Mittleman renews opposition to BGH offer for Village Roadshow

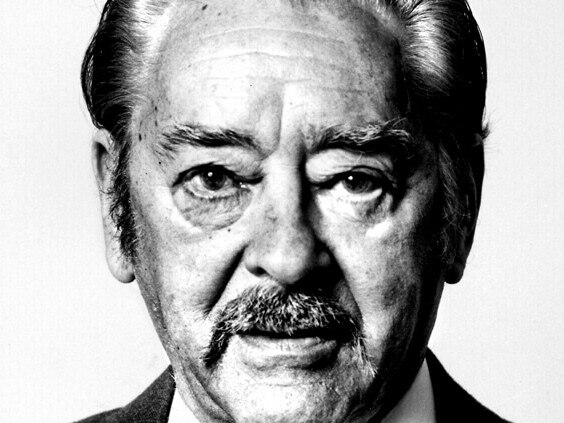

US investment house invokes name of entertainment legend Roc Kirby as it argues against takeover bid for Village Roadshow.

Melbourne-based private equity firm BGH Capital may face a rocky road as it tries to take cinema and theme park company Village Roadshow private in a $586m deal, as dissident US-based Mittleman Investment Management renews its opposition to the deal terms.

The investor claims that Village’s theme parks, including Queensland’s Sea World and Warner Bros. Movie World, will be worth just over $1bn and its movie theatres $480m once trade recovers.

It has called on other investors to oppose the deal it claims dramatically undervalues the iconic Australian company, saying there is no need to sell in a crisis before the economy recovers.

“The recent COVID-19 vaccine discoveries are likely undeniable game-changers,” Mittleman said.

“Thus, as Australia presumably returns to a pre-pandemic environment, we presume pre-pandemic economics and pre-pandemic valuations should be attainable, at the very least. In fact, we think better than pre-pandemic financial results are likely attainable in the near-term based on pent-up demand.”

In a shot across the bow of the once-warring founding Kirby family, which is supporting the sweetened BGH takeover plan, Mittleman noted the legendary Roc Kirby, who founded Village in 1954, had infused it with “contagious optimism” but the company was now taking the opposite approach.

“The ‘disingenuous pessimism’ used to induce minority shareholders to sell in this cynical buyout dishonours that legacy,” Mittleman said.

BGH on Monday lobbed a sweetened takeover deal of $3 per share, valuing Village at about $900m including debt, and won over its second-largest shareholder, Spheria Asset Management, which holds a stake of 7.8 per cent.

Mittleman previously rejected the prospect of a bid around this level, saying Village was worth more than $5 per share. The company is yet to reveal how it will vote but upped the ante by lifting its overall holdings from 14.34 per cent to 15.1 per cent this week.

The founding Kirby family and former chief executive Graham Burke, who control about 40.4 per cent, are backing the BGH bids, which could also be passed at $2.95 per share under a scheme in which they can vote.

“The current $2.95 to $3.00 range of best outcomes provided still appears unfairly low versus our estimate of indicative fair value which is currently $5.24 per share,” Mittleman said.

BGH shares bumped up 1c to $2.91 as investors expect the deal to succeed. It is being backed by all major proxies, with Ownership Matters and ACSI flipping their recommendations to support the bid.

Village was in play before the pandemic struck, when BGH was circling at $4 per share. But the company’s theme parks were hit and cinemas are now under more immediate threat from streaming services.

Village’s board is backing the bid, citing the continuing fallout from the crisis that has hit tourism and entertainment spending in a lasting way and forced it to borrow heavily, with projections that debt could hit $380m next June.

Village’s independent directors, advised by UBS and led by former Foxtel chief Peter Tonagh, recommend shareholders vote for BGH’s schemes, saying the deals were in the “best interests” of shareholders in the absence of a superior proposal.

The BGH offers are also above independent expert Grant Samuel’s valuation of $2.03 to $2.80.

Mr Tonagh said that for nearly 12 months, since an approach by private equity firm PEP, the independent board committee had reviewed options available to Village as part of a competitive process to maximise value for all shareholders.

“The independent directors unanimously believe that the BGH transaction is the best option available and represents significant value for Village shareholders compared to any alternatives, including the status quo,” Mr Tonagh said.

“Importantly, the BGH proposal submitted earlier this week is now above the independent expert’s value range and is supported by all four proxy advisers. The BGH proposal provides the opportunity for all Village shareholders to realise an attractive cash price for all of their shares, in a very uncertain operating environment,” he said.

“The values of theme park and cinema businesses globally have reduced on average by more than 45 per cent this year. The changes impacting the cinema sector are structural and not merely a reflection of a short-term COVID impact while border restrictions will continue to have a significant impact on theme parks.”

He said Village’s value had decreased materially during 2020 due to its significantly higher net debt position, which continues to grow on the back of ongoing negative cash flows and significantly lower earnings.

“These factors underscore the attractiveness of the BGH transaction and support the independent directors’ unanimous recommendation for Village shareholders to vote in favour of the proposal,” he said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout