John Gillam not interested in joining Solomon Lew’s Myer dream team

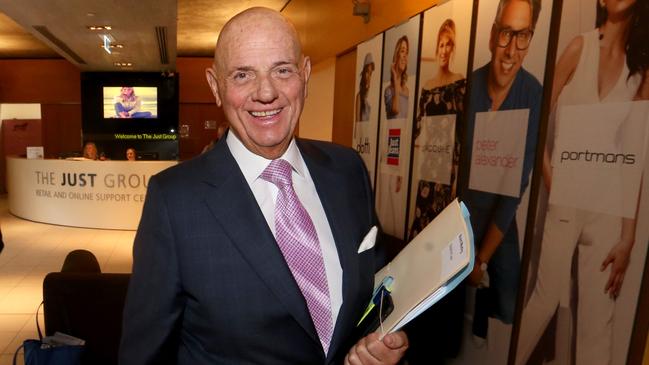

Former Bunnings boss John Gillam has ruled himself out of joining a ‘dream team’ of directors marshalled by Solomon Lew to run for the Myer board

Former Bunnings boss John Gillam has ruled himself out of joining a “dream team” of directors marshalled by Solomon Lew to run for the board of department store owner Myer, as the billionaire retailer and his advisers cobble together a list of nominees to drop into the Myer boardroom.

Mr Gillam, who was the chief executive of Bunnings between 2004 and 2016 and helped fashion the hardware chain into Australia’s most successful retailer, had been spoken about in the Lew camp as a strong contender for the chairmanship of Myer.

The former Bunnings CEO and Officeworks chair is currently chair of building products supplier CSR and chemicals company Nufarm, but it is in retail that he made his name by supercharging Bunnings to notch up profit growth over more than a decade.

He is just the sort of well-respected retail director the Lew camp is looking for as part of their team to win over Myer shareholders and the broader market.

Mr Gillam is also seen as independent and not a puppet of Mr Lew or his Premier Investments.

Mr Gillam confirmed he had heard chatter among institutional investors that his name had found its way onto a Lew wishlist and in particular to fill the chairman’s role at Myer, but said he was not interested in the role.

“I do not envisage taking on that role as chairman of Myer, and I have previously stated I would not be taking on any more roles as I have my current chairmanships at CSR and Nufarm,” Mr Gillam said.

“I’m not interested in the Myer chairman’s role.”

Institutional shareholders were excited about the prospects of the Lew camp signing up Mr Gillam as a Myer director, given his success recently at Nufarm, where the share price and outlook have vastly improved.

It comes as Mr Lew, whose Premier Investments is Myer’s biggest shareholder with a stake of 15.77 per cent, is working on a list of nominees to put up as directors for Myer at the AGM in November, or at an earlier extraordinary meeting he might call for October.

The Lew camp wants Myer directors who will gain support from other large shareholders and the market in general, hence the raising of the Gillam name.

In late 2017 Mr Lew ramped up his assault on the Myer board by nominating three directors, the former Myer Grace Bros boss Terrence McCartney, former UBS investment banker Tim Antonie and Abacus Property boss Steven Sewell.

Mr McCartney and Mr Antonie are also long-serving directors of Premier and might not be viewed by the market as independent of Mr Lew.

The complex corporate and business web surrounding the boardroom dust-up includes Mr Lew’s family companies and his other interests as Myer’s largest supplier outside of cosmetics, while Premier is also a competitor to Myer.

Mr Lew is telling institutional investors he wants a majority-independent Myer board after he sweeps out the remaining non-executive directors – acting chair JoAnne Stephenson, David Whittle and Jacquie Naylor.

This could see investors put up two nominees, most likely Mr Antonie and Mr Sewell, with the now fading hopes of Mr Gillam accepting the role of chairman.

Myer has been without a chair since November when Garry Hounsell quit after losing key shareholder support from Mr Lew and its second-biggest shareholder, Wilson Asset Management. Myer has been on a search for a new chair ever since.

Former Premier Investments chief executive Mark McInnes, who before joining Mr Lew in 2011 was a successful boss of department store David Jones, has also been spoken about as a possible Myer boardroom nominee but is not interested. He stepped down from Premier Investments this month and will be replaced as CEO by former JB Hi-Fi boss Richard Murray. Last week Myer surprised the market, and the Lew camp, by releasing a trading update that showed it had returned to profitability in the second half for the first time since 2017.

Myer is expecting a slender profit of $4m to $7m for the second half of 2021.

Mr Lew had been calling on Myer to issue a trading update when it ruled off its full-year results at the end of July, and has also been demanding Myer delay its AGM in November so as to give enough time for any of his board nominees to assess the retailer’s performance over fiscal 2021.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout