World takes urgent steps to prepare for trade war downturn

Governments from Europe to Asia are bracing their economies for a rocky road as China raises tariffs on US goods to 125 per cent.

Countries around the world are taking major steps to prop up their economies and prepare for a possible severe downturn as the US and China keep raising the stakes in an escalating global trade war.

Central banks are cutting interest rates, with India, New Zealand and the Philippines leading the way this week, and more expected to follow in the coming days. South Korea’s government has announced a multibillion-dollar package of emergency-support measures for the country’s auto sector, including subsidies for carmakers.

Several countries, including Australia, Spain and Canada are urging consumers to buy more locally, swapping imported foods and home furnishings for homegrown alternatives to support domestic companies facing tough times.

Canada is even planning to take funds raised through new duties it has imposed on the US to help pay auto workers affected by US tariffs.

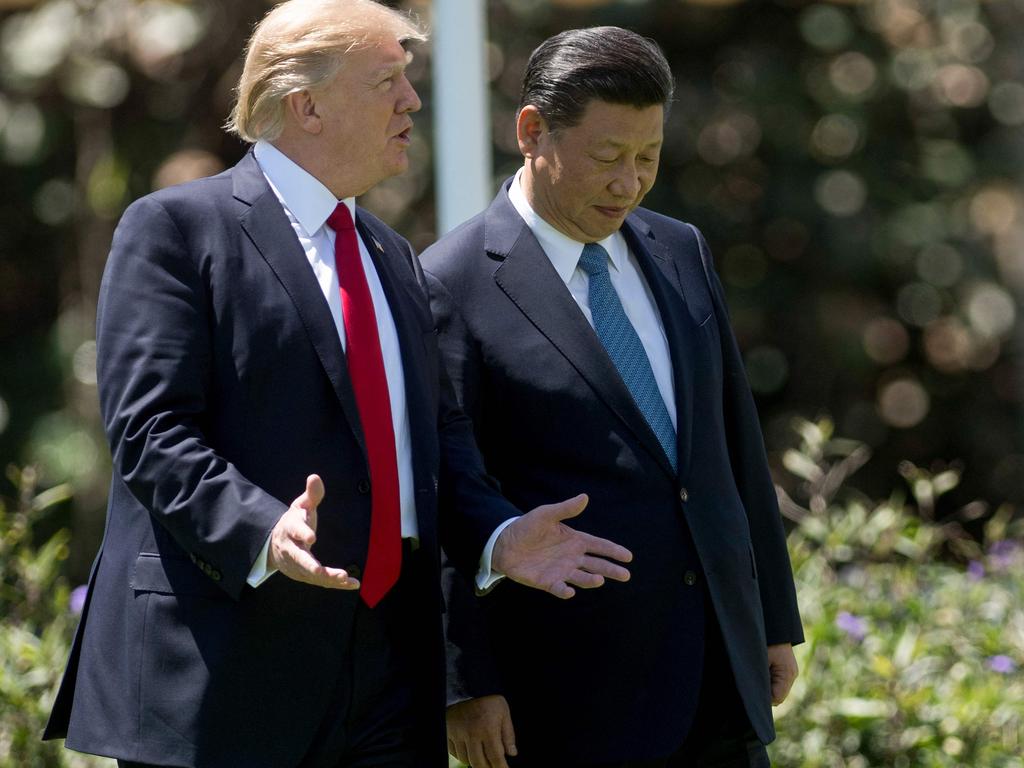

The steps come as the US and China keep matching one another in a tit-for-tat battle to see who can inflict the most pain. In the latest move, China said it would raise its tariff on US goods to 125 per cent to match an earlier escalation by the White House, adding that it wouldn’t raise levies further and that any more American increases would be seen around the world as a “joke.”

China is also stepping up support for its factories as US tariffs threaten to squeeze growth and hammer its exports. E-commerce company JD.com said it would purchase some $US27 billion ($about $43.2bn) of goods from Chinese firms in the coming year to help them shift purchases to Chinese consumers.

The People’s Bank of China has let China’s currency, the yuan, weaken against the dollar, aiding exports, while the government in Beijing is widely expected to borrow and spend more to counteract the drag from slowing trade. China “is not afraid of any unjust suppression,” its leader, Xi Jinping, said Friday.

The moves show how worries of a severe global economic downturn are intensifying. Financial market turmoil has added to the strain: The Bank of England postponed a planned sale of UK government bonds from its asset-purchase portfolio Thursday, blaming market volatility in bond markets ignited by a sell-off in US Treasurys.

The global economy is now widely expected to slow as tariffs begin to bite, and could even tip into recession if the brawl between the US and China intensifies or Trump revisits his plan for “reciprocal” tariffs on US trading partners. Economists at Capital Economics said in a report Friday that global growth could sink to 2.2 per cent in 2025, well short of the 2.5 per cent threshold that commonly signifies a global recession.

“Much hangs on the extent to which countries are able to do deals with the US to negotiate tariffs lower,” they said.

President Trump on Wednesday announced a 90-day pause on sweeping tariffs on imports unveiled on his self-proclaimed “Liberation Day” tariff bonanza on April 2. But a 10 per cent baseline tariff on virtually all imports arriving in the US has gone into effect as planned, and Trump has also raised tariff rates on cars, steel and aluminium.

Chinese imports, meanwhile, now face tariffs of around 145 per cent, according to the White House, after rounds of retaliation between Washington and Beijing pushed levies higher. In addition to raising its own tariffs, China is also targeting US companies and curbing access to rare-earth minerals.

More than 70 countries are engaged in high-speed efforts to negotiate ad hoc deals with Washington before the July deadline on higher reciprocal tariffs, The Wall Street Journal reported. Countries such as Vietnam have floated the ideas of buying more liquefied natural gas and agricultural products from the US, or lowering tariffs and dismantling regulatory barriers to imports in the hopes of avoiding higher duties that could crush their economies.

But with the outcome of negotiations still unclear, and some tariffs already in effect, governments are also looking for ways to stabilise their economies. Measures include targeted support for industries affected by tariffs as well as policy moves aimed at shoring up growth if trade and financial market disruptions worsen.

South Korea’s $US2 billion package, approved Tuesday, includes cheap loans, tax breaks and subsidies for carmakers, a key export sector. The government said it would also temporarily lower taxes on new-car purchases in South Korea and increase subsidies for electric-vehicle manufacturers to support auto sales at home.

In Spain, Prime Minister Pedro Sánchez in early April rolled out a government aid package to industry worth about $US16 billion to reduce the impact of Trump’s tariffs, including loans for companies, help for carmakers and funding for a buy-local campaign. Portugal’s development bank expanded trade credit and insurance aid to help exporters find new markets.

“Global trade is being transformed so we must go further and faster in reshaping our economy,” said UK Prime Minister Keir Starmer on April 6, announcing plans to give automakers some breathing room on environmental goals to help them manage tariffs. More help is on the way for other sectors, he said.

Canada has levied a 25 per cent counter tariff on roughly 67,000 US-made cars in retaliation for the 25 per cent levy the US imposed on foreign vehicles. Ottawa estimates it will collect roughly $US5.7 billion from the tariff, which it will use to pay auto workers and auto parts companies affected by the US tariff.

Canadian Prime Minister Mark Carney, currently campaigning in a federal election slated for April 28, has made it easier for laid-off workers to apply for employment insurance, deferred tax payments to corporations and asked Canada’s business development bank to lend more capital to companies in tariffed industries.

Carney warned this week that the risk of recession in the US has escalated, which will force the government to step in to help Canadians mitigate the economic fallout. His election rival, Conservative leader Pierre Poilievre, has also pledged financial support for workers in tariff-exposed sectors, and said he would also use the funds to cut taxes.

The European Central Bank meets Thursday and is expected to cut its key rate by a quarter-percentage point to help insulate the eurozone economy from tariffs. The Bank of England isn’t meeting until May, but is also expected to cut rates by a quarter point then. Partly reflecting a big rally in the Swiss franc as a result of trade and financial market gyrations, Switzerland’s central bank is now widely expected to cut rates to zero at its next meeting in June.

Reserve Bank of India Gov. Sanjay Malhotra, in a statement accompanying the central bank’s rate-cut decision Wednesday, said that as well as weaker exports, the uncertainty generated by trade frictions risks sapping investment and consumer spending, hurting overall economic growth.

The Reserve Bank of New Zealand was equally blunt: “Increases in global trade barriers weaken the outlook for global economic activity,” its rate-setting panel said, as it too, cut interest rates.

Indian officials are concerned that goods shut out from US markets could end up in India, undermining local producers. Piyush Goyal, India’s trade minister, in a speech on Monday urged Indian businesses to practice “economic nationalism” and favour domestic suppliers over tempting cheaper imports, highlighting another way governments are hoping their economies can weather the trade storm.

Dow Jones Newswires

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout