Fortune and the brave: Australia’s VCs launch crypto ‘space race’

The nation’s biggest venture capital firms are vying to control the fast-growing crypto and Web3.0 industries, backing founders sometimes before they’ve even settled on an idea.

Australia’s largest venture-capital firms have shrugged off growing ambivalence about cryptocurrencies, and say the sector and the related Web3 world will be the central themes in their investment plans for the coming year.

In wide-ranging interviews with The Australian, executives at the country’s best-known venture capital firms – Blackbird, AirTree and Square Peg – say the next Atlassian or Canva could be a cryptocurrency company.

The sector and blockchain projects have traditionally been seen as risky bets, but local venture capital firms are now viewing their potential upside as too lucrative to ignore.

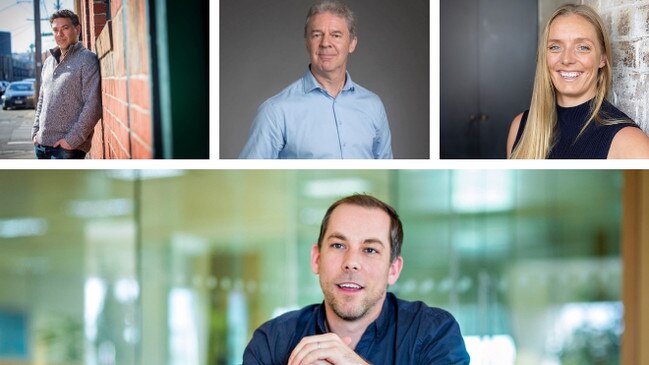

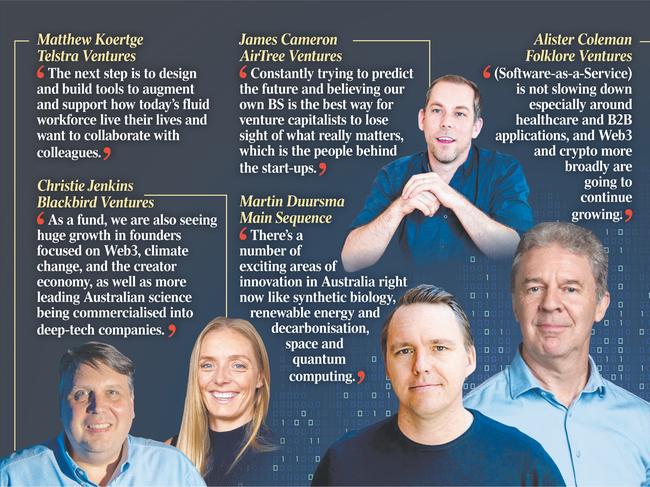

James Cameron is a partner at leading Australian venture capital outfit AirTree Ventures, whose portfolio last year surpassed a $2bn valuation with investments including Canva, GO1 and A Cloud Guru.

Cameron’s thesis is that Web3 projects – decentralised apps, cryptocurrencies and non-fungible tokens built using blockchain technology – are now preoccupying Australia’s best tech talent.

“We’ve seen tons of Australia’s best developer talent flock to Web3 projects in the last two years, and where the best developers go, consumers tend to follow,” Cameron says. “It’s been the driver behind several of our recent investments in teams building Web3 infrastructure in areas such as decentralised finance (DeFi) and non-fungible tokens (NFTs), including Immutable and Zeta.

“Overall, though, we make sure to stay open-minded and not be led too heavily by thematics. We know good ideas can come from anywhere, and our founders are in the best position to find gaps in their own markets.

“Constantly trying to predict the future and believing our own BS is the best way for venture capitalists to lose sight of what really matters, which is the people behind the start-ups. Our focus as always is on finding and partnering with the most ambitious founders, right from the start when their start-up’s DNA is just taking shape.”

Stew Glynn, managing partner at TEN13, the early-stage technology investment syndicate co-founded by Shark Tank star and serial entrepreneur Steve Baxter, says that his firm will be increasing its focus on Web3, cryptocurrency and gaming as a social network in the next 12 months.

“There has been an explosion of content and projects within the decentralised world and we will be looking to support more founders building in this category,” he says.

“We’re also witnessing the true arrival of ‘Generation Two’ from Australia’s start-up ecosystem. We’re seeing mid-level engineers and product managers from mature companies like Atlassian, Canva, Afterpay take the leap towards becoming founders themselves.

“We look forward to supporting this next generation as they start to build on their own.”

Dan Krasnostein, a Square Peg partner, agrees and says that just as brightest minds of the 1990s started internet businesses – many of which continue to thrive to this day – the next generation of founders will focus more and more on blockchain innovation.

Australia has always punched above its weight in fintech, and Square’s acquisition of Afterpay and Airwallex’s huge 2021 fundraisings have signalled our success to the world, he says.

“We expect that trend to continue growing in 2022, especially as more amazing Australian founders build decentralised finance products on the blockchain,’’ he says.

“In 2022, we’re increasingly excited by Web 3.0, not just for the value it unlocks for consumers, creators, and retail investors globally, but because of the sheer amount of talent entering the space.

“2022 will continue to see the start-up landscape mature. We expect more top Australian talent to quit their jobs to found and join tech companies, and with that, we’ll see more investors excited by the space. Over $9.6bn was invested into Aussie start-ups in 2021 – a record year by billions of dollars – and we don’t expect this to slow down any time soon.

“More capital in the space will see more ecosystem players emerge, like industry networks, incubators and accelerators, who in turn will encourage talent to join the next generation of Canvas and Airwallexes.”

Rampersand, a Melbourne-based venture capital firm which is in the midst of raising a fresh $40m fund, is also looking to ramp up investment in Web3 in 2022, according to co-founder Paul Naphtali.

The recent rise of so-called Web3 hasn’t come without controversy, with Block and Twitter co-founder Jack Dorsey criticising US investment firm Andreessen Horowitz and other VCs for trying to control an ecosystem that prides itself on decentralisation and community.

A Web3 agency founder, Joan Westenberg, says that the NFT and Web3 asset classes, while growing significantly in value throughout 2021, are still a relatively small market when compared to mainstream tech investment opportunities. She says that extra investment should be welcomed.

A key challenge for Australia’s Web3 and crypto ecosystems will be to “deliver beyond the hype’’ and build real solutions beyond crypto tokens themselves, says Alister Coleman, a partner at Folklore Ventures.

“We saw a record-breaking 2021 and 2022 will be no different,” he says. “The value being created is not speculation, it is a continued compounding of talent and capital into the Australian tech ecosystem that’s been occurring for almost a decade now.

“We believe that early-stage investment will pick up substantially, and the status quo of a few larger funds will likely evolve into more, larger VCs in 2022. SaaS (Software-as-a-Service) is not slowing down especially around healthcare and B2B applications, and Web3 and crypto more broadly are going to continue growing.”

Backing next-generation founders and their companies at an early stage is a common thread connecting Australia’s venture-capital firms.

Christie Jenkins, a Blackbird Ventures associate and former Australian trampoline champion, says that her personal focus is to find founders as early as possible.

She says Blackbird has invested in founders before they’ve turned 18, before they have a product, and even before they’ve settled on their idea.

“In 2022 I’m really pushing myself to go even earlier, and to go earlier more often. I never want my first time meeting a company to be when they are raising their Series A funding round,” Jenkins says.

“At Blackbird we invest in everything, and one of the reasons I most love working here is that the investing team all ‘follow our curiosity’ and search for companies in industries that interest us,” she says.

“For me, that’s human performance and founders who are building technology that allows us to be smarter, stronger, faster, sleep better or live longer.

“As a fund, we are also seeing huge growth in founders focused on Web3, climate change, and the creator economy, as well as more leading Australian science being commercialised into deep-tech companies.

“A few years ago start-ups were a black box of mystery to me, and I know a lot of other outsiders looking in probably feel the same way. At Blackbird we are thinking about how we can bring more people – whether that’s potential founders, operators, or advocates – into the start-up world.

“How can we educate, build relationships and share the magic of start-ups with people? And how can we do that at scale? I would love to see us double or triple the size of the ecosystem.”

Meanwhile Main Sequence, the deep-tech venture capital outfit managing CSIRO’s innovation fund, is ignoring Web3, and is instead busying itself backing companies tackling the planet’s greatest challenges, including climate change.

“The next 12 months is all about investing in Australian ingenuity and companies that fit with those challenges and continuing to support our existing portfolio companies to help them accelerate,” Main Sequence partner Martin Duursma says.

“There’s a number of exciting areas of innovation in Australia right now like synthetic biology, renewable energy and decarbonisation, space and quantum computing, each of which are reliant on deep research from our universities and science agency CSIRO to make significant leaps forward.

“We’re working to find new ways to capture that ingenuity through partnerships and company creation opportunities under the Main Sequence venture-science model to create the unicorns of the future.”

The strong investment growth locally and globally in Australian start-ups over the past 12 months is just beginning, Duursma says, and it’s clear that global investors are looking more than ever at Australian entrepreneurs and researchers to find differentiated opportunities that don’t follow the herd.

“Australian entrepreneurs are maturing too, looking at global markets and partners earlier in their journey and growing faster than ever. We’re spending more of our time connecting our portfolio companies to global capital and partners and see an opportunity to do more of this in 2022 as our Australian start-up ecosystem takes its next giant leap.”

Ultimately the continued maturation of Australia’s start-up ecosystem – with an increasing number of companies scaling globally – will lead to more founders who have had tasted success going back for round two, according to Jonathan Jeffries, co-founder and Partner of start-up consultancy Think & Grow.

Australian citizens who have returned home in Covid will remain and start to consider building a business in Australia, once they decide not to return overseas to continue their career in North America, Asia or the UK, Jeffries says.

“The trends of the last few years will continue with more investment being made earlier for great product market fit led business, from founders who have left industry and have now stepped into the disruption of the space. Fintech, Insure Tech, Payments and RegTech are strengths of our ecosystem as examples.

“The emergence of funds specifically to support sustainability, clean tech and green tech will also continue to drive more significant action in this area. Examples are The Great Wrap, Zero Co, Who Gives a Crap. With also well established businesses like Brighte and Thank You demonstrating continued growth in the space.’’