Fupay signs up with IGA, Foodworks and United Petroleum to offer BNPL for groceries, fuel

Fupay will become the nation’s first buy now, pay later provider to offer short-term loans for items such as milk, petrol and bread at three major outlets.

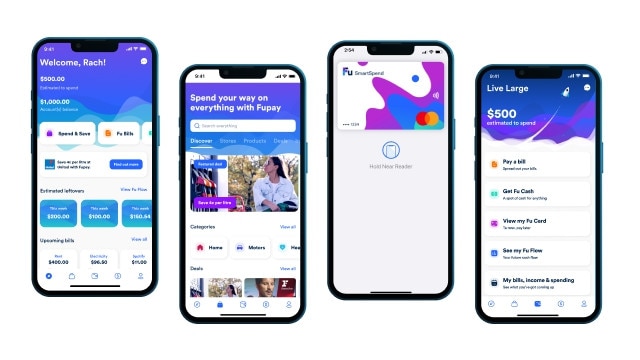

Rising financial services platform Fupay has become the nation’s first buy now pay later provider to successfully enter the grocery and fuel markets, providing short-term loans for everyday items including milk, petrol and bread.

The deal, struck between IGA, Foodworks and United Petroleum, will see Fupay provide short-term loans of up to $500 to spend on essential items as BNPL providers continue to target low-rate credit cards.

While many have raised concern at providing BNPL loans for essential items, Fupay co-founder and managing director Michael Fredericks said the decision was more about helping customers meet needs when they fall short.

“It’s an exciting development for us in providing that responsible payments smoothing solution where it’s needed most by consumers. In terms of payments smoothing, our focus is on the everyday spending categories – relative to that our data shows that’s where the greatest need is in terms of our transactions,” he said.

Mr Fredericks said Fupay had a growing customer base of around 200,000 people and was set to enter Europe in coming months.

While Fupay advertises BNPL loans of up $500, the platform rarely lends as much. Mr Fredericks said it wasn’t often that customers could borrow the full amount as their suitability is assessed based on so-called ‘smart spend’ features.

“In reality, not many people can pay back that amount or a lot of people struggle to pay back $500 in that buy now pay later pay eight week window,” he said.

“So it seems to be always under $200. That’s the common use case … it’s quite rare that we have a $500 transaction.”

Smart spend works by linking a customer’s bank account so that the platform’s algorithm could detect incoming and outgoing payments as well as upcoming bills.

A similar affordability check is made by tech giant PayPal, which late last year also entered the BNPL market.

When a customer applies for the company’s Pay in 4 service and is knocked back, they receive a message which reads: “Based on the data you’ve provided us and information we’ve received from a number of sources, including Equifax – a credit reference agency – your application has been denied.”

A spokesperson for the company said that it informs and seeks consent to check a customer’s credit before providing its Pay in 4 service and that any overdue amounts on a customer’s PayPal account would be reported to credit authorities. Unlike other BNPL providers, PayPal’s Pay in 4 does not have late payment fees.

“While PayPal predominantly uses its own PayPal account data to surface, approve or decline PayPal Pay in 4 availability for consumers, we do use an external credit reporting body when required,” they said.

PayPal doesn’t allow BNPL to be used for gambling, cryptocurrency trading, person-to-person transfers, not-for-profit donations, CFD and Forex.

Julia Davis of the Financial Rights Legal Centre said one of industry’s primary concerns surrounding BNPL is the lack of ability to deal with financial hardship such as for people currently impacted by flooding for example.

“BNPL has not made the same investment and some haven’t made any at all or know how to handle fraud or financial hardship,” she said.

Ms Davis said some BNPL offerings, usually from larger financial institutions which may already offer credit or a payments platform, offered their products under similar circumstances to their credit card offerings.

“I would certainly have more confidence in a big lender as opposed to a brand new fintech that is mostly an algorithm and not a lot of humans,” she said.

“One thing we’d love to see is for BNPL to stop advertising to children and people in hardship. One company used Rebel Wilson in an advertisement about Christmas presents.”

Mr Fredericks said Fupay largely agreed with consumer advocates and that more BNPL providers should use tools to assess affordability.

“This concept of credit being applied in everyday spending, that’s not a new thing,” he said. “I think the concern is that if you’ve got a buy now pay later company that doesn’t have those insights into a customer’s affordability then that bottom 20 per cent who shouldn’t be getting loans are, that’s the issue,” he said. “So we absolutely agree with consumer advocates that it isn’t good enough and that you need that affordability or that loan serviceability filter.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout