Apple eyes a huge slice of the BNPL market with Apple Pay Later

Apple’s move into BNPL doesn’t have immediate consequences for Australia as it’s initially in the US only from September. But it’s almost guaranteed to be here soon if Apple Pay itself is a guide. Launched in 2014, Apple Pay began operating in Australia a year later and now is in more than 70 countries.

Apple says Pay Later will be available at any location where Apple Pay operates.

The move may make other BNPL players nervous given that more than half a billion people use Apple Pay globally and the BNPL service is being engineered as a natural extension of it. It’s a mere tab away in Apple Wallet and many Apple Pay users will likely gravitate to it.

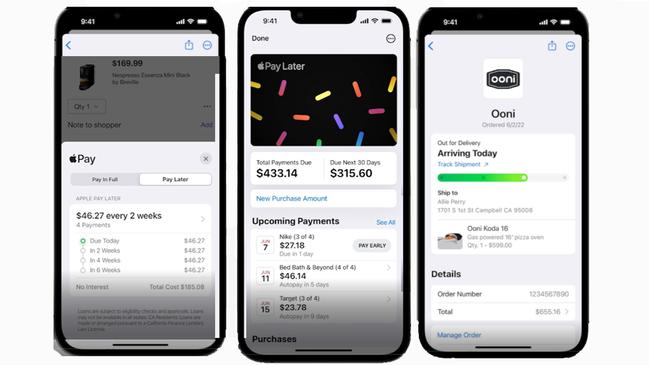

Consumers using Apple Pay will be asked to pay in full or pay later. If they choose later, they will get six weeks to make four equal payments and Apple promises no interest and no fees. As with BNPL generally, there is a hidden cost for the service, somewhere.

The Apple Wallet will become a one-stop shop for consumer commerce. It will manage upcoming payments and allow merchants to issue receipts and buyers to track orders.

If a merchant can’t process Apple Pay or Apple Pay Later, no problem. Apple is rolling out a “tap to pay” feature which lets merchants securely accept payments directly on an iPhone.

Some other BNPL providers might regard Apple’s move as giving it an unfair advantage if their customers have to transact through a separate app rather than natively through the wallet.

GlobalData said Apple already had an advantage entering the BNPL market tipped to be worth $576bn by 2026.

“Apple has enough cash reserves to finance the project over time whereas its competitors are raising questions about their ability to turn a profit once regulations are introduced,” said GlobalData analyst Chris Dinga.

Foad Fadaghi, managing director of tech research firm Telsyte, said Australia’s regulator might look at Apple Pay Later if it thought it gave Apple an advantage against other BNPL operators on iPhones.

“If it‘s implemented in a way that is exclusionary to other providers, and makes it advantageous only for Apple, it could attract the attention of the ACCC,” he said.

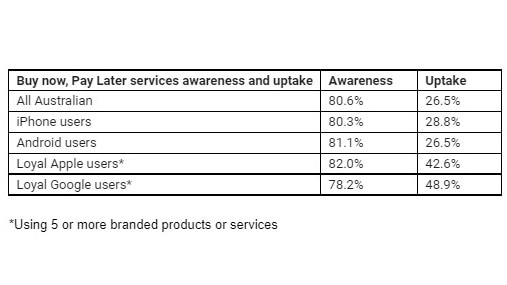

In Australia, nearly half the handsets sold are iPhones and 29 per cent of iPhone users use BNPL. That number swells to 43 per cent among loyal Apple users. Mr Fadaghi said these numbers suggested Apple’s Australian customer base would quickly adopt Apple Pay Later and the take-up would be significant.

According to an Australian Digital Consumer Study this year, more than a quarter of general phone users access BNPL services.

The BNPL announcement was among a lengthy list of new Apple updates including passkeys as a replacement for passwords. Users create them using their face and fingerprint biometrics. Apple passkeys will be universal, eventually available for use on competing Microsoft and Google devices under a plan by the FIDO (Fast ID Online) alliance.

Come September, Apple users can use their iPhones as high resolution web cameras on a Mac, and Apple Maps and CarPlay will let you key in multiple stops on a route. Users can also unsend Apple messages and emails.

The changes come into effect when users download new versions of Apple’s operating systems – iOS 16, iPadOS 16, watchOS 9 and MacOS Ventura – in Q3/22.

Not everyone is fazed by Apple offering BNPL. Payo CEO Taf Chiwanza said Apple’s move showed its commitment to innovation and evolution of payment options. “We welcome Apple to the industry,” he said.

David Marsh, principal industry consultant of payments company Endava, said any attempt by Apple to offer BNPL domestically would likely face stiff competition due to the saturation of ‘pay-in-instalment’ products within Australia. “The concerns vocalised by local banks and consumer groups on big tech’s influence in payments is also something to be mindful of, even more so as a large global entrant.”

At the conference this week, Australian start-up Procreate became only the second firm to win an Apple Design Award twice since the introduction of the App Store.

Apple looks set to grab a big slice of the multi-billion dollar buy now, pay later market after the tech giant announced its own BNPL service called Apple Pay Later at its Worldwide Developers Conference in California.