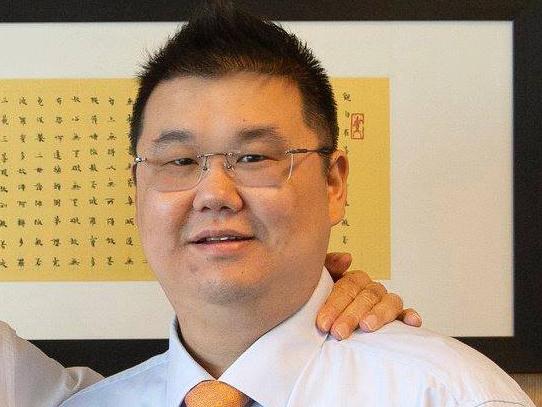

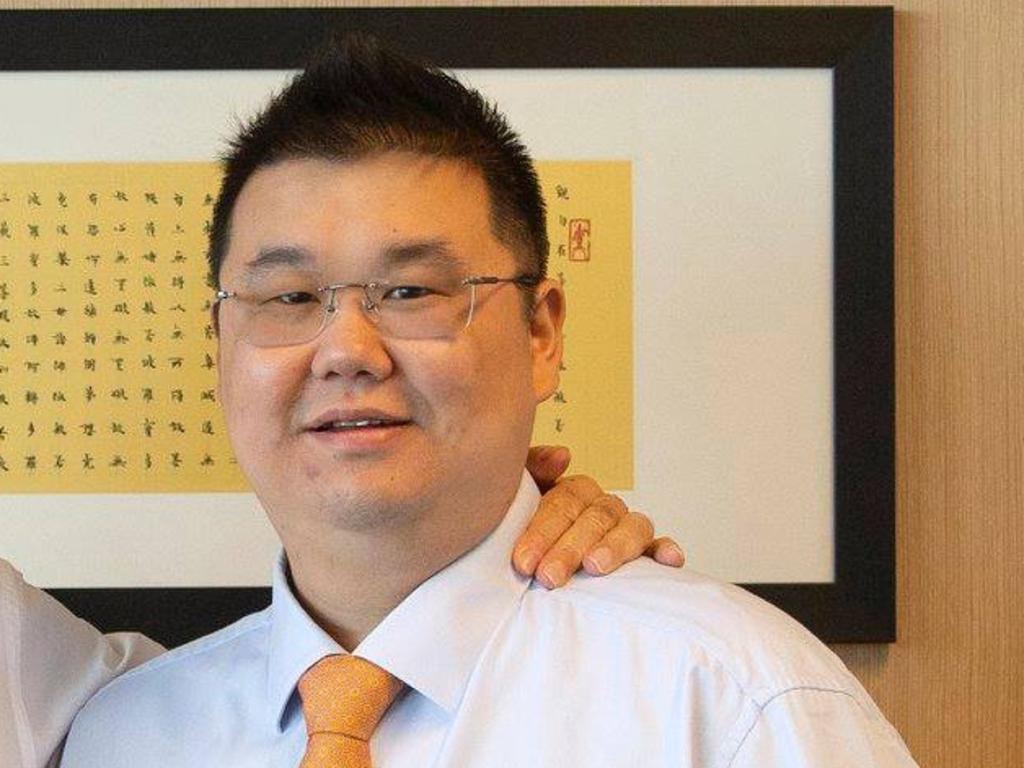

Agricultural Land Trust takes $132m hit on exposure to Michael Gu’s iProsperity empire

Agricultural Land Trust’s exposure to Michael Gu’s collapsed iProsperity empire confirms the fears of wealthy offshore investors.

The listed Agricultural Land Trust, which loaned millions to entrepreneur Michael Gu’s collapsed iProsperity empire, is set to resume trading after taking a $132.8m hit on capital it poured into the hotel funds management company.

The trust’s low-key ASX announcement confirms the deepest fears of wealthy offshore investors that a significant proportion of the $350m that liquidators Cor Cordis allege that iProsperity owed when it collapsed may be permanently lost.

Mr Gu’s high-flying empire raised millions of dollars from mainland Chinese investors seeking residency via the significant investor visa (SIV) program, in addition to the deals he struck which drew in institutions and other wealthy investors from Singapore and Hong Kong.

The Chinese would shift funds into one of two iProperity-linked vehicles - the Cornerstone Bond Fund and the Cornerstone New SIV Bond Fund - which would in turn invest in the Agricultural Land Trust. The listed vehicle would then loan money to Mr Gu’s iProsperity Underwriting (IPU) in a series of high-interest unsecured debenture issues.

But the river of funds dried up as iProsperity’s ambitious deal-making in the US and Australia collapsed and he left Australia shortly after calling in administrators in mid-July. Amid disputes about how funds were dealt with as the company ran into trouble, Sydney lawyer John Landerer also called in police, who are investigating.

One Managed Investment Funds Limited, the agricultural trust’s responsible entity, on Monday night told the ASX it would fully impair both the principal and interest due under the loans made by the fund to IPU, taking a hit of $132,801,000.

“Based on the information provided by IPU’s receiver (David Levi) and its voluntary administrator (now liquidator, Cor Cordis), OMIFL believes it is very unlikely that the fund will receive any further payments from IPU,” the trust said.

“However, neither party has been able to provide the group with sufficient information to determine the amount which may be recoverable from IPU and on this basis the group has determined to fully impair both the loan and interest receivable amounts,” it added.

“The group will continue to seek to maximise the amount which may be recovered from IPU.”

The agricultural trust insisted its exposure was limited as Chinese investors in the cornerstone bonds could only recover what the trust itself received from iProsperity.

“While these IPU loan receivables have been fully impaired, accounting standards do not allow the amount owed by the fund under the limited recourse debentures issued to the Cornerstone Bond Fund and the Cornerstone New SIV Bond Fund to be written off,” the Agricultural Land Trust said.

This meant that although it reported a “significant” net asset deficiency, the debentures had been issued on limited recourse terms, meaning the debenture holders were only entitled to recover what the fund gets back from IPU.

The agricultural trust said the net asset deficiency caused by the impairment of the IPU loan receivables was not expected to have a material impact on its other investments, notably Linkletter’s Place, a rural property near Esperance in Western Australia.

But the situation leaves the Chinese investors out of pocket and raises questions about regulation of the SIV scheme by the federal government, as well as the concerns about how an ASX-listed vehicle has become embroiled in iProsperity’s fall.

The stunning collapse has grabbed headlines for the founder’s gaudy spending, including on Mosman and Seaforth mansions and the firm’s luxury cars, including a 2017 Rolls Royce Wraith that was sold a week ago for $504,000 significantly less than its $700,000 valuation. Mr Gu also held a 2015 McLaren Spider.

KPMG, which is handling another part of the iProsperity collapse, revealed last month some funds had gone on a Lamborghini, that is now for sale.

The iProsperity blow-up has sparked a myriad of legal actions as investors seek to recover their funds, including against the responsible entity of the agricultural trust, although it has denied wrongdoing.

OMIFL has since portrayed itself as being on top of iProsperity’s woes from early this year. It told the ASX in January that IPU was in default under its loan agreements and in April, the agricultural fund was the first to appoint an external administrator to an iProsperity company, “signalling to others the serious problems within the entities controlled by Michael Gu”.

At the time iProsperity was telling the world it was buying a $720m US hotel portfolio and finalising another $212m hotel deal in Australia. Both purchases did not complete.

The trust’s annual results showed it crashed to a $127.2m loss and their release ends the voluntary suspension requested by the fund in mid-July as iProperity called in Cor Cordis.

“The major causes of this loss were the provisions for impairment that have been recorded against the principal and interest receivable on the loans the Group had advanced to iProsperity Underwriting Pty Limited (in liquidation),” it said. The trust was left with assets of $39.89m and crushing liabilities of $143.04m - resulting in a “net liability” position of $103.15m.

But it insisted the bulk of debentures - except for a series numbered 5 and 8 - were issued on a limited recourse basis, and as such the net liability position would not affect its ongoing operations.

Excluding the loans and liabilities relating to the series 3, 4, 6, 7 and 9 debentures which from the trust on-lent $123.15m, the trust said it now had net assets of $27.94m. Debentures series 5 and 8 amount to $1.63m and were used to fund the group’s working capital needs. It also has a $10m loan from IPG Mortgage Fund secured by Linkletter’s Place that matures at the end of February 2022.

The trust admitted it would lose one income stream - the interest margin it earned on the difference between the interest payable to it by IPU under loan agreements and the interest payable by it under the debentures issued to Chinese bond investors.

But its problems may run deeper

Trust auditors Crowe Sydney noted there was a “material uncertainty related to going concern” for the agricultural vehicle’s operation. The auditor noted the trust’s net liability position of $103.153m at the end of June and said the directors were taking actions to address its financial position.

The trust said it would be able to reduce the amount it owes under the debentures once the final recovery from the loans to iProsperity is determined.

But the auditors said if this and other proposed strategies did not eventuate, “it may result in material uncertainty that may cast significant doubt on the trust’s ability to continue as a going concern. Our opinion is not modified in respect of this matter”.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout