Developers offer incentives to boost sales as units flounder

Unit developer Harry Triguboff has brought in a raft of measures to halt weakening sales in a market he says is getting worse.

Billionaire apartment developer Harry Triguboff has brought in a raft of measures to halt weakening sales in a market he says is “getting worse”, while other developers including Stockland CEO Mark Steinert are also feeling the squeeze.

Mr Triguboff, founder of Meriton, has increased commissions to real estate agents, is covering buyers’ stamp duty and increasingly lending to buyers.

Meanwhile, Mr Steinert flagged leading property group Stockland could “reshape” the land sizes it was selling to meet affordability targets.

Mr Triguboff applauded the banking regulator scrapping the 10 per cent growth limit on investor lending, but said the lending “speed limit” had become irrelevant.

“It doesn’t matter if there is no demand,” the veteran builder told The Australian.

“The great demand was coming from the Chinese and they find it very difficult to get money. I know because I lend it to them.”

The NSW government last year doubled the foreign buyer surcharge to 8 per cent, while most other states also have varying levels of taxes for offshore property buyers.

The demand from local buyers was also very weak, Mr Triguboff said.

“Its slowed for my units which are mostly above $1 million. For the $500,000 units, I’m not sure, but I think it would be a complete disaster.”

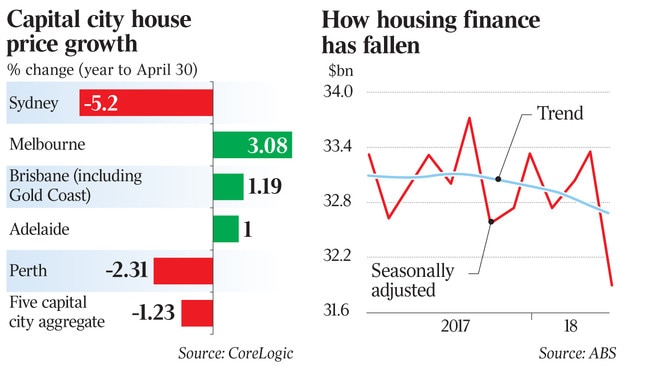

Lending to investors slumped to a five-year low, down 16 per cent in the year to March, according to figures from Australian Bureau of Statistics released on Friday. The fall away in investors — who made up 34 per cent of housing loans for the 12 months — has stoked concerns that tighter lending and a flow-on from the banking royal commission will further weigh on the weakening housing market.

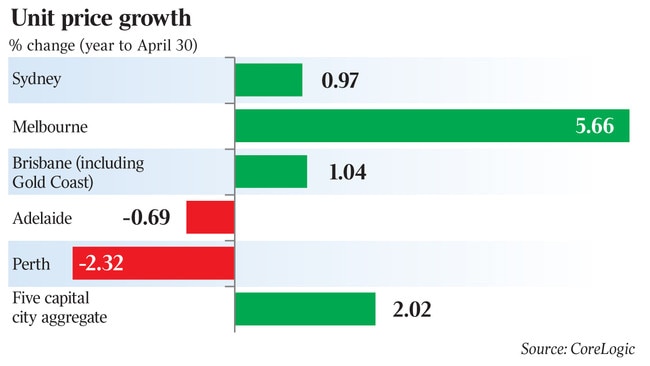

National housing prices for the year to April 30 drifted 0.1 per cent lower and were down 0.3 per cent over the quarter, led by a 3.4 per cent drop in Sydney’s housing market for the year, according to researcher CoreLogic.

However, unit prices, particularly in Sydney, held up better than house prices, with detached houses prices unaffordable for many after a five-year boom that saw prices surge 75 per cent by the middle of last year.

Despite the slower market, Mr Triguboff said turnover was reasonable and there was less than 1 per cent vacancy in Meriton’s portfolio of leased apartments. Mr Triguboff has retained around 4000 rental apartments as investments. Meriton’s serviced apartment business was also performing strongly, he said.

“I am an optimist. I believe it won’t continue like this,” he said.

When asked what would put a floor under the market, Mr Triguboff said the wave of apartment building was coming to an end. “There will be less built and less for rent,” he said.

This month’s federal budget was positive and should help the economy, he said.

“Australia is still too heavily taxed for most people,” Mr Triguboff said. “Less tax should stimulate the economy.”

However, he said the budget carried “nothing” for the tourism sector, which he believes has the potential to be one of Australia’s strongest industries.

Mr Triguboff said he was still buying sites, but Meriton’s appetite was slowing despite land prices falling about 30 per cent over the past year.

The group has finalised sales for nearly 1500 units at Sydney’s Parramatta and inner Rosebery, and at Southport on the Gold Coast. It has a 331-unit project under way at Homebush, has just started 172 units at Southport and is undertaking a very large long-term project at Sydney’s Pagewood.

Other major property developers are feeling the squeeze but remain confident that the segments in which they operate will remain strong.

Mr Steinert said the “demand/supply” fundamentals in the housing market were strong.

Stockland is the country’s largest residential developer and specialises in masterplanned communities.

“Where we’re operating, the volume of competing new projects has generally actually reduced, with the access to capital for mid-tier developers having been constrained by the reduction in investment bank lending in the last couple of years,” he said.

Mr Steinert cited the growth in employment levels and an expected moderate increase in interest rates as supporting the idea of an “elongate cycle”, saying “we continue to expect that that will be maintained”.

But he cautioned that in Sydney land prices would stagnate for a period.

“We can see competitors providing discounts. We’ve obviously seen the median house price come back somewhat in Sydney, which is an affordability challenge, but at the same time, you know, our product is very affordable, significantly below the median price and, of course, we continue to see an undersupplied market in housing, in particular, in Sydney,” he said.

In a play that could become common among developers, Mr Steinert said that Stockland could “reshape” its land sizes if affordability became harder to achieve.

“So if we do see a contraction in credit provision as a result of the royal commission, then we’re able to obviously marry up around wherever the new lending limits come out from the banks, given we can shape the product to match the customer’s spending capacity,” he said.

Other major players, including Singapore-backed Frasers Property Australia, remain optimistic that their middle-market-style apartments will find buyers.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout