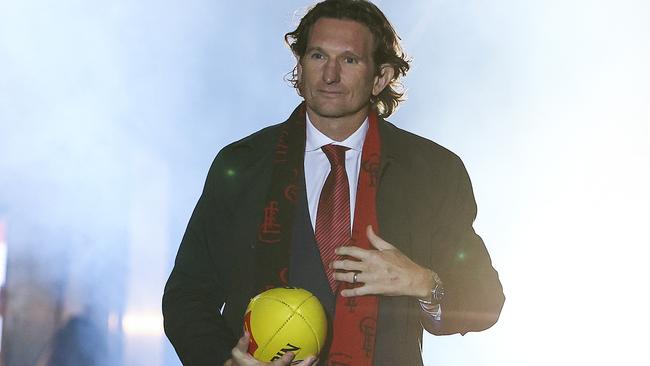

James Hird looks to boot investment goals after AFL spell

The AFL legend is forging a business career as a wealth manager with a listed firm snapping up a stake in his firm as it takes off.

AFL legend and former Essendon coach James Hird has sold a stake in his $5m funds manager Euree Asset Management to listed financial services firm Sequoia Financial Group as the pair ready to launch a new funds range.

The move will see Mr Hird, who runs the start-up firm Euree, and brings an extensive background in finance and investing, work with the listed company’s team on selecting investments and specialist managers for clients.

The group will select specialist managers to run equity, fixed income, international shares portfolios, with property and private equity, where Mr Hird has experience, to be run internally.

The deal has been structured with Sequoia acquiring 20 per cent of the shares in the business of Euree Asset Management for cash of $500,000 and a provision of services and goodwill for a further $500,000.

As a part of the goodwill contribution, veteran funds manager Winston Sammut will join Euree as senior investment manager, and be responsible for the funds dealings in domestic listed and direct property investments.

Both markets are at low points at the moment providing the opportunity for bargain-hunting and private equity is also active while listed markets are quiet.

A trio of senior executives at Sequoia – Mark Phillips, Michael Butler and Alex Edmonds – will also support the Euree management team to launch a range of multi-asset funds to financial advisers.

Mr Hird is chief executive of Euree Asset Management and the firm is chaired by Alan Hall, a former partner at legal firm Corrs Chambers Westgarth.

It will initially offer three fund options aimed at supporting financial advisers who want to reduce the cost of advice by accessing a single fund.

The venture is billed as having the intellectual property and know how to select a range of investments under a single umbrella across various asset classes to make up balanced, growth or property style funds.

The selection of the underlying investments will be managed by Mr Hird, Mr Sammut, Mr Edmonds, and a team of external investment consultants who will look to use funds and direct investments that have the premium ratings from independent research houses such as SQM Research, Lonsec and Morningstar in each asset class.

Mr Hird, who holds an Executive MBA from INSEAD, and has launched himself into his finance career after not getting the vacant head coach job at Essendon last year. The job went to Brad Scott and Mr Hird also left a post as an assistant coach at GWS Giants earlier this year.

At the time it was reported that Mr Hird was destined to go into the business sector after his brief return stint in the AFL, following his reign as Bombers coach ending in 2015 after the club’s drugs saga.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout