Intrigue and stern lawyer’s letters in battle for the Myer board

What is in the best interest of shareholders? It’s a good question for retail investors at Myer, which at a market capitalisation of $418m might scrape into the top 500 ASX companies. Pathetically, 65 per cent of shareholders by number in Myer, over 30,000 of them, can’t even sell their shares as they no longer have marketable parcels.

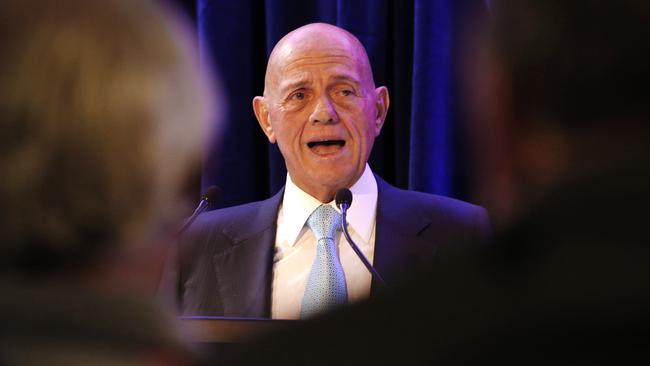

In the last few weeks the feud between the Myer board under acting chair JoAnne Stephenson, and its largest shareholder, Solomon Lew’s Premier Investments, has festered. It’s a battle to control the board and both sides are now armed with chiselled advisers.

The Myer camp has recently hired investment bank Luminis. If the noise from media reports has substance, by the AGM in late October the board plans to be well into executing a new strategy, and it has determined that under no circumstance should Lew be allowed to drive board changes, let alone get control of the company without paying a takeover premium.

For the Lew camp, if the Myer board strategy means selling assets, or raising equity to dilute Premier’s holding in Myer, then it’s off to the Takeovers Panel or the courts.

For months Solomon Lew has wanted the entire board sacked and replaced by a skills-based majority-independent board with an independent chair and representation for Premier, which he controls. Lew, whom investor John Sevior describes as probably the best retailer and best retail investor in the country, is outraged by a succession of chairs and management failing to turn around the retailer.

Yet something about the brinkmanship of the last few weeks suggests change is in the wind. Consider these moves.

On July 5 Lew increased Premier’s stake in Myer from 10.8 to 15.77 per cent. The next day he called again for the Myer board to be sacked and on July 9 Premier threatened to call for an EGM.

On August 3 Premier called for the immediate release of a trading update from Myer ahead of full year results. That call was backed by the second-largest shareholder in Myer, Wilson Asset Management.

There was no formal response from Myer but much has been happening through the media.

On August 5, Premier signalled it had no intention of making a takeover offer for Myer. Lew again called for a trading update given the gap between last year’s $172.4m loss and market consensus of $33.5m profit for the FY21 results.

Between August 9 and 11 there were reports that Myer was looking to raise capital at a 30 per cent-plus discount that would dilute Lew’s holding, and/or sell Myer assets.

On August 11, Lew threatened legal action over the rumours in the press.

On August 12 the Myer board released a trading update showing net profit after tax of $47m to $50m for the full year, excluding restructuring costs.

The events raise more questions than answers.

What made the board release the trading update after nine days? The Lew camp argued for the release to enable their board candidates to assess the company’s position ahead of sharing director names with the Myer board. But the trading update, well above market consensus, could also send a message to some of the parties that Luminis, on behalf of the board, has been duchessing.

Sources say the boutique bank has approached potential retailing partners and businesses, bouncing around a smorgasbord of options rather than one specific idea. Perhaps the Myer board sees the trading update as useful to drum up interest.

Regardless, the reports have been enough for Premier’s lawyers Arnold Bloch Leibler to fire off a missive to Myer’s Clayton Utz, warning Myer’s independent directors of their duties. The letter is a not too subtle shot at Luminis for reportedly encouraging parties to take a placement on the basis they would benefit from a takeover bid from Solomon Lew.

For the Myer board, Ryan Stokes’ artful takeover of Boral without a price premium while its board sat like a boiled frog can’t have escaped attention.

The week after Premier lifted its stake in Myer to 15.77 per cent the share price jumped over 30 per cent to 50c – that’s a fair takeover premium.

Myer would no doubt argue the release of its trading results, which lifted the stock 9.5 per cent, now underpin that price. Yet the thinly traded and volatile stock remains about the same level it lifted to after Premier bought in, closing on Friday at 51c.

Lew’s anger at the destruction of value at Myer since the IPO (including his own $100m investment) and his war with former chair Garry Hounsell is well known. Hounsell was spectacularly forced out hours before last year’s Myer AGM.

By indicating he had no intention of making a takeover on August 5, Lew under ASIC’s truth in takeovers policy cannot make a takeover for at least four months. That was a signal to anyone being pitched a nice fillip from a discounted placement of Myer shares.

Arnold Block Leibler’s August 11 letter hints at the arguments that play out if the gloves come off, threatening both the Takeovers Panel and court action. The claim by ABL that Myer is in caretaker mode is a bit rich. Premier has only said it intends to requisition an EGM, and now there is a trading update.

However, that trading update reveals over $100m in cash, so Myer’s need for a share placement seems odd. And if it transpires that a placement at a discount of up to 30 per cent was being shopped around as a way to dilute Premier, would that be enough for the Takeovers Panel to conduct proceedings?

If yes, it might ask for board papers to look for any link between when the board started considering such options and when Lew dialled up the pressure on board composition.

Then again, the Panel might also be interested in control premiums and vested interests given Lew’s well-known position in the broader retail supply chain.

The ABL letter also signals court action. Would a disposal by Myer of the online business that offers new partners a stake in that business or shares in Myer be enough for Premier to take action over oppression of minorities and breach of board duties?

Premier has a stellar record of growth and expertise in online with brands like Smiggle and Peter Alexander under Mark McInnes. Myer’s trading update shows online sales for the year up 27.7 per cent to $540m, making up 20 per cent of total sales.

Whether the online growth continues when shoppers head back to the malls is unclear. But Myer has been slow to build logistics to support online. On July 23 it announced a new leased facility in Victoria would become its national distribution centre.

Could MyerOne and Myer.com.au be enough as brands to attract buyers or strategic partners ahead of the AGM? And is this about driving a turnaround at Myer, which shareholders should applaud, or is it to stop Lew increasing his influence at all costs?

Lew has grown Premier Investments to a $4bn-plus business, 10 times the size of Myer, from a cash box in 1987, one of the original SPACs. And he controls Breville, another $4bn business.

The Myer trading update certainly surprised on the upside and may have given the board breathing space, but it won’t put Lew off his plan to change the board which has clearly been unable to attract new board members, let alone a permanent chair. Wilson Asset Management welcomed the trading update but declined to comment beyond confirming it had not been approached on a sale of Myer assets or share placement.