Solomon Lew and Myer board on a collision course

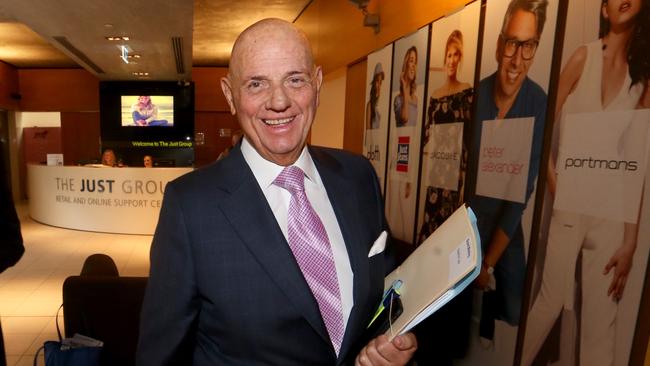

The spectacle of a public corporate brawl between the board of Myer and its biggest shareholder, billionaire Solomon Lew, is now more likely than ever.

The spectacle of a public corporate brawl between the board of department store owner Myer and its biggest shareholder, billionaire Solomon Lew, is now more likely than ever after Mr Lew’s Premier Investments did not send in nominations for the Myer board before the deadline of 5pm Thursday.

It sets Myer directors led by acting chairman JoAnne Stephenson and Mr Lew’s army of advisers and lawyers on a collision course at Myer’s annual general meeting in November and most probably an extraordinary general meeting (held possibly within days of the AGM), at which control of the board will be up for grabs.

Mr Lew is yet to unveil his own nominees for the Myer board, but tasted early victory last year when he successfully pushed for Myer chairman Garry Hounsell to be ejected from the board. Myer is yet to secure a new chairman, and has been led by a deputy chair since November.

For shareholders it is likely to provide another entertaining pitched battle between the Myer board and Mr Lew at the AGM slated for November 4, albeit most probably online rather than at the Myer Mural Hall in Melbourne.

Eight days ago Myer set itself up on a collision course with its largest shareholder, Mr Lew’s Premier Investments, by releasing a statement late on Wednesday night saying that it would hold its annual general meeting on November 4, rebuffing Mr Lew’s demand the shareholders meeting be delayed until later in the year.

Mr Lew and his Premier Investments company have been stalking the Myer board since he first bought a 10.77 per cent stake in the troubled retailer in early 2017, and has attempted to put up his own director nominations in the past.

However, if Mr Lew was now hoping to elect his own hand-picked directors to the Myer board at the AGM in November, he had to lodge the nominations with Myer by the close of business on Thursday.

Mr Lew, whose ASX-listed Premier Investments has built up its stake in Myer to 15.77 per cent, had wanted the delay to the AGM so he could pull together a list of credible nominees to put on the Myer board but crucially who could also have time to digest the retailer’s results when they are released in September.

The billionaire wrote to Ms Stephenson requesting the board delay releasing their notice of meeting, thus giving potential directors an opportunity to assess the latest Myer financial results and what they would be walking in to if they agreed to be nominated to the Myer board.

At the time, Mr Lew also issued a threat, warning that if what he called a “commonsense” request was not met by Myer to delay its AGM then he would use his 15.77 per cent stake to call an immediate extraordinary general meeting – which would be costly and held close to the AGM – at which he would seek to kick out all non-executive Myer directors.

Last week Myer rebuffed Mr Lew’s request by issuing its ASX notice to set a date for the AGM and seek nominations by Thursday.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout