Start-up investment tripled in 2021 in bumper year for tech

New statistics show Australia’s start-ups raked in more money last year than the previous three combined, with the nation boasting a record number of billion-dollar tech companies.

Venture capital firms more than tripled their investments in Australian technology companies in 2021 compared to the previous 12 months, new statistics show, and this year may be just as stellar for the local industry.

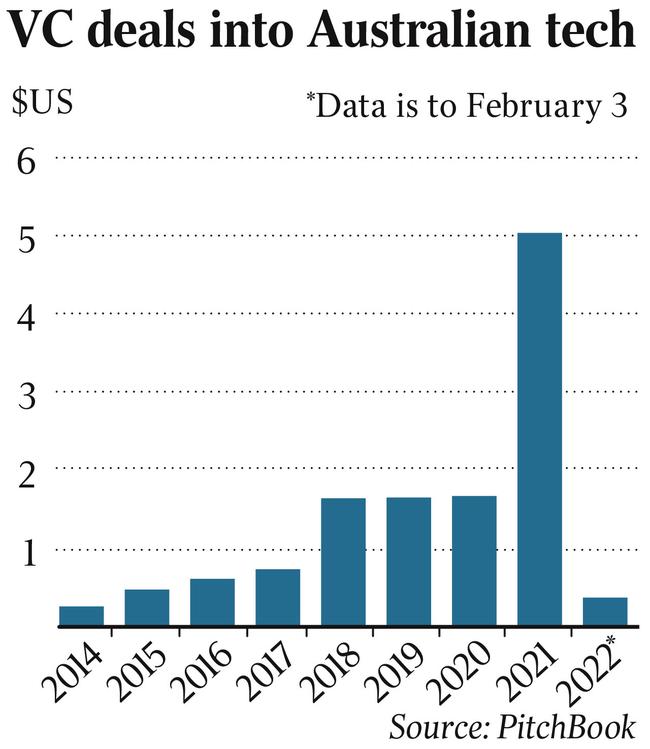

Research from Seattle-based venture capital analysis outfit PitchBook provided to The Australian found $US5bn ($7bn) was invested in Australian tech companies in 2021, more than the combined total of $US4.8bn between 2018 and 2020.

The researchers found that the investment in the local tech ecosystem increased dramatically from 2014, when $US300m was poured into tech start-ups, with 2022 investment at 16 times that of 2014 levels.

The bumper year also saw a record number of tech unicorns created, with more than a dozen new companies passing the $1bn valuation mark in the last year alone as investors looked to back the next big thing.

Rick Baker, the co-founder of Australia’s largest venture capital firm Blackbird Ventures, said more blockbuster deals were on the horizon for the year to come.

Blackbird’s portfolio companies are estimated to be worth a combined $10bn. “The increased flow of capital into the start-up ecosystem reflects the success of the industry. Much of the growth is due to larger rounds, which are being raised by very successful businesses, built over the last five to 10 years,“ Mr Baker said.

“Most of that capital will be used by these companies to grow their teams. Ten years ago our best founders ran off to Silicon Valley to start their businesses and build their teams over there. Now they are doing it here.”

Blackbird partner Nick Crocker said it was no surprise to him that last year was the biggest yet for the local start-up and venture capital industry, given the flurry of investment activity.

“These numbers reinforce to me that it’s the best time in history to be a founder, particularly here in Australia,” Mr Crocker told The Australian. “Recent rounds from Dovetail, Eucalyptus and others are proving that another generation of incredible founders are emerging from Australia.

“When Blackbird was started almost a decade ago, there was almost no venture capital in Australia. To see the investments being made here today, and the thriving community that is growing, is something that we feel extremely grateful to be a part of.”

Dovetail, a software start-up co-founded by former Atlassian executives, raised $89m in a funding round in January at a $960m valuation and is hiring 100 new staff over the next 12 months, while the Sydney-based health start-up Eucalyptus pocketed $60m ahead of a UK expansion.

Employment Hero, one of Australia‘s most valuable start-ups, closed two rounds in 2021, including a $45m Series D and a $140m Series E. The company is now estimated to be a tech unicorn worth more than $1bn.

“Employment Hero’s raising efforts were met with a warm welcome from both homegrown and international investors. In fact, 2021 marked the year we closed our biggest rounds to date,” chief executive Ben Thompson said.

“We received our first investment from OneVentures and AirTree back in 2016 and it’s been interesting to watch their success and rise alongside us.

“Employment Hero has raised $220m to date from local and international investors. We’ve had the pleasure of watching our local VCs grow and mature at a similar rate as the start-ups themselves. We’re particularly proud of OneVentures and their growth as it felt like they were a fellow start-up on the journey with us.

“For emerging tech innovation, Aussie VCs have become a force for good and continue to gain momentum. Just as VCs are proud of the success of their start-up portfolios, we’re equally impressed with the local homegrown growth of local VCs.”

Lauren Capelin, principal of the Blackbird-linked start-up accelerator Startmate, said the Australian start-up ecosystem was progressing at breakneck speed, despite the pandemic.

“While the amount of capital being deployed across the region is nothing short of impressive, the broader flywheel that is starting to spin is even more exciting,” she said. “In 2022, the industry will be flush with new talent joining the ranks, from those early in their career to more experienced professionals opting for employment opportunities at high-growth start-ups over more traditional career paths.

“We also have founders and senior operators stepping into the role of angel investor to support the next wave of start-ups, or coming full circle to launch their next venture.”

Rachael Neumann, co-founder at Flying Fox Ventures, said momentum was building for venture-backed companies.

Ms Neumann, a former chair of peak body StartupAu, started Flying Fox last year with co-founder Kylie Frazer, wanting to deploy $5m into early-stage start-ups each year. They’ve already backed Goterra, Mr Yum, Heaps Normal and Josef.

“Amazing companies tend to be highly competitive opportunities. Multiple investors want a seat on the rocket ship; if anything, that means we’ll continue to see valuations go up, and not down,“ she said. “We’re not yet concerned about the potential for rising entry prices either; we believe we’re still in the early days of what will be a seismic shift in the impact start-ups will have on Australia and the shift of capital from traditional investments like public equities into this asset class.”

The Melbourne-based Tractor Ventures takes a different approach to start-up capital than traditional venture funds, offering revenue-based financing of up to $500,000 at between two and five times a company‘s monthly revenue without taking equity or board seats.

Matt Allen, Tractor Ventures’ co-founder, said finance options available to entrepreneurs increased last year. “As our ecosystem matures and capital is abundant, it’s more important than ever for founders to choose the right partner,” he said. “There are so many more funding options available to founders, and founders are more savvy than ever. We believe that growth capital as finance instead of equity will continue to grow.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout