Afterpay brings pay-in-4 to Square check-outs across Australia, US

Customers across Afterpay’s two largest markets, Australia and the US, will now be able pay-in-4 across Square terminals.

Customers across Afterpay’s two largest markets, Australia and the US, will now be able pay-in-4 in person as the Aussie unicorn integrates its service at Square’s point of sales terminals across both countries.

The major move will see Afterpay stickers splashed across payment counters and cash registers across the country as businesses look to advertise their new buy now, pay later offering which many young Australians appear to favour over low-cost credit cards.

Head of Square Alyssa Henry said that Square merchants saw transactions increase twicefold during a beta phase roll out of the service.

“We’re excited about this and seeing that there is strong buyer demand in both Australia and the US in terms of being able to use buy now pay later with Afterpay at Square terminals,” she said. “Omnichannel isn’t just about selling across multiple channels, it’s about meeting your consumers’ shopping habits, whatever and wherever they are.”

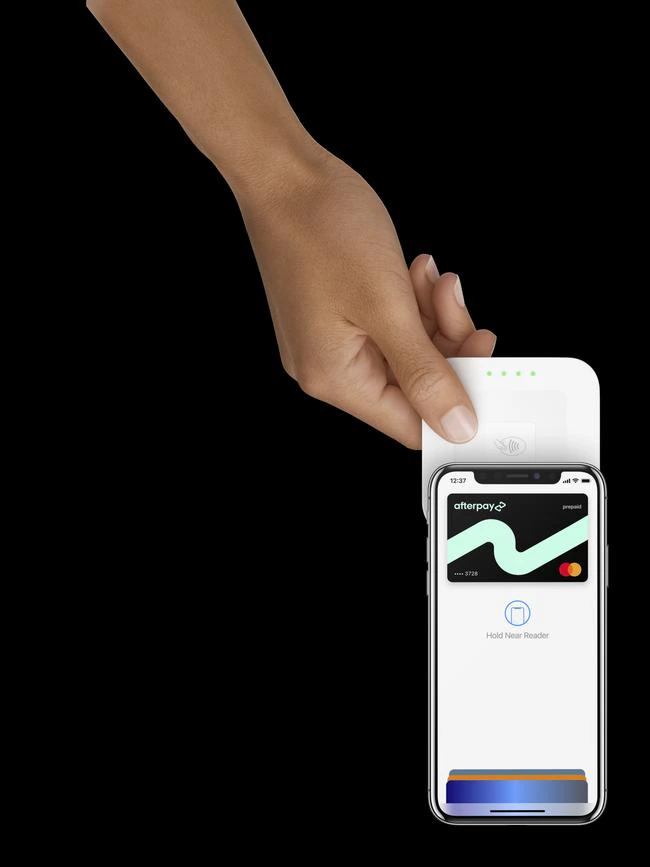

Customers will be able to use Afterpay via their mobile wallet after downloading a digital debit card from the app.

Square said that merchants would be paid in full meanwhile customers would pay for their items over four scheduled payments, with some customers, who are enrolled in Afterpay’s loyalty system Pulse, not paying anything at all for the first two weeks.

The move follows Square integration of Afterpay into payments portals online in February, a move Ms Henry said saw transaction sizes triple.

The new deal is expected to increase those sales further as Square merchants are added to Afterpay’s online directory which the fintech giant promises provides hundreds of millions of sales leads per year.

Afterpay founder, now Square’s BNPL lead, Nick Molnar said the offer would allow businesses to scale.

“Our buyers are young, high-intent consumers who prefer Afterpay and quickly become repeat customers for our merchant partners,” he said.

Globally, Square reported 180 per cent growth in customers using Afterpay via Square merchants.

One of the fastest growing sectors has been in the beauty and personal care sector, with merchants reporting a 26 per cent increase in Australia and a 16 per cent increase in the US.

Asked how Square and Afterpay would respond to criticisms that BNPL is encouraging people to spend outside their means, Ms Henry said the company sees Afterpay as a financial solution rather than a problem.

“The foundation is that we don’t want people to extend themselves beyond what they can pay,” she said. “When anyone misses even one payment, they get no more credit.”

Ms Henry said removing credit was unlike traditional finance. “The whole model in traditional finance is that they want you to miss payments so they can charge you interest fees on all of that,” she said.

Afterpay pushed customers “towards good financial habits,” Ms Henry said.

“Really where the money is made (for Afterpay), the core of the business model, is lead-gen (marketing to attract future sales) and advertising,” she said.

Afterpay charges customers an initial $10 late payment fee and a further $7 if the payment remains unpaid for seven days unless the item cost less than $40. Orders over that amount “are capped at 25 per cent of the original order value or $68, whichever is less”.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout