Blackbird Ventures joins Skip Capital in backing Inventia Life Science

Blackbird Ventures has joined Atlassian co-founder Scott Farquhar and wife Kim Jackson’s venture outfit Skip Capital in backing hi-tech start-up Inventia Life Science.

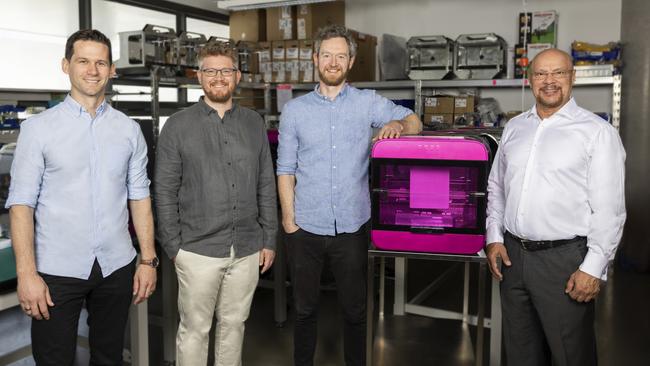

Blackbird Ventures, the nation’s largest venture capital firm, has joined Atlassian co-founder Scott Farquhar and wife Kim Jackson’s venture outfit Skip Capital in backing Inventia Life Science, a hi-tech start-up that uses 3D bioprinting to help ease access to affordable cancer research and new drug development.

Inventia has closed a $35m Series B funding round, led by Blackbird Ventures, which Inventia CEO Julio Ribeiro said would allow the company to scale up its team from 36 to 150 by the end of 2024, and expand its operations across the US, where the biomedical research and drug discovery markets are estimated to be worth more than $US40bn ($56bn).

The Sydney-based company builds printers and bio-inks that together allow human cells to be printed in three-dimensional structures, helping researchers create human tissue for research and therapy purposes.

“This new round of financing is a very significant milestone for Inventia,” Dr Ribeiro said. “The funds will enable us to scale up and take full advantage of the increasing global interest in such things as new approaches to cancer research and the development and validation of new drugs.

“The biomedical applications for the use of the Rastrum platform are very diverse. For example, it can be of enormous benefit to the pharmaceutical industry, by allowing new drugs to be tested in a 3D cellular environment and eliminated if necessary, long before they reach the stage of clinical trials. This can reduce by hundreds of millions of dollars the total cost of bringing a successful drug to market.

“Similarly, cancer researchers can now work at scale with cell models that mimic the human body almost exactly and produce research results that are more accurate and predictive than before.”

Skip Capital founder Ms Jackson said she was attracted to Inventia’s vision of helping scientists cure diseases with a breakthrough technology.

“It’s a big vision, it’s not a simple company,” she said. “I’ve been incredibly impressed with the team solving this problem, and Australia has some of the world’s leading printing experts, and they’ve put that together with drug discovery, hardware and software all in one.”

Blackbird Ventures partner Niki Scevak said Inventia’s technology could improve cancer and other cellular research in a fundamental way, and the benefits stood to reshape many biomedical industries, in particular the pharmaceutical industry.

“Our financial support of Inventia reflects our firm belief that there is a broadbased and urgent need in the biomedical world for what the company has developed and that its impact is going to be truly generational,” he said.

The company did not disclose its valuation.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout