No more interest rate rises, battling builders plead

Construction industry bodies are urging the Reserve Bank to end its series of back-to-back rate hikes on Tuesday.

Construction industry bodies are urging the Reserve Bank to end its series of back-to-back rate hikes on Tuesday, as new figures show home builders struggling to work their way through a record $53bn backlog of work.

Australian Bureau of Statistics figures revealed a constricted pipeline of activity as immigration surges and rental vacancy rates plummet, with experts saying higher borrowing costs would add to sky-high material costs and labour shortages that have bedevilled the industry and triggered high-profile corporate collapses.

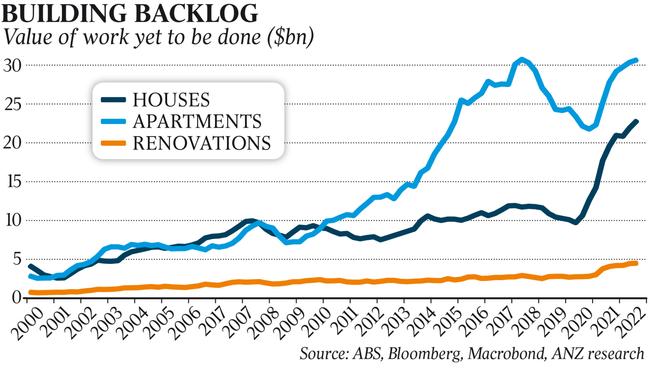

There was $22.8bn worth of house building work yet to be done, more than twice the pre-pandemic level, while the backlog of apartment construction had climbed to $30.7bn in February and around the previous high in mid-2018, according to the ABS.

Most economists believe the central bank will take the opportunity to pause on Tuesday, after monthly inflation fell to 6.8 per cent in February, following a peak of 8.4 per cent in December, and as evidence emerges that the most aggressive policy tightening cycle in decades has begun to weigh on household spending.

With under five weeks to the May 9 budget and consumer price growth still running high, Finance Minister Katy Gallagher on Monday said a key priority would be to offer some cost-of-living relief to struggling households while ensuring the budget “works alongside the Reserve Bank and doesn’t make their job harder”.

A household with a $750,000 mortgage would be paying $1474 more in monthly interest payments as a result of the 3.5 percentage points in rate increases since the first hike in May.

An increase to 3.85 per cent at Tuesday’s RBA board meeting would bring the total rise in interest obligations to $1590 a month.

With builders struggling to make headway into the historically high pipeline of outstanding work, the National Housing Finance and Investment Corporation on Monday projected the number of new homes built over the coming five years would come in 106,300 short of what was required to keep up with demand, including 62,300 fewer apartments than needed.

Separate data from the ABS on Monday showed that apartment building approvals had dropped 8 per cent in February to the lowest level since July 2012.

HIA chief economist Tim Reardon said the decline in approvals and new loans in the past year meant “there can be no justification for further rate increases”.

ANZ senior economist Adelaide Timbrell suggested developers were retreating from the market as climbing interest rates added to sky-high building costs.

Ms Timbrell said there were “a lot of HomeBuilder houses that are still not complete”, referring to the generous Covid-era federal subsidy that turbocharged approvals through 2020 and 2021.

With construction firms failing at double the pace of last financial year, and following the shock collapse of developer Porter Davis on Friday, Ms Timbrell said climbing insolvencies were adding to the challenges facing the sector. She said one positive of the massive backlog of work was the building industry was unlikely to suffer a sudden downturn, but the snail’s pace of new supply meant rental affordability was unlikely to improve quickly.

Master Builders Australia chief economist Shane Garrett said the slump in new apartment construction extended before the pandemic. “Inadequate volumes of new supply are contributing to growing difficulties in our rental market. Rents are currently rising at their fastest pace in over a decade,” he said.

NAB head of market economics Tapas Strickland said the annual rate of new home building approvals was running at 183,000, versus the increase in the adult population of 475,000 over the same period: “In other words, there is only one new dwelling approval per 2.4 new people being added to Australia’s population.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout