‘Re-educated by the market’: Why start-ups fail to raise

Weak founders, no numbers and an inability to tell a story. A VC fund, non-bank lender and accelerator tell it straight, and explain what ‘you’re too early’ really means.

Bad storytellers don’t make it far as start-up founders. Nor do founders who know less about an industry than their investors or have no numbers to show or who’ve confused a small business with a start-up.

That’s just a handful of reasons start-ups fail to raise money from investors in a market that has less money to invest and an influx of start-ups in need of funding.

Rising interest rates coupled with inflationary pressures is increasingly putting the squeeze on the private capital market and the start-ups in need of backing are feeling the pinch.

But most remain tight-lipped about failing to reach a funding goal despite missed targets being common.

In January, The Australian revealed that instant grocery delivery start-up Milkrun had twice failed to raise a Series B round.

Investors refused to deploy any further capital into the business, remaining unconvinced of its prospects outlined in a pitch deck which showed the start-up was losing $13 per delivery and that it planned to slash the wages of riders by about 30 per cent as it removed wet weather bonuses and other incentives.

Venture capitalists say the number of founders approaching them has doubled over the past year, and some are failing to grasp the basics, leaving them to be turned down.

Other investors say start-ups make the grave mistake of trying to get funding from a single source when they could be more efficient and have VC funds and angels play off against each other.

‘You’re too early’

At Galileo Ventures, the Sydney-based VC established in 2018, if a founder isn’t introducing a solution that’s unique or has the ability to create a category of its own, the firm isn’t interested.

The first thing that comes to mind when asked why start-ups fail, Galileo co-founder James Alexander said “weak founders”.

“What I mean by that is they don’t have any real insight into their market or their customers. Usually they won’t have a very developed way of thinking, they’ll have surface-level analysis and they’re not founder market fit,” he said.

Founder market fit, or founder problem fit, refers to understanding why a founder is the right person to be solving a problem.

“If we know more about the market than the founder pitching us, we instantly are concerned. It shows a surface level knowledge,” he said.

Mr Alexander said VCs often have their own jargon, and one of the less flattering terms used to let down a start-up is “you’re too early”.

“It’s a lazy response but really all ‘you’re too early’ means is that they don’t believe you have a real business. VCs won’t say that but that’s the translation,” he said.

Bad storytellers

Matt Allen is the co-chief executive of tech non-bank lender Tractor Ventures which lent funds to house moving platform Muval, social media analytics platform Social Status, electric car-sharing platform evee and luxury fragrance subscription ScentGod.

Mr Allen believes start-ups don’t fail because they can’t raise money, but because they can’t raise enough money.

“When you’re raising money, your start-up needs to be in one of two precise states: an amazing story and no numbers or an amazing story and amazing numbers,” he said.

Storytelling and being able to show a path to profitability has become a prerequisite for raises in a market where risk-adverse investors want more certainty and less empty promise.

Like many tech companies, the start-up sector has seen mass lay-offs over the past 12 months and many ditch the growth at all costs mentality and lean down their operation in a bid to become profitable.

“In 2021, the amount of capital coming in exceeded the amount of shares available which meant that investors had to get in quick and that drove prices up. But investors don’t need to write cheques overnight anymore,” Mr Allen said.

Too American

Ambitious founders heading to the US to raise further capital was once a rite of passage.

In 2023, many are finding their ideas are too ambitious for the local market yet “unimpressive” for American investors, Mr Allen said.

“Ironically, some people can’t raise money in Australia because they’re too American; they behave over the top and they don’t earn trust. Conversely, Australians can be too sleepy and too realistic when talking to American investors,” he said.

The venture capital industry has seen a condensing down of its own, with major players including Salesforce Ventures shutting local operations.

Others have taken a cautious approach to a drying up of investor funds and have begun to advise start-ups that they should avoid raises if possible and that any raise should include enough capital to last 12 to 24 months.

Can’t please everyone

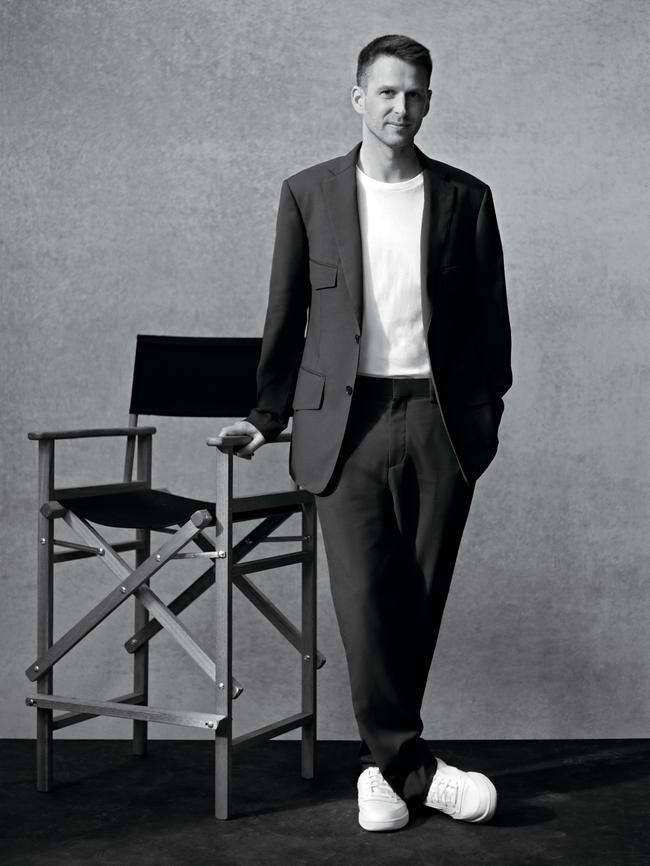

At Australian accelerator Startmate, one of the reasons start-ups fail to raise is because they choose a serial raising approach rather than parallel, said chief executive Michael Batko.

“What most first-time founders do is try to approach investors one by one. Essentially what they’re doing is stretching out their raising timeline and shortening their lifespan as they wait for investors to respond,” he said.

“A good fundraising process is one where you have parallel conversations and create competitive tension. When you talk to four different VCs at the same time, you actually let them play towards your timeline rather than their own.”

Some founders also make the mistake of implementing no customer feedback or too much.

“It can result in founders ending up with a product that doesn’t serve anyone or a product which has ignored all feedback,” Mr Batko said.

Calling it early

Fundraising goals are adjusted far more often than most start-ups care to admit but that’s not something many are willing to share, Mr Allen said.

“They often go out to raise a high valuation and get re-educated by the market,” he said.

Sometimes they adjust their goals at the advice of their lead investor. Galileo Ventures often advised start-ups it was better to call it early with a good amount of capital “rather than chase an arbitrary number”, Mr Alexander said.

“A lot of the time it’s all about survival, not a specific number. It’s much better to execute, to get customers and raise more money sooner, rather than wait just because you want to hit an arbitrary number.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout