House price lift sparks Christmas sales

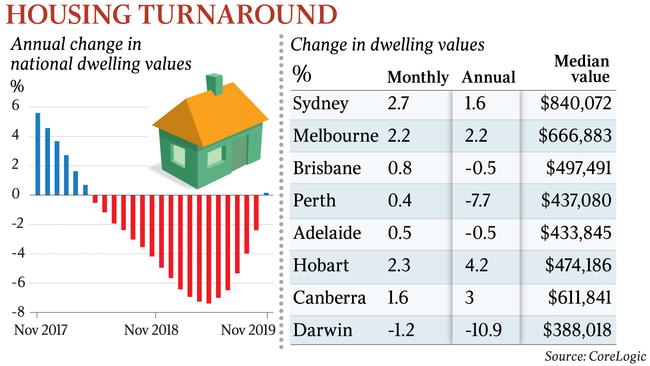

Sydney price growth has outpaced Melbourne as market growth accelerates, new data shows.

Surging property prices are expected to continue to rebound through the usually subdued Christmas period and into next year, prompting a rush of newly-listed properties to flood on to the market as vendors capitalise on the sharpest uptick in values for 30 years.

Sydney and Melbourne property prices have rocketed by 6.2 and 6.4 per cent respectively over the last quarter – the biggest increases since the late 1980s, driven by vastly improved sentiment and eased lending restrictions.

Agents in most capital cities are recording an increase in property numbers as they prepare for a busier than usual festive season, including a raft of vendors hoping to close deals before Christmas.

Pent-up demand from buyers that propelled the market forward through the latter half of the year is likely to be sustained into the year ahead despite sellers actively becoming more active.

READ MORE: Housing on fast track to recovery | House prices are up, but we’re good as gold, writes Adam Creighton| Sydney, Melbourne house prices could surge up to 15pc | House prices will keep rising … and this is why

Boutique inner-Sydney real estate agency Bresic Whitney has extended its auction run and is still bringing properties online in the hopes they sell before the end of the year. While listing rates are down 15 per cent year-on-year, almost 9 in ten properties are being converted to a sale, whereas normalised stock levels last year only achieved a 62 per cent sales rate.

Co-director Shannan Whitney said the market is being driven more by emotion than prices.

“Basically, what we are listing, we are selling,” Mr Whitney said.

“It’s not really about prices, it is about what people think will happen in the coming months. That has an impact on sentiment and behaviour.

“Given the energy now and the mindset of buyers at the moment, we are extending our calendar and optimising for December and January.”

Economists and property experts have pointed to sustained, high auction clearance rates in Sydney and Melbourne despite stock levels almost doubling since July. Enquiries for properties are also up, with data from realestate.com.au showing a significant spike through October.

Philip Hakim, 47, listed his waterfront Rose Bay mansion in Sydney’s prestigious eastern suburbs four days ago.

The property developer built the home when he was 26 and hopes to fetch upwards of $11m. The five-bedroom property offers views spanning Sydney Harbour from the glass-lined open-plan living space and rooftop deck.

Mr Hakim expects favourable exchange rates and demand for expats looking to return home in the new year to encourage buyers.

“For me, it was advantageous to sell it now. With the market going up, it was a fortunate coincidence,” Mr Hakim said.

In Sydney’s trendy inner-city suburb of Surry Hills, Angie and Ben Wain, aged 37 and 47, are selling their terrace home off-market to return to their native UK. They purchased the three-bedroom home for $1.67m ahead of the price gains in 2014 and are now hoping for upwards or $2.3m.

Ms Wain said if they weren’t looking to relocate so soon, it would be tempting to see how far the market would climb.

“We are very fortunate property prices are going up. It would be tempting to wait and see what happens but from what we have heard, now is a good time to sell before things plateau out next year,” Ms Wain said.

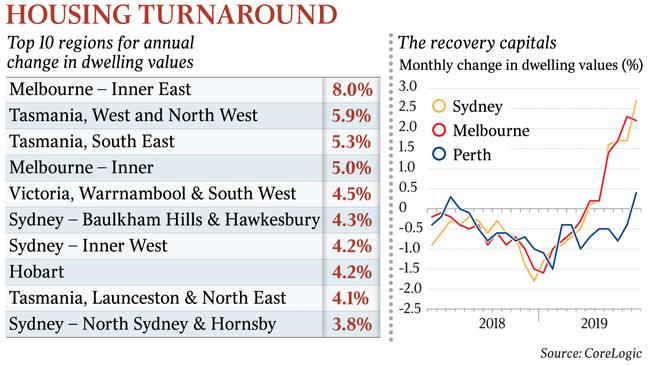

Sydney and Melbourne have been consistently leading the improvement in housing prices since June when the market bottomed out, with the confidence slowly spreading through the broader market.

This was evident in yesterday’s housing value figures from property researcher CoreLogic, with all bar one capital city recording price growth through November and pushing the market into positive annual growth territory for the first time since April 2018.

Real estate agency Ray White recorded $4.6bn in unconditional sales through November, a two year record for the network, with chairman Brian White noting a marked increase in prestige sales. Several of the company’s Sydney offices are seeing open homes steadily attract more viewing groups, averaging between 15 to 20 groups, with some attracting more than 100 through the campaign.

My Housing Market chief economist Dr Andrew Wilson described the recent Sydney and Melbourne price surges as “remarkable”.

“At these rates of growth, equating to around 30 per cent a year in Sydney and Melbourne, we will get back to peak prices towards the second quarter of next year,” he said.

“We have not seen housing price growth in these two markets like this for decades. We typically see high numbers of investors when these numbers are as strong, but we have relatively low numbers of investors,” he said.

But he said there are some weak points of the market particularly in Sydney with the new apartment market in the city’s outer west still relatively subdued.

The credit now available from banks has turned the Sydney housing market around, but buyers are paying at least $250,000 more per dwelling in the inner west than they did last January, says Richardson & Wrench Marrickville principal Aris Dendrinos.

“We had a finance drought precipitated by the Royal Commission into Misconduct in the Banking Industry and APRA,” Mr Dendrinos said.

“We now have a flood of finance and people can service a $1 million loan with less than $30,000 a year,” he said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout