Macquarie Group sells majority stake in LOGOS to Singapore’s ARA Asset Management

The multi-billion dollar LOGOS industrial property empire is one of Macquarie’s most successful property funds ventures.

Macquarie Group has exited one of its most successful property funds ventures of the last period, selling its majority stake in the multi-billion dollar LOGOS industrial property empire to Singapore’s ARA Asset Management.

The investment bank’s MIRA Real Estate unit had actively backed LOGOS’ rapid expansion across Asia over the past five years and has just exited after securing regulatory approvals.

The metrics were not disclosed, but the bank’s support helped the operator’s rapid growth from a start-up to one of the region’s major players alongside the likes of the Goodman Group, Hong Kong’s ESR and local player Charter Hall.

Macquarie was a big name in direct property investing and running listed funds before the global financial crisis (GFC) but sold the bulk of this business to Charter Hall a decade ago.

It has since taken stakes in property funds ventures around the world in areas including British and US logistics and multi-family apartment operations. It uses its networks to help build up the businesses and then looks for an exit.

LOGOS has been one of the most active property buyers and developers in Australia in the logistics property boom and also went into markets including China, India, Japan, and Indonesia with the backing of global pension funds.

Across the Asia Pacific region, the company has grown to more than five million sqm of property owned and under development, with a completed value of $S8.2bn ($8.9bn) across 17 ventures.

Set up by founders John Marsh and Trent Iliffe, with support coming later from Canada’s Ivanhoé Cambridge and Macquarie, LOGOS has focused on the Asia Pacific.

LOGOS expanded into China in 2012 and in 2016 ex-Macquarie and Goodman executive Stephen Hawkins founded LOGOS’ Southeast Asia business. The group later expanded into India, New Zealand and Vietnam.

Worldwide interest in logistics property

The exit sees the investment bank capitalising on the huge worldwide interest in logistics property and it selling to ARA’s logistics arm, ARA Logistics Partners.

It will join existing shareholders, LOGOS’ founders and Ivanhoé Cambridge. LOGOS will become ARA’s exclusive platform for logistics assets globally, including running its listed trusts.

The deal brings together ARA’s global fund management capabilities with LOGOS’ extensive Asia Pacific logistics property and development expertise.

ARA already manages the Cache Logistics Trust, a major Singapore logistics REIT with assets under management of about $S1.3bn, and it will be rebranded in the coming months to align with ARA and LOGOS’ growth plans.

ARA Group chief executive John Lim said both groups look forward to expanding their logistics platform in Asia Pacific.

LOGOS is one of the largest and fastest growing logistics real estate players in the region with a strong track record and its fund products are highly complementary to those of ARA.

“We will be able to offer our investors a comprehensive set of investment vehicles across the risk spectrum to meet their investment needs in the logistics real estate space via the new platform,” he said.

LOGOS joint managing director Trent Iliffe said the logistics sector was undergoing significant growth and the company was excited to be partnering with ARA to continue the expansion of LOGOS in Asia.

Despite fears that the coronavirus will interrupt global supply chains, the industrial and logistics sector is well-supported by a rising middle class which is driving consumer spending and the growth of e-commerce, especially in Asia.

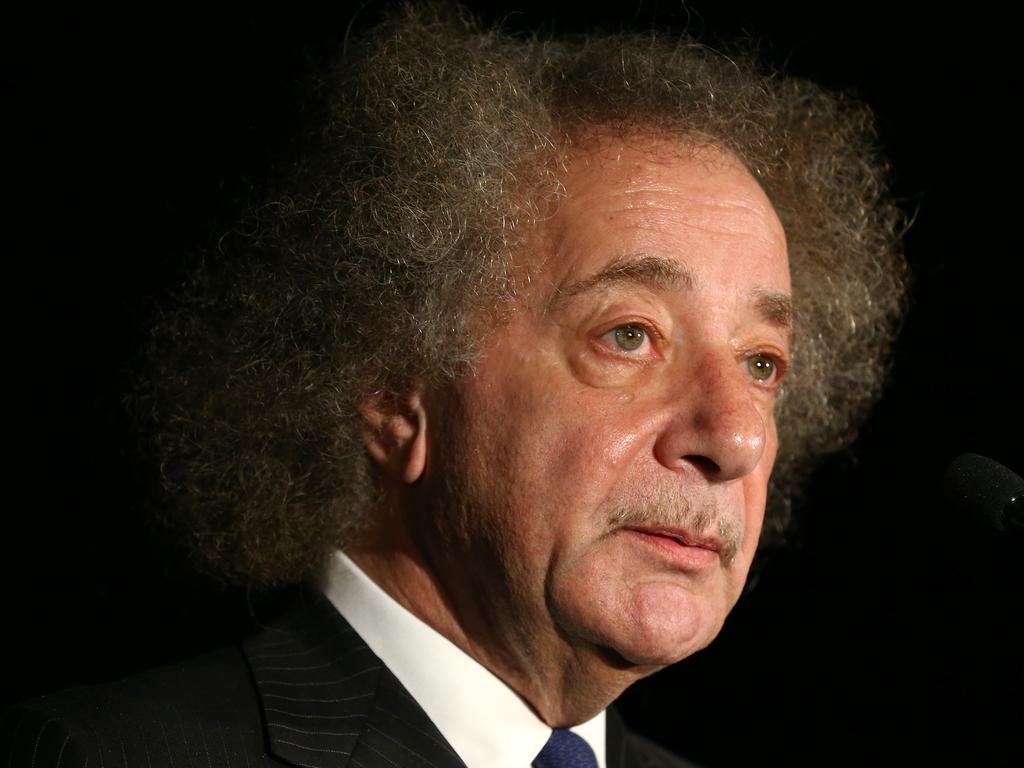

In recent years, ARA has expanded globally to the US and Europe from its Asia Pacific stronghold, and it is currently battling the board of Cromwell Property Group, where it is seeking to install Gary Weiss as a director.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout