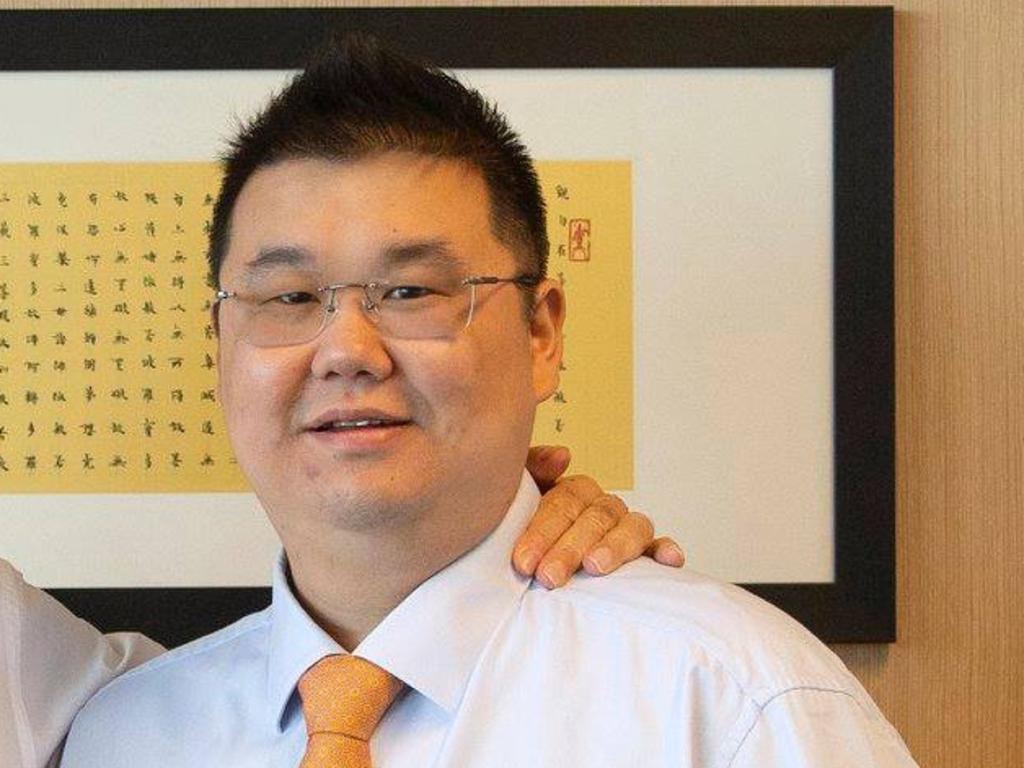

No documents the ‘Chinese way’, iProsperity founder Michael Gu told creditors

The fugitive founder of iProsperity group, which collapsed owing $185m, says it is the ‘Chinese way’ not to keep documentation.

The founder of the fallen iProsperity Group said it was the “Chinese way” not to keep company documentation but it now has creditors claiming about $350m, making it one of the largest company failures of the decade.

The scale of the collapse of the property funds empire founded by Michael Gu has blown out according to the administrators Cor Cordis, with its penchant for fast cars on display again as the administrator has also seized a luxury Rolls Royce.

The 2017 Rolls Royce Wraith will be sold off but a 2015 McLaren Spider was deemed uncommercial to realise on behalf of the secured lender and inquiries have failed to identify which entity owns a 2016 Ferrari 488 GTB.

Earlier this week KPMG, which is handling another part of the iProsperity collapse, revealed some funds had gone on a Lamborghini, that is now for sale.

The extent of creditor claims within the companies under administration by Cor Cordis is about $350m and it is too early to have an indication of what the ultimate shortfall might be.

But the process of unravelling the failed empire could take years as Cor Cordis only has some companies in the overall iProsperity Group under its control. All up there at least 64 entities with links to related units in Singapore, Hong Kong and Shanghai.

iProsperity Pty Ltd was the main treasury entity in the group and since mid-July 2018, about $321m was deposited into bank accounts, with money mainly raised from wealthy Asian investors.

These funds have since been exhausted, save for just $58,000 frozen in a bank account held with Commonwealth Bank.

The administrators report to creditors reveals that founder Mr Gu, who has left the country for the United States, said the lack of documentation within the iProsperity Group was due to his propensity to largely transact on verbal agreements.

“During our limited initial discussions with Mr Gu regarding the lack of documentation on hand to substantiate transactions made / entered into by the Group, he advised the nature of the ‘Chinese way’ is to largely transact on verbal agreements,” said a Cor Cordis report obtained by The Australian.

“For example, in respect to the Investment Loan Account he advised the information regarding the underlying transactions were contained in ‘his head’.”

Cor Cordis told creditors there was evidence to suggest that material amounts had been paid as director loans or payments made of $83m, with apparent receipts of $63m, suggesting that the directors have received a net benefit of about $19m since July 2018.

Since July 1, 2018, Mr Gu was paid $22.14m by the company and has since made repayments of just $635,000, resulting in a net balance payable of $21.505m.

Details of Mr Gu’s lavish lifestyle emerge through the document, including a payment of about $156,000 in relation to the financing of an Audi vehicle. A further $150,000 deposit for Iririki Island in Vanuatu was paid, plus another $1.004m in four separate transactions with reference to “Vanuatu Passports.”

Despite the present low interest rate environment, iProsperity Group was borrowing at rates of 14 to 16 per cent, the report notes.

The report also found that false representations may have been made to investors “in that they were of the view they were making an investment with one of the managed funds … but then the investor moneys were directly paid to iProsperity Group.

“Mr Gu advised that he would compile a listing of the investors with transactions posted to the investment loan ledger account. Despite a formal request being made on Mr Gu … no such information has been provided.”

High net worth individuals from China, Singapore and Hong Kong invested in iProsperity, which was set up by Mr Gu in 2005 to invest in hotel portfolios in Australia and the United States. The company collapsed last month and is now the subject of NSW Police and ASIC investigations.

Many of the investors had sought to gain an Australian visa through their investment in iProsperity, which attempted to negotiate Australia’s largest hotel deal last year, with the $220m acquisition of a number of Accor hotels. That deal and another transaction to buy a swag of Kimpton Hotels in the US also collapsed along with several suburban property development deals in Sydney and Chatswood.

The report also found evidence of substantial moneys being paid to related parties including Mr Gu, a former telco executive, as well as new funds repaying old investors.

“Our discussions with management indicate that there was no specific method or policy for the filing, maintenance or management of documents (including emails, agreements, evidence to support transactions) or the server maintained by iProsperity,” according to the report to creditors.

The report found funds being transferred to the director and management of iProsperity for no apparent benefit and “to the detriment to creditors in the entity which transferred the funds”.

Cor Cordis said numerous transactions had also been identified in iProsperity records making reference to John Landerer, who was promoted as the property group‘s chairman, but never appointed, and his law firm Landerer & Co.

The dealings include a $9.3m loan to Mr Landerer and his wife’s private company, Regina Equities. The Sydney lawyer last month called in police to investigate iProsperity’s actions. The Australian is not suggesting the Landerers are the subject of any investigation.

Cor Cordis is also investigating whether false representations have been made to investors and whether false representations resulted in investors remitting funds to the company “where the investor believed that the investment was being made into an asset of the fund”.

Cor Cordis also noted that it had made formal requests to both Mr Gu and another director of the company, chief financial officer Harry Huang, to deliver their laptops, phones and electronic devices. “At this stage both Mr Gu and Mr Huang have not complied with the requests.”

“We are currently taking further steps in relation to the lack of co-operation, including reporting the noncompliance of same to ASIC,” Cor Cordis said.

Of the 11 iProsperity companies investigated by Cor Cordis it noted that only five appeared to have current bank accounts.

iProsperity started banking with Commonwealth Bank in March 2020, after being advised to exit its previous banking facilities with NAB that same month.

The Australian is not suggesting the allegations against Mr Gu are true, only that they are being investigated by Cor Cordis.

Cor Cordis said it was too early to estimate on any return to creditors under a liquidation of the company.

The accounting firm said it would be liaising with NSW Police about their investigations, and police on Wednesday confirmed they were investigating.

It will also speak with ASIC and major creditors prior to the second meetings of creditors regarding liquidation funding, which could be used to trace funds.

Cor Cordis is also pressing the lawyers acting for Mr Gu and chief financial officer Harry Huang to collapse the remainder of the group into liquidation, which it says would benefit creditors.

The firm said if it was appointed as liquidator it would consider urgent court applications to trace and freeze assets and engage with forensic technology consultants allow for electronic data searching, as much of the business had been conducted via email.

The administrators noted that they have been in ongoing contact with the NSW Police since they were appointed and said they did not have “any particular information” about why Mr Gu left Australia, although he had been instructing his lawyer.