Million-dollar slideshow: Investors reveal the best pitch decks they’ve seen and why they grabbed attention

VIEW: The pitch decks that have won start-ups millions in funding from three venture capital firms and an investment syndicate.

Some pitch decks are so strong that they make investors want to pick up the phone and call the founder straight away over a fear of missing out.

Others teach investors a lesson or two about an industry and don’t demonstrate a potential solution but an idea that has the ability to disrupt an industry. And some pitch decks are a dry experience which fail to get that crucial second meeting in the capital raising process.

Pitch decks are a set of slides which start-ups send to investors in order to get a meeting about potential investment. These decks, which are typically between 10 to 20 slides, outline what the start-up does, their market strategy and their plans to grow their business.

As capital continues to be scarce and start-ups look for other methods of raising funds, three venture capital firms and the founder of an investment syndicate detail the most memorable pitch deck they’ve seen – and why they’re memorable.

Cheryl Mack, the founder of investment syndicate platform Aussie Angels, says while the perfect pitch deck doesn’t exist, “there are some that get my attention and make me want to have a meeting right now”.

Asked about one of the best pitch decks she has seen, she said Nullify – a cybersecurity software business which helps developers write secure code and deploy secure infrastructure.

“One of the things that I really loved about this pitch deck was that on the second slide they really get straight to the point,” she said.

Ms Mack said most start-ups filled their first few slides with titles and logos and it wasn’t really until the fourth slide that investors typically got any insight into who the start-up was and what they offered.

“On the second slide, Nullify has jumped straight into it, and they’ve put a really big number here; $5m is the average cost of a security breach and this cost is increasing at 6 per cent each year. That grabs my attention straight away,” she said.

The start-up then showed how it sought to solve the problem, she said.

Ms Mack said that over her career as an angel investor she had seen thousands of pitch decks and she typically read between two to three per day. On average, she receives five per day and about once per month she receives a deck which makes her want to speak to the founder immediately.

For Investible chief investment officer Charlie Ill, one of the best pitch decks he had seen belonged to Earthodic, a start-up which has developed a water-resistant coating for paper products.

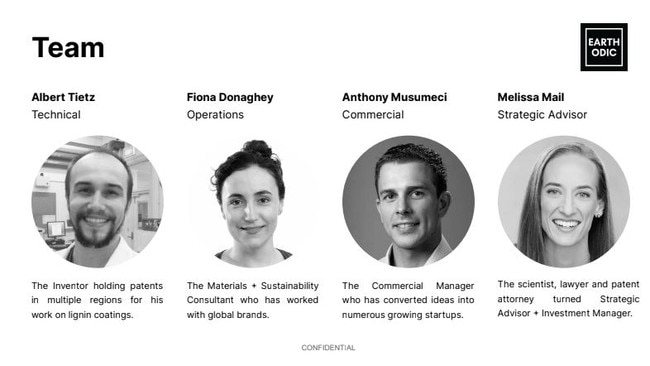

One of the first things that drew Mr Ill’s eye was the second slide which covered the team.

“They don’t oversell through logos but rather communicate the relevancy of each team member’s background,” he said.

“Most team slides have all the big logos and brands but the shortcoming of that is it doesn’t necessarily communicate whether the person has the necessary skills and capabilities to make the company successful.”

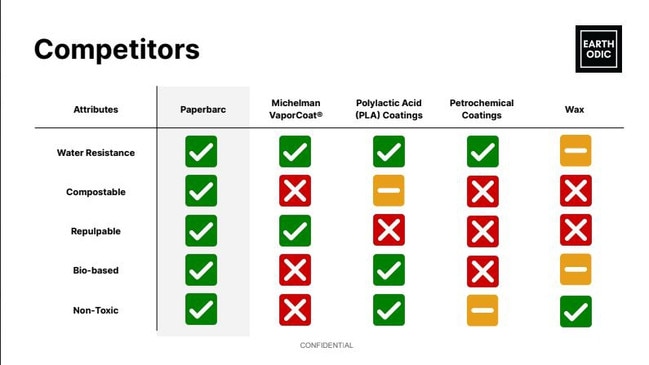

Another winning factor from Earthodic was a slide about who its competitors were.

“They were quite upfront about who their coming competitors were,” Mr Ill said.

“Oftentimes, we find some founders think they have zero competitors and in many cases, we believe that those founders are thinking too narrowly about their solution.”

The ultimate measure of a successful pitch deck was whether the start-up gets a meeting.

“Did they get the next meeting with us? The answer to that question is yes. And the types of behaviours that were communicated through the pitch deck were consistent in person,” he said.

“Sometimes an overcomplicated pitch deck is a sign of an overcomplicated presenter.”

For Jessy Wu, AfterWork’s investment principal, one of the best pitch decks she has seen belonged to Lyka, a pet food start-up which allows for customisable diets.

Ms Wu met with Lyka first in 2021 and has to date invested nearly $1m.

The slide that won the investors over was one about how the average lifespan of domesticated cats (14 years) and dogs (11 years) was only about 37 per cent of the full potential, and how changing the diet of each animal could allow them to live up to three years longer.

AfterWork invested despite the venture capital fund’s co-founder Mr Petersen having dog allergies. Miss Wu also wasn’t particularly a dog person, she said.

“It was more pointing out a kind of very obvious fact about the world and a very, very obvious trend about consumer behaviour. Even people who aren’t particularly akin to dogs can see that there’s a commercial opportunity,” she said.

“The average pitch decks don’t draw attention to a novel insight in quite the same way. While every founder has something they could teach us, sometimes those teachings can get lost in complexity.”

At Rampersand, investment associate Abhishek Maran believes the perfect pitch shouldn’t exist as a 10-slide template but rather it should pique the investors interest.

“I don’t think I’ve seen a perfect pitch deck, but I’ve seen good slides,” he said.

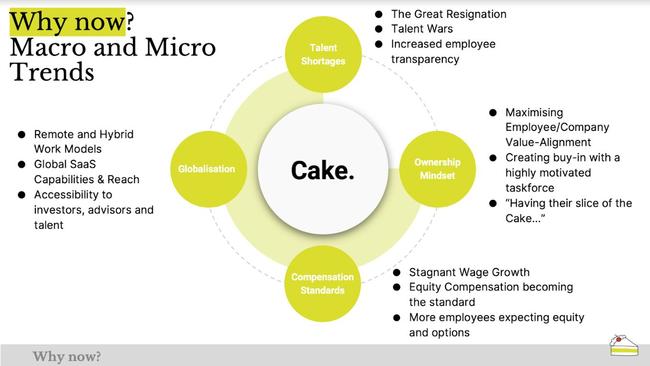

One of the best pitch decks Mr Maran has seen belonged to Cake Equity, a start-up which allows other start-ups and employees to manage stock options.

One of the attractive factors about the deck was a slide of the micro and macro picture of the economy and what the future of wealth looked like.

“A lot of founders don’t think globally but fortunately for us the Cake Equity founders thought about going global from day one. And they’ve been able to execute on that vision,” he said.

“They’ve since been able to build out a platform that is feasible and workable in many different countries across the world, which is quite rare.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout