Housing affordability boosted by low interest rates and falling house prices, says Moody’s Investors Service

Housing affordability is at its best level in more than a decade and will improve further, according to Moody’s Investors Service.

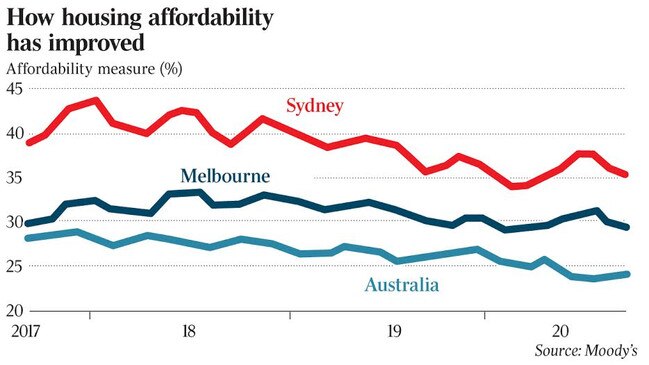

Housing affordability is at its best level in more than a decade and will improve further over the coming year thanks to low interest rates and falling house prices, according to Moody’s Investors Service.

The boost to affordability will come despite household incomes taking a hit as coronavirus-related government support measures peter out, the credit rating agency predicted on Monday.

For new home loans issued in September, households with two income earners were shelling out 23 per cent of their monthly earnings on mortgage repayments, Moody’s said. This was down from 25.1 per cent a year earlier.

The last time housing in Australia was this affordable was in March 2009, in the aftermath of the global financial crisis.

“We expect low interest rates for the foreseeable future and lower housing prices over the next 12 months, further improving housing affordability.

“Conversely, household incomes will come under pressure in coming months as coronavirus-related government income support measures end, but in respect of housing affordability, we do not expect this to outweigh low mortgage interest rates and lower housing prices,” the ratings agency said.

Affordability improved across all major capital cities in 2020, Moody’s vice president Alena Chen said.

“Housing affordability improved in Sydney, Melbourne, Brisbane, Perth and Adelaide over the year to September.

“For all capital cities, housing was the most affordable or near the most affordable in a decade in September,” she said.

House prices fell, on average, 1.5 per cent over the five months to September as Covid-19 battered the economy, though prices are still up 3.2 per cent over the year.

The Reserve Bank of Australia’s rate cuts, which brought the official cash rate to a record-low 0.25 per cent, drove home loan rates down further, giving housing affordability an extra push. The RBA is widely tipped to cut again on November 6.

Government assistance payments, meanwhile, have supported households since the pandemic hit Australia. Before Covid-19, average household incomes had risen 5.4 per cent over the year to May, Moody’s said.

In Sydney, new borrowers spent 29.9 per cent of their income on mortgage repayments in September. This compares with 30.9 per cent this time last year and an average of 32.7 per cent over the past decade.

Sydney remains the least affordable city for housing in Australia, although the median price fell 1.6 per cent over the five months to September. House prices are 6.7 per cent higher than they were a year ago.

In Melbourne, 24.6 per cent of household income was used for new mortgage repayments in September, down from 27 per cent the year prior. The Melbourne median housing price has dipped 2.2 per cent over the past five months but is up 4.1 per cent over the year.

Perth is the most affordable capital city for housing, with borrowers spending just 15 per cent of their income on repayments. That’s down from 17.4 per cent a year earlier. The Perth median housing price declined 1.1 per cent over the year to September, the most of any major Australian city.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout