ARA makes takeover play for Cromwell

The long-running battle for Cromwell Property has taken a new turn, with major shareholder ARA making a takeover bid.

The long-running battle for Cromwell Property Group has taken a new turn, with major shareholder ARA Asset Management lodging a proportional takeover bid for the company that runs a $11bn property funds empire across Australia and Europe.

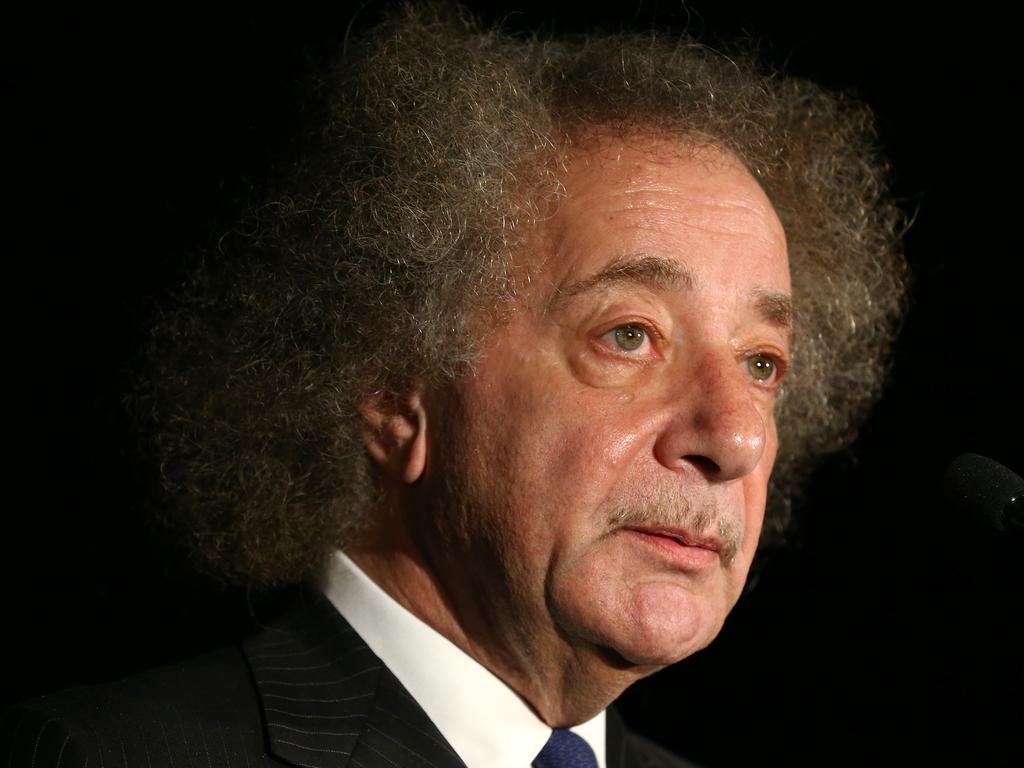

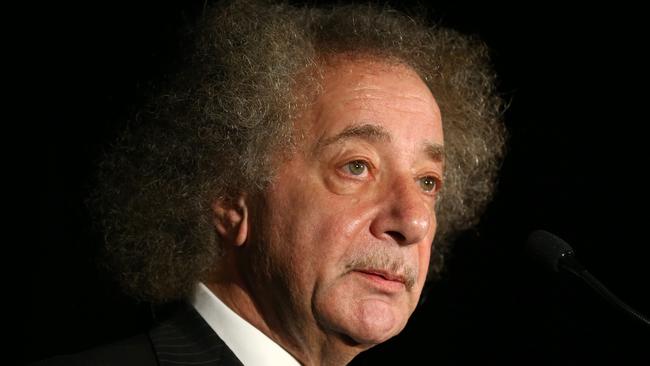

The move comes after months of fighting between Singapore-based ARA and Cromwell, in which it has a 24 per cent stake, with ARA making two failed bids to install corporate raider Gary Weiss to the Cromwell board.

These were narrowly defeated and ARA has now lodged a proportional takeover offer at 90c per share, only just above the company‘s last close of 87c, as it seeks greater control to turn the company around.

The $518m tilt could see ARA increase its stake to abut 49 per cent via its $520m proportional takeover and by using the creep provisions.

The takeover play for the $2.27bn company could also be influenced by the Singapore-based Tang family, which holds a substantial 16.6 per cent slice of the company, and had backed ARA‘s efforts to overhaul the Cromwell board.

Cromwell is yet to respond but it is likely to defend the takeover offer, although few other suitors are likely to emerge given the positions of ARA and the Tangs on the register.

The listed property investor and funds manager took the pair to the Takeovers Panel last year but they have insisted that they are not working in the league against the company‘s Paul Weightman-led management.

ARA said it would make an offer to acquire 29 Cromwell securities for every 100 owned at a cash price of 90c per share. While at a premium to the last price, it is well below the pricing at which Cromwell shares traded at before the coronavirus crisis.

ARA said the offer represents a certain and immediate cash return while allowing shareholders to continue participating in the upside from any turnaround.

The offer was also pitched as providing liquidity in uncertain market conditions and as a way of warding off the potential of a dilutive capital raising as a result of Cromwell’s elevated gearing and exposure to Polish retail assets.

JPMorgan has estimated the company would need to raise $600-$800m to recapitalise amid falling asset values.

ARA said it intends to drive a “vital process of board change and renewal” to improve governance and urgently address Cromwell‘s deteriorating operational performance.

An ARA entity will give shareholders the opportunity to receive cash for a portion of their holdings at a premium to the prevailing market price.

ARA said it was seeking to increase its holding to protect its significant investment in Cromwell through a reinvigorated board with a clear proprietorial focus. It said it had an extensive regional and global property presence that could boost Cromwell.

It also flagged it would undertake a robust “strategic review” of the business.

“ARA has been left with no choice but to pursue this course to try and restore value for the benefit of ARA and all security holders in Cromwell. We seek change based on our strong belief that the existing Cromwell strategy is failing and exposing our investment to unacceptable risks. This is magnified by poor cost control by management, at times inexcusable largesse, and weak corporate governance,“ ARA chief executive John Lim said.

The Singaporean group attacked Cromwell for buying Valad Europe, and then writing off much of the goodwill, and also for buying a portfolio of Polish shopping centres for close to $1bn which are now likely subject to significant value reduction.

Moelis Australia and Credit Suisse are financial advisers to ARA.