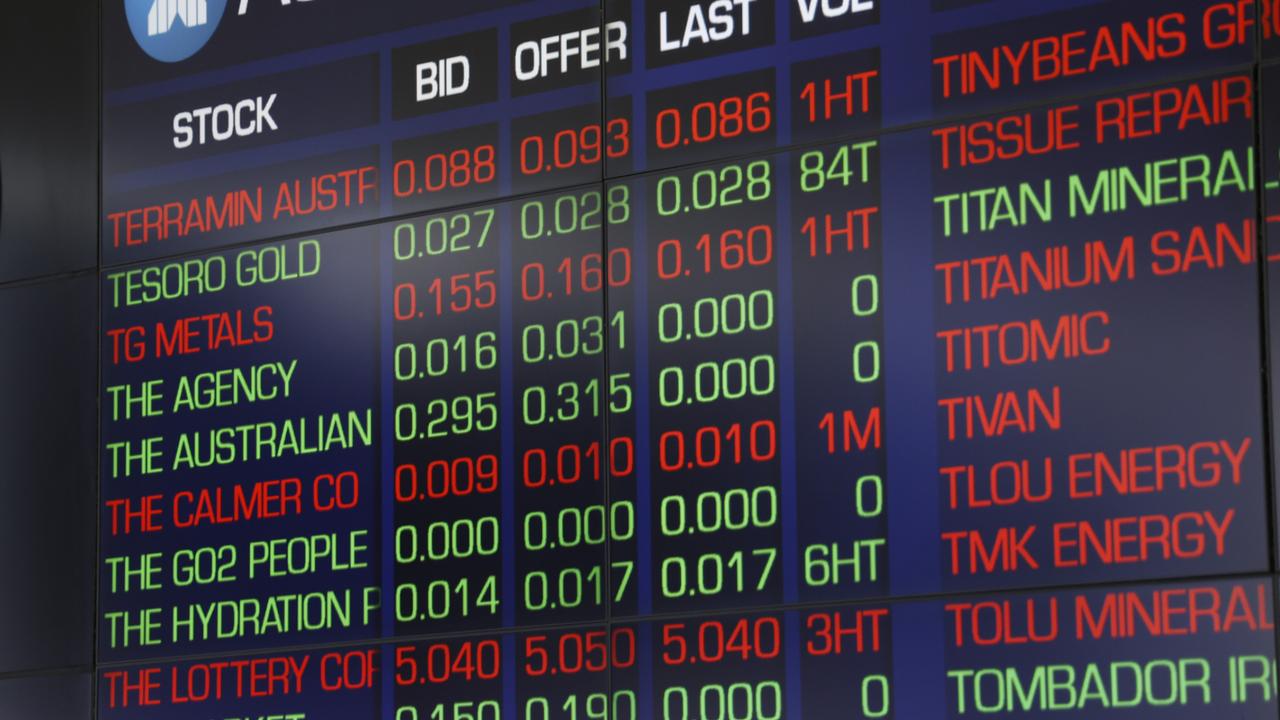

Australia's share market fades along with US futures after hitting a fresh record high in quiet trading after the Easter long weekend.

The ASX 200 index ends down 0.1 per cent at 7887.9 after rising to 7910.5.

Nine of 11 sectors fall with communications, health care, real estate, consumer discretionary, tech, staples and industrials underperforming after the overall market got a boost from end-of-quarter rebalancing last week.

CSL falls 0.8 per cent, Wesfarmers loses 1 per cent, Goodman falls 1.3 per cent, ResMed drops 3 per cent, Brambles falls 2.2 per cent and Telstra slips 1 per cent.

Orora drops 15 per cent on a profit warning.

S&P futures fall 0.2 per cent after the US benchmark shied off a record high on Monday as stronger than expected ISM Manufacturing data damped expectations of US interest rate cuts, sparking a jump in bond yields.

Singapore iron ore futures fall to $100.70 a tonne after bouncing from a 10-month low of $US95.40 to $US102.80 on China's stronger than expected official manufacturing PMI data released over the weekend.

But BHP rises 1.9 per cent and Rio Tinto adds 0.7 per cent. Newmont jumps 4.9 per cent after spot gold hit a record high of $US2265.73 an ounce.

Austal jumps 11 per cent after rebuffing a takeover from South Korea's Hanwha Ocean.