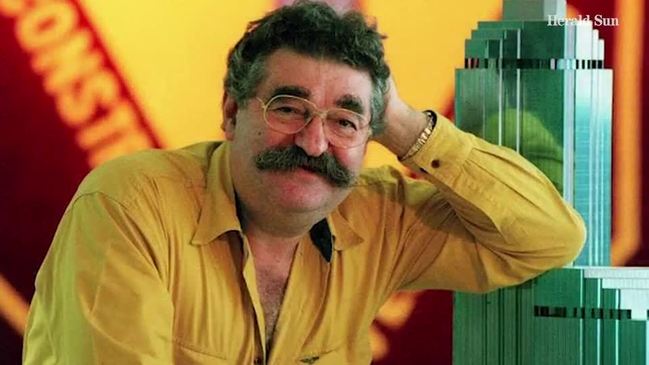

Daniel Grollo develops new build-to-rent construction giant as Grocon crashes

Even as Grocon faces liquidation owing millions, Daniel Grollo’s privately-held business is booming.

As Grocon crashed last year owing tens of millions of dollars, work has continued at chief executive Daniel Grollo’s privately-held apartment development business which he insists is separate to the collapsed construction empire.

The one-time property tycoon has quietly moved out of his Eureka penthouse and back to the family’s sprawling fortress-like compound in Melbourne’s northern suburbs.

But Mr Grollo’s move has not interrupted the booming business of his build-to-rent company which he has quietly continued in the background of the administration of Grocon.

The business, Home BT, has not been caught up in the wave of administrations that have swept up much of Grocon in recent months.

Grocon’s administration has been complicated as four separate groups of Grocon companies have fallen into the hands of KordaMentha with each owing hundreds of millions in inter-company loans, complicating both a deed of company arrangement or a liquidation unless a restructure plan wipes these debts.

This is because Mr Grollo maintains Home BT is not part of Grocon and therefore not liable to be caught in the collapse of his family’s business.

However, he has remained tight-lipped about the nature of Home BT, who its clients are, how much it’s spending, or why administrator reports reveal funds flowing from the collapsed Grocon to entities associated with Home BT.

Home BT is tiny compared to the vastly bigger Grocon, but still oversees up to a dozen staff and contractors in co-work office spaces in Sydney and Melbourne.

Mr Grollo he declined to speak on the matter, saying he would address questions after the release of the Grocon creditors’ report on March 24.

A spokeswoman said Mr Grollo had spoken for a number of years “about moving Grocon’s core business away from its origins in the construction industry”.

“The current administration process of the Grocon legacy construction companies does not affect the build-to-rent business,” she said.

Mr Grollo has referred to previous statements the build-to-rent business – which sees apartments built not to sell, but to rent out, is a separate entity from Grocon.

Despite maintaining Home BT distinct from Grocon, its board is composed of long time company executives, including ex-Grocon chief financial officer Keiran Pryke, general counsel John Easy and chief financial officer Angela Farbridge-Currie, according to documents filed with ASIC.

Home BT is run by Christian Grahame who also acts as head of residential at Grocon.

Earlier creditors’ reports reveal a number loans out of Grocon and into the new build to rent business.

Documents show loans totalling $11.6m to GroconFunds Management, GFM Investment Services and GFM Delivery Services, companies which are all ultimately controlled by Mr Grollo.

These businesses provide services to Home BT, according to people with knowledge of the Grocon structures.

APN Property, which has been pursuing Grocon as part of the recent administration process, questioned whether the distinction long touted by Mr Grollo that Home BT was legally distinct from Grocon was the case.

“Daniel Grollo and Grocon have valuable assets such as its build-to-rent business which while seemingly funded by creditors of companies now in administration have not been offered up to meet claims,” an APN spokesman said.

“We are really not convinced these assets should be treated separately given how much money has been transferred out. Liquidation probably gives a better prospect of accessing these assets to meet creditors’ claims.”

The spokesman suggested the Home BT business could be worth as much as $40m-$80m if sold.

APN has been pushing hard to claw back nearly $15m in loans made to Grocon and its related entities.

If Grocon were to be placed into liquidation loans may then be clawed back.

Home BT is developing six prime locations around Sydney and Melbourne, breaking ground on the City Road site in Melbourne’s Southbank in mid-2019.

Funding for the sites has come from Singapore Sovereign Wealth player GIC, which has snapped up several major locations across Australia.

The collapse of Grocon was marked by work ceasing on several sites the developer had underway across Melbourne, including the Northumberland Street site in Collingwood where subcontractors went unpaid.

But when The Australian/News Corp visited one Home BT site on Bridge Road Richmond workers from construction firm Hacer were on the site.

Despite the distinctions between Home BT and Grocon, when The Australian/News Corp made inquiries to speak with the manager of the site, they were directed to the same media relations spokeswoman who provides comment for Grocon and for Mr Grollo.

The recent expansion of the Grocon administration that saw Mr Grollo made redundant also saw APN achieve its goal of the corporate entity controlling the luxury Grollo sub-penthouse in the Eureka Tower also put up to cover potential debts.

Almost $15m was spent fitting out Mr Grollo’s apartment but never finished, according to industry insiders, who say the sub-penthouse is not “liveable” in its current state.

The loss saw Mr Grollo, who has returned to the family compound in Thornbury, made redundant from the company that was founded by his grandfather Luigi in 1948.

On March 5 this year Mr Grollo put forward a deed of company arrangement that may avoid the flagship Grocon going into liquidation.

However under the deed it is unclear just how much would be paid back to creditors, with any payout almost certain to hinge on a victory in the courts by Grocon against the NSW government over its actions that potentially affected the resale value of a harbourside Barangaroo development by Grocon.

KordaMentha administrators will assess the plan put forward by Mr Grollo, with any announcement scheduled this week.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout