Cromwell Property Group confident despite coronavirus hitting business confidence

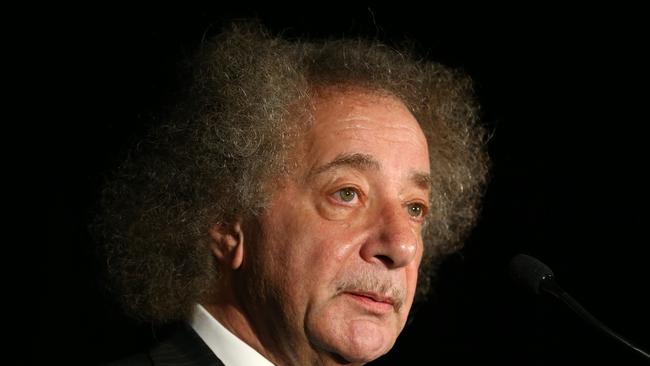

Singapore’s ARA Asset Management is stepping up its campaign to install corporate raider Gary Weiss on the Cromwell board.

Cromwell Property Group has declared its local and offshore property empire is running ahead of expectations and it remains on track for the second half in the face of the coronavirus hitting business confidence.

The company delivered a $227.3m first half profit as its chairman Geoff Levy formally departed and largest shareholder, Singapore’s ARA Asset Management, stepped up its campaign to install corporate raider Gary Weiss on Cromwell’s board.

Flanked by new chairman Leon Blitz, Cromwell chief executive Paul Weightman said Dr Weiss had been rejected at a meeting last year and was the wrong person at the wrong time for the company.

Cromwell, which has tapped investment banks UBS and Goldman Sachs to undertake a strategic review, says its model focused on value add property and funds management is faring well at this high point in the property cycle.

Locally, the company has outlaid an ambitious agenda to overhaul its portfolio with works underway in Melbourne, Brisbane and Sydney’s Chatswood, where it has won US giant BlackRock to back a $120m office and hotel venture.

But much of the focus is on how Cromwell is managing its $8bn funds business and it said it was in talks with prospective investors for a new Polish retail vehicle. It has taken the assets on balance sheet, lifting gearing, and is hopeful of getting away the new fund this year.

Cromwell’s operating profit was $134.1m, equivalent to 5.18c per share, a 26 per cent jump from the 4.1c per share reported in the previous first half. Mr Weightman said the company’s long-dated balance sheet assets drove operating earnings above its rolling net operating income target of 3 per cent.

“Our strategy, which involves investing to acquire or develop assets, creating new funds, selling down to capital partners and then recycling the proceeds also continues to bear fruit,” he added.

In a busy half, Cromwell sold Sydney’s Northpoint Tower and bought Brisbane’s 400 George Street, advanced its LDK Healthcare venture and acquired the third-party interests in the Polish fund ahead of launching a new vehicle.

“The group has a clear proven strategy, a long-weighted average lease expiry portfolio of balance sheet properties, a $1.2bn-plus value-add development pipeline ... a successful and growing business in Singapore and a robust platform and presence in Europe,” Mr Weightman said.

Cromwell’s direct property investment is now valued at $3.2bn and he said the company’s portfolios were performing strongly. “We also have a very strong portfolio of value-add projects to consider,” he said.

The company also holds a 30.4 per cent interest in the Singapore-listed Cromwell European REIT, a half interest in a venture with LDK Healthcare and the Polish shopping malls, where it bought out other investors for €512.9m ($823.3m).

The Polish fund will be restructured by the end of March and will then be offered to capital partners with Cromwell expecting to retain a long-term stake of 20 per cent to 30 per cent.

Cromwell warned 2020 would be a difficult year for the world economy as the knock-on effects of the coronavirus were fully felt, adding to the impact of bushfires, floods, reduced numbers of tourists and international students, that meant growth forecasts were being lowered.

But is stuck to its forecast that operating profit was expected to be no less than 8.3c per share and distributions no less than 7.5c per share.

“Despite the considerable uncertainty in the general external environment, the distractions from consistent security holder agitation and the looming economic impact of the coronavirus, we are confident to maintain fiscal 2020 operating earnings guidance of not less than the 8.3c per share previously provided to the market,” Mr Weightman said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout